Multigenerational wealth planning is a long-term financial strategy designed to help families preserve and grow their wealth across multiple generations. It involves identifying the financial goals and objectives of each generation, developing a comprehensive plan to achieve those goals, and implementing strategies to minimize taxes and protect assets. At its core, multigenerational wealth planning focuses on creating a structure that allows for the seamless transfer of wealth from one generation to the next. This may include setting up trusts or other legal entities, establishing gifting programs, and utilizing tax-efficient investment vehicles. The key to successful multigenerational wealth planning is to start early and involve all members of the family in the process. By creating a shared vision and implementing a coordinated strategy, families can ensure that their wealth is passed on to future generations in a way that aligns with their values and goals. It is important to note that multigenerational wealth planning can be complex and may require the expertise of financial advisors, attorneys, and other professionals to ensure that all legal and tax considerations are properly addressed.

A successful multigenerational wealth plan begins with a clear understanding of the family's values and priorities. Family members should work together to identify shared goals, values, and objectives that will guide the planning process. Effective communication and decision-making are crucial for successful multigenerational wealth planning. Families should assess their communication styles and establish a decision-making framework that promotes collaboration and consensus-building. A well-rounded wealth plan must balance individual goals and aspirations with the family's collective objectives. By integrating personal and shared goals, families can create a unified vision that ensures the long-term success of the wealth plan. Wills and trusts form the foundation of a solid estate plan. Various types of trusts can be utilized, including revocable living trusts, irrevocable trusts, and testamentary trusts, each with its unique benefits and purposes. A comprehensive estate plan should also include power of attorney documents and healthcare directives to ensure that a trusted individual can make crucial decisions on behalf of family members in the event of incapacity. Properly designating beneficiaries and titling assets is essential to ensuring a smooth and tax-efficient transfer of wealth. Families should regularly review and update beneficiary designations and asset titling to reflect changing circumstances. Strategies for minimizing estate and inheritance taxes should be a key component of the wealth plan. This may include utilizing trusts, gifting strategies, and other tax-saving methods. Incorporating charitable giving and philanthropy into the estate plan can help fulfill family values and create a lasting legacy while also providing potential tax benefits. A well-diversified investment portfolio is crucial for preserving and growing family wealth. Diversification and risk management strategies should be tailored to each family's risk tolerance, time horizon, and financial goals. Implementing tax-efficient investment strategies can help families retain more of their wealth over time. This may include maximizing tax-deferred accounts, utilizing tax-loss harvesting, and investing in tax-efficient assets. Retirement planning is an integral part of multigenerational wealth planning. Families should establish distribution strategies that ensure a comfortable retirement while preserving wealth for future generations. For families with significant real estate holdings or business interests, real estate and business succession planning should be incorporated into the overall wealth plan to ensure a smooth and successful transition. Preparing for the educational needs of future generations is essential for maintaining the family's financial stability. Families should consider various education funding options, such as 529 plans and trusts, to meet this objective. Life insurance plays a vital role in protecting family wealth and providing financial security. Different types of life insurance policies, such as term life, whole life, and universal life insurance, can be utilized depending on the family's needs and objectives. Disability insurance is essential for protecting family income in the event of a disability that prevents an individual from working. Families should consider purchasing adequate disability insurance coverage to safeguard their financial stability. Long-term care insurance can help cover the costs of long-term care services that may be needed as family members age. Incorporating long-term care insurance into the wealth plan can protect family assets and ensure the necessary care is provided. Family governance structures, such as family meetings, family councils, and family mission statements, can help promote communication, decision-making, and cohesion within the family. Establishing these structures is vital for the success of the multigenerational wealth plan. Financial education and mentoring are crucial for preparing future generations to manage and preserve family wealth. Families should prioritize financial literacy, investment education, and inheritance preparation to ensure a seamless transition of wealth management responsibilities. Family foundations and donor-advised funds can provide a structured and tax-efficient approach to philanthropy, allowing families to support causes they are passionate about while building a lasting legacy. Families should align their charitable giving strategies with their values and objectives. This can help create a sense of purpose and unity within the family while fostering social impact. Involving future generations in philanthropy can help instill a sense of responsibility, empathy, and purpose. Families should encourage younger members to participate in charitable activities and decision-making processes. Families should regularly review and update their wealth plan to ensure it remains aligned with their goals, values, and changing circumstances. This may include revisiting the plan following significant life events or market changes. As family dynamics and financial circumstances evolve, the wealth plan must be adjusted accordingly. Open communication and transparency are key to addressing these changes and maintaining the plan's effectiveness. Multigenerational wealth planning is a critical process for securing a lasting legacy and financial stability for future generations. By addressing family dynamics, implementing comprehensive estate, financial, and insurance planning strategies, and fostering family governance, education, and philanthropy, families can successfully navigate the challenges and opportunities of wealth transfer. Engaging professional advisors and specialists can provide invaluable guidance and support throughout this complex process, ensuring the family's goals are achieved and sustained across generations.What Is Multigenerational Wealth Planning?

Understanding Family Dynamics and Values

Identifying Family Values and Priorities

Assessing Family Communication and Decision-Making Styles

Integrating Individual and Collective Goals

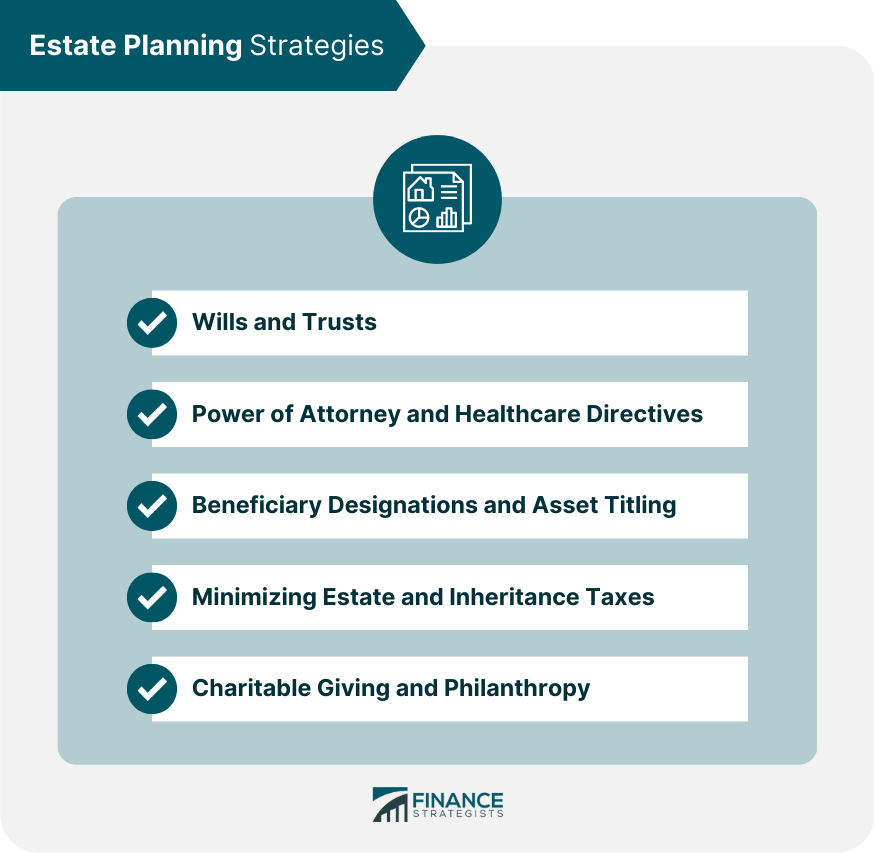

Estate Planning Strategies

Wills and Trusts

Power of Attorney and Healthcare Directives

Beneficiary Designations and Asset Titling

Minimizing Estate and Inheritance Taxes

Charitable Giving and Philanthropy

Financial Planning and Investment Strategies

Diversification and Risk Management

Tax-Efficient Investment Strategies

Retirement Planning and Distribution Strategies

Real Estate and Business Succession Planning

Education Funding for Future Generations

Insurance Planning

Life Insurance Strategies

Disability Insurance

Long-Term Care Insurance

Family Governance and Education

Establishing Family Governance Structures

Financial Education and Mentoring

Philanthropy and Social Impact

Family Foundations and Donor-Advised Funds

Aligning Charitable Giving With Family Values

Engaging Future Generations in Philanthropy

Monitoring and Adjusting the Multigenerational Wealth Plan

Regular Plan Reviews and Updates

Addressing Changes in Family Dynamics and Financial Circumstances

Conclusion

Multigenerational Wealth Planning FAQs

Multigenerational wealth planning refers to the process of creating and implementing a financial plan that aims to preserve and grow wealth across multiple generations. This type of planning takes into account the unique needs and goals of each generation, as well as any potential tax implications or legal considerations.

Multigenerational wealth planning is important because it can help families avoid financial pitfalls, such as estate taxes or disputes over inheritance. It also allows families to pass on their wealth and values to future generations, providing them with a strong financial foundation and the tools they need to achieve their own goals.

Some common strategies used in multigenerational wealth planning include creating trusts, establishing family limited partnerships, gifting assets, and utilizing tax-efficient investment vehicles. These strategies can help families minimize taxes, protect assets from creditors, and ensure that wealth is distributed according to their wishes.

Anyone who has significant assets and wants to ensure that their wealth is preserved and passed on to future generations should consider multigenerational wealth planning. This type of planning is especially important for high-net-worth families, business owners, and individuals with complex financial situations.

To get started with multigenerational wealth planning, it's important to consult with a financial advisor or estate planning attorney who has experience working with families on this type of planning. They can help you assess your current financial situation, identify your goals and objectives, and create a customized plan that meets your unique needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.