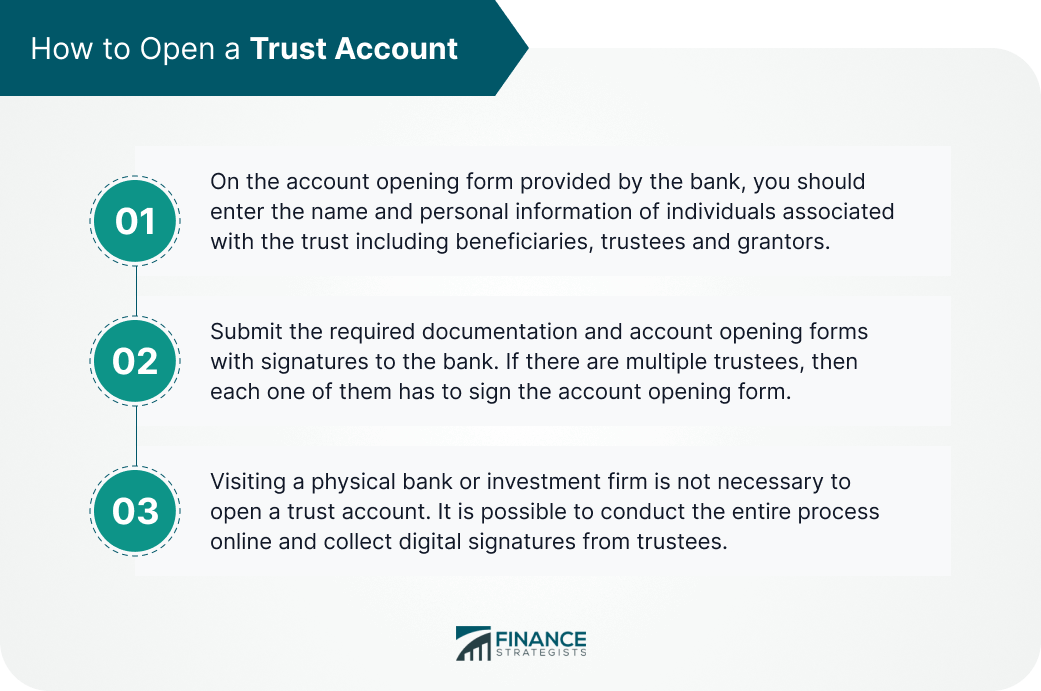

Trust accounts are estate planning tools that hold funds for beneficiaries. A trust account can also refer to escrow accounts used to pay off loans, such as home mortgages and insurance. Trust accounts distribute income and pay taxes for estate planning. They may also be FDIC-insured, provided they meet certain criteria specified by the Federal Deposit Insurance Corporation (FDIC). The trust account is a repository of all the assets contained in a trust. Therefore, it can hold various types of assets including money, property, artwork, and cryptocurrencies. When a trust makes a distribution or pays taxes, the amount for such transactions comes from the trust account. The operations of trust accounts are managed by trustees who have substantial discretionary power on the funds held in the account. For example, trustees can create subsidiary accounts to manage expenses from the trust or they can designate co-account holders responsible for managing transactions related to the account. The characteristics of trust accounts differ based on the type of trust. For example, revocable trusts or living trust accounts can be amended or dissolved. Their trust accounts, therefore, have fewer restrictions on operations as compared to irrevocable trusts, which cannot be changed after creation. Setting up a trust account is the final step in the creation of a trust. The requirements to open a trust account differ between banks but the general process remains the same. All documentation required to open a trust account must be notarized. You need the following documents to open a trust account: It consists of the following steps: On the account opening form provided by the bank, you should enter the name and personal information of individuals associated with the trust including beneficiaries, trustees and grantors. Submit the required documentation and account opening forms with signatures to the bank. If there are multiple trustees, then each one of them has to sign the account opening form. It is possible to conduct the entire process online and collect digital signatures from trustees. A trust account is closed after the trust has been executed, meaning the contents of the trust have been distributed per the grantor’s wishes and all debts, including tax liabilities, have been paid. The process to close a trust account is similar to the one to set it up. You must produce identification to verify your identity and provide proof that the trust’s contents have been distributed. Follow the closure process as defined by the bank. The Federal Deposit Insurance Corporation (FDIC) insures a certain portion of funds held in trust accounts. All revocable trust accounts owned by the same person at the same bank are added together and the owner is insured up to $250,000 per beneficiary. For an irrevocable trust to be valid for FDIC insurance, the beneficiaries must have non-contingent interests i.e., they must not meet certain criteria to be eligible for the trust’s contents. In such cases, each beneficiary’s non-contingent interests are insured for up to $250,000 by the FDIC.Basics of Trust Accounts

How to Open a Trust Account

How to Close a Trust Account

Trust Accounts and Insurance

How to Open and Close a Trust Account FAQs

Trust accounts are estate planning tools that hold funds for beneficiaries. A trust account can also refer to escrow accounts used to pay off loans, such as home mortgages and insurance. Trust accounts distribute income and pay taxes for estate planning.

The Federal Deposit Insurance Corporation (FDIC) insures a certain portion of funds held in trust accounts. All revocable trust accounts owned by the same person at the same bank are added together and the owner is insured up to $250,000 per beneficiary.

The documents required to open a trust account include two forms of identification attesting to your identity and an original trust agreement with details regarding the trust, including name, legal address, tax ID, and beneficiaries.

Trust accounts are managed by trustees who have substantial discretionary power on the funds held in the account. For example, trustees can create subsidiary accounts to manage expenses from the trust or they can designate co-account holders responsible for managing transactions related to the account.

The process to close a trust account is similar to the one to set it up. You must produce identification to verify your identity and provide proof that the trust’s contents have been distributed. Follow the closure process as defined by the bank.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.