Valuing a house for probate involves appraising the property to determine its fair market value at the time of the deceased's death. This task typically begins by hiring a professional real estate appraiser or surveyor, who will assess the property's condition, size, location, and comparable sales in the area. The appraiser will consider any unique features or improvements that could affect the value. Additionally, the appraiser will review the local property market to compare the house with similar properties sold recently. This process results in a detailed report outlining the home's market value, which is used for probate purposes. It's important to note that the date of valuation is usually the date of death, and any market fluctuations after this date don't affect the value for probate purposes. The valuation is then submitted to the probate court as part of the estate's inventory of assets. Always consult a legal professional for specific advice tailored to your circumstances. The valuation of a house in probate proceedings is not only a requirement but a vital element. The valuation provides a basis for calculating inheritance tax, where applicable. It also determines how assets will be distributed among beneficiaries. An accurate valuation is essential to prevent disputes among heirs and to ensure fair distribution of the deceased's estate. The valuation of a house for probate purposes is subject to certain legal requirements. In most jurisdictions, the value must represent the fair market value of the house at the time of the owner's death. It must be an 'open market value,' meaning the price the property might reasonably be expected to fetch if sold on the open market at that time. Compliance with these legal requirements is critical for the smooth execution of the probate process and for minimizing potential legal disputes. When preparing to value a house for probate, gathering necessary documents is an essential first step. These documents provide critical information about the property that will factor into its overall valuation. The deed to the house contains vital information, such as the legal description of the property and the owner's name. It also may include details about the property's history, including previous sales, which can help in assessing its value. Property tax records often contain an assessed value for the house and land, providing a basis for the property's valuation. Any mortgages or home equity loans on the property must also be considered in the valuation. These loans represent liens on the property that must be paid off before it can be sold or transferred to heirs. If the deceased made significant improvements to the house, such as remodeling a kitchen or adding a room, these enhancements could increase its value. Records of these improvements, including receipts and permits, can provide evidence of their value. After gathering relevant documents, it's crucial to understand the different factors that can affect the value of a house. The location of the property is one of the most significant factors in its valuation. A house in a desirable neighborhood or in a city with a robust real estate market will generally have a higher value. The size, layout, and condition of the house can significantly affect its value. Larger houses generally have higher values, as do homes in good condition. But even a smaller house in excellent condition in a desirable area can have a higher value. Understanding recent trends in the real estate market can also help in the valuation process. For instance, if the market is robust, the house may be worth more. Conversely, in a down market, it might be worth less. Comparing similar houses that have recently sold in the same area can also provide a benchmark for valuing the house. A professional real estate appraiser is an unbiased third party who estimates the fair market value of the property. The appraiser should be licensed or certified in the state where the property is located. They will inspect the house, compare it to similar properties recently sold in the area, and give an official report of its estimated value. During an appraisal, the appraiser will evaluate the overall condition of the property and consider various factors, including the home's size, quality of construction, location, and market conditions. They may also consider any improvements or damages. The final appraisal report will detail the property's value and the factors contributing to that value. A Comparative Market Analysis, or CMA, is another way to estimate a house's value. A real estate agent usually conducts it. The agent will compare the house to similar properties in the same area that were sold recently, considering factors like size, age, location, and condition. To get a CMA, you should contact a reputable real estate agent in the area where the property is located. After inspecting the property and conducting their research, the agent will provide you with a report that gives an estimated market value for the house. Online valuation tools, also known as automated valuation models (AVMs), provide property value estimates using mathematical modelling combined with a database of recent transactions and property characteristics. These tools can offer a quick, preliminary estimate of a home's value. Online valuation tools are easy to use and can provide an immediate estimate of a property's value. However, these estimates can sometimes be inaccurate due to outdated or incomplete data. They also don't consider the home's condition, which can significantly impact its value. Therefore, online valuations should be used as a starting point and supplemented with other valuation methods. Before the appraisal, you should gather all necessary documents, including property deeds, tax records, and information about any major improvements. You should also ensure the property is in the best possible condition. During the appraisal, the appraiser will thoroughly inspect the property, noting its condition and any improvements or damages. They may take measurements and photos and ask questions about the property. The appraisal report will provide a detailed assessment of the property's value and the factors contributing to that value. You should review this report carefully to understand the appraiser's rationale for their valuation. After the valuation, the executor can use the property's value to pay any debts or taxes owed by the estate. This might involve selling the house or other assets if there isn't enough cash in the estate. Once debts and taxes have been paid, the remaining assets, including the house, can be distributed to heirs as outlined in the will. If the house must be sold to pay debts or because the will directs it, the executor will arrange a probate sale. This sale must often be approved by the court, and the proceeds will go towards settling the estate. The valuation of the house will directly impact the amount of estate tax owed, if applicable. A higher valuation means higher estate taxes, while a lower valuation results in lower taxes. Valuation disputes may arise among heirs or with tax authorities. If disputes cannot be resolved through negotiation, it may be necessary to involve a court or a professional mediator. Keeping detailed records of the valuation process can help in these situations. Valuing a house for probate involves careful consideration of its fair market value at the time of the deceased's death, which is crucial for calculating inheritance tax and the distribution of assets among beneficiaries. This process typically involves hiring a professional real estate appraiser to assess the property's condition, size, location, and comparable sales. Relevant documents such as deeds, property tax records, and home improvement records play a vital role in the valuation. The valuation's legal implications involve its impact on estate taxes and potential disputes among heirs. After the valuation, debts and taxes are settled, assets are distributed, and a probate sale may occur if necessary. Online valuation tools, while providing a quick estimate, should be used with caution due to their limitations. In all aspects of valuation, professional guidance and comprehensive records are essential to ensure a smooth and fair probate process.How Do You Value a House for Probate?

Understanding the Need to Value a House for Probate

Role of House Valuation in Probate Proceedings

Legal Requirements for Property Valuation

Initial Preparation for Valuation

Gather Relevant Documents

Deeds

Property Tax Records

Mortgages

Home Improvement Records

Understand Factors Affecting Property Value

Location

Property Size and Condition

Recent Market Trends

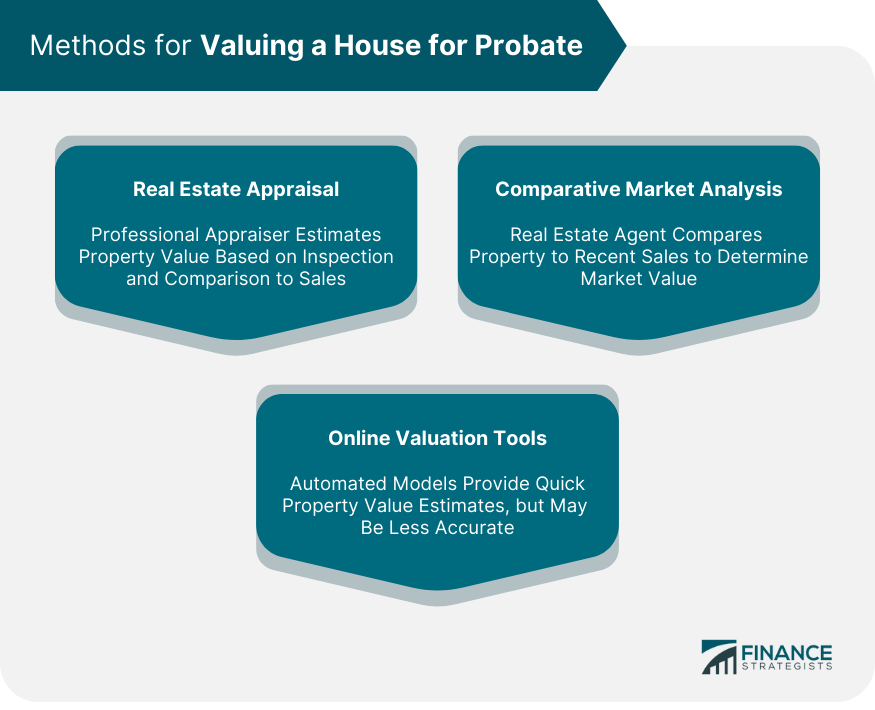

Methods for Valuing a House for Probate

Real Estate Appraisal

Hiring a Professional Appraiser

Process of a Professional Appraisal

Comparative Market Analysis (CMA)

Understanding CMA

How to Get a CMA

Online Valuation Tools

Explanation of Online Valuation Tools

Pros and Cons of Using Online Valuation Tools

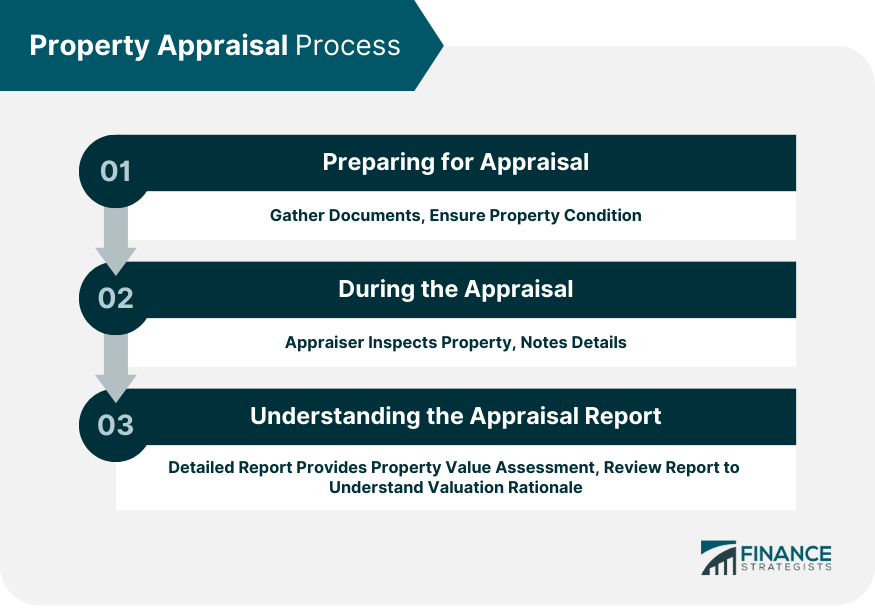

Detailed Review of the Property Appraisal Process

Preparing for the Appraisal

During the Appraisal

Understanding the Appraisal Report

What to Do After the House Valuation

Settling Debts and Taxes

Distribution of Assets

Probate Sale, if Necessary

Legal Implications of the Valuation

Impact on Estate Taxes

Possible Disputes and How to Resolve Them

The Bottom Line

How Do You Value a House for Probate? FAQs

Valuing a house for probate involves assessing its fair market value, often through methods such as a professional appraisal, a comparative market analysis, or online valuation tools.

When valuing a house for probate, you should gather relevant documents such as property deeds, property tax records, mortgage information, and home improvement records.

An accurate valuation of a house for probate is crucial because it impacts estate taxes, asset distribution among heirs, and potential probate sales.

Yes, online valuation tools can be used to get a preliminary estimate when valuing a house for probate. However, these should be supplemented with other methods for a more accurate valuation.

After valuing a house for probate, the executor can settle debts and taxes. Once these are paid, the remaining assets, including the house, can be distributed to heirs as outlined in the will.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.