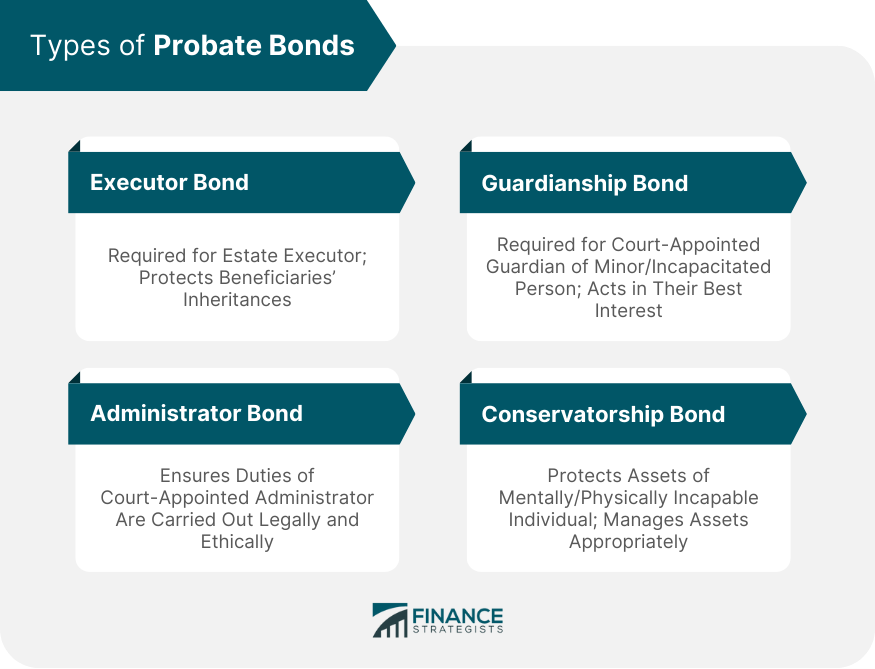

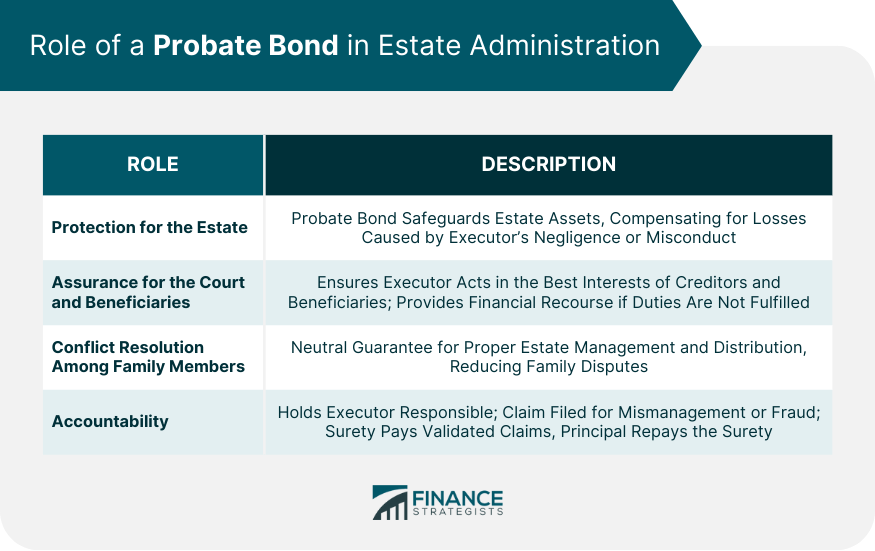

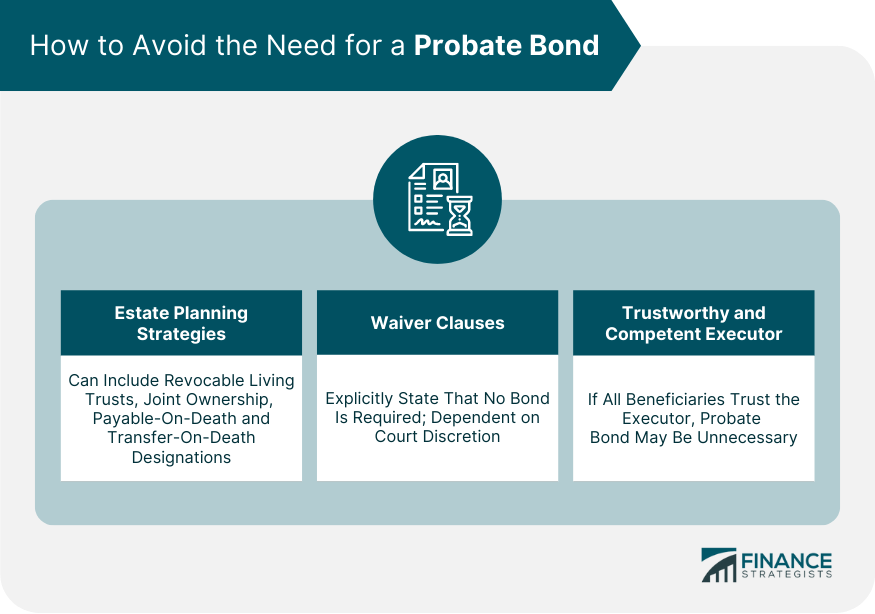

A probate bond, also known as an estate bond, executor bond, or fiduciary bond, is a type of surety bond that courts may require from the administrators or executors who are handling a deceased person's estate. The bond serves as a financial guarantee that the executor or administrator will fulfill their duties honestly and according to the law. It protects the deceased's estate and the beneficiaries. If an executor or administrator mismanages the estate or does not fulfill their duties appropriately, a claim can be made against the bond. If the claim is validated, the surety company pays out the claim to cover the losses, and the executor or administrator (the principal on the bond) is obligated to repay the surety company. The requirement for a probate bond and its amount usually depends on the size and complexity of the estate, whether the deceased's will specifies it, and the local laws of the jurisdiction where the estate is being administered. An executor bond, as the name suggests, is required of the executor of an estate. This is the person named in a will to manage and distribute the assets of the deceased. The executor bond provides protection to the estate's beneficiaries, ensuring they receive their rightful inheritances. In cases where the deceased did not leave a will, or the named executor is unable or unwilling to perform the duties, the court will appoint an administrator. An administrator bond is then used to ensure that this person carries out their responsibilities in a legal and ethical manner. When a court appoints a guardian to manage the personal and financial affairs of a minor or incapacitated individual, a guardianship bond may be required. This bond ensures the guardian will act in the best interests of the person under their care. A conservatorship bond is similar to a guardianship bond but typically applies when an individual has been deemed mentally or physically incapable of managing their own affairs. This bond provides protection for the incapacitated person's assets, ensuring they're managed and used appropriately. Not all estates require a probate bond. The will, if there is one, may waive the need for a bond. Additionally, some jurisdictions do not require probate bonds, except under certain conditions. However, if the court determines a bond is necessary, the executor or administrator must secure one before they can perform their duties. Applying for a probate bond typically involves submitting an application to a surety company, detailing the size of the estate and the type of bond required. The surety company will then assess the applicant's creditworthiness and risk. Once approved, the bond is issued to the principal, who is then responsible for paying the bond premiums. The cost of a probate bond depends on several factors, including the bond amount, the applicant's credit score, and the risk associated with the estate. Premiums usually range between 0.5% and 2% of the bond's total value but can vary depending on the circumstances. The primary role of a probate bond is to protect the assets of the estate. The bond ensures that the executor or administrator performs their duties correctly and ethically. If they fail to do so, the bond can be used to compensate the estate or its beneficiaries for any losses incurred. The court's responsibility is to ensure that the estate is managed in the best interests of the creditors and beneficiaries. The bond offers a guarantee that if the appointed executor or administrator fails to do their job correctly, there will be financial recourse. In many cases, the death of a loved one can lead to disputes among surviving family members, especially when it comes to the distribution of assets. A probate bond can alleviate some of these tensions, as it serves as a neutral guarantee that the estate will be managed and distributed according to the law and the terms of the will. If an executor or administrator mismanages the estate or commits fraud, they are in breach of the bond's terms. In such cases, a claim can be filed against the bond. If the claim is validated, the surety company pays out the claim amount, which the principal is then obligated to repay to the surety company. Thoughtful estate planning is one of the most effective ways to bypass the need for a probate bond. Here are some common strategies: A trust allows an individual to transfer ownership of their assets to the trust. After the individual's death, the assets within the trust are managed and distributed according to the terms of the trust, without the need for probate. Since there is no need for a court-appointed administrator or executor, there is also no need for a probate bond. Assets owned jointly with a right of survivorship will automatically pass to the surviving owner upon the death of the other, bypassing probate. Bank accounts, retirement accounts, securities, and even some types of real estate and vehicles can be designated to pass directly to a named beneficiary upon the owner's death, avoiding probate. Such a clause explicitly states that the named executor is not required to post a bond. However, it's essential to note that the court has the discretion to ignore this clause if it believes a bond is necessary to protect the estate's beneficiaries, especially if they are minors or vulnerable adults. When a dependable and competent person is appointed as the executor, there may be no need for a probate bond. If all beneficiaries trust the executor and are confident in their abilities, they may agree collectively to waive the probate bond requirement. Surety bonds, as a broad category, are a form of guarantee that certain tasks or obligations will be fulfilled. Fidelity bonds are more common in business environments, particularly in industries where employees have access to valuable assets or sensitive information. They protect businesses against losses caused by fraudulent or dishonest acts of their employees, such as theft or embezzlement. While probate bonds protect beneficiaries, fidelity bonds primarily protect businesses. Construction bonds, meanwhile, are often required to ensure contractors complete their projects according to the terms of the agreement. These bonds protect project owners and investors from the risk of a contractor failing to complete a project or meet the project's specifications. Finally, commercial bonds are a wide-ranging category of bonds that encompass various bonds required in different business scenarios. They are typically used to protect the public or specific entities from losses due to violations of regulations or statutes by a business. These might include license and permit bonds, tax bonds, and utility bonds. Commercial bonds have broader scopes, applying to a variety of business-related contexts. A probate bond serves as a crucial financial guarantee for the proper administration of an estate. It protects the assets of the estate and ensures that the executor or administrator fulfills their duties honestly and in accordance with the law. The bond offers reassurance to the court and beneficiaries, providing a form of recourse if the appointed individual fails to fulfill their responsibilities. It can also help prevent conflicts among family members by ensuring the estate is managed and distributed impartially. Furthermore, the bond holds the executor or administrator accountable, with the ability to file a claim in cases of mismanagement or fraud. However, individuals can avoid the need for a probate bond through thoughtful estate planning strategies such as revocable living trusts, joint ownership, and payable-on-death designations. It is essential to understand that probate bonds differ from other types of surety bonds, such as fidelity bonds, construction bonds, and commercial bonds, which serve different purposes in various business contexts. Overall, a probate bond plays a crucial role in protecting the interests of the estate and beneficiaries, and ensuring the proper administration of an individual's final affairs.What Is a Probate Bond?

Types of Probate Bonds

Executor Bond

Administrator Bond

Guardianship Bond

Conservatorship Bond

Process of Obtaining a Probate Bond

Understanding the Need for a Bond

Application Process

Bond Pricing and Premiums

Role of a Probate Bond in Estate Administration

Protection for the Estate

Assurance for the Court and Beneficiaries

Conflict Resolution Among Family Members

Accountability

How to Avoid the Need for a Probate Bond

Estate Planning Strategies

Revocable Living Trusts

Joint Ownership

Payable-On-Death and Transfer-On-Death Designations

Waiver Clauses

Trustworthy and Competent Executor

Comparing Probate Bonds With Other Surety Bonds

Final Thoughts

Probate Bond FAQs

A Probate Bond, also known as an estate bond, executor bond, or fiduciary bond, is a type of surety bond that courts may require from the administrators or executors who are handling a deceased person's estate. This bond ensures that the executor or administrator will carry out their duties in compliance with the law and the terms of the will, providing protection to the beneficiaries of the estate.

The requirement for a Probate Bond largely depends on the laws of the jurisdiction where the estate is being administered and the terms of the deceased's will. In some cases, the will may specify whether a bond is required. If the will is silent on this matter, local law will typically dictate whether a bond is necessary. Generally, a probate bond is required when there are significant assets in the estate and when minors, incapacitated individuals, or other vulnerable parties stand to inherit from the estate.

The cost of a Probate Bond, known as the bond premium, is a percentage of the total bond amount, typically ranging from 0.5% to 2%. This percentage can vary based on factors such as the total value of the estate, the creditworthiness of the executor or administrator, and the specific requirements of the jurisdiction.

If the executor or administrator mismanages the estate or fails to fulfill their obligations, a claim can be made against the bond. If the claim is validated, the surety company will pay out the claim amount to compensate for the losses incurred. The executor or administrator, as the principal of the bond, is then obligated to repay the surety company for the claim amount.

Yes, the requirement for a Probate Bond can often be avoided through thoughtful estate planning. This could involve establishing a trust, owning assets jointly, or using payable-on-death and transfer-on-death designations. In some cases, a waiver clause can be included in the will to negate the need for a bond. However, the ultimate decision rests with the court, which may require a bond if it deems necessary for protecting the beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.