In certain situations, it is possible to settle an estate without going through probate. Assets held in joint ownership, assets with named beneficiaries (such as life insurance or retirement accounts), or assets owned by a living trust typically bypass probate. Small estates may also qualify for simplified probate procedures or exemptions depending on state laws. Moreover, assets with transfer-on-death or payable-on-death designations can be transferred directly to beneficiaries without probate. It's important to consult with an estate planning attorney or expert to understand how to properly plan an estate to avoid probate and to navigate the complexities of state-specific laws and regulations The first step is to evaluate the type and value of assets owned by the deceased to determine whether probate is necessary. This process often involves consulting an attorney or doing extensive research about state laws and the specific nature of the assets involved. Next, the deceased's assets must be identified and located. This step includes tangible assets like real estate and personal belongings, as well as intangible ones such as bank accounts and investments. If the assets were held in a trust or jointly with a right of survivorship, the assets are typically transferred directly to the beneficiary or surviving owner. Before assets can be distributed, the deceased's debts must be paid. This includes mortgages, car loans, credit card debts, and any medical bills. Ideally, these debts should be paid from the estate's assets. It is crucial to note that beneficiaries or heirs are not usually responsible for the deceased's debts unless they co-signed the debt obligation. After debts and taxes have been paid, the remaining assets can be distributed to the beneficiaries. How this is done will depend on how the assets were owned or titled. For assets held in a trust, the trustee will distribute the assets according to the terms of the trust. For jointly held assets, the surviving owner typically assumes full ownership. Finally, a final income tax return must be filed for the deceased. This return includes income earned in the year of their death. Any tax owed is typically paid from the estate's assets. In some states, you can use a transfer-on-death (TOD) deed for real estate, which automatically transfers property to the named beneficiary upon the owner's death. For example, if a parent uses a TOD deed to leave their home to their child, the property will automatically pass to the child upon the parent's death, bypassing probate. A payable-on-death (POD) designation is another tool that allows assets to bypass probate. It is applicable to bank accounts, certificates of deposit, and even certain types of savings bonds. The owner retains full control of the assets during their lifetime, but upon their death, the assets are immediately transferred to the named beneficiary, circumventing probate. Property owned jointly with 'rights of survivorship' automatically passes to the surviving owners when one owner dies. It includes real estate, bank accounts, and other assets held in this manner. For instance, if a husband and wife own their home as joint tenants with rights of survivorship, the home will automatically pass to the surviving spouse without probate. Living trusts, also known as revocable trusts, are legal entities created by the individual (the grantor) to hold their assets during their lifetime. Upon the grantor's death, the trustee (often a spouse, relative, or trusted advisor) distributes the assets according to the grantor's wishes, bypassing probate. Even if probate can't be completely avoided, many states offer simplified probate processes for smaller estates. The definition of a "small estate" varies, but if the estate qualifies, this expedited process can save time and expense. Avoiding probate can have numerous benefits, including saving time and money, maintaining privacy, and reducing disputes among beneficiaries. However, it also has potential drawbacks. Bypassing probate can complicate matters if there are claims against the estate, or if the will is contested. Moreover, distributing assets outside of probate may be challenging if the deceased owned assets in multiple states. Heirs and beneficiaries can be positively impacted when an estate avoids probate, as they usually receive their inheritance more quickly. However, they might also be deprived of a forum to contest the distribution of assets if they believe the process was mishandled or if they dispute the validity of the will or trust. Even if you plan your estate to avoid probate, drafting a will is still crucial. A will serves as a backup plan for any assets that might not be covered by other probate-avoidance methods. It ensures that any assets not titled in a trust or jointly held, or designated to a specific beneficiary, are distributed according to your wishes. Trusts are effective tools for avoiding probate. Assets held in a living trust can pass to heirs without being probated. This not only speeds up the process of getting assets to your heirs but also keeps your estate private and can potentially save on taxes. Properly titling assets can help avoid probate. For instance, designating transfer-on-death or payable-on-death beneficiaries for your bank accounts and retirement plans, or owning property jointly can help these assets bypass probate. It's essential to review and update your estate plan regularly, especially after major life events like marriage, divorce, the birth of a child, or the death of a beneficiary. This ensures that your estate plan reflects your current wishes and circumstances, helping to avoid unnecessary probate. If the estate is large, complex, or involves contentious family dynamics, it may be wise to seek legal advice. An experienced estate planning attorney can guide you through the probate process or help devise strategies to avoid it. Estate planning attorneys can provide invaluable assistance by helping draft wills, establish trusts, navigate the probate process, or settle an estate without probate. They can also ensure your estate plan complies with state laws and maximizes tax efficiencies. Settling an estate without probate is possible under certain conditions such as when assets are jointly owned, titled in a living trust, or have designated beneficiaries. Tools like transfer-on-death deeds, payable-on-death designations, and living trusts offer pathways to avoid the probate process. Nevertheless, it's important to evaluate the estate's complexities, including its size and the nature of the assets involved. While avoiding probate offers advantages such as cost and time savings, potential challenges may arise, such as handling claims against the estate or dealing with multi-state assets. Regular updating of the estate plan, proper titling of assets, and the creation of trusts and wills are essential strategies in effective estate planning. Legal advice is beneficial, especially for complex or large estates, underscoring the critical role of estate planning attorneys in providing expert guidance and ensuring compliance with state laws.Can You Settle an Estate Without Probate?

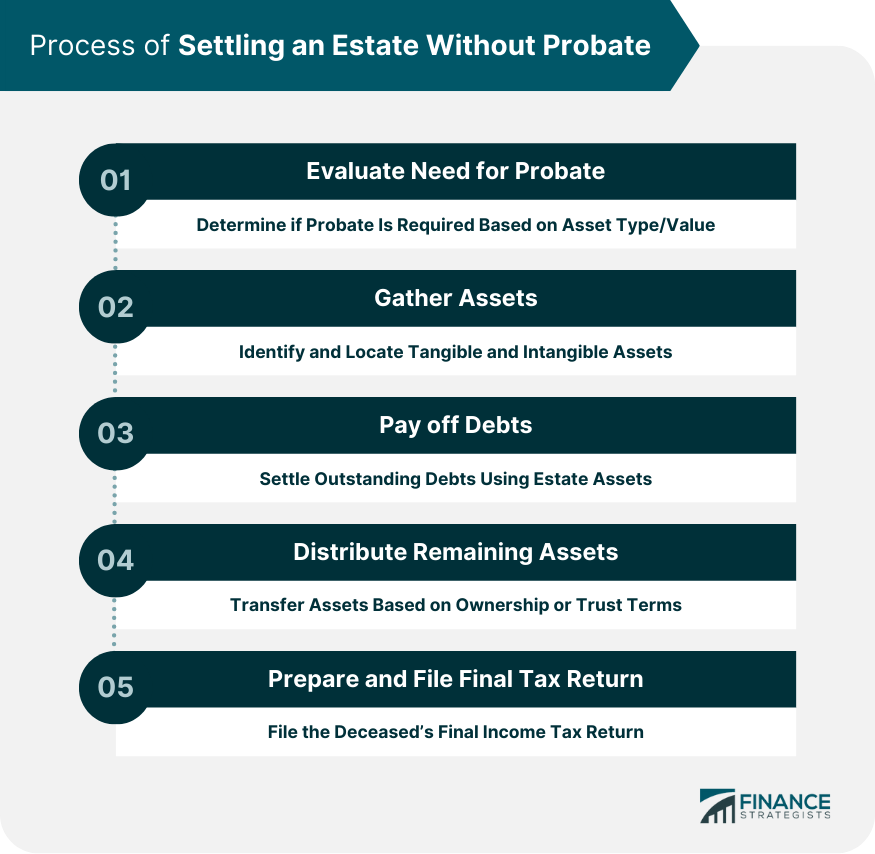

Process of Settling an Estate Without Probate

Evaluation of Whether Probate is Needed

Gathering Assets

Paying off Debts

Distribution of Remaining Assets

Preparing and Filing Final Tax Return

Alternatives to Probate

Transfer-On-Death Deeds for Real Estate

Payable-On-Death Designations for Bank Accounts

Joint Ownership of Property

Living Trusts

Simplified Probate Procedures

Legal and Financial Implications of Avoiding Probate

Pros and Cons

Impact on Heirs and Beneficiaries

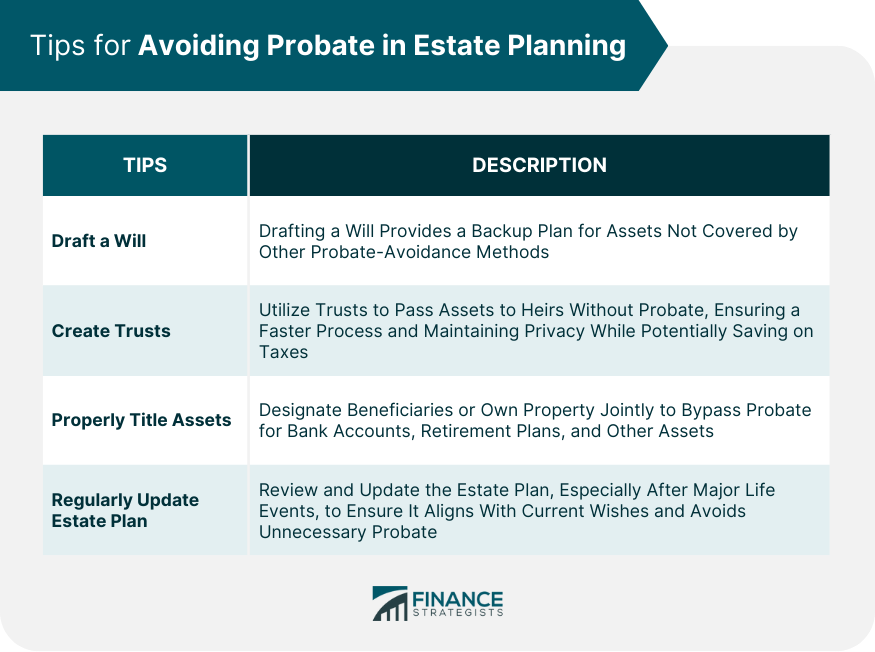

Tips for Estate Planning to Avoid Probate

Drafting a Will

Creating Trusts

Properly Titling Assets

Regularly Updating the Estate Plan

When to Seek Legal Advice

Situations Requiring Legal Guidance

Role of Estate Planning Attorneys

Conclusion

Can You Settle an Estate Without Probate? FAQs

Yes, small estates may qualify for simplified probate procedures or exemptions, depending on state laws. This allows for the settlement of the estate without the full probate process.

The deceased's debts should ideally be paid from the estate's assets. It's important to note that beneficiaries or heirs are usually not responsible for these debts unless they co-signed for them.

Yes, if assets were jointly owned with a right of survivorship, these assets typically bypass probate and are transferred directly to the surviving owner.

Assets held in a living trust can bypass the probate process. Upon the grantor's death, the trustee distributes the assets according to the trust's terms, helping to settle the estate without probate.

If the estate is large, complex, or involves contentious family dynamics, it's wise to seek legal advice. An experienced estate planning attorney can guide you through the process and help you devise strategies to settle an estate without probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.