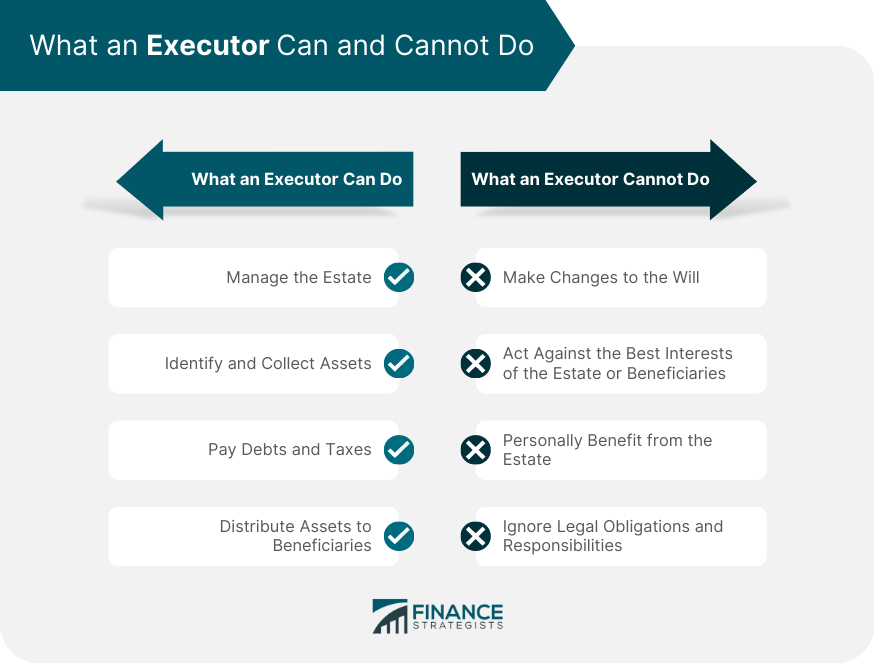

The executor is an individual designated in a will to oversee the management of a deceased person's estate. Their obligations comprise identifying and retrieving assets, settling outstanding debts and taxes, and allocating assets to beneficiaries. An executor must understand the limitations of their authority and responsibilities to avoid any misconduct. An executor has several critical responsibilities, including the following: The executor bears the responsibility of administering the deceased person's estate, which encompasses safeguarding the assets, settling any unresolved debts, and distributing them as specified in the will. The executor's first task is identifying the deceased person's assets, including real estate, bank accounts, stocks, and personal property. They must collect all the assets and ensure they are secure until they are distributed to the beneficiaries. The executor must pay any outstanding debts and taxes the deceased person owes. This includes funeral expenses, outstanding bills, and taxes owed to the government. The executor is responsible for distributing the deceased person's assets to the beneficiaries named in the will. They must ensure that the distribution is done according to the terms of the will. An executor has certain limitations and must comply with legal obligations and responsibilities, including the following: An executor cannot change the will. The will is a legal document that reflects the deceased person's wishes. The deceased person must make any changes to the will while they were alive. The executor has a fiduciary duty to act in the best interests of the estate and the beneficiaries. They cannot act in their own self-interest or in the interest of others, which may conflict with the estate's best interests. The executor cannot personally benefit from the estate. They cannot take any assets or use any funds for their own benefit. The executor must comply with all legal obligations and responsibilities. They cannot ignore any legal requirements or duties, which may result in legal consequences. Being an executor is not just a matter of managing the estate but also complying with specific legal obligations and responsibilities, which include their fiduciary duty, timely administration, accurate accounting and record-keeping, and communication with beneficiaries. The executor has a fiduciary duty to act in the best interests of the estate and the beneficiaries. This includes managing the assets, paying the debts and taxes, and distributing the assets according to the terms of the will. The executor must administer the estate in a timely manner. This includes identifying and collecting assets, paying debts and taxes, and distributing the assets to the beneficiaries. Failure to administer the estate promptly may result in legal consequences. The executor must keep accurate records of all the assets, debts, and distributions made from the estate. This includes maintaining records of all the financial transactions and keeping track of the beneficiaries' information. The executor must communicate with the beneficiaries and keep them informed of the administration of the estate. They must answer the beneficiaries' questions and provide regular updates on the administration's progress. Misconduct by an executor can have severe consequences, including removal from their position, personal liability for losses incurred by the estate, and legal action by the beneficiaries. If an executor engages in misconduct, they may be removed from their position. This may result in the court appointing a new executor to administer the estate. The executor may be held personally liable for any losses incurred by the estate due to their misconduct. This includes any financial losses resulting from the mismanagement of assets or failure to pay debts and taxes. If the beneficiaries believe that the executor has engaged in misconduct, they may take legal action against the executor. This may include seeking damages for any losses incurred by the estate due to the executor's misconduct. An executor plays a crucial role in administering the estate of a deceased person. However, an executor must understand their limitations and responsibilities to avoid misconduct. They cannot change the will, act against the estate's best interests or beneficiaries, personally benefit from the estate, or ignore any legal obligations and responsibilities. Failure to comply with these limitations and responsibilities may result in legal consequences, such as the beneficiaries' removal as executors, personal liability, or legal action. Choosing a trustworthy executor who can administer the estate responsibly and ethically is essential. By understanding the limitations and responsibilities of an executor, one can ensure that their estate's administration is done appropriately. Failure to comply with these rules may lead to legal consequences such as removal as executor, personal liability, or legal action by the beneficiaries. Given the complexity of estate planning and the potential risks involved, it is highly advisable to seek the assistance of an estate planning lawyer. They can help you navigate the legal requirements and ensure your estate is managed efficiently and ethically. What Is an Executor?

What an Executor Can Do

Manage the Estate

Identify and Collect Assets

Pay Debts and Taxes

Distribute Assets to Beneficiaries

What an Executor Cannot Do

Make Changes to the Will

Act Against the Best Interests of the Estate or Beneficiaries

Personally Benefit From the Estate

Ignore Legal Obligations and Responsibilities

Legal Obligations and Responsibilities of an Executor

Fiduciary Duty

Timely Administration

Accurate Accounting and Record-Keeping

Communication with Beneficiaries

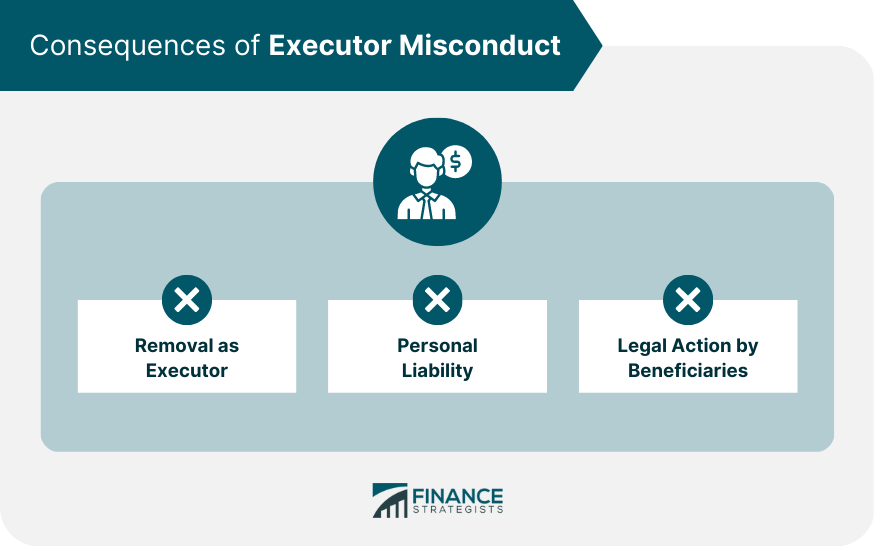

Consequences of Executor Misconduct

Removal as Executor

Personal Liability

Legal Action by Beneficiaries

Conclusion

What an Executor Cannot Do FAQs

An executor cannot change the will, act against the estate's best interests or beneficiaries, personally benefit from the estate, or ignore legal obligations and responsibilities.

The legal obligations and responsibilities of an executor include their fiduciary duty, timely administration, accurate accounting and record-keeping, and communication with beneficiaries.

No, an executor cannot make any changes to the will. Only the deceased person can change their will while they are alive.

If an executor engages in misconduct, they may be removed from their position, held personally liable for any losses incurred by the estate, or face legal action by the beneficiaries.

While hiring an estate planning lawyer is unnecessary, ensuring that the estate is managed efficiently and ethically and the executor understands their limitations and responsibilities is highly recommended.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.