An executor of a will is the individual assigned in a will to manage the estate of a deceased person. They ensure that the decedent's assets are properly managed, debts and taxes are paid, and the remaining property is distributed to the beneficiaries as specified in the will. Executors are typically appointed by the deceased person in their will and must be approved by a court before they can begin their duties. Executors are commonly family members or close friends of the deceased person, although in some cases, professional executors or attorneys may be appointed. The role of an executor in managing the estate of a deceased person is a significant responsibility that carries legal authority and power, as well as specific duties and obligations. The appointed executor of a will has legal authority and power over the estate of the deceased. They have the power to take control of the assets of the estate, sell property, pay debts and taxes, and distribute property to the beneficiaries. Executors are typically required to obtain "Letters Testamentary" from a court to demonstrate their legal authority to act on behalf of the estate. An executor oversees the administration of the deceased person's estate. This includes identifying and collecting all assets, such as bank accounts, real estate, and personal property, and determining their value. Executors manage the estate's assets until they are ready to be distributed to the beneficiaries. This encompasses investing any funds and selling assets if deemed necessary. The executor must also pay off any debts owed by the deceased person, such as mortgages, credit cards, and medical bills. Once all debts are paid, any leftover assets are allocated to the beneficiaries according to the instructions in the will. Executors have a fiduciary duty to manage the estate according to the deceased person's wishes as outlined in their will. This means that they must act in the best interest of the beneficiaries and follow the instructions laid out in the will. Executors are also subject to state and federal laws regarding the administration of estates, and may be held personally liable for any violations or breaches of their duties. An executor of a will has specific obligations to the beneficiaries of the estate: The executor has a duty to act in the best interest of the beneficiaries and must avoid any conflicts of interest. This means that the executor cannot favor one beneficiary over another, and must follow the instructions in the will without bias. The executor must also use their best judgment when making decisions regarding the management and distribution of the estate assets. The executor has a duty to keep the beneficiaries informed about the administration of the estate and provide regular updates. This includes providing notice of the probate proceedings, keeping beneficiaries informed about the assets and debts of the estate, and communicating any changes or delays in the probate process. The executor must act impartially and avoid conflicts of interest. This means that the executor cannot engage in self-dealing, favor one beneficiary over another, or engage in any other behavior that would compromise their duty to act in the best interest of the beneficiaries. The executor must also maintain confidentiality and refrain from disclosing any confidential information about the estate. The executor has a responsibility to act in a timely and efficient manner when administering the estate. This includes completing probate proceedings in a timely manner, meeting deadlines for filing documents and paying taxes, and keeping accurate records. The executor must also use their best judgment when making decisions regarding the management and distribution of the estate assets. Although an executor has legal authority and power over the estate of a deceased person, there are situations where their power may be limited or restricted: If there is a dispute among beneficiaries, the executor may not be able to distribute assets until the matter is resolved. Additionally, a court may intervene and restrict the powers of an executor if they believe that the executor is not acting in the best interest of the beneficiaries. In some cases, a beneficiary may challenge the validity of the will or the executor's actions, which may result in a delay or limitation on the executor's powers. The executor must be prepared to navigate these situations and act in accordance with the law. This happens when the executor fails to perform their duties, breaches their fiduciary duty, or engages in any other misconduct, they may be removed from their position by a court. Additionally, if the executor becomes incapacitated, dies, or resigns, a court may appoint a new executor to complete the administration of the estate. A designated individual mentioned in a will, responsible for overseeing the assets of a deceased person's estate is referred to as an executor. The role of an executor of a will is an important one that carries significant responsibilities and obligations. Executors have legal authority and power over the estate of a deceased person and are responsible for managing the assets, paying debts, and distributing property to the beneficiaries according to the will. However, there are limitations and restrictions on the executor's powers, and the executor must act in the best interest of the beneficiaries while avoiding conflicts of interest. It is important to choose an executor who is trustworthy, competent, and capable of carrying out their duties. Executors must also be prepared to navigate any disputes or legal challenges that may arise during the administration of the estate. By fulfilling their duties and obligations, the executor can ensure that the deceased person's wishes are carried out and that the beneficiaries receive the property they are entitled to. Hiring an experienced estate planning attorney can ensure that the process of appointing an executor and drafting a will is done properly, and can help to minimize the potential for disputes or legal challenges down the line.Definition of an Executor of a Will

What Power Does an Executor of a Will Have?

Executor’s Duties and Responsibilities

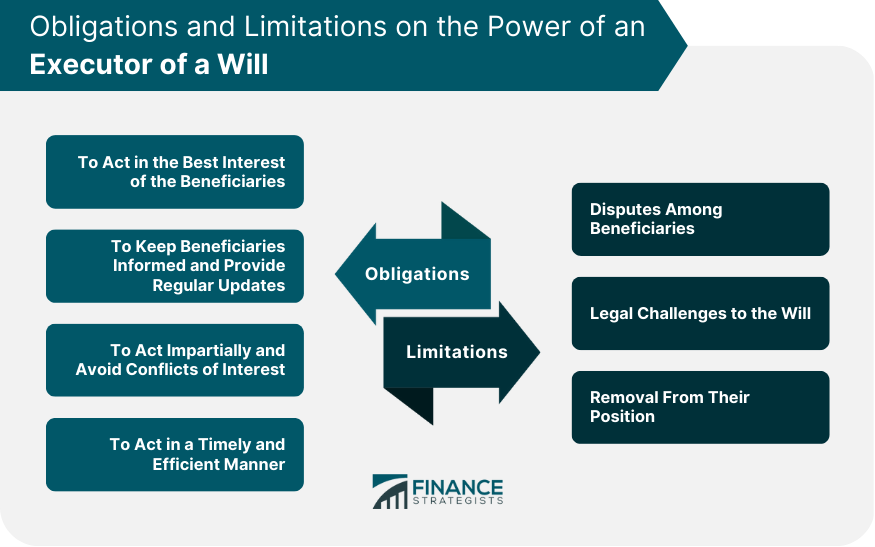

Executor's Obligations to Beneficiaries

To Act in the Best Interest of the Beneficiaries

To Keep Beneficiaries Informed and Provide Regular Updates

To Act Impartially and Avoid Conflicts of Interest

To Act in a Timely and Efficient Manner

Limitations and Restrictions on an Executor's Powers

Disputes Among Beneficiaries

Legal Challenges to the Will

Removal From Their Position

Final Thoughts

What Power Does an Executor of a Will Have FAQs

An executor of a will has legal authority and power over the estate of a deceased person. This includes managing assets, paying debts and taxes, and distributing property to beneficiaries according to the instructions in the will.

Yes, there are situations where the power of an executor may be limited or restricted, such as disputes among beneficiaries or legal challenges to the will. In these cases, the executor may require court intervention or may be subject to removal from their position.

Limitations on an executor's power may include court intervention, beneficiary objections, or legal challenges to the will's validity. Executors must be prepared to navigate these situations with care and act in accordance with the law.

An executor of a will has specific obligations to beneficiaries, including the duty to act impartially, keep beneficiaries informed, and manage the estate in a timely and efficient manner. Executors must also avoid conflicts of interest and fulfill their obligations to distribute property according to the will's instructions.

If an executor of a will fails to fulfill their duties or violates their obligations, they may be subject to legal action or removal from their position. Beneficiaries may also have the ability to challenge the executor's actions and seek legal remedies. It is important for an executor to take their responsibilities seriously and act in accordance with the law.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.