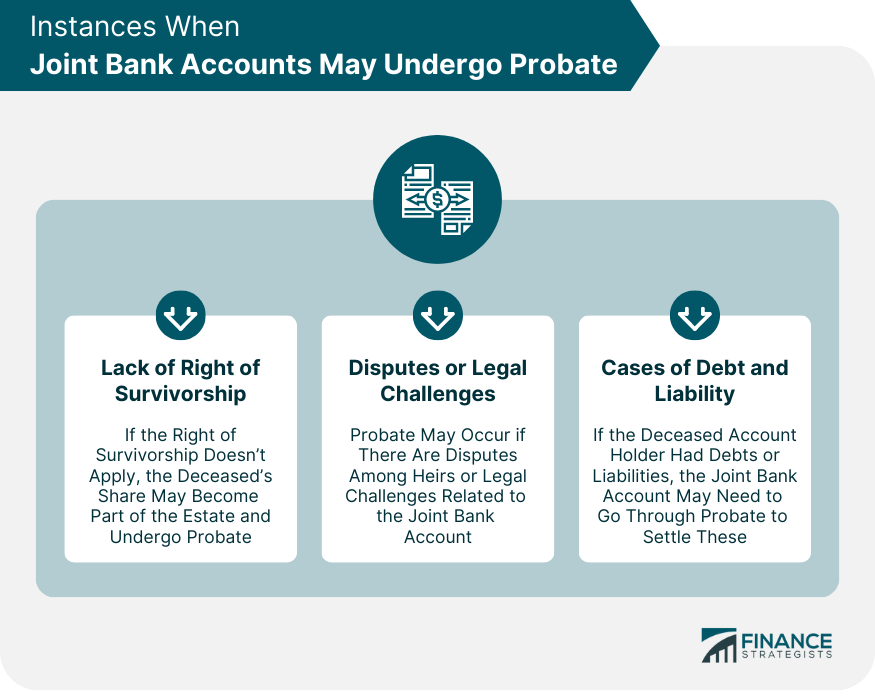

Typically, joint bank accounts do not go through probate due to a principle known as the right of survivorship. This principle implies that when one account holder dies, their share of the account's assets automatically transfers to the surviving account holder(s), bypassing the probate process. However, exceptions exist. In cases where there's a lack of right of survivorship, disputes or legal challenges, or cases of outstanding debts and liabilities, a joint bank account may have to go through probate. Furthermore, the treatment of joint bank accounts in probate can vary based on different state and regional laws. In some types of joint bank accounts, the right of survivorship may not apply. In such cases, the deceased's share of the account might not automatically go to the surviving account holder(s) but instead may become part of the deceased's estate and go through probate. Even with the right of survivorship, joint bank accounts may end up in probate if there are disputes among heirs or legal challenges. For instance, if it's argued that the deceased was coerced into creating a joint account or if the deceased's will indicates a different beneficiary for these funds, the probate court may need to intervene. If the deceased account holder had outstanding debts or liabilities, creditors might make claims against their estate, including their portion of a joint bank account. In these cases, probate might be necessary to settle these debts. The treatment of joint bank accounts in probate can vary from one state to another. Some states might allow joint accounts to bypass probate entirely, while others may require them to be included in the probate process under certain circumstances. Region-specific laws and legal frameworks also play a role in determining whether joint bank accounts go through probate. Different regions may have different probate laws, regulations, and processes. One significant benefit of joint bank accounts is that they offer easy access and management of funds for all account holders. This access can be particularly helpful in emergency situations or when immediate financial decisions need to be made. Another significant advantage of joint accounts is their ability to avoid the probate process due to the right of survivorship. This bypass can save time and money, as probate can be a lengthy and costly procedure. Joint accounts also ensures that funds remain available to the surviving account holders, regardless of probate proceedings. This immediate availability can be a financial lifeline in a time of loss. One downside to joint bank accounts is that they offer less individual control over finances. All account holders have equal access and decision-making authority, potentially leading to conflicts or misuse of funds. Because all account holders have access to the account, there's a risk of one party draining the account or using the funds irresponsibly. A joint account might affect an individual's eligibility for financial aid or certain benefits. For instance, a student with their name on a joint account might have their financial aid reduced because the account assets are considered in the student's assets for financial aid calculations. To prepare for potential probate issues, consulting with a legal expert, preferably one with experience in estate planning and probate law, is advisable. They can guide you through potential pitfalls and help you make informed decisions about your joint bank account. Regularly reviewing and updating your joint ownership agreements can also help you stay ahead of potential probate issues. Ensure that your agreement aligns with your current financial and personal circumstances. Communication and transparency are essential in managing a joint bank account effectively. Regular discussions about the account, its use, and any changes to its terms or conditions can prevent misunderstandings and disputes. Regularly reviewing the account's activity and updating the joint account agreement when necessary can also help avoid potential problems. This process can ensure that the account continues to serve its purpose and meet the needs of all account holders. One alternative to a joint bank account is a trust account, where a trustee controls funds for the benefit of one or more individuals. Trust accounts can offer more control and protection than joint accounts and can also bypass the probate process. A payable-On-Death (POD) account is another alternative. In a POD account, the account owner designates a beneficiary who will receive the account's funds upon the owner's death, bypassing probate. Joint bank accounts offer a mechanism for shared financial management and often bypass probate due to the principle of the right of survivorship. Yet, exceptions can occur, and in the circumstances like disputes, debt settlements, or when the right of survivorship is not applicable, these accounts may still undergo probate. Notably, regional and state laws play a substantial role in dictating how these accounts are treated in probate. While joint bank accounts provide several advantages, such as ease of access and immediate fund availability, they carry potential drawbacks like a lack of individual control and the risk of misuse. It's essential for account holders to maintain open communication and regularly update their joint ownership agreements. Consulting with legal experts can also be beneficial. Alternatives like trust accounts and payable-on-death accounts present other options for those wishing to bypass the probate process.Do Joint Bank Accounts Go Through Probate?

Instances When Joint Bank Accounts May Undergo Probate

Lack of Right of Survivorship

Disputes or Legal Challenges

Cases of Debt and Liability

Understanding State and Regional Differences

State Law Variations Regarding Probate and Joint Accounts

Impact of Regional Legal Frameworks

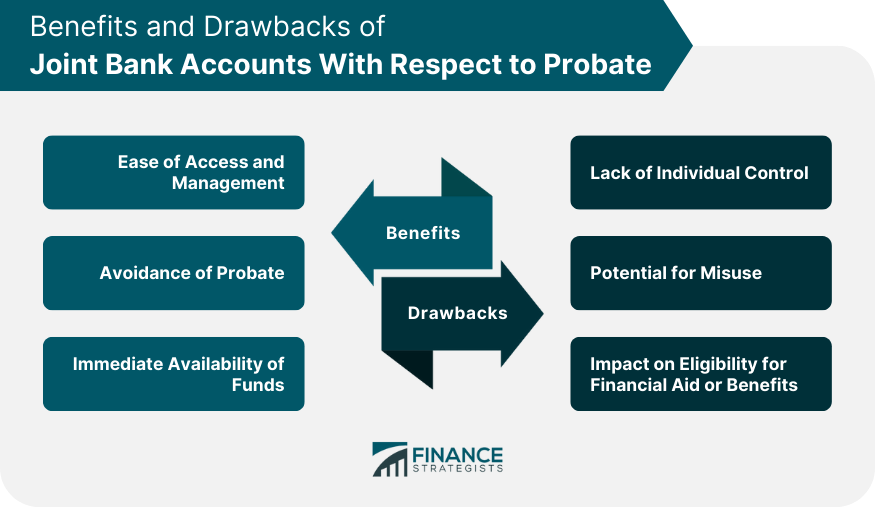

Benefits and Drawbacks of Joint Bank Accounts With Respect to Probate

Benefits of Joint Bank Accounts

Ease of Access and Management

Avoidance of Probate

Immediate Availability of Funds

Potential Drawbacks of Joint Bank Accounts

Lack of Individual Control

Potential for Misuse

Impact on Eligibility for Financial Aid or Benefits

Practical Tips and Legal Advice

Preparing a Joint Bank Account for Potential Probate Issues

Consultation With a Legal Expert

Reviewing Joint Ownership Agreements

Best Practices for Joint Bank Account Holders

Communication and Transparency

Regular Updates and Review

Alternatives to Joint Bank Accounts

Trust Accounts

Payable-On-Death Accounts

Conclusion

Do Joint Bank Accounts Go Through Probate? FAQs

A joint bank account is a bank account owned and operated by two or more individuals. These account holders could be spouses, parents and children, business partners, or friends. Everyone on the account has equal privileges to deposit, withdraw, or manage the funds in the account.

Probate is a legal process that takes place after an individual's death. It involves validating the deceased's will, appointing an executor, identifying and appraising the deceased's assets, settling their debts and taxes, and distributing the remaining assets as per the will or state law if there is no will.

Typically, joint bank accounts do not go through probate due to a principle known as the right of survivorship, which allows the assets of the deceased account holder to be automatically transferred to the surviving account holder(s). However, in certain cases, such as when there is a dispute, debt, or lack of right of survivorship, a joint bank account may undergo probate.

The benefits of joint bank accounts include easy access and management of funds for all account holders, avoidance of probate, and immediate availability of funds after one account holder's death. However, there are also drawbacks, such as a lack of individual control over finances, the potential for misuse of funds, and possible impacts on eligibility for financial aid or benefits.

Alternatives to joint bank accounts include trust accounts and payable-on-death (POD) accounts. In a trust account, a trustee controls funds for the benefit of other individuals, which can offer more control and protection than joint accounts. A POD account allows the account owner to designate a beneficiary who will receive the funds upon their death, avoiding probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.