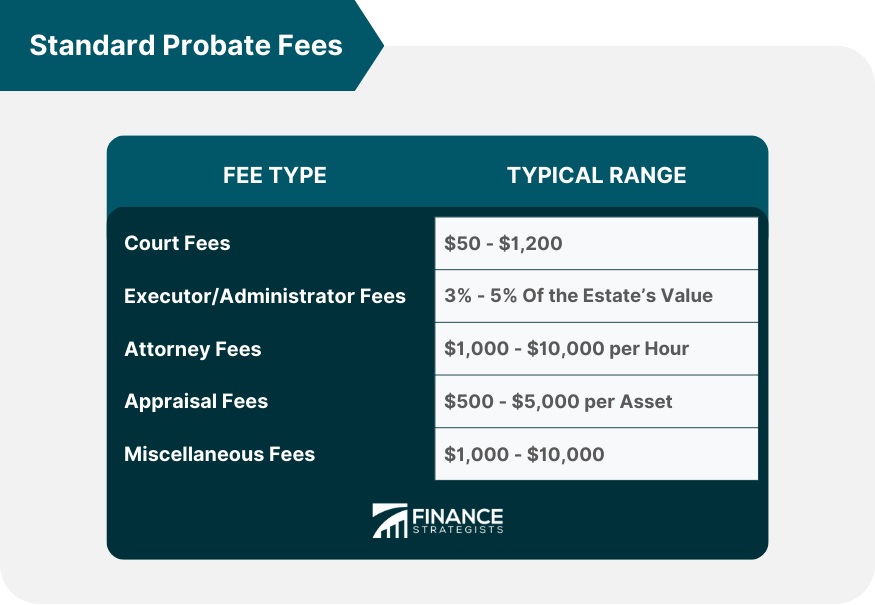

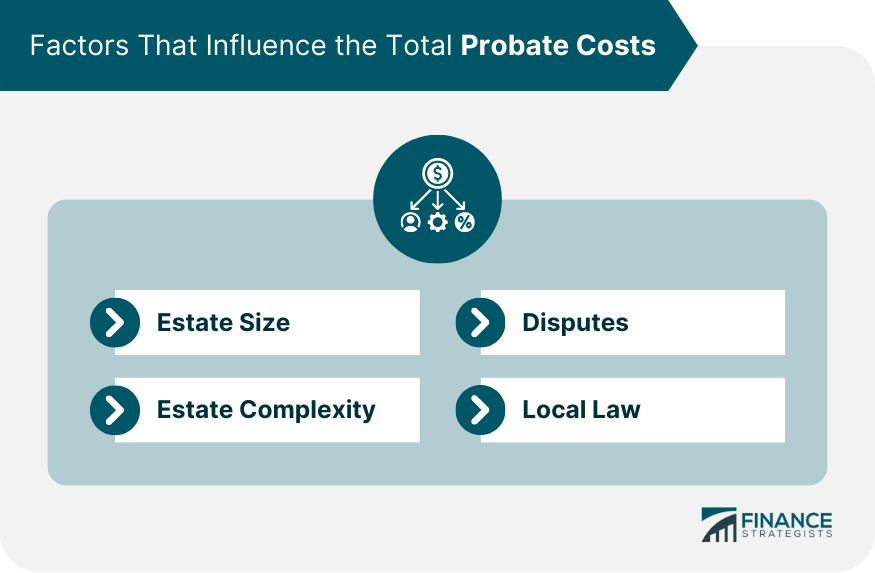

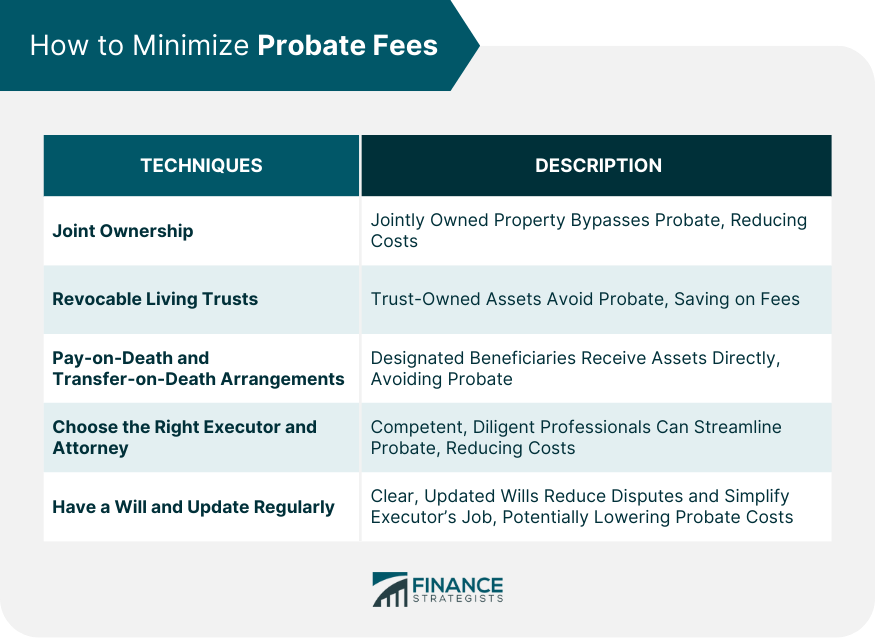

Probate is the legal process through which a deceased person's estate is managed and distributed. When someone passes away, their assets, which include properties, possessions, and finances, are not automatically transferred to their heirs. The probate court supervises the validation of the deceased’s will, the identification and appraisal of their assets, the payment of debts and taxes, and ultimately the distribution of the remaining assets to the rightful heirs. Understanding probate fees is crucial for both estate planners and potential heirs. For estate planners, knowing the costs involved in the probate process can help them design a more efficient estate plan, aiming to minimize these fees and maximize the inheritance passed to their heirs. Additionally, if one is appointed as an executor or administrator of an estate, one will need to know the costs one may encounter during the probate process. Probate fees are the costs associated with the legal process of administering the deceased's estate. They are often paid out from the estate itself before any distribution to the beneficiaries. Probate fees vary considerably depending on the size, complexity of the estate, and the jurisdiction where the process takes place. The cost of probate can vary depending on the size and complexity of the estate, as well as the jurisdiction in which the probate is being conducted. However, there are some standard probate fees that are typically incurred. The first step in the probate process is to file a petition with the probate court. This filing typically requires a filing fee, which can range from $50 to $1,200. In addition to the filing fee, there may be other court-related costs, such as the cost of certified copies of court documents and publication fees for legal notices. The executor or administrator of the estate is the person responsible for managing the estate during the probate process. The executor or administrator is typically entitled to a fee for their services. The amount of the fee is typically a percentage of the estate's value, and it can range from 3% to 5%. Most people choose to hire an attorney to help them with the probate process. The attorney's fees can vary depending on the complexity of the estate and the amount of work that the attorney does. However, attorney fees typically range from $1,000 to $10,000. In order to determine the value of the estate's assets, it may be necessary to have them appraised. The cost of appraisal fees can vary depending on the type of asset and its value. However, appraisal fees typically range from $500 to $5,000 per asset. In addition to the fees mentioned above, there may be other miscellaneous costs associated with the probate process. These costs can include accounting fees, storage fees, and selling costs. Here is a table that summarizes the typical ranges of probate fees: It is also important to note that these are just estimates. The actual fees may be higher or lower, depending on the specific circumstances. 1. Estate Size: Larger estates often require more work to manage and distribute, increasing the total probate costs. 2. Estate Complexity: If an estate includes complex assets like businesses or properties in multiple states, probate can be more complicated and costly. 3. Disputes: If heirs or beneficiaries contest the will or dispute the executor's decisions, legal costs can skyrocket. 4. Local Law: Probate laws and fees vary by jurisdiction, affecting the total cost of probate. Property owned jointly with a right of survivorship automatically passes to the surviving owner(s) without going through probate, reducing probate costs. Assets placed in a revocable living trust avoid probate because the trust, not the deceased, technically owns them. The trustee simply transfers ownership to the beneficiaries according to the trust's terms. For bank accounts and certain types of property, you can designate a beneficiary who will automatically receive the asset upon your death, bypassing probate. Choosing a competent, trustworthy, and diligent executor can streamline the probate process and minimize costs. Similarly, an experienced probate attorney can provide valuable guidance and prevent costly mistakes. Having a well-crafted will and keeping it updated is crucial. It provides clear instructions about asset distribution, reducing disputes among heirs and simplifying the executor's job, thus potentially reducing probate costs. Navigating through the intricacies of probate fees is a daunting task. While standard probate fees encompass court fees, executor fees, attorney fees, appraisal fees, and various miscellaneous fees, their accumulation varies significantly based on factors such as the estate's size, complexity, disputes among beneficiaries, and the local jurisdiction's laws. However, with strategic planning, you can minimize these costs. Techniques such as establishing joint ownership, creating a revocable living trust, and setting up pay-on-death or transfer-on-death arrangements can effectively reduce probate fees. Crucially, the appointment of a competent executor and a skilled probate attorney can further streamline the process, eliminating potential pitfalls that may add unnecessary costs. This highlights the importance of considering professional legal guidance. If you're navigating probate or planning your estate, consulting with an estate planning attorney can help ensure that you're making the most informed decisions.Overview of Probate

Standard Probate Fees

Court Fees

Executor/Administrator Fees

Attorney Fees

Appraisal Fees

Miscellaneous Fees

Factors That Influence the Total Probate Costs

How to Minimize Probate Fees

Estate Planning Techniques to Reduce Probate Fees

Joint Ownership

Revocable Living Trusts

Pay-on-Death and Transfer-on-Death Arrangements

Choose the Right Executor and Attorney

Have a Will and Update Regularly

Bottom Line

Standard Probate Fees FAQs

Standard probate fees refer to the costs incurred during the legal process of administering a deceased person's estate. These typically include court fees, executor or administrator fees, attorney fees, appraisal fees, and other miscellaneous expenses.

Probate fees are typically calculated based on the size and complexity of the estate. They encompass court fees, executor or administrator compensation, legal fees, appraisal costs, and other miscellaneous charges.

Yes, through careful estate planning, it's possible to avoid or reduce standard probate fees. Strategies include creating a revocable living trust, establishing joint ownership, and setting up pay-on-death or transfer-on-death designations.

Typically, probate fees are paid out of the deceased person's estate before any distribution to the beneficiaries.

An attorney can guide the executor or administrator through the probate process, assist with legal documentation, and help resolve any disputes that arise. Their fees, usually the largest component of probate costs, can be charged as an hourly rate or a percentage of the estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.