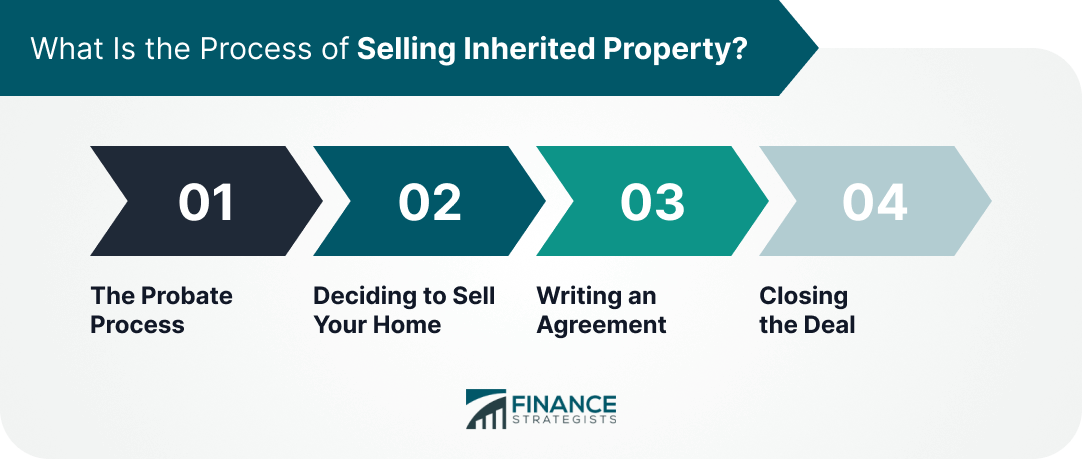

Inherited Property is a type of property that is bought by one person but the title to the property has been passed on to another person after death or when a court order appoints someone else as the property's owner. Selling inherited property is often much more complicated than selling a normal property because there are many legal issues to consider. Have questions about selling inherited properties? Click here. The process of selling an inherited property will largely depend on whether the person inheriting the property is attempting to sell it or if one of their family members wants to buy it. When a person dies, their estate goes through a legal process called probate. The purpose of probate is to settle the deceased person's debts and to distribute their assets among their heirs. The probate process can be lengthy and it is important to have an attorney who specializes in this area of law to help you through the process. An attorney can also advise you on how to sell an inherited property during the probate process. If you inherit a house and decide that you want to sell it, you must first deal with any liens attached to the house. Liens prevent the property from being sold until they are paid. If there is a lien on your inherited home, you will need to either pay off the loan attached to it or settle with the lender so that the terms of the lien can be altered to allow for a quick sale. You must then contact your local assessor and find out the value of the property as it stands. You will also need to get an estimate of how much it will cost to bring the property up to code if it is not currently in compliance. You can then list the property with a real estate agent, who will help you market and sell the home. Selling an inherited property can be difficult because there are often emotional attachments to the home. It is important to be honest with potential buyers about the condition of the property and any repairs that may need to be made. If you are unable to sell the property, you may have to consider a short sale or even a deed in lieu of foreclosure. If you want to sell an inherited property but your family members do not want to purchase it, you will need to draw up a contract. You should make sure that the contract states whether or not you are willing to act as a co-broker in order to speed up the sale process. It is also important that the contract states that you can exit the agreement if a family member decides to buy the property at any point. An attorney who specializes in selling inherited properties should be able to help you draft an agreement that will protect your interests while also expediting the sale process. Once an agreement has been reached, the buyer will need to apply for a loan and the property will need to be appraised. The sale will not be final until all of the paperwork has been completed and the loan has been approved. It is important to note that there may be additional fees associated with selling an inherited property that is not normally required when selling other types of property. Before listing your inherited property, there are a few things you should consider. Selling an inherited home can be tricky because the property may have been in the family for generations. People who inherit homes often feel emotional ties to them and it can be difficult to let go of them even if they do not want or need the home. Before you put your home on the market, take some time to consider the following: Selling an inherited home can be difficult because it may not feel like your home anymore. Selling a family house takes time, patience, and a lot of hard work. If you are not able to sell the home on your own, you may want to consider hiring a real estate agent who specializes in inherited property sales. If you inherit a property and decide that you want to sell it, the first step is to find a buyer. There are a few ways to go about finding a buyer for your inherited home. You can list the property with a real estate agent, put an ad in the newspaper, or contact people who have recently bought homes in the area. You can list your inherited property with a real estate agent. Selling an inherited property through an agent will mean giving up a percentage of the commission, but it is likely to be worth it if you are unable to sell the home on your own. If you choose to list the property with a real estate broker, he or she should be able to give you a list of potential buyers who are interested in purchasing an inherited property. If you choose to advertise your home in the newspaper, you should be prepared to wait a while for a buyer to come along. Selling an inherited home through a classified ad can be a slow process and may not result in the sale of the property. However, it is important to be aware that there are people out there who are looking for inherited properties and they may find your ad enticing enough to make an offer on the home. If you have lived in your inherited property for a while, you probably know some of the neighbors and friends who have children or grandchildren who are looking for their first home. You may want to consider giving your neighbors and friends the first option of buying your inherited property before you list it. Selling an inherited property on good terms can help you form lasting relationships in the community. When selling an inherited property, it is important to get a good price for it. Here are a few tips on how to achieve this: Before putting your home on the market, it is important to make any necessary repairs. Selling an inherited property in poor condition will likely result in a lower price than if the property is in good condition. Before you set the price for your inherited property, it is important to keep an eye on how recently similar homes have been sold in the area. Selling an inherited home at a price above market value will give buyers less incentive to buy the house. You do not want to price your inherited home too low because you will sell the house quickly, but it is equally important to price your home high enough so that buyers are not discouraged from making an offer. Selling an inherited property at market value is likely to result in a faster sale than if you underprice or over-price your inherited property. Selling an inherited property can be a difficult process because you do not want to disrespect the memory of your loved one or neglect the responsibility that comes with owning a family house. It takes time and patience, but if you are unable to sell on your own it may be helpful to hire a real estate agent who specializes in inherited property sales. Selling an inherited property can be a difficult process. You have to find a buyer, and you may not get the best price for your home. It is important to be patient and to make necessary repairs before putting your home on the market.What Is the Process of Selling Inherited Property?

The Probate Process

Deciding to Sell Your Home

Writing an Agreement

Closing the Deal

Things to Consider When Selling Inherited Property

How To Find A Buyer For Your Inherited Property

Real Estate Agent

Newspaper Ad

Neighbors and Friends

Tips on How to Get a Good Price for Your Inherited Property

Make Necessary Repairs

Keep an Eye on Comparable Sales

Price Your Home High but Reasonable

Key Takeaways

Inherited Property FAQs

A property inherited from a family member is one that has been passed down to you through inheritance.

The Selling Inherited Property Process consists of three steps: Deciding to sell your home, writing up an agreement, and then closing the deal.

One way to find a buyer for your inherited property is via an agent. Another way is by listing the home locally and waiting for potential buyers to contact you. Selling it privately can also be done if you want to keep costs down and sell quickly.

People may choose to sell their inherited property for a number of reasons: they may no longer want to live in the home, they may need the money, or they may simply want to move on from the property.

The fair market value of your inherited property will depend on the condition of the home, the location and other factors such as recent comparable sales. To get a good price for your inherited property, it is important to do research and understand the market before setting a sale price.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.