Yes, you can sell a house while it is in probate, but the process is subject to specific rules and regulations and often requires court approval. Probate is a legal procedure that manages the assets and liabilities of a deceased person, and the home often constitutes a significant part of the estate. The executor or administrator of the estate, appointed by the court or named in the deceased's will, is responsible for overseeing the property's sale. The sale proceeds are then used to pay off any outstanding debts or taxes, and the remaining balance is distributed to the heirs. The exact probate and sale procedures can vary by state, so professional advice should be sought to navigate this complex process. The executor, named in the decedent's will or appointed by the court if there is no will, oversees the distribution of the deceased's estate. They hold a significant role in the probate real estate sales process, which includes listing the property, accepting bids, and finalizing the sale, all while adhering to local probate laws. Probate begins with the validation of the deceased's will. The court examines the will to verify its legitimacy and then instructs the executor to distribute the assets according to the will's instructions. If no will exists, state law dictates the asset distribution process, which could impact who ends up owning the property and, therefore, who has the right to sell it. The probate process may affect a property's value due to factors like the condition of the property, market conditions, and the time it takes to complete probate. It's essential to keep in mind that the property's value will be determined by a court-approved appraisal, not market estimates. One of the first steps in selling a probate property is obtaining an appraisal. The executor must hire a certified appraiser to determine the property's fair market value. This value becomes the home's new cost basis, and any future sale must reflect it to avoid issues with underpricing or overpricing. Selling a probate property often requires expertise beyond a standard real estate transaction. It's advisable to hire a real estate agent experienced in handling probate sales to navigate the legal and logistical intricacies. They can help market the property, advise on accepted offers, and ensure court requirements are met. Once an offer is accepted, the sale is still subject to court confirmation. The executor will petition the court to approve the sale. During the hearing, other potential buyers may bid on the property, and the highest bid accepted by the court will win. After the court approves the sale, the property changes hands. The proceeds from the sale are then used to pay any outstanding debts, claims, or taxes associated with the estate. Any remaining funds are distributed to the heirs according to the will or state law. Probate proceedings can become complicated if anyone disputes the will. Disagreements about property distribution or the interpretation of the will's terms can delay the sale process. These disputes often require legal resolution. The executor is responsible for notifying creditors about the decedent's death, providing them the opportunity to make claims against the estate. Debts must be paid before any property can be sold, which may require selling the house to satisfy these obligations. The executor must prioritize these debts according to the law and ensure they're correctly paid. Taxes are an inescapable aspect of probate sales. The estate is liable for any outstanding property taxes, and income tax must be paid on any income generated by the estate. Additionally, if the property's value appreciates significantly, capital gains tax might be levied. Marketing a probate property can be challenging due to the unique nature of these sales. It's important to showcase the property's potential, especially if it needs work. High-quality photos, detailed descriptions, and transparency about the probate process can attract motivated buyers. Negotiating a probate sale involves not just the buyer and seller but also the court. While you can negotiate terms with the buyer, the court has the final say. Understanding this dynamic is essential to manage expectations and make the process smoother. Probate sales often require more documentation than traditional sales. Ensuring a smooth closing involves staying organized, being responsive, and having all required documents prepared and in order. A closing attorney or a title company experienced in probate sales can be an invaluable resource. Selling a house in probate is possible but requires careful navigation through complex legal terrain. The executor plays a critical role, in overseeing the process which includes property appraisal, marketing, and finalizing the sale in compliance with probate laws. Complications may arise, such as will disputes or outstanding debts and taxes, and it's vital to address these efficiently. Experts, like probate attorneys, tax professionals, and real estate agents experienced in probate sales, can significantly aid in this process. They can help ensure smooth negotiations, effective marketing, and proper handling of legal and tax issues. Though each state's laws may differ, understanding these key steps and seeking professional assistance can lead to a successful probate property sale.Can You Sell a House While in Probate?

Understanding Probate and Real Estate

Role of the Executor in Probate Real Estate Sales

How Property Ownership Is Determined During Probate

Impact of Probate on the Value of the Property

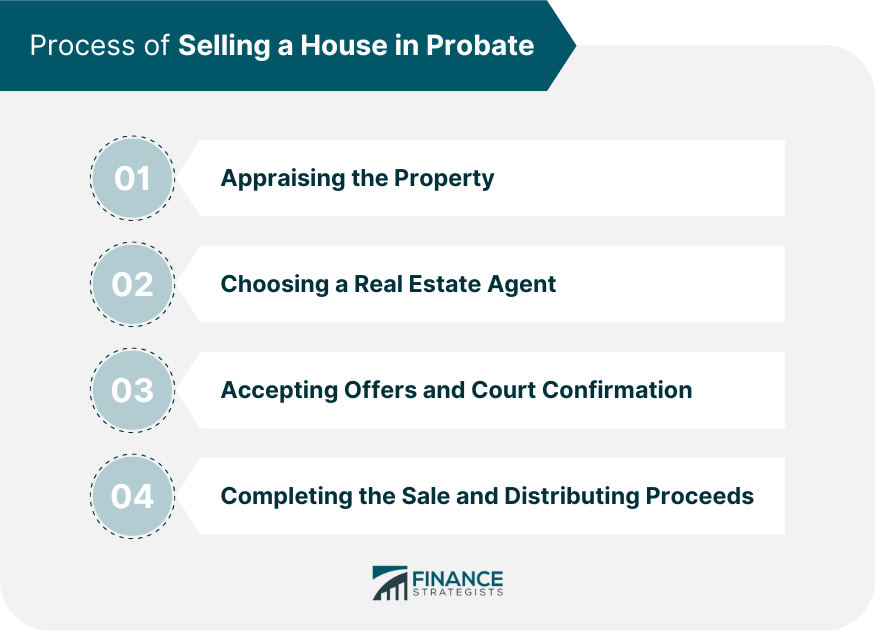

Process of Selling a House in Probate

Appraising the Property

Choosing a Real Estate Agent

Accepting Offers and Court Confirmation

Completing the Sale and Distributing Proceeds

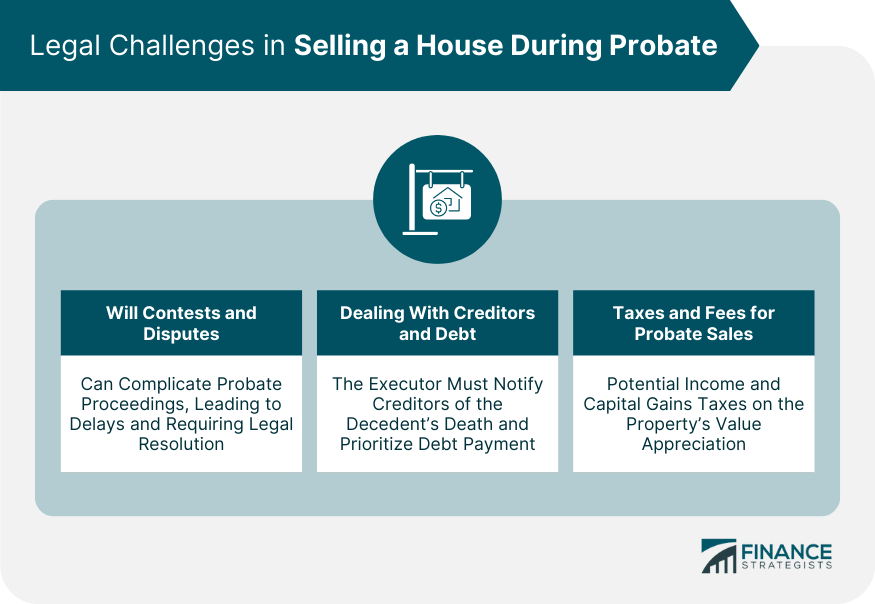

Legal Challenges in Selling a House During Probate

Addressing Will Contests and Disputes

Dealing With Creditors and Debt

Handling Taxes and Fees Associated With Probate Real Estate Sales

Tips for Selling a House While in Probate

Marketing a Probate Property

Navigating Negotiations and Sales Agreements

Ensuring a Smooth Closing Process

Conclusion

Can You Sell a House While in Probate? FAQs

Yes, you can sell a house while in probate even without a will. In this case, state law dictates how the property should be distributed, which includes its potential sale. An administrator appointed by the court oversees the process.

If a house is sold during probate, the proceeds first go towards settling any debts or taxes the deceased person owed. Once these are paid, the remaining funds are distributed among the heirs as specified by the will or, in the absence of a will, according to state law.

Yes, a house can be sold during probate even if it's not fully paid off. However, the outstanding mortgage balance will need to be paid off from the sale proceeds before any distribution to the heirs.

The speed of a probate sale often depends on the complexity of the estate, the local probate court's schedule, and the real estate market conditions. However, hiring professionals such as a probate attorney and a real estate agent experienced in probate sales can streamline the process.

Yes, it's possible to sell a house in probate to a family member. The sale still has to be approved by the probate court, and it should be at a fair market value to ensure the interests of all heirs are preserved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.