International estate planning is crucial for individuals who own assets or have beneficiaries in different countries. It involves the creation of a comprehensive estate plan that considers the legal, financial, and tax implications of transferring assets across international borders. International estate planning involves the application of estate planning principles and strategies to the unique challenges posed by international borders. Individuals with international assets or beneficiaries must consider legal systems, currency fluctuations, cultural differences, and tax implications. Failure to address these issues can lead to costly and time-consuming legal disputes, tax liabilities, and unintended consequences. Domestic and international estate planning differ in several ways. Domestic estate planning focuses on the legal and tax implications of transferring assets within the same legal jurisdiction. In contrast, international estate planning involves addressing the legal and tax implications of transferring assets across international borders. This can require understanding different legal systems, tax laws, and cultural norms. In international estate planning, several factors need to be considered to create an effective plan. These factors include: 1. Ownership and Location of Assets: The location and type of assets can impact the legal and tax implications of transferring them across borders. 2. Nationality and Residency: The nationality and residency of the individual and beneficiaries can determine the jurisdictional issues that need to be addressed in estate planning. 3. Language and Cultural Differences: Communication barriers can create misunderstandings that may affect the distribution of assets and tax planning. 4. Political and Economic Instability: Political and economic instability in a country can impact the safety and stability of assets. International estate planning can present unique challenges that require careful consideration. Some common issues include: 1. Currency Fluctuations: The value of assets can be impacted by currency fluctuations, which can affect tax and estate planning. 2. Foreign Tax Laws: International estate planning requires knowledge of the tax laws in different countries to ensure compliance and avoid double taxation. 3. Succession Laws: Different countries have different succession laws that can affect the distribution of assets. 4. Immigration and Emigration: Changes in residency or citizenship can impact estate planning strategies and tax liabilities. To create an effective international estate plan, several key components need to be considered. These components include: Wills and trusts are legal documents that play a crucial role in international estate planning. A will outlines an individual's wishes regarding the distribution of assets after death. In contrast, a trust is a legal entity that holds assets on behalf of the beneficiaries. By establishing a trust, individuals can protect their assets from creditors and ensure their assets are distributed according to their wishes. A power of attorney is a legal document that grants a designated individual the authority to manage an individual's financial affairs in the event of incapacity. This document can be crucial in international estate planning, where individuals may have assets in different countries that need to be managed. Advanced healthcare directives allow individuals to express their wishes regarding medical treatment in the event of incapacity. These documents can provide peace of mind to individuals and their families by following their medical wishes. Asset protection planning involves creating strategies to protect assets from potential creditors and liabilities. In international estate planning, asset protection planning is essential to protect assets in different countries' legal systems. Strategies for asset protection may include creating trusts, establishing offshore bank accounts, and diversifying investments. International estate planning has significant tax implications that need to be considered. These tax implications include: 1. Estate and Gift Tax: Many countries impose estate and gift taxes on assets transferred during an individual's lifetime or after their death. 2. Income Tax: Income tax can be impacted by the ownership and location of assets and the residency status of the individual and beneficiaries. 3. Foreign Tax Credits: Foreign tax credits can be used to offset tax liabilities in one country for taxes paid in another country. 4. Double Taxation Treaties: Double taxation treaties are agreements between countries that aim to eliminate double taxation of income and assets. Jurisdictional issues are a critical consideration in international estate planning. These issues include: 1. Choice of Law: The choice of law can impact the interpretation and enforcement of estate planning documents. 2. Domicile and Residency: Domicile and residency can determine the jurisdictional issues that need to be addressed in estate planning. 3. Cross-Border Succession Laws: Different countries have different succession laws that can impact the distribution of assets. 4. Immigration and Emigration: Changes in residency or citizenship can impact estate planning strategies and tax liabilities. International estate planning can present several challenges that need to be addressed to create an effective plan. These challenges include: 1. Language and Cultural Barriers: Communication barriers can create misunderstandings that may affect the distribution of assets and tax planning. 2. Currency Conversion and Exchange Rate Fluctuations: The value of assets can be impacted by currency fluctuations, which can affect tax and estate planning. 3. Legal and Regulatory Complexities: The legal and regulatory complexities of different countries can create challenges in estate planning. 4. Political and Economic Instability: Political and economic instability in a country can impact the safety and stability of assets. To create a successful international estate plan, several strategies can be employed. These strategies include: 1. Working With Experienced Professionals: Working with professionals such as lawyers, financial advisors, and accountants who have experience in international estate planning can help navigate the challenges and complexities of the process. 2. Regularly Reviewing and Updating Estate Planning Documents: Estate planning documents should be regularly reviewed and updated to reflect changes in personal circumstances, changes in the law, and changes in economic conditions. 3. Staying Informed About Changes in Laws and Regulations: Changes in laws and regulations can impact estate planning strategies, and individuals should stay informed about these changes. 4. Considering the Impact of International Estate Planning on Beneficiaries: International estate planning can significantly impact beneficiaries, and individuals should consider the implications of their decisions on their loved ones. International estate planning is a complex and challenging process that requires careful consideration of legal, financial, and tax implications. It involves the creation of a comprehensive estate plan that addresses the unique challenges posed by international borders. By understanding the key components of international estate planning, the tax implications, jurisdictional issues, challenges, and strategies for success, individuals can create an effective plan that meets their unique needs and protects their assets for future generations. If you have international assets or beneficiaries, it is essential to seek the advice of an estate planning lawyer who has experience in international estate planning. They can assist in creating a comprehensive estate plan that takes into account the unique challenges posed by international borders and ensures that your assets are protected and distributed according to your wishes. What Is International Estate Planning?

Factors to Consider in International Estate Planning

Common Issues in International Estate Planning

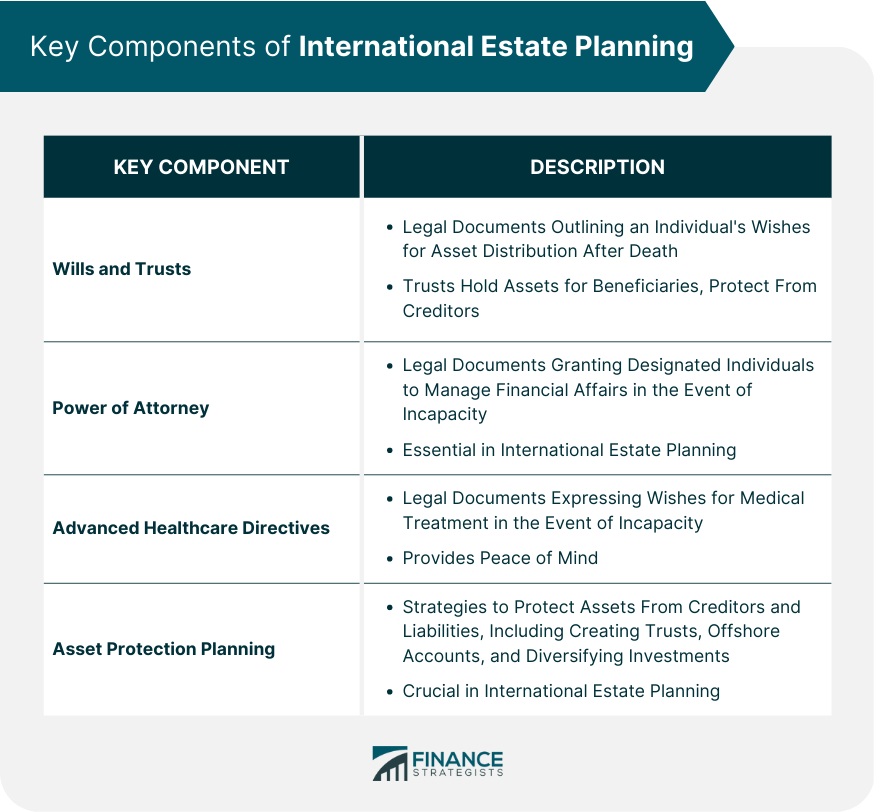

Key Components of International Estate Planning

Wills and Trusts

Power of Attorney

Advanced Healthcare Directives

Asset Protection Planning

Tax Implications of International Estate Planning

Jurisdictional Issues in International Estate Planning

Challenges in International Estate Planning

Strategies for Successful International Estate Planning

Final Thoughts

International Estate Planning FAQs

International estate planning is the process of creating a comprehensive estate plan that considers the legal, financial, and tax implications of transferring assets across international borders.

International estate planning is important because it helps individuals protect their assets and ensure compliance with the laws of different jurisdictions. It can also help minimize tax liabilities and avoid legal disputes.

The key components of international estate planning include wills and trusts, power of attorney, advanced healthcare directives, and asset protection planning.

International estate planning has significant tax implications, including estate and gift tax, income tax, foreign tax credits, and double taxation treaties.

An estate planning lawyer who specializes in international estate planning can provide guidance and advice on the best strategies for protecting your assets and ensuring compliance with the laws of different jurisdictions. They can also assist in creating a comprehensive estate plan that takes into account the unique challenges posed by international borders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.