What Is a Successor Trustee?

A successor trustee assumes the responsibility of trust management in the event of the initial or previous trustee's death, incapacitation, or retirement from the role.

The detailed obligations and responsibilities of a successor trustee depend on the directions set by the trust's creator, called the grantor.

The trust document will outline this information for the successor trustee to follow.

The role of a successor trustee is very relevant when establishing a revocable living trust. In this kind of trust, the grantor typically serves as the initial trustee until their death or incapacitation, but a successor trustee will ultimately be required.

Duties of a Successor Trustee

A successor trustee's role is crucial in ensuring that the trust agreement is followed and the grantor's wishes are fulfilled even after death. Here are some of the typical duties involved in this role:

- Notify the Beneficiaries: Often, the beginning of the successor trustee's role is preceded by the death or incapacitation of the grantor.

Thus, their first duty is to notify all the trust beneficiaries and provide them with a copy of the trust agreement. - Appraise the Value of Assets: The successor trustee must accurately evaluate the current value of the trust's assets so that beneficiaries can receive their due share.

- Identify and Settle Tax Liabilities: The successor trustee must identify any of the trust's tax liabilities and ensure that these are paid. This includes filing all necessary forms, such as those related to estate taxes and income taxes.

- Secure Trust Administration Funds: The successor trustee is also responsible for ensuring that the trust has enough funds to cover any costs related to trust administration.

- Collect Insurance Policies: In some cases, the grantor may have left behind life insurance policies that the successor trustee must collect. These assets may include death benefits and social security.

- Decide How to Invest Assets: The successor trustee must also determine how best to invest the trust assets to maximize the value of the trust for its beneficiaries.

- Monitor Investments: To protect the trust, the successor trustee must regularly monitor the investments and make necessary changes.

This is to protect the trust's assets and ensure that it can provide for the beneficiaries as planned by the grantor. - Distribute Assets to Beneficiaries: After the grantor's death, the successor trustee must distribute funds or assets to beneficiaries according to the grantor's wishes.

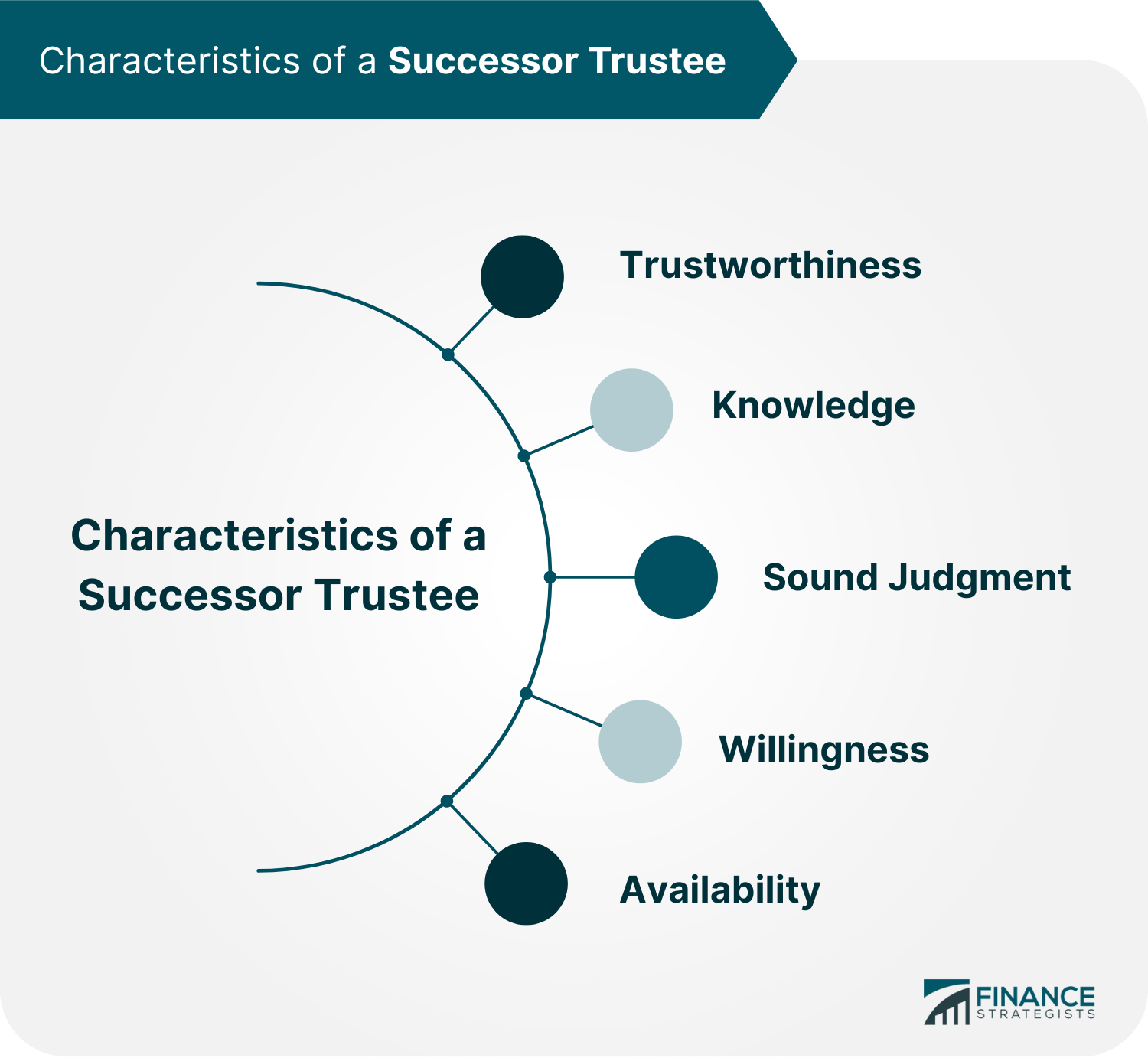

Characteristics of a Successor Trustee

When selecting a successor trustee, it is essential to consider if potential candidates possess the following characteristics:

- Trustworthiness: Successor trustees must be people who can be trusted to handle the trust's assets with integrity and honesty. They should faithfully execute the terms of the trust with the beneficiaries' welfare in mind.

- Knowledge: Managing a trust's assets may require decision-making about various financial situations. Thus, it is helpful for a successor trustee to have experience in areas such as investment, real estate, and taxation.

- Sound Judgment: Successor trustees must make responsible decisions to protect the trust assets. They should also be able to balance the best interests of the beneficiaries and remain neutral if there are disputes.

- Willingness: The best successor trustees are willing to assume the obligations of being a trustee. The chosen individual must be satisfied with the terms of the trust agreement and have no conflicts with their duties.

- Availability: A successor trustee should be easily accessible and readily available to make decisions promptly. This includes responding quickly to inquiries and allotting enough time to attend to the trust's affairs.

How to Choose a Successor Trustee

Almost anybody can serve as a successor trustee, including family members, acquaintances, trust beneficiaries, attorneys, and organizations.

Selecting a single trustee or numerous individuals to act as co-trustees is also possible.

Having a single individual serve as successor trustee helps prevent any disputes between co-trustees during trust management.

It is typical practice in estate planning to appoint one trustee at a time for this reason.

On the other hand, having successor co-trustees may guarantee a system of checks and balances that protects the trust from potential authority abuses.

With this in mind, a grantor may also choose two or more trustworthy individuals as successor co-trustees.

For example, they could designate a professional trustee service to manage trust investments or accounting and tax information.

Then another trustee, such as a family member or close friend, could be assigned to handle the distribution of assets and other related responsibilities.

Whether a grantor chooses one or more successor trustees, it remains crucial for them to select someone who comprehends what the work requires and is comfortable executing it.

Appointment of a Successor Trustee

When grantors create a trust, they must assign a successor trustee who will take over if something happens to the initial trustee.

If the initial trustee dies, is incapacitated, or otherwise retires from the role, the successor trustee will take over and follow the instructions in the trust document.

A grantor must invite potential successor trustees to take on the role, discuss the expectations involved and allow candidates to accept or decline the offer.

Once the successor trustee accepts the position, the grantor can begin filing all legal documents related to the trust.

In the case of a revocable living trust, grantors often assign themselves as the initial trustees. Thus successor trustees usually begin their role with the death or incapacitation of the grantor,

Once a successor trustee steps into their role, they should examine the trust document for specific instructions and prepare other documents that support their authority.

Then, they must notify the other people involved in the trust, such as co-trustees, attorneys, and beneficiaries.

It is also crucial for the successor trustee to inform the Internal Revenue Service (IRS) of the change in trustee by filing Form 56.

Finally, banks, investment firms, and other financial institutions related to the trust should also be informed about the change of trusteeship.

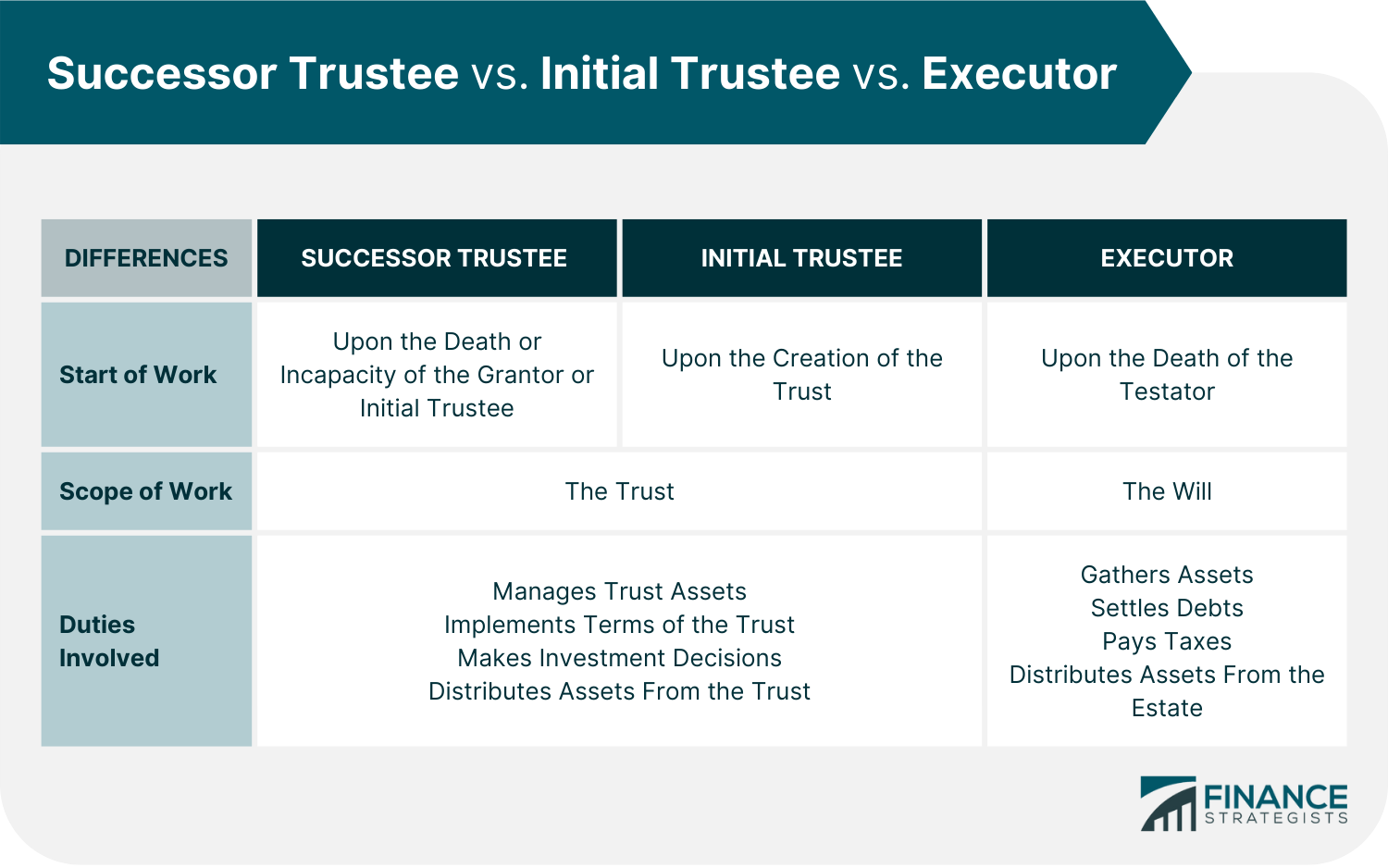

Successor Trustee vs. Initial Trustee vs. Executor

There can be some confusion about the roles of a successor trustee, an initial trustee, and an executor.

An initial trustee is assigned upon the creation of the trust. As in the case of revocable living trusts, grantors often assign themselves to the initial trustee role.

Initial trustees are responsible for managing the trust's assets according to the instructions in the trust document. They make decisions about investments, distributions, and other activities related to the trust.

If the grantor or the initial trustee dies, is incapacitated, or otherwise retired from the role, the successor trustee takes over and continues to manage the trust according to the grantor's wishes.

The initial trustee and the successor trustee are appointed by the grantor when they create the trust. In contrast, an executor is appointed by the creator of a will, also known as a testator.

An executor's primary role is to manage a testator's estate upon death. This involves duties such as gathering assets, settling debts, paying taxes, and distributing the estate's assets according to the terms of the will.

Final Thoughts

A successor trustee is an individual authorized to assume the trustee position if the initial trustee cannot do so due to death or incapacity.

A successor trustee's duties include notifying the beneficiaries, appraising asset values, settling tax liabilities, making investment decisions, and distributing assets to beneficiaries.

Trustworthiness, knowledge, ability to make sound judgments, willingness to take on the role, and availability are preferable characteristics for a successor trustee.

The successor trustee may be family members, close friends, or organizations. They can be a single individual or multiple individuals serving as co-trustees.

Whether a grantor chooses one or more successor trustees, it remains crucial for them to choose someone who will respect the trust's provisions and the grantor's intentions.

It is also vital to select someone dependable and capable of carrying out their duties.

Making decisions related to trusts is a big responsibility, and selecting someone with the right qualifications is essential.

Thus, individuals contemplating the creation of a trust may approach a financial advisor to support them through the process.

Successor Trustee FAQs

If the trust document does not specify a replacement or successor trustee, a court must choose someone to serve in that capacity.

A successor trustee can be named for an irrevocable trust. They will have the same duties and responsibilities as in any other type of trust, such as managing assets and representing the beneficiaries' best interests.

Anyone above 18 and of sound mind can be a successor trustee. The grantor can appoint an organization, such as a bank, to serve as the trustee. Adult children, relatives, and close friends may also become successor trustees.

A successor trustee is responsible for managing the trust assets according to the trust document, making distributions to beneficiaries, settling debts, and paying taxes. They must also act in good faith and respect the trust's provisions.

Successor trustees are appointed by the grantor when they create the trust. The grantor can specify in the document who will become the initial trustee and who will be the successor trustee. A court may appoint someone as a successor trustee if one is not designated.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.