What Is Durable Power of Attorney for Finances?

A durable power of attorney for finances is a legal document that authorizes another person to manage the principal's financial affairs, including investments, banking, real estate, and taxes, among others, in the event of incapacity or disability.

This document allows the agent to act on behalf of the principal and make important financial decisions, such as paying bills, managing investments, and filing taxes, among others.

Some of the benefits of a durable power of attorney for finances include:

Ensuring that the principal's financial affairs are managed according to their wishes and interests.

Providing a mechanism for the agent to act on behalf of the principal in the event of incapacity or disability, avoiding the need for court-appointed guardianship or conservatorship.

Allowing the agent to make critical financial decisions promptly and efficiently, avoiding delays and financial losses.

Protecting the principal's assets and finances from fraud, abuse, and mismanagement.

Reducing the burden on family members or friends who may have to manage the principal's financial affairs in the absence of a durable power of attorney.

Importance of Establishing a Durable Power of Attorney for Finances

Establishing a durable power of attorney for finances is essential for anyone who wants to ensure that their financial affairs are managed according to their wishes in the event of incapacity or disability.

Without this document, the court may appoint a guardian or conservator to manage the principal's finances, which can be a costly and time-consuming process.

Moreover, the court-appointed guardian or conservator may not have the same knowledge and understanding of the principal's financial goals and values, which can lead to suboptimal financial decisions.

A durable power of attorney for finances ensures that the agent appointed by the principal has the necessary authority and knowledge to manage the principal's finances, protecting their interests and assets.

Difference Between Durable Power of Attorney and General Power of Attorney

A durable power of attorney for finances is different from a general power of attorney in that it remains valid even if the principal becomes incapacitated, while a general power of attorney terminates upon the principal's incapacity.

A general power of attorney is a legal document that authorizes the agent to act on behalf of the principal in a broad range of legal and financial matters, including banking, real estate, and legal transactions.

However, a general power of attorney may not be effective in the event of the principal's incapacity or disability, as the agent's authority terminates upon the principal's incapacity.

On the other hand, a durable power of attorney for finances remains effective even if the principal becomes incapacitated, allowing the agent to continue managing the principal's financial affairs.

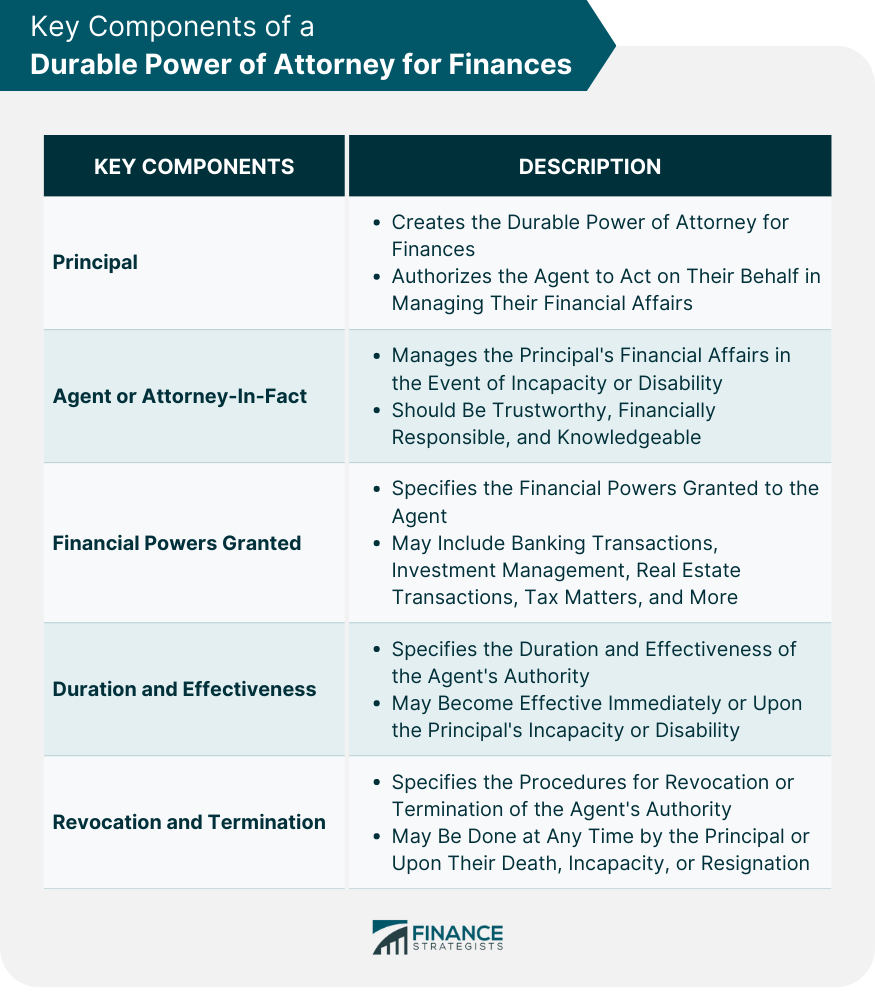

Key Components of a Durable Power of Attorney for Finances

The key components of a durable power of attorney for finances include:

Principal

The principal is the person who creates the durable power of attorney for finances and authorizes the agent to act on their behalf in managing their financial affairs.

The principal should be of legal age and capacity and should understand the consequences of creating a durable power of attorney for finances.

Agent or Attorney-In-Fact

The agent or attorney-in-fact is the person appointed by the principal to manage their financial affairs in the event of incapacity or disability.

The agent should be trustworthy, financially responsible, and knowledgeable about the principal's financial goals and values.

The agent's authority is limited to the financial powers granted in the durable power of attorney for finances.

Financial Powers Granted

The durable power of attorney for finances should specify the financial powers granted to the agent.

These powers may include banking transactions, investment management, real estate transactions, personal property management, tax matters, retirement accounts and benefits.

It may also cover insurance policies, legal and professional services, debt management and credit transactions, and estate planning and trusts.

Duration and Effectiveness

The durable power of attorney for finances should specify the duration and effectiveness of the agent's authority.

The document may become effective immediately or upon the principal's incapacity or disability. The duration of the agent's authority may be limited or indefinite, depending on the principal's preferences.

Revocation and Termination

The durable power of attorney for finances should specify the procedures for revocation or termination of the agent's authority.

The principal may revoke the durable power of attorney for finances at any time, provided they are of legal age and capacity. The agent's authority may also terminate upon the principal's death, incapacity, or resignation.

Selecting an Agent for Creating the Durable Power of Attorney for Finances

Selecting an agent is critical to creating a durable power of attorney for finances.

The agent should be trustworthy, financially responsible, and knowledgeable about the principal's financial goals and values.

Some key considerations when selecting an agent include:

Trustworthiness and Financial Responsibility

The agent should be someone the principal trusts to manage their finances according to their wishes and interests.

The agent should also be financially responsible, with a good track record of managing their own finances.

Knowledge of the Principal's Financial Goals and Values

The agent should understand the principal's financial goals and values well.

This knowledge can help the agent make decisions that align with the principal's interests and objectives.

Willingness to Serve as an Agent

The agent should be willing to serve as the principal's agent and manage their financial affairs in the event of incapacity or disability.

The agent should understand the responsibilities and duties of the role and be willing to act in the principal's best interests.

Potential for Conflicts of Interest

The agent should not have any conflicts of interest that may interfere with their ability to manage the principal's finances.

For example, the agent should not have any financial interests that conflict with the principal's interests, such as investments in competing businesses.

Considerations for Naming Co-agents or Successor Agents

The principal may also consider naming co-agents or successor agents to ensure that their financial affairs are managed even if the primary agent is unavailable or unable to act.

The principal should consider the same factors when selecting co-agents or successor agents as they would when selecting the primary agent.

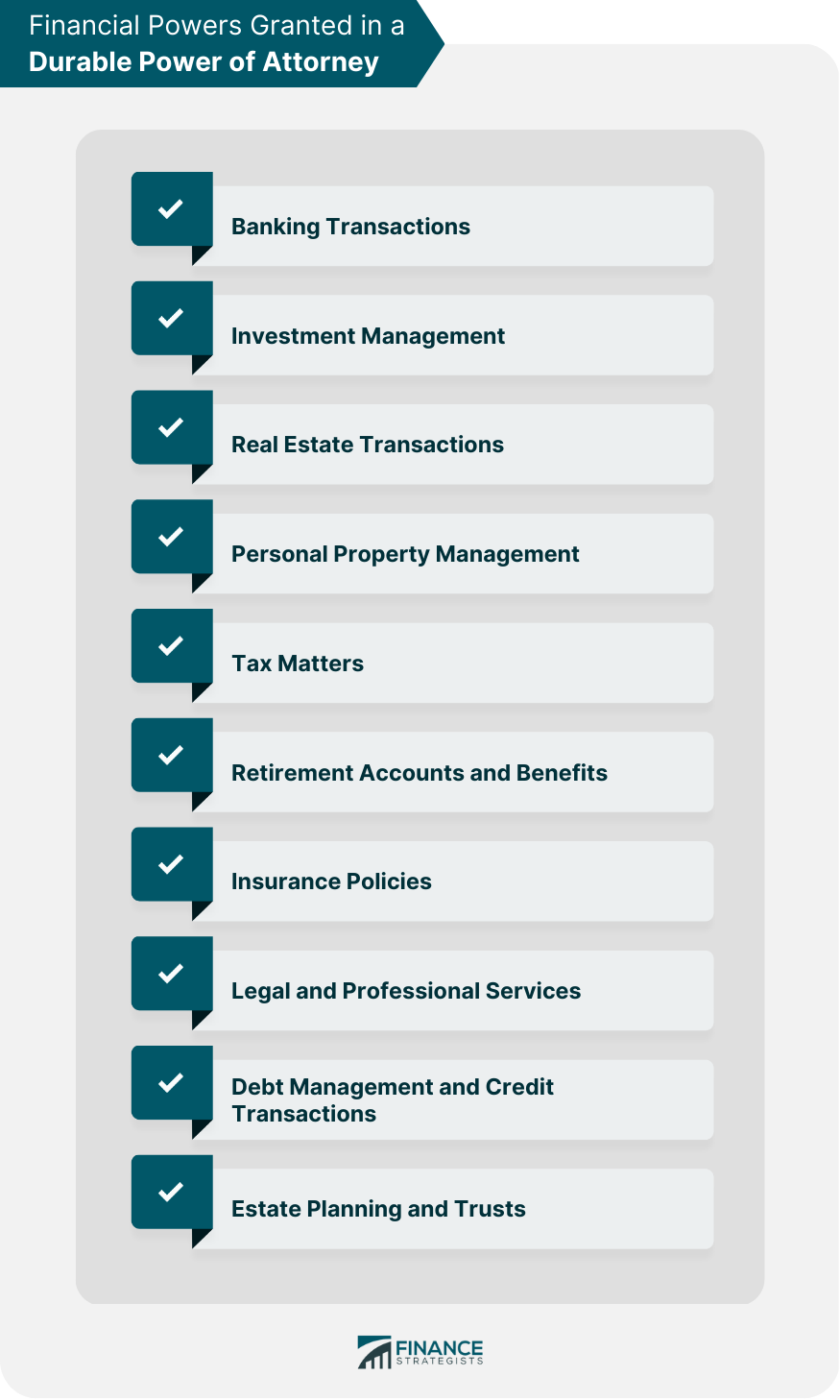

Financial Powers Granted in a Durable Power of Attorney

A durable power of attorney for finances may grant the agent various financial powers, including:

Banking Transactions: The agent may be authorized to open, close, or manage bank accounts, including checking, savings, and money market accounts, among others.

Investment Management: The agent may be authorized to manage the principal's investments, including buying and selling securities, managing retirement accounts and benefits, and making investment decisions on behalf of the principal.

Real Estate Transactions: The agent may be authorized to buy, sell, or manage the principal's real estate, including residential and commercial properties.

Personal Property Management: The agent may be authorized to manage the principal's personal property, such as cars, boats, and other assets.

Tax Matters: The agent may be authorized to file tax returns, pay taxes, and make tax-related decisions on behalf of the principal.

Retirement Accounts and Benefits: The agent may be authorized to manage the principal's retirement accounts and benefits, including 401(k)s, IRAs, and pensions.

Insurance Policies: The agent may be authorized to manage the principal's insurance policies, including life insurance, health insurance, and property insurance.

Legal and Professional Services: The agent may be authorized to engage legal and professional services on behalf of the principal, such as hiring attorneys, accountants, and financial advisors.

Debt Management and Credit Transactions: The agent may be authorized to manage the principal's debts and credit transactions, including paying bills, obtaining loans, and using credit cards.

Estate Planning and Trusts: The agent may be authorized to engage in estate planning and trusts on behalf of the principal, including creating wills, trusts, and other estate planning documents.

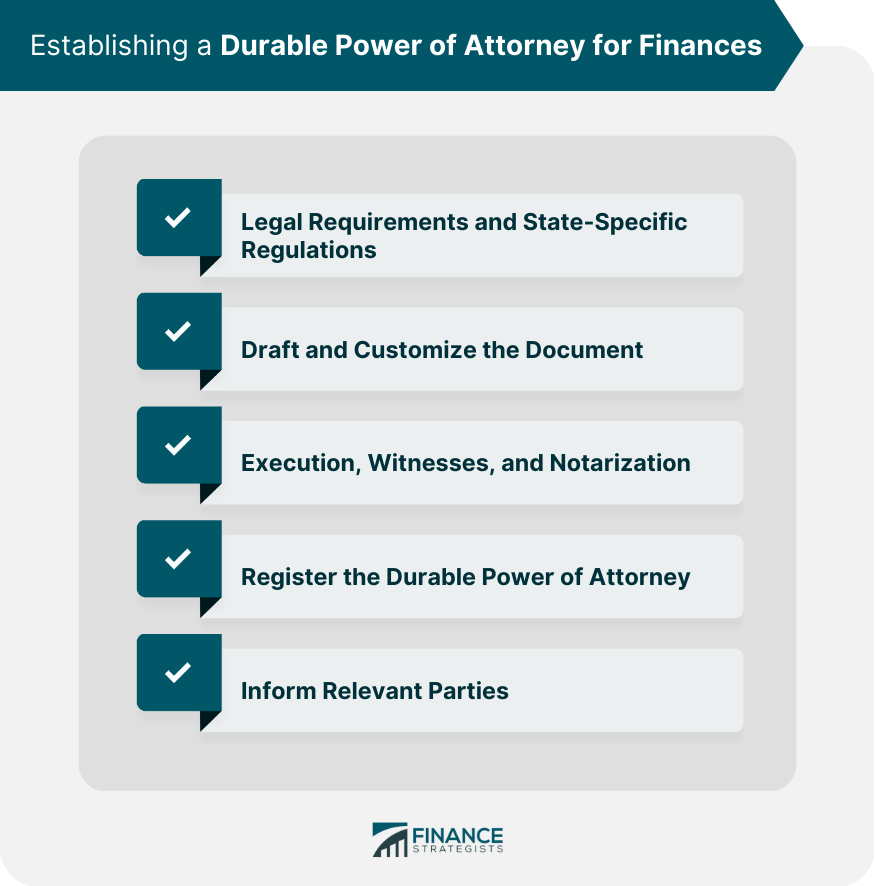

Establishing a Durable Power of Attorney for Finances

Establishing a durable power of attorney for finances involves several steps, including:

Legal Requirements and State-Specific Regulations

The durable power of attorney for finances should comply with the legal requirements and state-specific regulations in the principal's state of residence. The document should be drafted and customized by an experienced attorney who understands the relevant laws and regulations.

Drafting and Customizing the Document

The durable power of attorney for finances should be drafted and customized according to the principal's preferences and needs. The document should specify the financial powers granted to the agent, the duration and effectiveness of the agent's authority, and the procedures for revocation or termination of the agent's authority.

Execution, Witnesses, and Notarization

The durable power of attorney for finances should be executed by the principal in the presence of witnesses and a notary public. The number of witnesses and notary requirements may vary depending on the state's regulations.

Registering the Durable Power of Attorney

The durable power of attorney for finances may need to be registered with relevant parties, such as financial institutions, government agencies, and healthcare providers, to ensure that the agent's authority is recognized.

Informing Relevant Parties

The principal should inform relevant parties, such as family members, healthcare providers, financial institutions, and government agencies, of the existence of the durable power of attorney for finances and the agent's authority.

Revoking or Modifying a Durable Power of Attorney for Finances

The principal may revoke or modify the durable power of attorney for finances for various reasons, such as changing circumstances, dissatisfaction with the agent's performance, or a desire to name a new agent.

The proper procedures for revocation or modification may vary depending on the state's regulations, but they generally involve notifying the agent and relevant parties of the changes.

Safeguards and Monitoring of Durable Power of Attorney for Finances

Safeguards and monitoring are essential to ensure that the principal's interests are protected and that the agent is acting in the principal's best interests.

Some key safeguards and monitoring mechanisms include:

Protecting the Principal's Interests: The agent should act in the principal's best interests and should not engage in any activities that may harm the principal or benefit the agent.

Accountability and Transparency Requirements for the Agent: The agent should maintain accurate records of all financial transactions and should provide regular reports to the principal and relevant parties.

Monitoring and Oversight by Third Parties: Third parties, such as family members, attorneys, and financial advisors, may monitor the agent's activities to ensure that they are acting in the principal's best interests.

Legal Remedies for Abuse or Misuse of Power: The principal or relevant parties may seek legal remedies, such as removing the agent, revoking the durable power of attorney for finances, or pursuing legal action, in the event of abuse or misuse of power by the agent.

Final Thoughts

Establishing a durable power of attorney for finances is an essential part of estate planning. It ensures that the principal's financial affairs are managed according to their wishes and interests in the event of incapacity or disability.

Selecting an agent, specifying the financial powers granted, establishing, modifying, and revoking the document, safeguards and monitoring, and the importance of careful planning and communication are all critical components of the durable power of attorney for finances.

Creating a durable power of attorney for finances is a crucial part of estate planning that should not be overlooked.

To ensure that the document meets your needs and complies with the relevant legal requirements and regulations, it is essential to seek professional guidance and assistance from experienced attorneys and financial advisors.

An estate planning lawyer can provide the expertise and support needed to draft, customize, and execute the durable power of attorney for finances that meet your specific needs and preferences.

Durable Power of Attorney for Finances FAQs

A durable power of attorney for finances is a legal document that authorizes another person to manage your financial affairs in the event of incapacity or disability. It is essential because it ensures that your financial affairs are managed according to your wishes and protects your interests.

The key components of a durable power of attorney for finances include the principal, the agent or attorney-in-fact, the financial powers granted, the duration and effectiveness of the agent's authority, and the procedures for revocation or termination of the agent's authority.

When selecting an agent for your durable power of attorney for finances, consider their trustworthiness, financial responsibility, knowledge of your financial goals and values, willingness to serve as an agent, and potential for conflicts of interest. You may also consider naming co-agents or successor agents to ensure that your financial affairs are managed even if the primary agent is unavailable or unable to act.

To establish a durable power of attorney for finances, you should consult with an experienced attorney to ensure that the document complies with the legal requirements and state-specific regulations, customize the document according to your preferences and needs, execute the document in the presence of witnesses and a notary public, register the document with relevant parties, and inform relevant parties of the agent's authority.

To revoke or modify a durable power of attorney for finances, you should follow the proper procedures specified in the document and the state's regulations, notify the agent and relevant parties of the changes, and seek legal advice if necessary. Common reasons for revocation or modification include changing circumstances, dissatisfaction with the agent's performance, or a desire to name a new agent.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.