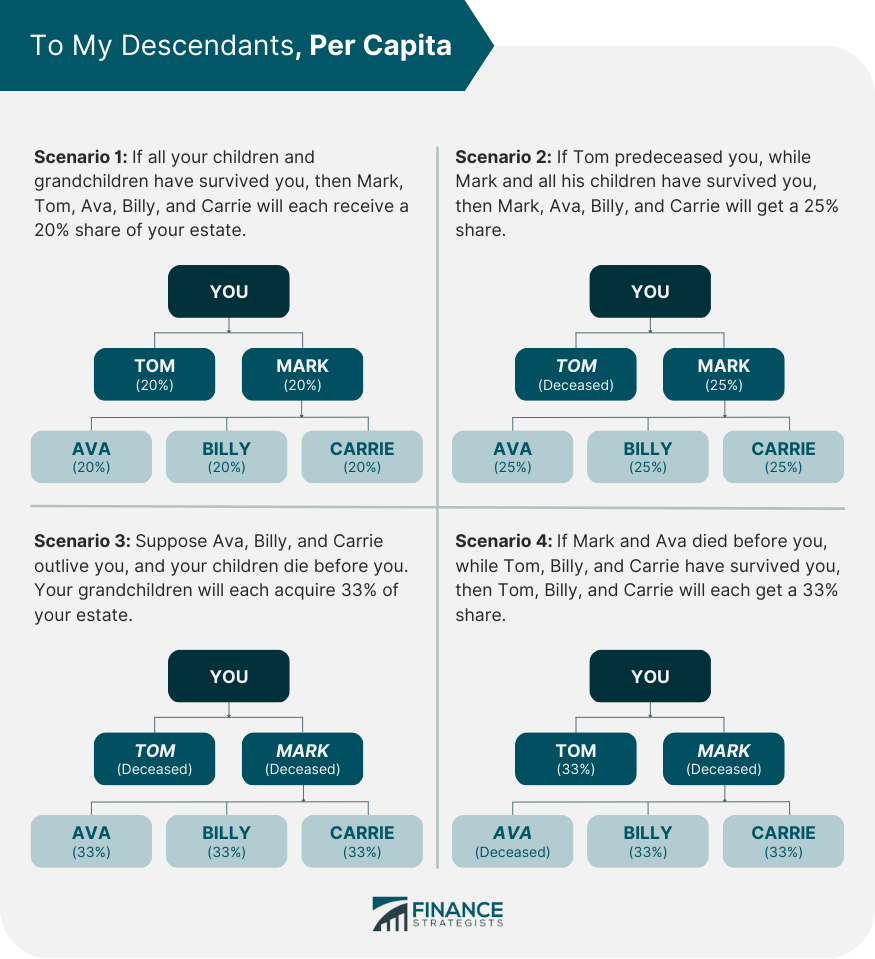

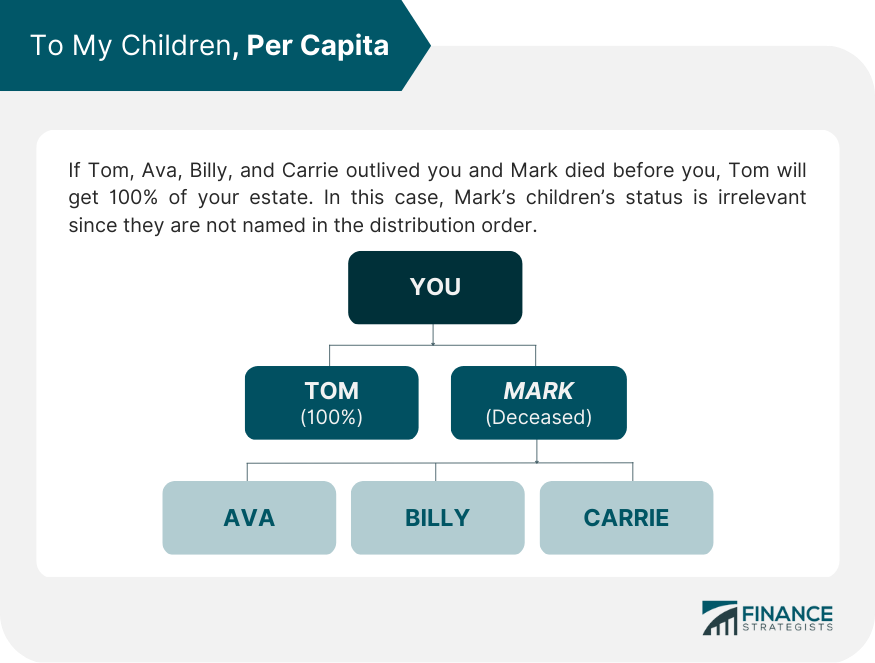

Per capita is a way of distribution in which the estate or trust assets are divided among all beneficiaries individually and equally. It is commonly used when multiple names or identified in-class beneficiaries exist. In per capita distribution, each person receives the same amount regardless of their relationship to the deceased or the asset holder, granted they are listed in the distribution order. The two most common stipulations are “to my descendants, per capita” and “to my children, per capita.” It is important to note that per capita distributions can only be applied to estates and trusts distributed according to intestate succession laws or predefined rules in wills, trusts, or other documents. Suppose you have two children, Mark and Tom. Suppose further that Tom has no children while Mark has three: Ava, Billy, and Carrie. Mark's kids have no descendants. Consider what happens if your will stipulates: to my descendants, per capita. The assets will be distributed among your then-living descendants: Consider another common way of per capita distribution if your will stipulates your estate to be given to your children per capita: Per capita means by head in Latin. All the surviving members of the identified group receive an equal share of your estate in the case of your death. Beneficiaries who die before you do not receive a share, increasing the portion for those who outlive you. Consider the following benefits of per capita distributions: The per capita method lets you designate specific beneficiaries and list them in a distribution order. It allows for exacting control over who will receive a share of your estate. It makes it easier to ensure that your assets will go to those you named as beneficiaries. Rather than having to make decisions about the value of specific assets, per capita distribution ensures that each beneficiary will receive an equal share of total estate assets. It helps avoid arguments about who gets what and allows for a smoother, more efficient distribution of assets. This method can make administering an estate easier and less expensive since it specifies beneficiaries and provides equal shares to all. It simplifies the legal process and reduces the work involved for the executor or trustee, thus avoiding delays. Drawbacks of per capita distributions include the possibility of triggering additional taxes and neglecting the beneficiaries' specific needs and financial situation. This type of taxation is imposed on assets transferred to grandchildren and distant generations rather than directly to children. Per capita distribution may trigger generation-skipping taxes if your children predecease you and your grandchildren are beneficiaries. In these cases, taxes must be paid with respect to each generation for the estate to pass on properly. It may be particularly relevant if substantial generational wealth transfers are expected. Since all beneficiaries receive an equal share regardless of their individual financial situations, some may benefit more than others. One beneficiary may have greater needs or require more assistance than another. Giving beneficiaries the same share of an estate may not make sense in this case. You may wish that some beneficiaries receive a larger portion of your assets while others receive less. Per capita distribution does not provide for such a situation. Per capita divides the assets equally regardless of a beneficiary's relationship to the deceased, as long as they are listed in the distribution order. On the other hand, per stirpes distributes an estate among heirs relative to how many generations are involved in the inheritance. Per capita divides the estate into portions allocated to each generation, beginning with the oldest and working down to the youngest. Typically, per capita distribution is preferred when the deceased has few living relatives, and they all share a close relationship. On the other hand, per stirpes is suited for estates with numerous descendants in multiple family tree branches. Lastly, if a beneficiary predeceases you, they are removed from the per capita distribution list. The would-be share reverts to your estate to be divided equally among the living beneficiaries. With per stirpes, the bequest automatically shifts to a deceased beneficiary's descendants by representation. The per capita method appropriates your estate equally among the beneficiaries you specify in the distribution order. It disregards your relationship with the beneficiaries or how many generations are involved in the bequest. It provides ease of distribution due to its specificity, fairness, and simplicity. However, it may not be suitable if your estate has numerous beneficiaries or disparate needs. It may also trigger generation-skipping taxes in certain cases. Per capita differs from per stirpes distribution in that the latter is more suitable for estates with numerous descendants in multiple family tree branches. It facilitates inheritance through representation if a beneficiary predeceases you. Overall, it is important to consider your estate situation and beneficiary needs before deciding on the most appropriate distribution method. This can help ensure your assets are properly disbursed without any complications or additional taxes. Finally, it is recommended to consult a qualified estate planning lawyer or financial advisor before choosing a distribution method. These experts can help you formulate the best plan for managing and distributing your assets after you pass away.What Is Per Capita Distribution?

Examples of Per Capita Distributions

To My Descendants, Per Capita

To My Children, Per Capita

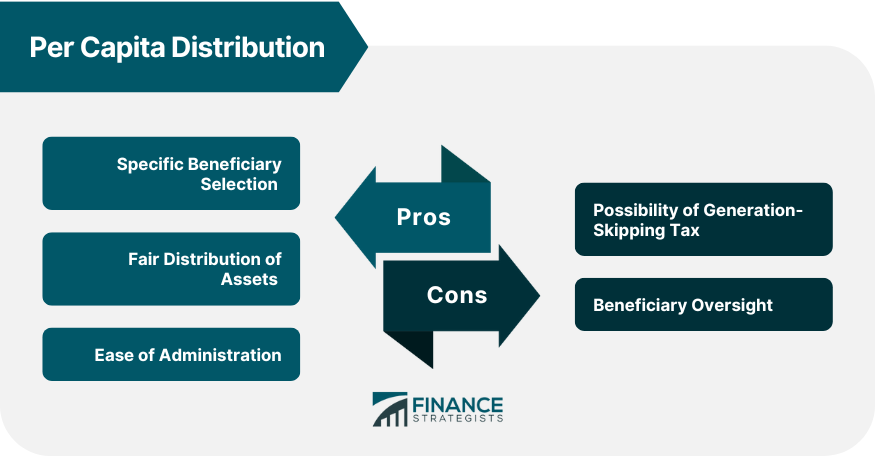

Advantages of Per Capita Distributions

Specific Beneficiary Selection

Fair Distribution of Assets

Ease of Administration

Disadvantages of Per Capita Distributions

Possibility of Generation-Skipping Tax

Beneficiary Oversight

Per Capita vs Per Stirpes

Final Thoughts

Per Capita Distributions FAQs

To write a per capita distribution in a will, you should specify that your assets and property are to be divided equally among all living beneficiaries as of the date of death. It is important to clarify which beneficiaries are eligible for receiving an inheritance.

Per capita distribution can be used in a will to indicate how assets should be divided upon your death. This method is often used when multiple heirs have different relationships with you.

Per capita distribution can be a good idea depending on your individual needs and circumstances. It guarantees an equal share for each beneficiary, preventing disputes and simplifying the estate planning process.

Per capita and per stirpes are two different ways of distributing assets according to a will. Per capita distribution allocates an equal amount to each living heir at the time of the distribution. Per stirpes distributes assets among heirs in generations, meaning assets are distributed equally among all descendants of any deceased heirs.

Yes, it is possible to choose a per capita beneficiary for an IRA account. However, it is important to consider the implications of making this choice before doing so. When selecting a per capita beneficiary, ensure that the amount each heir receives is equal and that all heirs are aware of their inheritance rights.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.