If you inherit a house, there are some key things you need to know in order to make the most of the situation.

This includes understanding the financial implications, legal requirements, and relationship considerations involved in inheriting property.

By understanding these issues, you can ensure that you make the most of your inheritance and avoid any potential problems.

Have a question for an Estate Planning Lawyer? Click here.

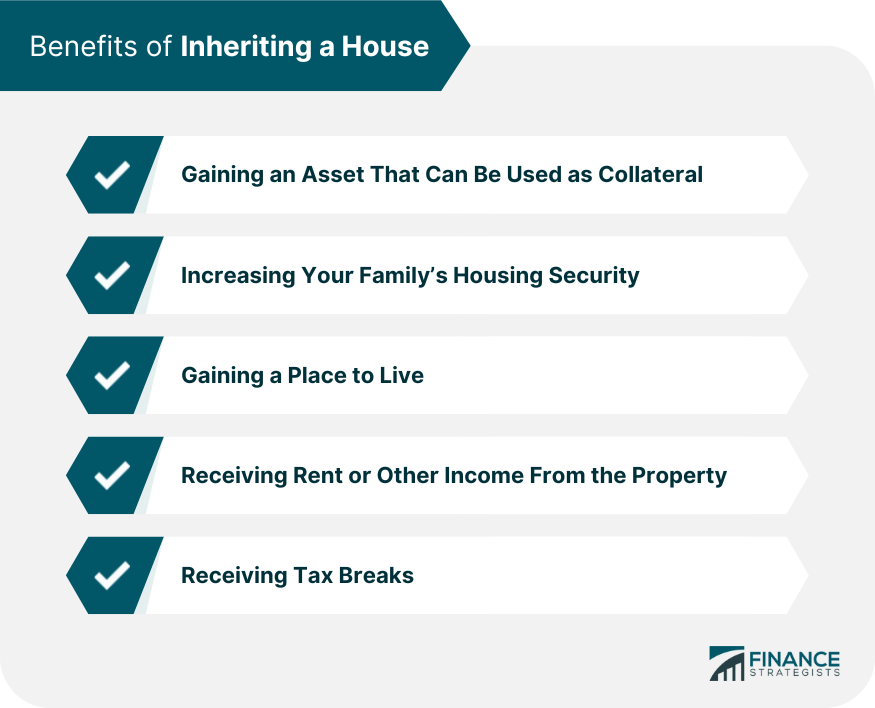

Benefits of Inheriting a House

There are a number of potential benefits to inheriting a house. These include:

Gaining an Asset That Can Be Used as Collateral for a Loan or Mortgage

One of the main benefits of inheriting a house is that it can provide collateral for a loan or mortgage.

This can be helpful in obtaining financing for renovations, repairs, or other projects.

Increasing Your Family’s Housing Security

Inheriting a house can provide your family with greater security in terms of housing.

This is because an increasing number of people are spending more than half their income on rent or mortgage payments.

Gaining a Place to Live

In some cases, inheriting a house can provide you with a place to live.

This can be helpful if you struggle to find affordable housing or need a larger home for your family.

Receiving Rent or Other Income From the Property

Another potential benefit of inheriting a house is that you may be able to collect rent or other income from the property.

This can help to offset the costs associated with owning and maintaining a home.

Receiving Tax Breaks

Finally, inheriting a house can provide you with tax breaks.

This is because you may be able to deduct the costs associated with owning and maintaining the property from your taxable income.

Legal Requirements

The first step in inheriting a house is to understand your legal requirements.

These requirements vary depending on whether you inherit a house as an individual or as part of a family.

As an individual, you will typically need to take title to the property and register it in your name. You will also need to pay any associated taxes.

If the house needs any repairs or renovations, you may need to obtain a permit from your local government.

You do not have to consult with anyone else about using the property.

However, if you inherit a house as part of a family, there are additional considerations you will need to take into account.

In some cases, an executor or trustee will be named in the person’s will, and you may need to consult them before taking the title.

Some states also require that you file the property with the probate court.

These requirements are usually not too onerous, but they can add some extra time and expense to the process of inheriting a house.

If you inherit a house as part of a family, you may need to consult with the other beneficiaries.

While they do not have an active role in handling an inheritance (if you are an individual), it is still important that everyone who has inherited property discuss together any decisions related to the property.

These discussions should be held in person and include all beneficiaries.

Financial Considerations

There are a number of financial considerations you need to take into account when inheriting a house.

This includes understanding the implications of taking on a mortgage, paying taxes, and insurance.

Mortgages

If you inherit a house with a mortgage, you will be responsible for the payments.

This can be a significant financial burden, so it is important to understand the terms of the mortgage and how it will impact your budget.

In some cases, you may be able to assume the mortgage from the previous owner.

This can be helpful in avoiding any breaks in payments and ensuring that you do not have to worry about refinancing.

However, you should always consult with a mortgage broker to understand the implications of taking on a new mortgage.

Taxes

In most cases, the inheritor of a house is responsible for paying any applicable taxes.

This can include property taxes, estate taxes, and capital gains taxes.

It is important to understand these taxes and how they will impact your budget.

- Property Taxes

Every state has different rules and regulations regarding property taxes, and the owner is usually required to pay these taxes on an annual basis.

When you inherit a house, you will be responsible for paying these property taxes every year.

- Estate Taxes

Estate taxes are imposed when someone passes away, and their estate is worth more than a certain amount of money. In most cases, the estate tax is paid by the heir of the property.

The amount of the estate tax can vary significantly, so it is important to understand how it will impact you.

- Capital Gains Taxes

Capital gains taxes are imposed when an asset is sold for more than it was purchased for.

When you inherit a house, any increase in the property value from the time of purchase is subject to capital gains taxes.

Insurance

It is important to maintain insurance on the property you inherit.

This can help protect you from any potential damages and ensure that you are not liable for any accidents or injuries that occur on the property.

In some cases, you may not be able to make any changes to the insurance policy of a house you inherit.

If another person is named on the policy, this will affect your ability to name beneficiaries and make certain changes.

This can lead to complications and issues in paying for insurance, and it is important to know these limitations before taking ownership of a house.

Takeaways

When you inherit a house, there are a number of financial considerations you need to take into account. This includes understanding the implications of taking on a mortgage, paying taxes, and insurance.

It is important to consult with a financial advisor to understand these implications and make sure that you are able to afford the inherited house.

You should also consult with a tax accountant to understand the applicable taxes and capital gains.

This can help you avoid incurring any additional expenses from inheriting a house.

Inheriting a House FAQs

There are a number of benefits to inheriting a house, including avoiding paying rent, getting a free place to live, and receiving tax breaks.

The legal requirements for inheriting a house vary from state to state. In most cases, the heir is responsible for paying any applicable taxes and maintaining insurance on the property.

The financial considerations for inheriting a house include taking on a mortgage, paying taxes, and maintaining insurance. It is important to consult with a financial advisor to understand these implications and make sure that you are able to afford the inherited house.

When a person inherits a house, they have the option to live in it or sell the property. Selling the property is an effective way to recoup your initial investment and make a profit from the inherited house.

In many cases, people who inherit a house must pay taxes on it. The amount of tax you will be required to pay and the type of tax varies between states and how much profit you make from the sale of the house.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.