Overview of Probate and Quitclaim Deed

Probate

Probate refers to the legal process through which a deceased person's estate is properly distributed to the heirs or beneficiaries, and any debt owed to creditors is paid off.

It typically involves proving in court that a deceased person's will is valid, identifying and inventorying the deceased person's property, having the property appraised, and paying off debts and taxes.

It also includes distributing the remaining property as the will (or state law, if there's no will) directs.

Quitclaim Deed

A quitclaim deed, on the other hand, is a legal instrument that is used to transfer interest in real property. The entity transferring its interest, the "grantor", quits its claim to the property and transfers it to the recipient, the "grantee".

Unlike other property deeds, a quitclaim deed contains no title covenant and thus, offers the grantee no warranty as to the status of the property title.

Does Quitclaim Deed Avoid Probate?

In general, property transferred through a quitclaim deed before the grantor's death can avoid the probate process. This is because probate only applies to assets that the deceased owned at the time of death.

If property has already been transferred through a quitclaim deed, the grantor no longer legally owns the property, and it will not be considered part of their estate when they die.

Legal Implications of Quitclaim Deeds and Probate Avoidance

Immediate Transfer of Ownership

The most significant advantage of using a quitclaim deed to avoid probate is the immediate transfer of ownership.

The property changes hands the moment the deed is signed and delivered to the grantee, saving time, court costs, and potential legal fees associated with probate.

Potential Drawbacks and Legal Complexities

However, using quitclaim deeds as a probate avoidance strategy is not without its drawbacks and complexities.

It's essential to consider potential issues such as the grantor's right to use the property after it's been transferred, the impact on the grantor's eligibility for Medicaid, and potential gift tax implications.

In-Depth Analysis of Quitclaim Deeds

Function and Purpose

The main function of a quitclaim deed is to transfer the grantor's rights or interests to the grantee.

It is often used in non-sale transactions, like adding or removing a spouse from the property title during a marriage or divorce, transferring property into a living trust, or clarifying ownership in a will.

Advantages and Disadvantages

Advantages

Simplicity: Quitclaim deeds are easy to execute, requiring only basic information about the parties involved and the property.

Speed: As they do not require a title search or warranty, quitclaim deeds can be processed quickly.

Flexibility: They are ideal for transferring property between family members, or adding/removing a spouse from the property title.

Cost-Effective: Due to their simplicity, quitclaim deeds are usually cheaper to prepare and record than other types of deeds.

Disadvantages

Lack of Protection: Unlike warranty deeds, quitclaim deeds offer no guarantees about the property title's status, leaving the grantee vulnerable to future claims or liens.

Potential Fraud: Unscrupulous individuals can use quitclaim deeds to take advantage of unsuspecting buyers, as they don't guarantee ownership.

Difficulties in Reselling: Future buyers might hesitate to purchase a property transferred with a quitclaim deed due to the lack of guarantees about the property's title.

Ineligibility for Title Insurance: Many title insurance companies refuse to issue a policy on a property transferred by a quitclaim deed without a thorough title search.

Legal Consequences of Using a Quitclaim Deed

Legal Rights and Obligations for the Grantor and Grantee

When a quitclaim deed is used, the grantor's obligations are significantly reduced. They are not responsible for any title defects or claims brought by third parties.

However, the grantee assumes all risks. If a dispute over the title arises later, the grantee has limited legal recourse against the grantor.

Potential Risks and Legal Controversies

The main risk with quitclaim deeds is that the grantee has no legal recourse if problems with the title arise after the transfer.

If there's an outstanding lien on the property or if a previously unknown heir comes forward, the grantee's claim to the property could be jeopardized.

Thus, using quitclaim deeds as a tool to avoid probate should be done with caution and under the guidance of an experienced attorney.

In-Depth Analysis of the Probate Process

Purpose and Function

The primary purpose of probate is to prevent fraud after someone's death.

It's a way to freeze the estate until a judge determines that the Will is valid, all relevant people have been notified, all property in the estate has been identified and appraised, and all creditors and taxes have been paid.

Advantages and Disadvantages

The probate process has advantages such as providing a court-supervised method of transfer of property, protecting the rights of creditors by ensuring valid debts are paid, and enforcing the orderly distribution of assets if the deceased did not leave a Will.

However, it also has disadvantages, including time consumption, public disclosure of assets, and the potential cost, which can eat into the estate's value.

How Probate Works

Step by Step Process

Probate procedures can vary by state, but there are general steps that most probate cases follow.

These steps include:

- 1. Filing a petition with the probate court

2. Notifying heirs and creditors

3. Taking inventory of the estate

4. Paying the estate's debts

5. Filing tax returns

6. Distributing the remaining assets to the heirs

Possible Complications

Potential complications may arise during the probate process, including disputes between beneficiaries, lost or unclear assets, and claims from creditors.

A misstep in any step of the probate process can lead to significant delays, legal complications, and possibly litigation.

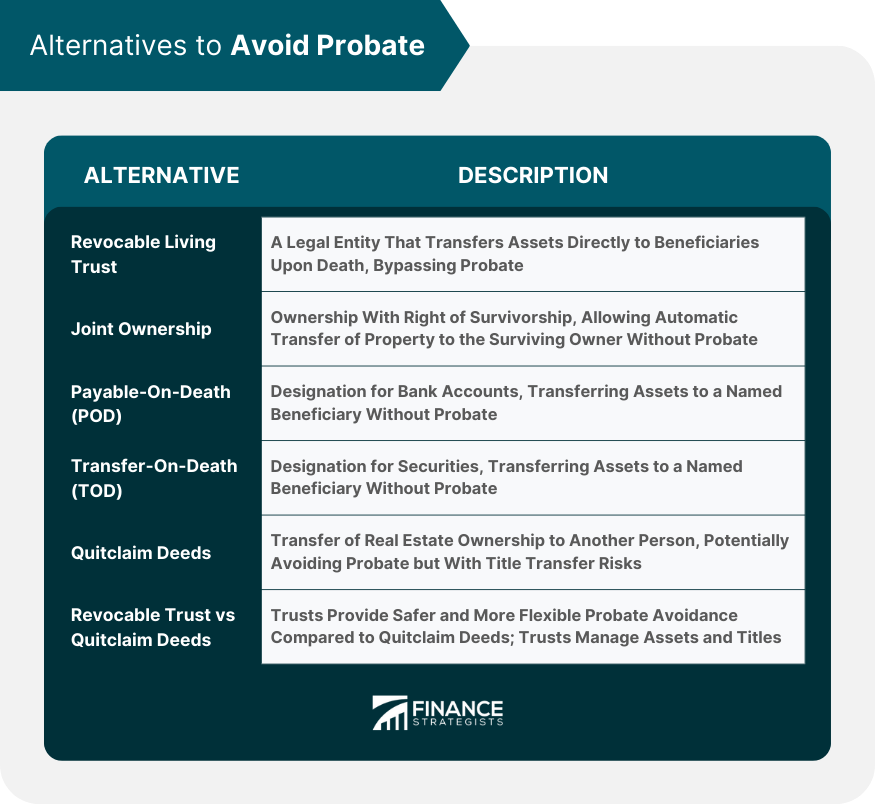

Alternatives to Avoid Probate

Using a Revocable Living Trust

A revocable living trust is a legal entity created to hold ownership of an individual's assets. Upon the individual's death, the assets are transferred directly to the beneficiaries by the trustee, thereby bypassing the probate process. This can save time and court fees.

Joint Ownership of Property

Assets owned jointly with the right of survivorship are not subject to probate. When one owner dies, the property automatically passes to the surviving owner without the need for probate.

Payable-On-Death and Transfer-On-Death Arrangements

POD and TOD designations are simple ways to keep bank accounts and securities respectively, out of probate. The owner names a beneficiary who will inherit the asset at their death, bypassing probate.

Comparison With Quitclaim Deeds in Avoiding Probate

While quitclaim deeds can effectively avoid probate for real estate properties, they are not without risk, as detailed earlier. Revocable trusts, joint ownership, and POD/TOD designations, on the other hand, tend to offer safer and more flexible probate avoidance methods.

The Bottom Line

Probate, an essential but often complex process, ensures orderly distribution of a deceased's assets. Quitclaim deeds, facilitating immediate transfer of property rights, can sidestep probate, thus saving time, court fees, and potential legal hassles.

Yet, they come with their own set of challenges, like lack of title protection and potential legal complications.

While simplicity, speed, and cost-effectiveness make quitclaim deeds appealing, issues like Medicaid eligibility, gift tax implications, and future title disputes necessitate careful consideration.

Safer alternatives for probate avoidance such as revocable living trusts, joint property ownership, and payable-on-death or transfer-on-death arrangements can offer more protection and flexibility.

Therefore, while quitclaim deeds can be a tool to avoid probate, their use should be guided by thorough legal counsel to prevent potential risks.

Does Quit Claim Deed Avoid Probate? FAQs

Yes, a quitclaim deed can help avoid probate by transferring ownership of the property before the owner's death, as probate only applies to assets owned at the time of death.

Yes, there are risks associated with using a quitclaim deed to avoid probate, including potential tax implications and the possibility of the property still going through probate if the grantor retains a life interest.

Alternatives to a quitclaim deed for probate avoidance include setting up a revocable living trust, owning property jointly with rights of survivorship, and setting up payable-on-death or transfer-on-death arrangements.

If a property was transferred by a quitclaim deed before the grantor's death, it won't be part of the grantor's estate, and therefore won't go through probate.

No, a quitclaim deed offers no protection for the grantee against claims or liens on the property. If there are any such issues, the property may still be subject to probate or other legal processes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.