What Is a Durable Power of Attorney?

A durable power of attorney in finance is a legal document that grants an individual, called the agent, the authority to make financial decisions on behalf of another person, known as the principal, in the event that the principal becomes incapacitated or unable to make decisions for themselves.

The durable aspect of this power of attorney means that it remains valid even if the principal becomes incapacitated.

This document is an important part of estate planning and can help ensure that an individual's financial affairs are taken care of if they become unable to manage them on their own.

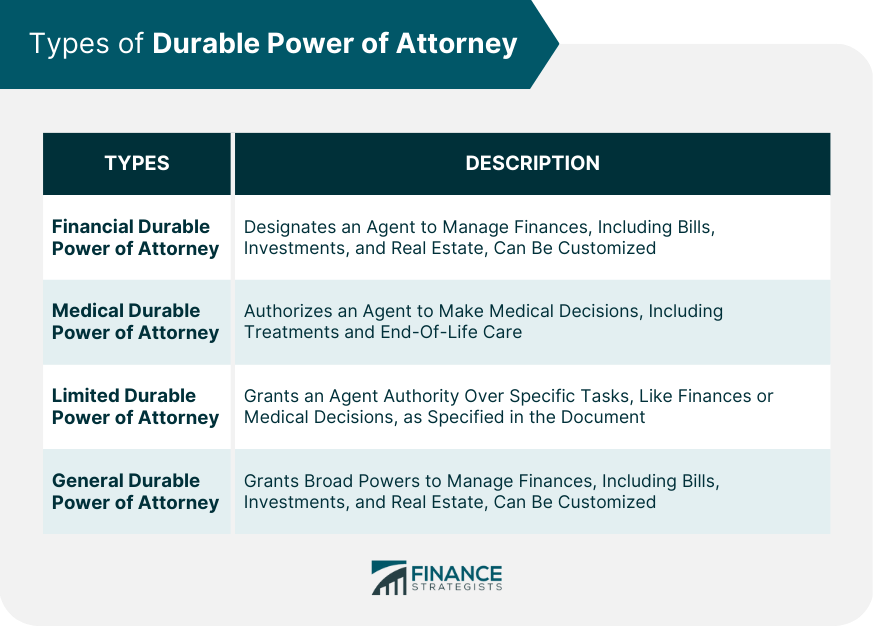

Types of Durable Power of Attorney

Financial Durable Power of Attorney

A financial DPOA designates an agent to manage your financial affairs, including paying bills, managing investments, and handling real estate transactions. The scope of authority can be customized to suit your specific needs and preferences.

Medical Durable Power of Attorney

Also known as a healthcare power of attorney, a medical DPOA authorizes an agent to make medical decisions on your behalf when you are unable to do so. This includes decisions related to medical treatments, surgical procedures, and end-of-life care.

Limited vs General Durable Power of Attorney

A limited DPOA grants the agent authority over specific tasks or transactions, whereas a general DPOA grants broad powers to manage your financial affairs. The scope of authority can be customized depending on your requirements and circumstances.

Establishing a Durable Power of Attorney

Selecting an Agent

When choosing an agent, consider factors such as trustworthiness, financial acumen, and the ability to act in your best interest. The responsibilities of an agent include acting in good faith, avoiding conflicts of interest, and maintaining accurate records of all transactions.

Legal Requirements

Each state has its own regulations concerning DPOAs. It is essential to familiarize yourself with the specific requirements in your jurisdiction. Necessary documentation includes a properly drafted DPOA document that complies with state laws and regulations.

Execution Process

The process of creating a DPOA involves drafting the document, signing it in the presence of witnesses, and notarizing it if required by your state. It is crucial to follow the prescribed legal procedures to ensure the validity of your DPOA.

Revoking or Modifying a Durable Power of Attorney

Reasons for Revocation or Modification

You may need to revoke or modify your DPOA due to changes in your personal circumstances, relationships, or financial situation. Regularly reviewing your DPOA helps maintain its effectiveness and alignment with your current wishes.

Procedures to Revoke or Modify a DPOA

The process of revoking or modifying a DPOA typically involves drafting a revocation or amendment document, signing it, and notifying relevant parties, such as your agent, financial institutions, and healthcare providers.

Durable Power of Attorney in Financial Crisis

Role of DPOA in Debt Management

A DPOA can be instrumental in managing debts and handling creditors on your behalf, ensuring that your financial obligations are met and protecting your credit standing.

DPOA and Bankruptcy Proceedings

In the event of bankruptcy, a DPOA can empower your agent to navigate the complex legal process and represent your interests in court proceedings and negotiations with creditors.

DPOA and Financial Fraud Prevention

A DPOA can help safeguard your finances against fraud by allowing your agent to monitor your accounts, detect suspicious activities, and take necessary actions to prevent unauthorized transactions or identity theft.

Durable Power of Attorney and Estate Planning

DPOA's Role in Estate Planning

A DPOA is a valuable tool in comprehensive estate planning, as it ensures that your financial affairs are managed according to your wishes in case of incapacity. It can help maintain the continuity of your financial management and preserve your assets for your beneficiaries.

Coordinating DPOA with Wills and Trusts

It is essential to coordinate your DPOA with your will and any trusts you may have established. Ensuring consistency among these documents can prevent potential conflicts and legal complications that could arise in the future.

Tax Implications and Considerations

A DPOA can help minimize tax liabilities and maximize the value of your estate by allowing your agent to make informed financial decisions. Your agent can work with tax professionals to ensure compliance with tax laws and take advantage of available deductions and credits.

Conclusion

Establishing a durable power of attorney is a crucial component of financial planning. By choosing a trusted agent and ensuring proper execution, you can have peace of mind knowing that your financial affairs will be managed according to your wishes, even if you become incapacitated.

Periodic review and updates to your DPOA will help maintain its effectiveness and alignment with your current needs and circumstances.

Durable Power of Attorney FAQs

A durable power of attorney in finance is a legal document that allows an individual, known as the principal, to grant another person, called the agent or attorney-in-fact, the authority to make financial decisions on their behalf in the event that the principal becomes incapacitated or otherwise unable to make decisions for themselves.

A durable power of attorney is important in finance because it can help ensure that your financial affairs are taken care of if you become incapacitated. Without a durable power of attorney, your loved ones may have to go to court to gain the legal authority to make financial decisions on your behalf, which can be a costly and time-consuming process.

A durable power of attorney in finance typically goes into effect as soon as it is signed and notarized by the principal. However, some individuals may choose to have the document go into effect only if and when they become incapacitated.

The types of financial decisions that an agent can make with a durable power of attorney will depend on the specific language in the document. Generally, the agent can manage the principal's bank accounts, pay bills, manage investments, file taxes, and make other financial decisions on behalf of the principal.

To create a durable power of attorney in finance, you will need to consult with an attorney or use a legal document preparation service. The document must be signed by the principal, witnessed by two witnesses, and notarized. It's important to choose an agent that you trust and to discuss your wishes and expectations with them before creating the document.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.