Do You Need Probate When a Spouse Dies?

The need for probate when a spouse dies depends on various factors. If assets were owned jointly, they often pass directly to the surviving spouse without probate.

Similarly, assets like life insurance policies or retirement accounts with designated beneficiaries don't require probate. If the deceased had a living trust, assets within the trust could bypass probate.

However, if the deceased owned property solely in their name or they had a will, probate is typically necessary to transfer these assets legally to the intended beneficiaries.

Some states also offer simplified probate procedures for small estates. It's advisable to consult with a probate lawyer or a professional estate planner to fully understand if probate is necessary for your specific situation.

Factors Influencing the Need for Probate

Existence of a Will

The existence of a valid will does not necessarily avoid probate but can streamline the process. However, all wills must go through probate for the court to deem them legally binding.

Types of Assets Involved

Certain types of assets—such as those held in joint tenancy, retirement accounts, and life insurance proceeds—may not need to go through probate and can be transferred to the surviving co-owner or named beneficiary directly.

Ownership of the Assets

The way assets are owned affects whether they need to go through probate. Solely owned assets generally must be probated to be transferred legally to the beneficiaries.

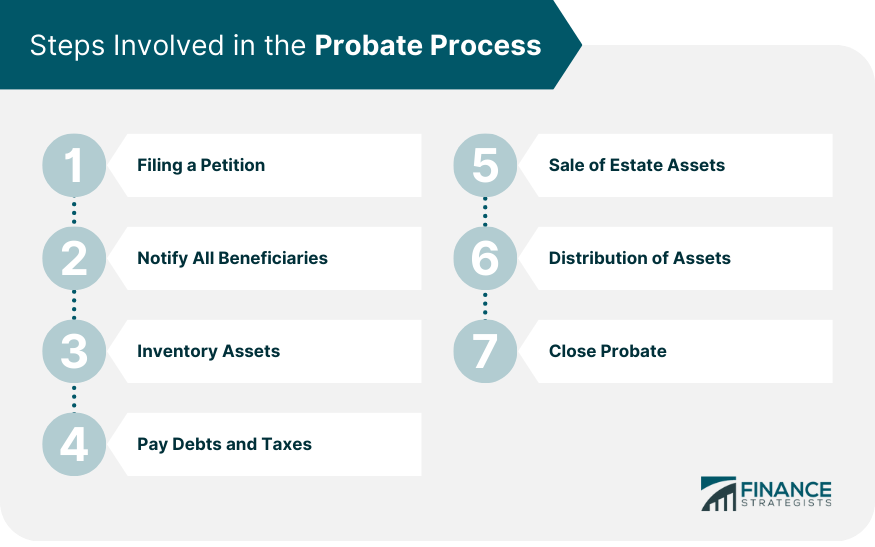

Steps Involved in the Probate Process

1. Filing a Petition: Start the probate process by filing a petition at the probate court to either admit the will to probate and appoint the executor or, if there is no will, appoint an administrator of the estate

2. Notification: Notify all beneficiaries, heirs, and creditors known to have an interest in the estate about the ongoing probate process.

3. Inventory Assets: Identity, inventory, and appraise the deceased's assets to ascertain the total value of the estate.

4. Pay Debts and Taxes: Use estate funds to pay off debts, including any taxes owed by the deceased. An accountant may be necessary for tax matters.

5. Sale of Estate Assets: If necessary, sell estate assets to satisfy the decedent's obligations.

6. Distribution of Assets: Once debts and taxes are paid, distribute the remaining assets among the beneficiaries as per the will or state law if there's no will.

7. Close Probate: Lastly, close the probate process by filing a final account and report of the executor or administrator with the probate court.

Timeline of the Probate Process

The timeline of the probate process can vary widely, depending on factors such as the size and complexity of the estate and the specific probate laws of the state.

However, on average, the process typically takes between six months to a year. In more complex cases, probate can extend beyond a year, sometimes spanning several years.

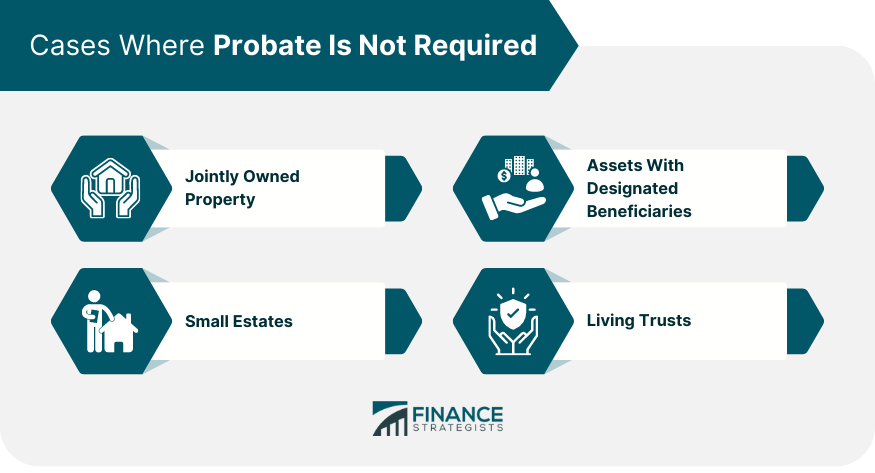

Specific Cases Where Probate Is Not Required

Jointly Owned Property

If a deceased spouse held property in joint tenancy with rights of survivorship, the surviving spouse would typically receive the deceased's portion of the property without the need for probate.

Assets With Designated Beneficiaries

Assets such as life insurance policies, retirement accounts, or payable-on-death bank accounts that have designated beneficiaries bypass probate and go directly to the named beneficiaries.

Small Estates

Many states provide simplified probate procedures for small estates, allowing assets to be transferred without a formal probate process.

Living Trusts

If the deceased had a living trust, the assets held in the trust could bypass probate. The trustee can distribute these assets according to the terms of the trust.

Consequences of Not Going Through Probate

Legal Consequences

Beneficiaries may encounter difficulties in securing legal ownership of the assets, creating a stalemate. Moreover, the lack of a formal probate process might spur disagreements over asset distribution, escalating into expensive and time-consuming litigation.

Financial Consequences

The absence of probate doesn't absolve an estate from its financial obligations. Creditors maintain the right to stake claims against the estate's assets.

If these claims aren't correctly managed, beneficiaries could inadvertently inherit these debts, inflicting unforeseen financial burdens.

Therefore, it's crucial to ensure a thorough settlement of financial obligations, a process efficiently managed within probate.

Alternatives to Probate

Joint Tenancy

Owning property as joint tenants allows the property to pass directly to the surviving owner(s) upon one owner's death, bypassing probate.

Payable-On-Death Accounts and Registrations

These accounts allow the account holder to designate a beneficiary who will automatically receive the assets in the account upon the holder's death, avoiding probate.

Living Trusts

A living trust can help avoid probate for nearly any asset the decedent owned—real estate, bank accounts, vehicles, and so on. Upon the decedent's death, the trustee can transfer these assets to the trust beneficiaries without court supervision.

Simplified Procedures for Small Estates

Many states offer simplified probate procedures for small estates. These procedures are quicker, less complicated, and less costly than the regular probate process.

Bottom Line

Understanding the role of probate when a spouse dies is essential to navigating asset transfers smoothly.

While jointly owned assets, assets with designated beneficiaries, and those within a living trust typically avoid probate, assets solely owned by the deceased or dictated by a will typically require probate.

Nevertheless, some states offer simplified procedures for small estates, easing the process. The probate timeline can vary, usually spanning six months to a year, but it can extend further for complex estates.

Bypassing probate when necessary can lead to serious legal and financial consequences, emphasizing its importance.

Alternatives like joint tenancy, payable-on-death accounts, and living trusts can also circumvent probate.

Do You Need Probate When a Spouse Dies? FAQs

Assets owned jointly or with designated beneficiaries can often be transferred directly to the surviving spouse without probate. However, assets solely owned by the deceased or governed by a will typically require probate.

The probate process usually takes between six months to a year, but it can be longer for more complex estates. Factors such as the size of the estate and specific state laws can affect the timeline.

Not going through probate when required can have legal and financial consequences. Legal ownership of assets may be challenging to establish, leading to disputes and potential litigation. Creditors can also make claims against the estate, and beneficiaries may inherit debts if not managed properly.

Yes, there are alternatives to probate. Joint tenancy allows assets to pass directly to the surviving owner(s). Payable-on-death accounts and registrations designate beneficiaries to receive assets upon the account holder's death. Living trusts can also help avoid probate by transferring assets to beneficiaries without court supervision. Simplified procedures exist for small estates.

The requirement for probate varies, and not all wills undergo the process. Several factors come into play, including the nature and worth of the deceased's assets, the ownership structure of those assets, and the applicable state laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.