Remainder interest is a type of estate planning tool that allows an individual to transfer ownership of an asset to someone else while still retaining the right to use the asset until they die. Essentially, the owner transfers the remainder interest in the property to another party, while retaining a life estate in the property. This means that the owner has the right to use and enjoy the property during their lifetime, but upon their death, the remainder interest passes to the designated recipient. It is important to note that remainder interest is a form of legal ownership and comes with certain rights and responsibilities. Additionally, the holder of the remainder interest may be responsible for taxes, maintenance, and other expenses related to the property. Estate planning is an important aspect of financial planning for individuals of all ages and income levels. By planning ahead and making arrangements for the transfer of assets, individuals can ensure that their loved ones are taken care of and that their wishes are followed after they pass away. Remainder interest is an important tool in estate planning that allows individuals to transfer property while still retaining the right to use and enjoy it during their lifetime. Vested remainder interest refers to a transfer of ownership that is immediate and certain. The designated recipient of the remainder interest is known at the time of the transfer, and their right to the property is guaranteed upon the death of the current owner. Vested remainder interest is a popular tool in estate planning because it provides a clear plan for the transfer of assets, which can help to avoid disputes among heirs. Contingent remainder interest refers to a transfer of ownership that is conditional on certain events occurring. For example, the transfer of property might be contingent on the designated recipient surviving the current owner. If the designated recipient does not survive, the property may pass to a different recipient, or it may be returned to the current owner's estate. Contingent remainder interest can be a useful tool in estate planning because it allows for flexibility in the transfer of assets. Absolute remainder interest refers to a transfer of ownership that is unconditional and immediate. Upon the transfer of the remainder interest, the designated recipient has an absolute right to the property upon the death of the current owner. Absolute remainder interest is less common in estate planning, as it does not allow for the current owner to retain any rights to the property during their lifetime. A life estate with remainder interest is a common estate planning tool that allows an individual to transfer property to a designated recipient while retaining the right to use and enjoy the property during their lifetime. For example, an individual might transfer ownership of a family home to their children while retaining a life estate in the property. This allows the individual to continue living in the home and using it as they see fit, while ensuring that the property passes to their children upon their death. Charitable remainder trusts are another type of remainder interest that can be used in estate planning. These trusts allow an individual to transfer property to a charity while retaining the right to use and enjoy the property during their lifetime. Upon the individual's death, the remainder interest in the property passes to the designated charity. Charitable remainder trusts can provide tax benefits for the individual, while also supporting a charitable cause. Qualified personal residence trusts are a type of remainder interest that is specific to real estate. These trusts allow an individual to transfer ownership of their home to a designated recipient while retaining the right to use and enjoy the property during their lifetime. Qualified personal residence trusts can provide tax benefits for the individual, while also allowing them to pass on their home to their loved ones upon their death. Remainder interest can provide several tax benefits for individuals. By transferring ownership of property while retaining a life estate, individuals can avoid estate taxes on the property. This is because the property is not considered part of their estate when they pass away, but instead passes directly to the designated recipient. Additionally, charitable remainder trusts can provide tax benefits for individuals who transfer property to a charity, as the transfer can be considered a charitable donation. Remainder interest can also provide asset protection for individuals. By transferring ownership of property to a designated recipient, individuals can protect those assets from creditors and legal claims. This can be particularly useful for individuals who are at risk of lawsuits or who have significant debts. Remainder interest provides flexibility in estate planning by allowing individuals to transfer ownership of property while still retaining the right to use and enjoy it during their lifetime. This can be particularly useful for individuals who want to ensure that their loved ones are taken care of after they pass away, but who also want to maintain control over their assets during their lifetime. Remainder interest can be used in conjunction with other estate planning tools, such as trusts and wills, to create a comprehensive plan for the transfer of assets. One of the disadvantages of remainder interest is that it can result in a loss of control over the property. While individuals retain the right to use and enjoy the property during their lifetime, they must also consider the needs and desires of the designated recipient. This can be particularly challenging if the designated recipient is a family member or friend who has different ideas about how the property should be used. Remainder interest can also result in limitations on the use of property. For example, if an individual transfers ownership of a family home to their children, they may no longer be able to make changes to the property or use it as they see fit. Additionally, if the designated recipient is a charity, the individual may no longer be able to use the property for personal use during their lifetime. Remainder interest can be a complex estate planning tool, requiring careful consideration of tax implications, legal requirements, and the needs and desires of all parties involved. Individuals who are considering using remainder interest in their estate planning should consult with a qualified attorney and financial advisor to ensure that their wishes are properly documented and that all legal requirements are met. Remainder interest is an essential estate planning tool that allows individuals to transfer ownership of property while still retaining the right to use and enjoy the asset during their lifetime. Vested, contingent, and absolute remainder interest are different types of transfers that can provide clarity and flexibility in the transfer of assets. The advantages of remainder interest include tax benefits, asset protection, and flexibility in estate planning. However, there are also disadvantages such as the loss of control over the property, limitations on the use of the asset, and the complexity of the estate planning process. As the population ages and wealth becomes more concentrated, estate planning and the use of remainder interest are likely to become increasingly important. Thus, it is essential to seek the advice of a qualified attorney and financial advisor when considering using remainder interest in estate planning to ensure all legal requirements are met and wishes are properly documented.Definition of Remainder Interest

The holder of the remainder interest has the right to the property after the death of the life estate holder, but they do not have any rights to use or occupy the property during the lifetime of the original owner. Importance of Remainder Interest in Estate Planning

Types of Remainder Interest

Vested Remainder Interest

Contingent Remainder Interest

Absolute Remainder Interest

Examples of Remainder Interest

Life Estate With Remainder Interest

Charitable Remainder Trusts

Qualified Personal Residence Trusts

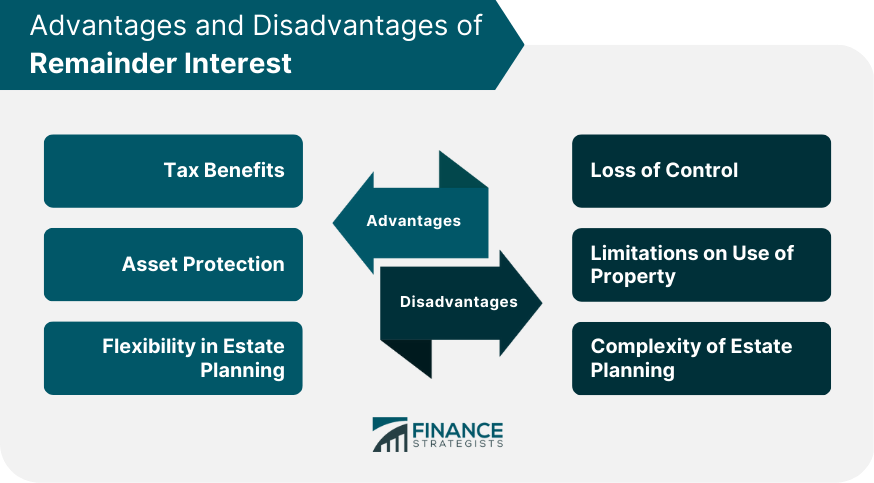

Advantages of Remainder Interest

Tax Benefits

Asset Protection

Flexibility in Estate Planning

Disadvantages of Remainder Interest

Loss of Control

Limitations on Use of Property

Complexity of Estate Planning

Final Thoughts

Life estate with remainder interest, charitable remainder trusts, and qualified personal residence trusts are examples of how remainder interest can be used in real-life situations.

Remainder Interest FAQs

Remainder interest refers to a property interest that remains with the original owner but will pass to a designated beneficiary upon the owner's death.

The two main types of remainder interest are vested remainder and contingent remainder.

An example of remainder interest is when a parent transfers ownership of a property to a child but retains a life estate in the property. Upon the parent's death, the child would become the owner of the property.

Some pros of remainder interest include the ability to transfer property outside of probate, potential tax benefits, and the ability to provide for loved ones after death.

Some cons of remainder interest include the potential for disputes among beneficiaries, limited control over the property during the owner's lifetime, and the possibility of the remainder interest being subject to creditors' claims.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.