Yes, you can technically sell the property before probate, but not in the way you might think. The individual who owned the property is the only one who could have sold it, but upon their death, the right to sell property doesn't immediately transfer to the heirs or executors. It's actually the estate, through the executor or administrator appointed by the probate court, that has the legal authority to sell the property. However, this can only happen after probate has been initiated and the court gives permission to sell. Selling property prior to this is not typically possible because the title isn't clear until the probate process completes. If attempted, it may result in legal complications. Generally, selling property before probate is not allowed. When a person dies, the ownership of their property often gets transferred to the executor named in their will. The executor holds the property in trust for the beneficiaries until the probate process is complete. This legal standpoint ensures the orderly distribution of the deceased's assets and the settlement of any outstanding debts or taxes. From a practical perspective, selling property before probate can lead to problems. Potential buyers may be hesitant to purchase a property that is part of an estate before probate completion. This hesitation is because there's a risk that the property might have undisclosed liens, or a will could appear that changes the property's disposition. Before proceeding with the sale, the executor must obtain court approval. This involves filing a "Petition for Sale of Real Property," detailing the reasons for the proposed sale. Establishing the property's fair market value is crucial. The court generally assigns an appraiser for this purpose. An accurate appraisal ensures the property is not sold below its worth. Once the court approves the sale, the executor can proceed with the transaction. After the sale, the executor reports the sale's details to the court for confirmation. This is a necessary step to validate the transaction. Significantly influence the selling price. Understanding the market trends is necessary to ensure the property isn't undervalued or overpriced. It also helps to decide the right timing for the sale. The executor must also consider the financial obligations of the estate. If there are considerable debts or taxes owed, it might be necessary to sell the property to meet these obligations. It's essential to understand that selling property before probate may lead to legal complications and potential financial loss. The executor should seek professional guidance to avoid these pitfalls. The beneficiaries' potential inheritance may be affected by the sale of the property during probate. It's crucial to consider their interests during the process. The complexities of selling the property during probate necessitate professional guidance. Estate lawyers can provide legal advice, real estate agents can give insights into market conditions, and financial advisors can help understand the financial implications. When property is jointly owned, typically with rights of survivorship, the ownership automatically transfers to the surviving owner(s) upon the death of one owner. In such cases, probate may not be necessary to transfer the property's title. This exception commonly applies to spouses who jointly own their homes. Since the surviving owner(s) already has legal ownership rights, they can sell the property without going through the probate process. Another situation where property may be sold prior to probate is if the deceased person had transferred the property to a living trust before their death. A living trust is a legal arrangement where the individual (grantor) transfers their assets, including real estate, into a trust during their lifetime. They typically serve as the trustee during their lifetime, maintaining control over the trust assets. However, they also designate a successor trustee to take over the management of the trust upon their death or incapacitation. The executor of the estate must initiate the process of selling real property by filing a "Petition for Sale of Real Property" with the probate court. This petition outlines the reasons why the sale is necessary, such as to pay debts of the estate or distribute the proceeds to beneficiaries. The executor may need to provide supporting documentation and evidence to justify the sale. Before the property can be sold, it must be appraised to determine its fair market value. The court typically appoints a qualified appraiser to assess the property's value. The appraiser conducts a thorough evaluation, taking into account factors such as the property's condition, location, comparable sales in the area, and other relevant factors. The appraised value helps establish the minimum price at which the property can be sold. Once the court has approved the sale and the property has been properly appraised, it can be sold. After the sale, the executor files a report with the court detailing the sale's terms. The court then holds a hearing to confirm the sale. If there are no objections and the court is satisfied that the sale is in the best interests of the estate, it will confirm the sale. Selling property before probate can introduce certain legal risks and consequences. The executor has a duty to manage the estate responsibly and in the best interests of the beneficiaries. If an asset, such as a property, is sold before probate without proper consideration for potential debts or taxes, it could lead to complications. For example, if it later becomes apparent that the sold asset was required to satisfy outstanding debts or tax obligations, the executor may be held personally liable for the shortfall. This can have significant legal and financial implications for the executor. Selling property before probate may not always be a sound decision from a financial perspective. The timing of the sale can impact the property's market value. A rushed or forced sale to liquidate assets quickly may lead to the property being sold below its fair market value. This can diminish the overall value of the estate, potentially reducing the amount available for distribution to beneficiaries. Selling property before probate can have implications for beneficiaries. If a property is sold before probate, beneficiaries may be negatively impacted. They might receive less than they would have if the property had been sold after probate. This is because the property's fair market value might not have been accurately determined, and the rushed sale could result in a lower sale price. Selling property before probate isn't typically feasible due to legal constraints, with exceptions for jointly owned property or property transferred to a trust. Probate ensures the proper settlement of debts, taxes, and the orderly distribution of assets. Selling during probate requires court permission and appraisal to determine market value. Market conditions and estate debts should be taken into account while selling. Premature selling can lead to legal issues, and potential financial loss, and may adversely impact beneficiaries. Thus, the guidance of estate lawyers experienced real estate agents, and financial advisors is vital during this process. They provide legal advice, market insight, and financial implications, ensuring the best outcomes for all parties involved in the probate process.Can You Sell Property Before Probate?

General Rules About Selling Property Before Probate

Legal Standpoint

Practical Standpoint

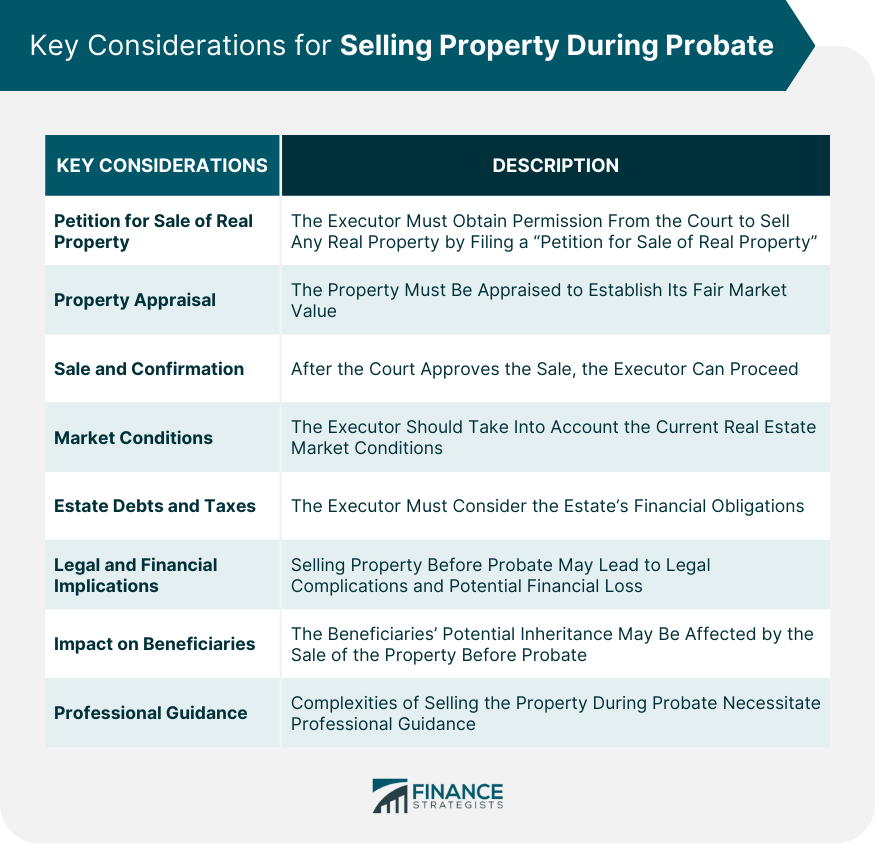

Key Considerations for Selling Property During Probate

Petition for Sale of Real Property

Property Appraisal

Sale and Confirmation

Market Conditions

Estate Debts and Taxes

Legal and Financial Implications

Impact on Beneficiaries

Professional Guidance

Situations Where Property May Be Sold Prior to Probate

Jointly Owned Property

Property Transferred to a Trust

Process of Selling Property During Probate

Petition for Sale of Real Property

Property Appraisal

Sale and Confirmation

Legal and Financial Implications of Selling Property Before Probate

Potential Legal Risks and Consequences

Financial Aspects to Consider

How Beneficiaries Might Be Affected

Conclusion

Can You Sell Property Before Probate? FAQs

No, typically you can't sell the property before probate is granted. The authority to sell lies with the estate's executor or administrator and this power comes into effect only after probate has been granted by the court.

Selling property before probate could lead to legal complications and potential financial loss. The executor could be held liable if the asset was needed to pay debts or taxes, and it might be sold for less than its market value.

Yes, there are exceptions. For instance, if the property was jointly owned, the surviving owner can typically sell it without probate. Also, if the property was transferred to a living trust before death, the trustee has the power to sell without probate.

If a property is sold before probate, beneficiaries could be adversely affected as they may receive less than they might have if the property had been sold after probate.

Professional guidance from estate lawyers, real estate agents, and financial advisors is strongly recommended. They can help navigate the legalities, market conditions, and financial implications of selling property before or during probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.