An estate plan is a comprehensive strategy to protect and manage your assets during life and ensure their efficient distribution upon death. It typically includes a will, power of attorney, healthcare directives, and possibly trusts. Through careful planning, you can minimize estate taxes, avoid probate, and ensure your wishes are carried out. Professional guidance is essential to tailor your plan to specific goals, family dynamics, and legal requirements. Regular updates are crucial to reflect changes in your life and the law. Assets are anything of value that you own. This may include real estate properties, personal properties, investments, business interests, retirement, and insurance accounts. Real estate properties encompass your primary residence and any other properties you might own, such as vacation homes or rental properties. Personal properties are items like cars, jewelry, antiques, furniture, and other personal belongings. Investments and business interests include stocks, bonds, mutual funds, certificates of deposit, partnership interests, and any businesses you own, either partially or entirely. Retirement accounts could include Individual Retirement Accounts (IRAs), 401(k) accounts, pension plans, and other retirement savings. Lastly, insurance accounts could be life insurance, annuity contracts, and any other insurance policies you might have. Identifying your liabilities is just as critical as knowing your assets. Liabilities are what you owe to others. This includes your outstanding mortgage and personal loans, credit card debts, and other financial obligations such as unpaid taxes or loans from retirement accounts. Once you have identified your assets and liabilities, the next step is calculating your net worth. Your net worth is the difference between your total assets and total liabilities. Understanding your net worth is key to estate planning because it gives you a clear picture of your financial situation. Keeping a document of all your personal information and important contacts is an essential part of estate planning. This document should include details of all your assets and liabilities, insurance policies, bank accounts, investment accounts, and other financial information. Beneficiaries are the individuals or entities that you designate to receive your assets upon your death. Identifying your beneficiaries early in the planning process can help to ensure that your wishes are carried out and that your assets are distributed according to your intentions. Your estate plan should reflect your personal objectives and priorities. This might include providing for your loved ones, contributing to a favorite charity, or ensuring the continuity of your business. Carefully consider what is most important to you as you make your estate plan. A last will and testament is a legal document that communicates a person's final wishes pertaining to possessions and dependents. It should clearly indicate how you want your assets to be distributed after your death, who should take care of your minor children, and who will be responsible for carrying out your wishes. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries. Different types of trusts can be used to achieve different estate planning goals, such as minimizing estate taxes or protecting assets from creditors. A power of attorney is a legal document that allows you to appoint someone to manage your financial affairs if you become unable to do so. There are two main types of power of attorney: financial power of attorney and healthcare power of attorney. A financial power of attorney gives someone the authority to handle financial transactions on your behalf, while a healthcare power of attorney allows someone to make healthcare decisions for you if you become incapacitated. An advance health care directive, also known as a living will, is a document in which you specify what actions should be taken for your health if you are no longer able to make decisions for yourself because of illness or incapacity. Beneficiary designations are a key part of estate planning. These designations determine who will receive your assets, such as life insurance proceeds and retirement account funds, upon your death. A letter of intent is a document left to your executor or a beneficiary specifying what you want to be done with a particular asset or detailing other special requests or desired arrangements. The federal estate tax is a tax on the transfer of a person's assets at death. The tax applies to the portion of the estate that exceeds the federal estate tax exemption amount, which is adjusted annually for inflation. Some states also impose their own estate taxes, which may have different exemption amounts and tax rates than the federal estate tax. If you live in a state with an estate tax, it's important to consider this in your estate planning. There are several effective strategies available to minimize estate taxes and preserve wealth for future generations. One common approach is to establish a trust, such as a bypass or generation-skipping trust, which can help maximize the use of estate tax exemptions. Gifting assets during your lifetime is another viable option, as it allows you to transfer wealth while potentially taking advantage of gift tax exclusions. Utilizing charitable giving, through methods like charitable remainder trusts or foundations, not only benefits a worthy cause but can also provide tax advantages. Additionally, life insurance can be used strategically to provide liquidity and cover estate tax liabilities. Consulting with an experienced estate planning professional is crucial to identify the most suitable strategies based on your specific circumstances and goals. You should review your estate plan regularly to ensure that it continues to meet your needs and reflects your current wishes. Major life events such as marriage, divorce, the birth of a child, retirement, or major changes in your financial situation are good times to review and possibly revise your plan. Changes in your personal or financial situation, tax laws, or your wishes for how your assets should be distributed can all require updates to your estate plan. The process of updating your estate plan can vary depending on what changes need to be made. Minor changes might be accomplished through a codicil to your will or an amendment to your trust, while major changes may require a complete revision of your estate planning documents. Estate planning is an imperative process, one that safeguards your financial legacy and assures that your wishes are respected posthumously. This process involves taking stock of your assets and identifying your liabilities, which allows you to calculate your net worth - the foundation of your estate plan. The creation of key legal documents such as wills, trusts, power of attorney, and living wills ensures your desires are executed appropriately. Understanding estate taxes and strategies to mitigate them can help protect your estate's value. Consulting with knowledgeable professionals such as estate planning attorneys, financial advisors, and tax professionals can provide invaluable guidance and expertise. Ultimately, the dynamic nature of life necessitates regular reviews and updates to your estate plan to mirror your evolving circumstances and wishes. It's a journey that demands time and attention but provides invaluable peace of mind and security for your loved ones.Estate Plan Overview

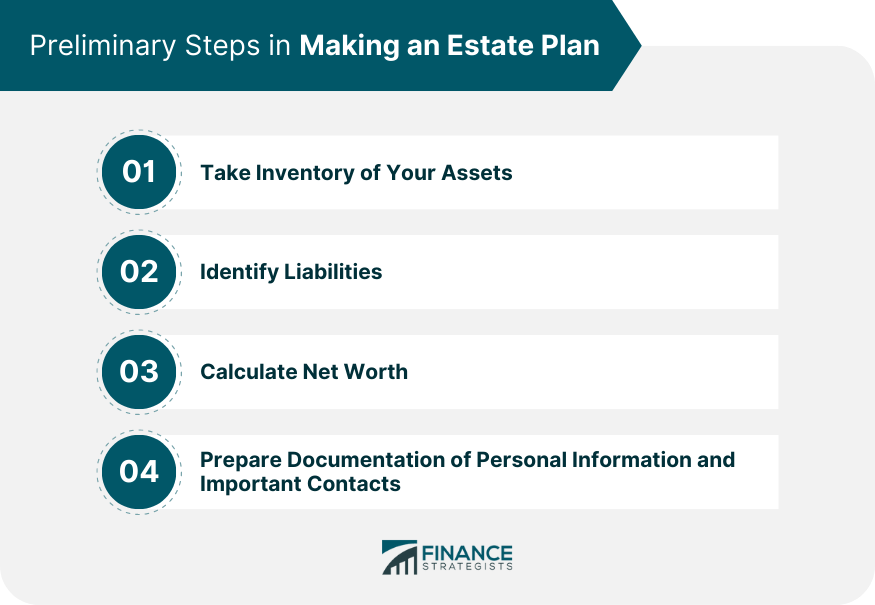

Preliminary Steps in Making an Estate Plan

Make an Inventory of Assets

Identify Liabilities

Calculate Net Worth

Prepare Documentation of Personal Information and Important Contacts

Establish Estate Planning Goals

Identify Beneficiaries

Clarify Objectives and Priorities

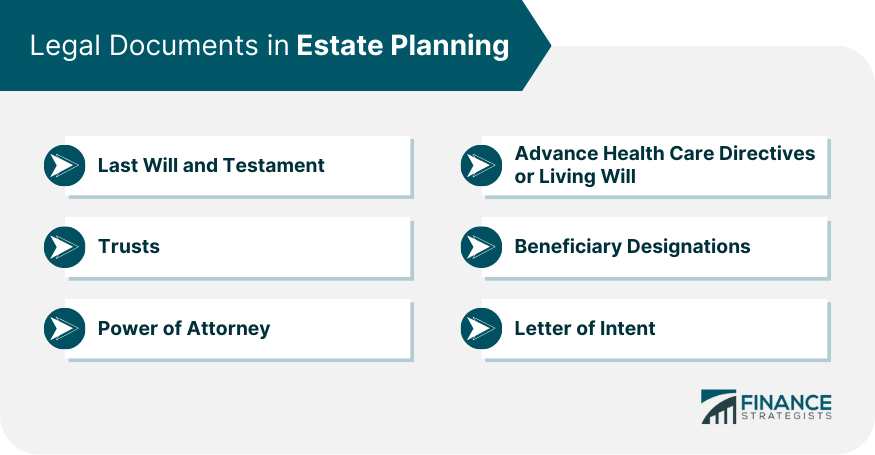

Legal Documents in Estate Planning

Last Will and Testament

Trusts

Power of Attorney

Advance Health Care Directives or Living Will

Beneficiary Designations

Letter of Intent

How to Reduce Estate Taxes

Estate Taxes

Strategies to Reduce Estate Taxes

Regular Review and Update of Estate Plan

Bottom Line

Making an Estate Plan FAQs

Making an estate plan involves several initial steps. Start by taking an inventory of your assets, including real estate, personal belongings, financial investments, and retirement and insurance accounts. Then, identify your liabilities like outstanding loans or credit card debts. After that, calculate your net worth and document all your personal information and important contacts.

Identifying beneficiaries is crucial because they are the individuals or entities that you designate to receive your assets upon your death. By identifying your beneficiaries early in the planning process, you can ensure your assets are distributed according to your wishes and avoid potential disputes among heirs.

Various legal documents are necessary when making an estate plan. These can include a last will and testament, trusts, power of attorney, advance health care directive or living will, beneficiary designations, and a letter of intent. Each of these documents serves a specific purpose in your estate plan and helps to ensure your wishes are carried out.

Professionals play a crucial role in making an estate plan. Estate planning attorneys can guide you through the legal aspects, draft your will, and establish trusts. Financial advisors can help assess your financial situation and develop a plan to achieve your goals. Tax professionals can help you understand the tax implications of your estate plan and suggest strategies to minimize your tax liability.

Your estate plan should be reviewed regularly to ensure that it still aligns with your needs and current situation. Major life events such as marriage, divorce, the birth of a child, or significant changes in your financial status are often good times to review your plan. Updating your estate plan can involve minor changes through a codicil to your will or an amendment to your trust, or major changes may require a complete revision of your estate planning documents.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.