A trust fund is a financial account in which assets are held for the benefit of another person or organization usually for the purpose of providing financial support for a family member, funding a charitable organization, managing an inheritance, providing for an aging parent's care, or saving for retirement. Trust funds are often used to provide financial security for children or other dependents. They may be funded with cash, real property, insurance, stocks, and other assets. The person who manages the trust fund is known as the trustee.

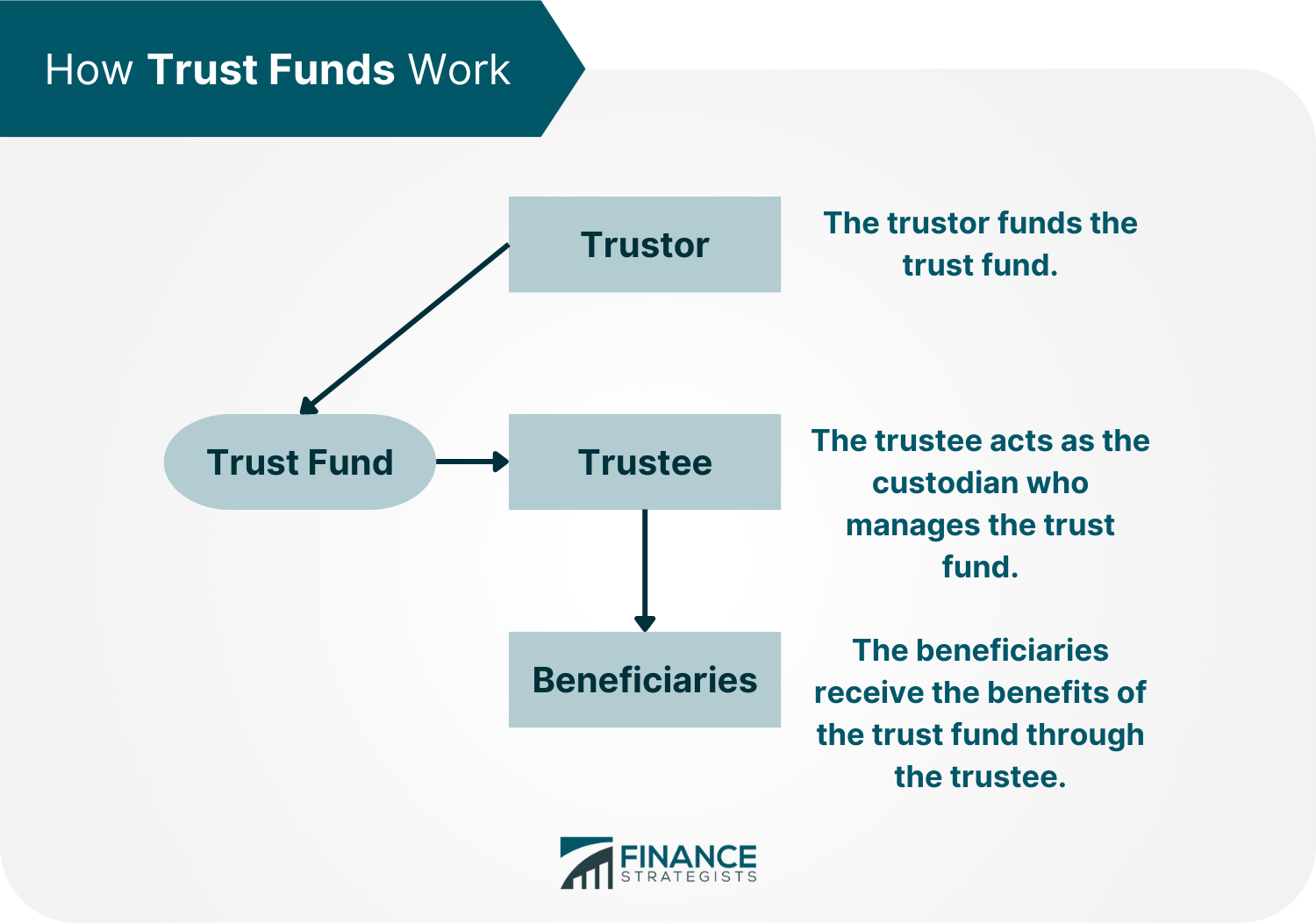

A trust is a fiduciary relationship in which one person (the trustee) holds legal title to the assets (the trust property) of the original owner (the trustor) for the benefit of another person (the beneficiary). A trust fund is a financial account in which the assets of a trustor are held with the trustee as the custodian, for the benefit of a designated beneficiary. The trustor, often called grantor, is the owner of the assets and the person who establishes the trust fund. The trustor transfers ownership of assets to be held by the trustee. The trustee, typically a trust company, a lawyer, or the trustor’s friend or family, is responsible for managing the trust fund and ensuring that the beneficiary receives the benefits of the trust according to the stipulations set forth in the trust agreement. The beneficiary, an individual or organization, receives the benefits of the trust fund. The trustee must act in the best interests of the beneficiary and ensure that the trust fund is used for its intended purpose. A trust agreement outlines who the trustor, trustee, and beneficiaries are. It also details how the assets in the trust will be managed and other important information about the trust fund. Trust funds can be categorized as either revocable or irrevocable. It is important to know the difference because it will determine how the assets in the trust are managed and whether or not the trustor can make changes to them. A revocable trust fund is one in which the trustor has the ability to change or revoke the terms of the trust at any time. This means that the trustee can be removed and replaced, assets can be added or subtracted from the trust, the beneficiary can be changed, and other stipulations may be amended as the trustor sees fit. The advantage of a revocable trust is that it gives the trustor a great deal of flexibility. If the circumstances change, the terms of the trust can be modified to reflect those changes. The disadvantage of a revocable trust is that it does not provide the same level of asset protection as an irrevocable trust. Revocable trusts are also subject to estate taxes, whereas irrevocable trusts are not. Irrevocable trusts are unchangeable and permanent once they have been established. The trustor surrenders all ownership and control of the assets in the trust to the trustee. The trustee is left to manage the assets in the trust according to the terms of the trust agreement. Irrevocable trusts are common in estate planning purposes because they can offer tax advantages and asset protection. Trust funds come in different types and in order to choose the best type of trust fund for your needs, it is important to understand them and how they work. An asset protection trust is an irrevocable trust that is used to protect assets from creditors. The transfer of the assets into the trust is permanent and will be fully managed by the trustee. By removing the trustor's ownership of the assets, creditors will not be able to reach them. A charitable trust fund is established to financially support a charitable organization and its programs. The trustee of a charitable trust fund is responsible for ensuring that the funds are used for the benefit of the charity. Charitable trust funds are a popular way to donate money to charities because they offer tax benefits to the donor. A tax deduction is granted to the donor for the value of the assets donated to the trust fund. An effective way to transfer assets from the trustor to their grandchildren is through a generation-skipping trust. Skipping the trustor's children or the next generation allows trustors to avoid estate taxes. The beneficiary can be the trustor’s grandchildren or anyone who is at least 37.5 years younger than the trustor and must not be a spouse or ex-spouse. A spendthrift trust is created to protect the assets of the beneficiary from being wasted or squandered. This is a popular way to protect the assets of children or young adults who are not responsible with their money. The trustee ensures that the funds are used for things like education, housing, or other essentials. Blind trusts are frequently established when people desire to avoid conflicts of interest. The trustor grants full control of the trust to the trustee. The trustee has complete authority over the assets and investments and takes responsibility for its management and profitability. The trustor has the ability to revoke the trust, but otherwise has no power over the movements in the trust and receives no reports from the trustees. A typical example is for politicians who want to avoid conflicts of interest between their personal agendas and the welfare of the people they serve. A testamentary trust is a particular type of trust incorporated in a person's last will and testament. This specifies when assets will be distributed to the identified beneficiaries. This trust takes its effect after the trustor's death. Setting up a trust fund provides many benefits. Let us take a closer look at each of these benefits. Trust funds provide a convenient way of managing assets and can be used for a variety of purposes. Trusts provide an opportunity to customize an estate plan with specific details. The trustor may include conditions like age attainment provisions or certain parameters on how the assets should be used. Trust funds allow assets to be transferred outside of the probate process, where the court decides what happens to the person's money and property. This saves time and money for the beneficiary. Avoiding probate can also help to keep the details of your estate private. Trust funds provide personal and financial privacy for the trustor and the beneficiaries. The details of the trust are not accessible to the public and are not subject to disclosure. This can be beneficial for people who want to keep their affairs private. Trust funds prevent conservatorship, a procedure when a court appoints someone to manage the affairs of another person who is unable to do so. A trust fund can be used to ensure that the beneficiary has the funds they need to live without the need for a conservator. Trust funds offer many benefits, but they also have some drawbacks. Below are possible disadvantages of setting up a trust fund. Setting up a trust fund typically involves additional paperwork. The trustor is responsible for creating the trust document, which includes the terms and conditions of the trust. The trustee must also sign the document and agree to comply with the terms. This can be a time-consuming process, but it is important to make sure all the details are in order. A disadvantage of trust funds is their complex nature. There are many different types of trusts, and it can be difficult to understand how they work. Detailed and accurate written records are required which requires the expertise of a professional. There are expenses involved with setting up and maintaining a trust fund. These costs can include legal fees, accounting fees, and trustee fees. There are also taxes and filing fees associated with trusts. On average, it would cost $1500 to $2500 to draft a trust but this will largely depend on the complexity of the trust and in what state you are in. In some cases, these costs can outweigh the benefits of the trust fund. Establishing a trust fund can be complicated, but there are a number of steps to consider to ensure it is set up correctly. Choose the type of trust fund and consider the purpose it will serve. There are many different types of trust funds, so it is important to choose the one that best suits your needs. This includes specifying the type of trust, designating the trustee who will manage, and specifying who the beneficiary is. It is important to establish the conditions under which the trustee can distribute assets to the beneficiary. The assets that will be held in the trust should be clearly listed and any restrictions on their use should be identified and how the funds can be accessed should be detailed. After setting up the trust fund, the trustor needs to formalize it by creating a trust agreement. The terms and conditions of the trust are outlined in this document, including the name of the trustee, the purpose of the trust, and how and when the assets can be distributed to the beneficiary. The trust agreement should be signed and dated by all parties involved. Bring your trust documents to a financial institution or a bank. Create a trust fund bank account in the trust's name. Supply the trustees' names and contact details. You can choose to make a full payment or deposit into the trust in terms. Eventually, the trust fund takes over ownership of the assets. After your trust fund is established, you need to register it for taxes. Every trust fund will most likely require its own taxpayer identification number (TIN) for tax returns and financial accounts. This can easily be filed online on the IRS website, but if you prefer printouts, you can download and submit Form SS-4 by mail. There are a few alternatives to trust funds that can provide similar benefits. Exploring them before deciding if a trust fund is the right option for you is important. A TOD (transfer-on-death) or POD (payable-on-death) account is a type of bank account that allows the owner to transfer funds to a designated beneficiary after their death. TOD accounts are concerned with stocks, brokerage accounts, or bonds distribution to the beneficiary while a POD account is used when handling a person’s bank assets in cash and not their securities to the beneficiary. A 529 plan is another option to consider if you are looking for a way to save for your child's education. This type of plan is offered through state governments. There are no income restrictions on contributors and contributions are tax deductible. The money in a 529 plan can be used to pay for qualifying educational expenses at any accredited college or US university. Setting up a joint account with someone is a very easy way to share assets. The two parties involved simply need to open an account at a bank or credit union and designate themselves as co-owners. This arrangement gives both parties access to the funds in the account and allows them to make transactions together. In the event that one signer dies, the surviving account holder can proceed with using the account and its content without any disruption. A trust fund is a legal and financial account that holds assets for a designated beneficiary. Trust funds can be used for a variety of purposes and come in different types. Trust funds provide a convenient way of controlling assets, avoiding probates and conservatorship, thereby maintaining privacy. However, it requires certain fees and detailed paperwork. Setting up a trust fund involves choosing a trustee, establishing the terms of the trust, identifying the beneficiaries, funding the account, and registering it. There are alternatives to trust funds, and exploring options before deciding if a trust fund is right for you is important. What Is a Trust Fund?

The person or organization that owns the assets is known as the trustor, while the person or organization that benefits from the trust is known as the beneficiary. How Do Trust Funds Work?

Categories of Trust Funds

Revocable Trust Fund

Irrevocable Trust Fund

Most Common Types of Trust Funds

Asset Protection Trust

Charitable Trust Fund

Generation-Skipping Trust

Spendthrift Trust

Blind Trust Fund

Testamentary Trust

Benefits of a Trust Fund

Control Over Management of Assets

Avoidance of Probate

Personal and Financial Privacy

Prevent Conservatorship

Drawbacks of a Trust Fund

Additional Paperwork

Complex Structure

Costly

How to Set Up a Trust Fund

Choosing the Right Trust Type

Detailing the Contents of the Trust

Formalizing the Trust

Funding the Trust

Registering With the IRS

Alternatives to a Trust Fund

Using a TOD or POD

Getting a 529 Plan

Setting Up Joint Accounts

The Bottom Line

Trust Fund FAQs

A trust fund baby is someone who is born into a family that has set up a trust fund specifically to provide for their needs. This can be a very advantageous way to provide for a child's future, as it ensures that they will have a cushion of money to fall back on throughout their life. There are many different ways to set up a trust fund, and it is important to consult with an expert to make sure that you are taking advantage of all the benefits that are available.

A trust fund is certainly a great way to provide for someone's future. One thing to keep in mind is that trust funds can be very complex. Benefits include privacy, flexibility in how the funds can be used, and convenience of administration. But they might deal with a lot of paperwork and can be expensive.

Consulting an expert is the first step to determining if establishing a trust fund is the right option for you. Once you have decided to move forward, the next steps would be to choose a trustee, identify beneficiaries, establish the terms of the trust, and fund the trust. You will also need to register the trust with the IRS and comply with any state laws that apply.

A trust is a legal agreement that enables you to transfer assets, such as cash or property, to another person or entity. A trust fund, on the other hand, is a type of financial account that allows you to save money for a specific purpose.

Some pros of trust funds include the fact that they offer privacy, and flexibility in how the money can be used. However, some cons to consider include the potential for high fees and the complexity of the paperwork involved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.