Joint tenancy is a legal concept that refers to a type of co-ownership of the property where two or more people share equal ownership, with the right of survivorship. This means that when one owner dies, the ownership interest in the property is automatically transferred to the surviving co-owner(s). This right of survivorship is one of the defining characteristics of joint tenancy. It is a way of co-owning property often used by couples, business partners, family members, and friends. Joint tenancy has several characteristics that distinguish it from other types of co-ownership. Joint tenancy requires that all co-owners acquire their ownership interest in the property at the same time, through the same title, with the same interest, and with the same right to occupy and possess the property. This is known as the "unity of time, title, interest, and possession." This requirement ensures that all co-owners have an equal and undivided interest in the property. Creating a joint tenancy requires specific legal requirements and methods. These requirements and methods should be followed carefully to ensure the joint tenancy is created correctly and legally. There are certain requirements that must be complied with by co-owners to establish a joint tenancy. First, the co-owners must have equal ownership interests in the property. Second, the co-owners must acquire their interests in the property at the same time, through the same title, and with the same right to occupy and possess the property. Finally, the co-owners must include specific language in the deed or other legal document that creates the joint tenancy, explicitly stating that the property will be held in joint tenancy with the right of survivorship. There are several methods of creating a joint tenancy. The most common method is through a deed that explicitly states that the property will be held in joint tenancy with the right of survivorship. The deed must be signed and notarized by all co-owners, and it must be recorded to make it legally binding. Another method of creating a joint tenancy is through a will. If a will explicitly state that property will be held in joint tenancy with the right of survivorship, then the property will pass to the surviving owner(s) without probate. In some states, joint tenancy can also be created by operation of law. For example, when a married couple purchases property together, it is automatically held in joint tenancy with the right of survivorship unless otherwise specified. Joint tenancy offers several advantages that make it an attractive option for co-ownership of property. These advantages include: The main advantage of joint tenancy is the right of survivorship. When one owner dies, the ownership of the property automatically transfers to the surviving owner(s) without the need for probate or other legal proceedings. This means that the surviving owner(s) will inherit the deceased owner's share of the property, regardless of whether there is a will or other estate planning documents. Because the right of survivorship means that the property passes automatically to the surviving owner(s), joint tenancy can help avoid the need for probate. This can save time and money, as probate can be a lengthy and expensive process. In a joint tenancy, all co-owners have an equal ownership interest in the property. This means that each owner has the same share of the property, and all owners have an equal say in decisions related to the property. Joint tenancy is a relatively simple way to co-own property, requiring only the inclusion of specific language in the deed or other legal document that creates the joint tenancy. Joint tenancy can offer protection of assets from creditors. Because the property is co-owned, creditors of one owner may not be able to attach the property to satisfy a debt. While joint tenancy offers several advantages as a form of co-ownership of property, it also has some disadvantages that should be carefully considered before entering such an arrangement. These disadvantages include: In a joint tenancy, all co-owners have an equal say in decisions related to the property, regardless of their financial contribution to the property or their level of involvement in managing the property. This can disadvantage co-owners who want more control over the property. Joint tenancy is a relatively inflexible way of co-owning property. For example, if one co-owner wants to sell their share of the property, they must obtain the consent of the other co-owner(s) to do so. Joint tenancy requires that all co-owners have an equal ownership interest in the property, regardless of their financial contributions to the property. This can disadvantage co-owners who have contributed more financially to the property than the other co-owners. Joint tenancy can have tax implications, particularly regarding capital gains taxes. When the property is sold, the surviving owner(s) may be subject to paying capital gains taxes. Joint tenancy can also expose co-owners to creditor risk. Because each co-owner has an equal ownership interest in the property, creditors of one owner may be able to attach the property to satisfy a debt. To gain a complete understanding of the legal and financial consequences of joint tenancy, it is crucial to comprehend the methods and implications of termination. There are several methods of terminating a joint tenancy. One way is for one co-owner to sell or give their share of the property to someone else. This can be done without the consent of the other co-owner(s) and will effectively terminate the joint tenancy. Another way to terminate a joint tenancy is for one co-owner to transfer their interest in the property to themselves as a tenant in common. This can be done through a legal document explicitly stating the co-owner's intent to sever the joint tenancy. When a joint tenancy is terminated, the right of survivorship is also terminated. This means that if one co-owner dies, their share of the property will not automatically transfer to the surviving owner(s) but will pass according to their will or other estate planning documents. If the co-owners cannot agree on dividing the property after joint tenancy is terminated, a court may order a partition, which involves dividing the property into separate parcels and assigning ownership to each co-owner. Tenancy in common is a form of co-ownership of property that differs from joint tenancy in several key ways. It is crucial to comprehend the variations between the two types of property co-ownership to identify the one that is most suitable for your circumstances. Tenancy in common is a form of co-ownership where each co-owner has a separate and distinct ownership interest in the property. Unlike joint tenancy, there is no right of survivorship in a tenancy in common, meaning that when one co-owner dies, their share of the property passes to their heirs and/or beneficiaries rather than the other co-owner(s). The main differences between joint tenancy and tenancy in common are the right of survivorship, the level of ownership interest, and the ability to transfer ownership. In a joint tenancy, there is a right of survivorship, meaning that when one co-owner dies, their share of the property passes to the surviving co-owner(s). In tenancy in common, there is no right of survivorship; the ownership of the property is transferred to the heirs or beneficiaries of the deceased co-owner. Joint tenancy is a type of co-ownership of property that offers several advantages and disadvantages. It is important to understand the key characteristic of joint tenancy, such as the unity of time, title, interest, and possession, as well as the advantages and disadvantages of a joint tenancy before entering into such an arrangement. Terminating joint tenancy can have legal and financial implications, including tax implications. It is important to seek advice from a qualified tax attorney or other legal professionals providing tax services before terminating a joint tenancy. Tenancy in common is another type of co-ownership that differs from joint tenancy in several key ways, including the right of survivorship, level of ownership interest, and ability to transfer ownership. It is highly recommended to consult an estate planning lawyer before entering into a joint tenancy agreementWhat Is Joint Tenancy?

Characteristics of Joint Tenancy

Creation of Joint Tenancy

Requirements

Methods of Creation

Advantages of Joint Tenancy

Right of Survivorship

Avoidance of Probate

Equal Ownership

Simplicity

Protection of Assets

Disadvantages of Joint Tenancy

Limited Control

No Flexibility

Unequal Contributions

Tax Implications

Creditor Risk

Termination of Joint Tenancy

Methods of Termination

Effect of Termination

Key Differences Between Joint Tenancy and Tenancy in Common

Definition of Tenancy in Common

Key Differences

Final Thoughts

Joint Tenancy FAQs

With joint tenancy, co-owners possess an equal ownership stake in a property and have the right of survivorship.

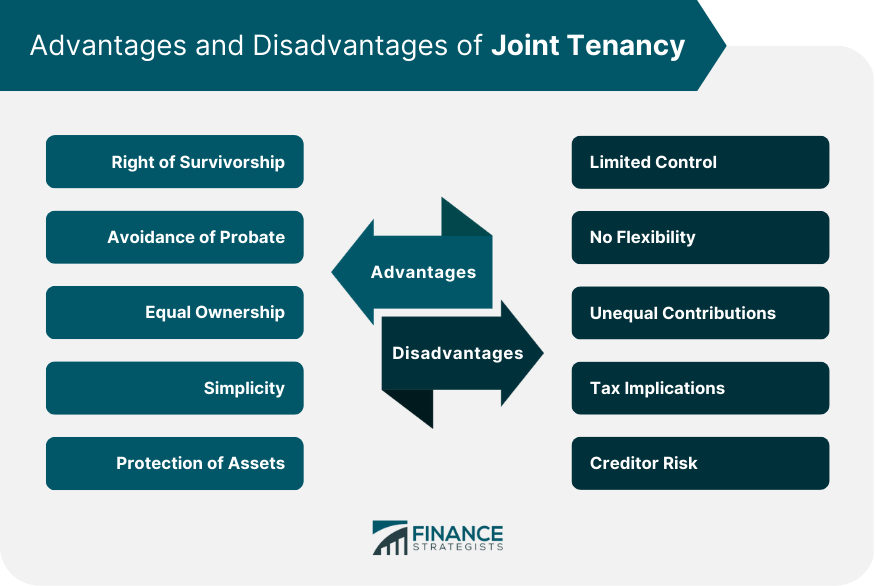

The advantages of joint tenancy include the right of survivorship, avoidance of probate, equal ownership, simplicity, and protection of assets from creditors.

The disadvantages of joint tenancy include limited control, inflexibility, unequal contributions, tax implications, and creditor risk.

Tenancy in common is another form of co-ownership of the property where each co-owner has a separate and distinct ownership interest in the property, with no right of survivorship. The major differences between the two include the right of survivorship, level of ownership interest, and ability to transfer ownership.

Yes, it is recommended to seek the advice of a qualified attorney or other legal professionals before entering into a joint tenancy agreement to understand the legal and financial implications of joint tenancy fully and to explore other options for co-ownership of property.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.