Probate is a legal process that comes into play after a person's death. It involves the validation of the deceased's will, identification and inventory of the deceased person's property, appraisal of the property, paying off debts and taxes, and finally, the distribution of the remaining property as the will directs. In the absence of a will, state law determines the distribution. The probate process can be lengthy and costly, depending on the complexity of the estate, and for many, this poses significant challenges. Moreover, probate is a public proceeding, meaning the details of the deceased's estate and the distribution process are accessible to the public, which can be a concern for those seeking privacy in their affairs. While probate can ensure the lawful and orderly distribution of assets, it has some notable disadvantages. First, probate can be a long process, sometimes taking months or even years to finalize. This delay can be particularly detrimental when assets need to be liquidated quickly or when beneficiaries need immediate access to the funds. Second, probate can be expensive. Fees can include court costs, attorney fees, executor fees, and other administrative expenses. These costs can take a sizable chunk out of the estate's value, leaving less for the intended beneficiaries. Finally, probate is a public process. All documents and proceedings become a matter of public record, which means the deceased's financial affairs become accessible to anyone who seeks the information. For those who value privacy, this can be a significant drawback. Given the limitations of probate, seeking alternatives can be beneficial in certain circumstances. For instance, if you have a simple estate or your assets are primarily composed of joint accounts or life insurance, bypassing probate might make sense. Moreover, if privacy or speed of asset transfer is a primary concern, alternatives to probate can be attractive. One way to avoid probate is through joint property ownership with rights of survivorship. This arrangement means that when one owner dies, the property automatically and immediately transfers to the surviving owner(s) without the need for probate. The advantages of this strategy include simplicity, as it requires no additional legal documentation, and efficiency, as it allows for an immediate transfer of assets. However, joint ownership isn't without its drawbacks. For one, you'll be sharing control of your property, which can lead to conflicts. In addition, the joint asset might be subject to claims from the other owner's creditors. There could also be gift tax implications if you add a non-spouse as a joint owner to an account or property. Another probate alternative is using Payable-On-Death (POD) designations for bank accounts and Transfer-On-Death (TOD) designations for securities. With these designations, the assets will be transferred directly to the named beneficiary upon your death without probate. This tool offers simplicity and speed while allowing you to retain full control of your assets during your lifetime. The primary limitation of POD and TOD designations is that they only cover specific assets. If you have a variety of assets in your estate, this tool might not be comprehensive enough. Furthermore, as your life circumstances change, such as marriage, divorce, or the birth of a child, you'll need to remember to update your designations accordingly. A living trust, specifically a revocable living trust, is a legal entity you create to hold your assets. During your lifetime, you maintain control over the trust and its assets. After your death, the assets in the trust are distributed to your beneficiaries by the successor trustee you named, bypassing the probate process. Living trusts offer several benefits. They allow for a quick distribution of assets to beneficiaries, they maintain privacy as they are not part of public record, and they can be altered or revoked at any time during your lifetime as long as you are mentally competent. Despite the benefits, living trusts have potential drawbacks. Setting up a trust can be complex and typically requires the assistance of an attorney, which means it can be more costly upfront than other alternatives. Furthermore, for a living trust to be effective, all relevant assets must be transferred into the trust. Any assets left out of the trust may still need to go through probate. Gift transfers are exactly what they sound like: you give your assets away before you die. This strategy can effectively reduce the size of your estate and thus the assets subject to probate. It can also bring joy to see your loved ones enjoy your gifts while you are alive. However, gift transfers aren't without potential pitfalls. Once you give a gift, you no longer control it, which can lead to regret or disputes. Plus, large gifts can trigger federal gift taxes, though most people won't exceed the lifetime gift tax exclusion amount. It's crucial to understand the tax implications before deciding on gift transfers as an estate planning strategy. A life insurance policy can be a useful tool for avoiding probate. The death benefit is paid directly to the named beneficiaries, bypassing probate entirely. Life insurance can provide an immediate source of cash for your beneficiaries to pay for any expenses, such as funeral costs, debts, or taxes. As with any financial strategy, there are considerations. The cost of life insurance premiums may be a concern, especially for older policyholders. Also, if you're in poor health, obtaining life insurance could be challenging. Additionally, if you name your estate as the beneficiary (which you typically should avoid), the policy proceeds may still be subject to probate. In deciding on the right probate alternative, it's essential to consider the following factors: The larger and more complex your estate is, the more likely it is that you may need a more comprehensive solution like a living trust. For smaller or simpler estates, joint ownership or payable-on-death designations might be sufficient. If privacy is a significant concern for you, an option like a living trust, which remains a private document, might be a better fit than probate, which becomes a matter of public record. How quickly you want your heirs to receive their inheritance can also influence your decision. Some methods, such as joint ownership or life insurance, can result in almost immediate transfer, while a will going through probate could take months or even years. If maintaining control of your assets during your lifetime is important, options such as living trusts or payable-on-death accounts, which allow you to maintain control, might be preferable to giving away assets during your lifetime. The potential costs associated with establishing and maintaining the alternative method should also be considered. For example, setting up a living trust will often require attorney assistance and thus may be more expensive upfront than other methods. Each probate alternative has potential estate tax implications. For example, assets in a living trust are still part of your taxable estate, while life insurance proceeds are usually not subject to estate tax. Large gifts given during your lifetime can reduce your estate's size and thus the potential estate tax liability, but they might trigger gift taxes. Consulting with a tax professional or attorney is advised to understand these implications. Some probate alternatives, particularly giving away assets, could impact future eligibility for Medicaid. Under Medicaid rules, there's a five-year "look-back" period, during which any asset transfers could potentially be penalized. Lastly, consider how your choices might impact family dynamics. Certain alternatives, such as naming a joint owner or giving assets away during your life, can cause disputes or hard feelings among family members. A clear, well-thought-out plan can help minimize potential family conflict after your death. Probate is a legal process that ensures a deceased person's assets are appropriately distributed, but it's not always the most beneficial or desirable route for many people. There are several alternatives to probate, such as joint property ownership, payable-on-death designations, living trusts, gift transfers, and life insurance. Each alternative offers distinct advantages and potential drawbacks that need to be weighed carefully. It's crucial to carefully consider your individual circumstances, the complexity of your estate, privacy needs, desired speed of asset distribution, future control over assets, and potential costs. Understanding the potential legal considerations, such as estate tax implications, effects on Medicaid eligibility, and impacts on family dynamics, is equally important. Given the complexities and potential legal and financial ramifications, it's advisable to seek the guidance of an experienced estate planning attorney. Overview of Probate

Need for Alternatives to Probate

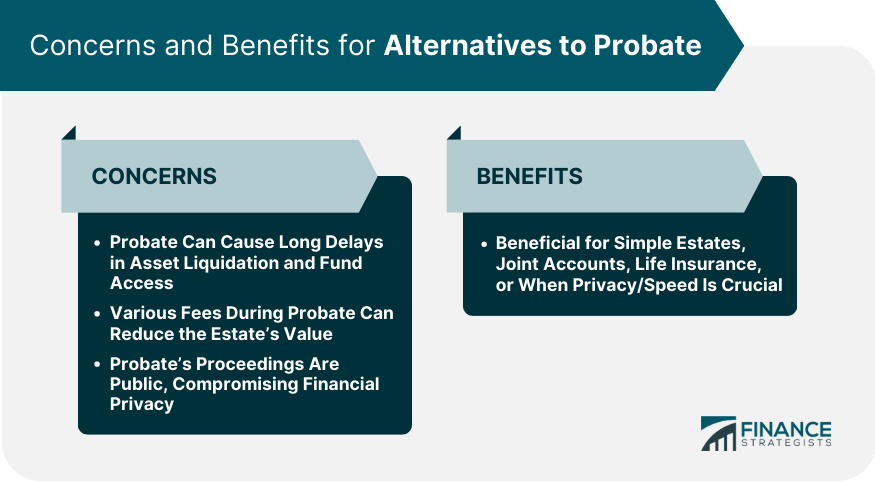

Understanding the Drawbacks

Long Process

Expensive

Public Process

Circumstances Where Alternatives to Probate Are Beneficial

Detailed Exploration of Alternatives to Probate

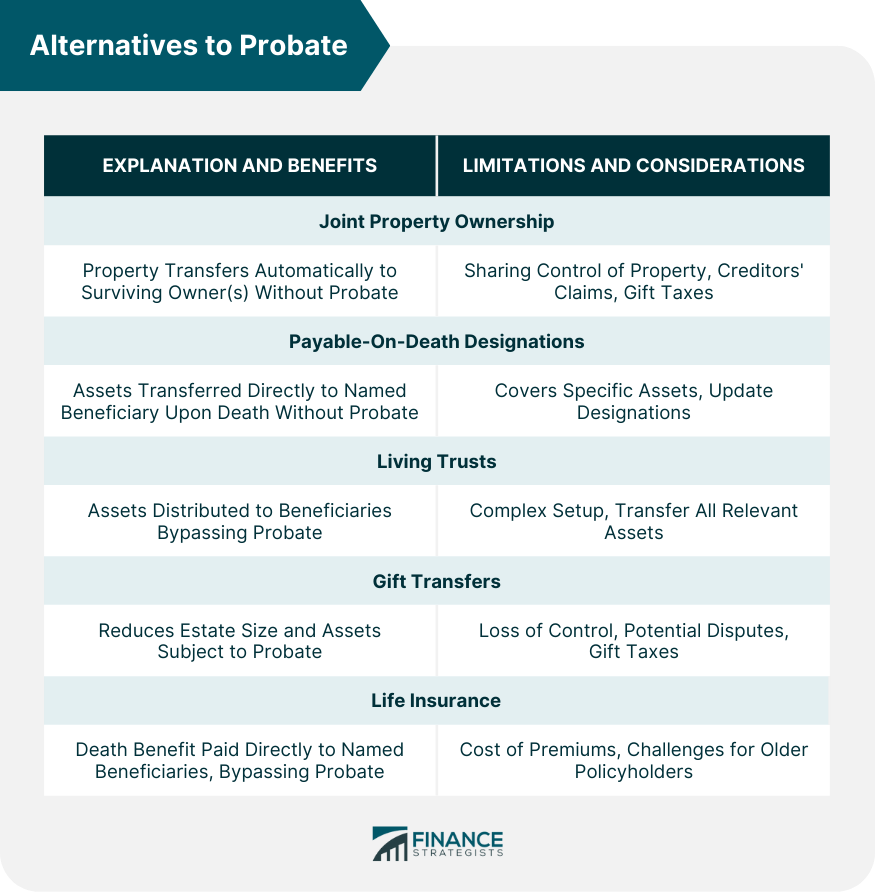

Joint Property Ownership

Explanation and Advantages

Disadvantages and Risks

Payable-On-Death Designations and Accounts

Explanation and Benefits

Limitations and Considerations

Living Trusts

Detailed Description and Benefits

Potential Drawbacks

Gift Transfers

Explanation and Advantages

Potential Pitfalls and Tax Implications

Life Insurance

Role of Life Insurance in Avoiding Probate

Considerations and Potential Disadvantages

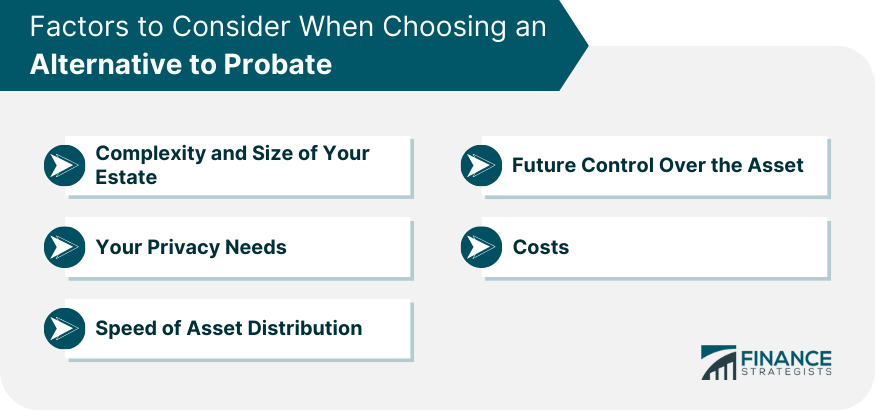

Factors to Consider When Choosing an Alternative to Probate

Complexity and Size of Your Estate

Your Privacy Needs

Speed of Asset Distribution

Future Control Over the Asset

Costs

Legal Considerations When Choosing an Alternative to Probate

Estate Tax Implications

Possible Effects on Medicaid Eligibility

Impact on Family Dynamics and Potential for Disputes

The Bottom Line

Alternatives to Probate FAQs

Common alternatives to probate include joint property ownership, payable-on-death designations, living trusts, gift transfers, and life insurance.

Yes, life insurance can be an alternative to probate as the proceeds from a life insurance policy can go directly to the named beneficiaries, bypassing the probate process entirely.

Potential drawbacks of alternatives to probate can include loss of control over assets, possible tax implications, impacts on Medicaid eligibility, and potential for family disputes, among others.

Alternatives to probate are often considered to speed up the transfer of assets to beneficiaries, reduce costs, maintain privacy, and avoid the complexities of the probate process.

While it's possible to set up some alternatives to probate without legal assistance, it's generally recommended to consult with an estate planning lawyer. The legal and financial implications can be complex, and a professional can provide valuable guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.