Probate administration is a legal process where the assets of a deceased person are managed and distributed under court supervision. It involves executing the terms specified in the decedent's will, or if there is no will, it follows the probate laws of the jurisdiction. The process includes identifying, inventorying, and appraising the decedent's property, paying debts and taxes, and eventually distributing the remaining assets to the rightful heirs. A probate administrator, also known as an executor or personal representative, carries out the probate process.They manage the decedent's estate, pay any outstanding debts or taxes, and distribute the remaining assets as specified by the will or as dictated by law if there's no will. The probate administrator also has a fiduciary duty to act in the best interests of the estate and its beneficiaries, taking all steps necessary to prevent losses or waste of the estate's assets. Probate administrator commissions vary, but typically range from 2% to 5% of the estate's value, with 3-4% being quite common. These percentages represent the industry standard but are not absolute; they may be negotiated or subject to court approval. Several factors can influence the rate of probate administrator commissions. One of the most important factors is the complexity of the estate. If the estate includes a vast array of assets, multiple properties, or assets located in different jurisdictions, the probate administrator's job becomes much more challenging, possibly warranting a higher commission. Likewise, if there are contentious issues between beneficiaries or potential legal disputes, these complications could result in increased work for the administrator, thus justifying a higher rate. Probate administration laws, including those governing commissions, are primarily state-based in the U.S., leading to some regional variation. Some states provide a statutory fee schedule, establishing maximum allowable commissions based on the estate's size. Other states leave the commission amount largely to the agreement between the estate and the administrator, subject to court approval. Therefore, average rates can vary significantly across different jurisdictions. As mentioned earlier, commissions are generally calculated as a percentage of the estate's value. This value includes all assets owned by the decedent at the time of death, including real estate, personal property, bank accounts, investments, and any business interests. Debts are not subtracted from this total when calculating the commission. The larger the estate, the higher the commission in dollar terms, even if the percentage is lower. For example, a 3% commission on a $500,000 estate is $15,000, while a 2% commission on a $2 million estate is $40,000. However, many states and courts will reduce the percentage for larger estates, acknowledging that the work involved doesn't necessarily scale proportionately with the estate's value. Consider an estate valued at $1 million in a jurisdiction where the probate administrator commission rate is typically 3%. The commission would be $30,000. For a larger estate, say $5 million, the court may approve a reduced percentage, say 2%. In this case, the commission would be $100,000. For a small estate valued at $50,000 with a set rate of 5%, the commission would be $2,500. The total commission compensates the probate administrator for their work, reflects the estate's value, and aligns with local laws and standards. A clear understanding of these factors can ensure a fair outcome for all parties involved. Negotiating the commission rate for a probate administrator requires a nuanced understanding of various elements. Here's a closer look at some key factors to consider during such negotiations: The estate's total value often serves as the starting point for negotiation. This value includes all assets owned by the deceased at the time of their death. Larger estates typically result in higher commissions, even when the percentage rate is lower. The complexity of the estate is a crucial factor in the negotiation process. If an estate comprises diverse assets, multiple properties, or holdings in various jurisdictions, it can significantly increase the workload for the administrator. This complexity can justify a higher commission rate. The time that an administrator must commit to effectively manage the probate process is another essential consideration. The administrator may need to spend a considerable amount of time performing various tasks, including identifying and valuing assets, paying debts and taxes, dealing with legal paperwork, and distributing assets. If an estate requires substantial time and effort to administer, a higher commission may be warranted. Administrators with a high level of expertise and a proven track record may command higher commission rates. Their skill and knowledge can ensure the process runs smoothly and efficiently, providing value to the beneficiaries. Each jurisdiction may have its own laws and regulations regarding probate administrator commissions, which can establish guidelines or even caps on commission rates. It's important to familiarize yourself with these laws before starting negotiations, to ensure any agreed-upon rate is legal and fair. In some cases, parties may agree on a flat fee for probate administration rather than a commission based on the estate's value. This approach can be beneficial if the work involved is straightforward and predictable, providing certainty and simplicity. However, it may not adequately compensate the administrator if unexpected complexities arise, making it less suitable for larger or more complicated estates. Hourly rates can be a suitable alternative for estates that require a substantial amount of work but may not have high monetary value. This method ensures that the administrator is compensated for their time and effort, regardless of the estate's worth. However, it can make costs less predictable, and there's a risk of disputes over the time spent on various tasks. Voluntary administration is an option for small estates in some jurisdictions, allowing for a simpler and less costly process. Under this system, an administrator (often a beneficiary) handles the probate process without receiving a commission. While this can save money, it also requires a significant time commitment and may be overwhelming for those unfamiliar with probate procedures. Furthermore, voluntary administrators are still legally responsible for handling the estate correctly, potentially leading to personal liability if they make mistakes. Probate administration is a complex process that necessitates careful planning and execution. A probate administrator plays a pivotal role in the process, assuming fiduciary duties to manage, protect, and distribute the decedent's estate. The commission paid to a probate administrator typically ranges from 2% to 5% of the estate's value, although this percentage can vary depending on several factors such as the estate's complexity, size, and the regional laws. Other than commission-based compensation, alternatives like flat fees, hourly rates, and voluntary administration may also be considered. However, each of these has its own advantages and disadvantages and should be chosen after thoroughly understanding the estate's specifics and potential legal implications. It's imperative to comprehend the influencing factors and calculation methods involved in determining probate administrator commission to ensure a fair outcome for all parties involved. Consider consulting an estate planning lawyer. They can provide guidance tailored to your situation, ensuring a fair and legal resolution that respects the decedent's wishes and protects the interests of all beneficiaries.Overview of Probate Administration

Probate Administrator Commission: Average Rates

Industry Standard Averages

Factors Influencing Variation in Average Rates

Regional Differences in Average Commission Rates

Understanding Probate Administrator Commission Calculation

Common Basis for Calculating Commissions

How the Value of the Estate Affects Commission Rates

Scenario-Based Examples of Commission Calculations

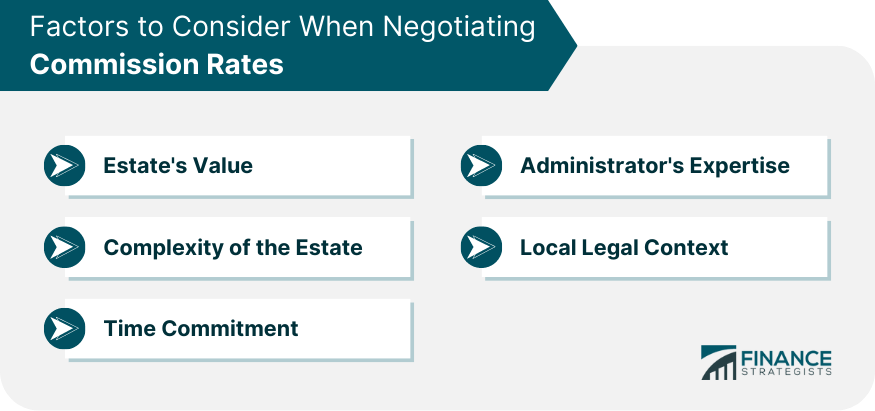

Factors to Consider When Negotiating Commission Rates

Estate's Value

Complexity of the Estate

Time Commitment

Administrator's Expertise

Local Legal Context

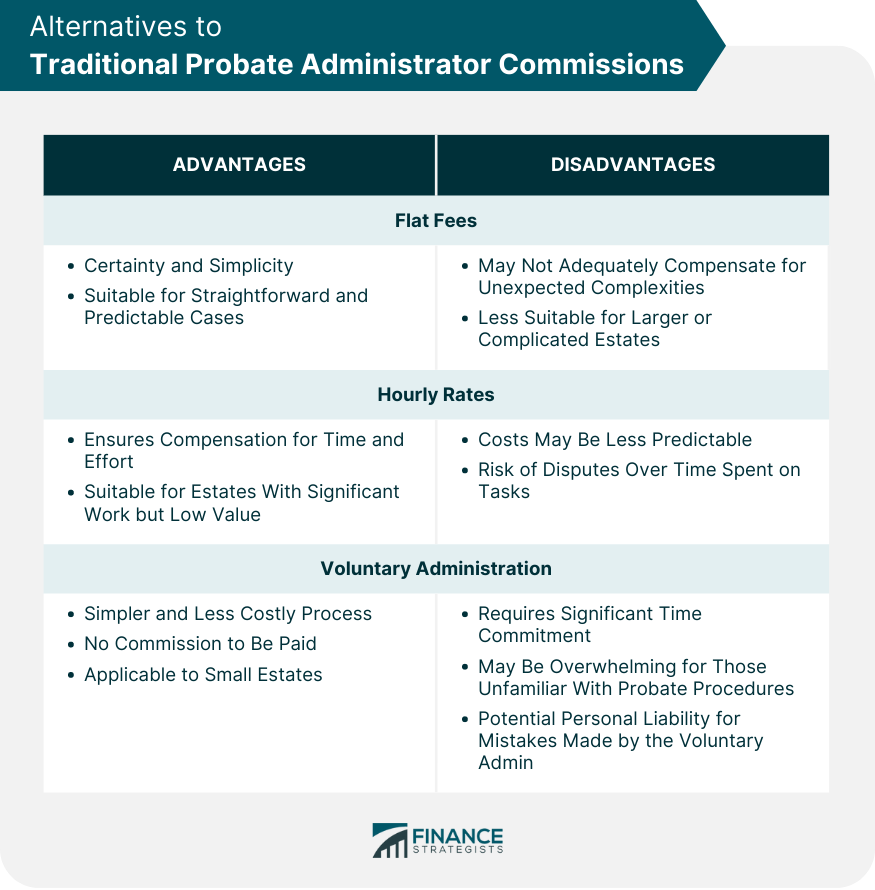

Alternatives to Traditional Probate Administrator Commissions

Flat Fees: Advantages and Disadvantages

Hourly Rates: When This Could be a Preferable Choice

Voluntary Administration: When and How It Can Be Used

The Bottom Line

Probate Administrator Commission FAQs

The average commission typically ranges from 2% to 5% of the estate's value, with many states providing guidelines or fee schedules.

The commission is usually calculated as a percentage of the estate's total value, including all assets owned by the decedent at the time of death.

Yes, the rate can vary based on several factors, including the estate's complexity, the probate administrator's workload, and the specific laws of the jurisdiction.

Probate Administrator Commissions are regulated by state laws, with many jurisdictions setting guidelines or caps on commission percentages based on the estate's value.

Yes, alternatives can include flat fees, hourly rates, or voluntary administration, depending on the estate's size and complexity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.