Trust administration refers to the management and oversight of trust by a trustee, ensuring the terms are executed according to the trust document. This process involves managing assets, making distributions, and fulfilling legal and tax obligations. Effective trust administration is crucial for preserving assets and ensuring beneficiaries receive what is intended for them. Proper administration ensures the trustor's wishes are respected, reduces the risk of disputes, and complies with legal and tax requirements. There are various types of trusts, such as special needs, living, testamentary, revocable, and irrevocable trusts. Each type serves a specific purpose and has unique administration requirements, depending on the goals and circumstances of the trustor. The trustor, also known as the grantor or settlor, is the person who establishes the trust. They create the trust document, determine the trust's purpose, and transfer assets to the trust. The trustee is the individual or entity responsible for managing the trust according to the trust document. They have a fiduciary duty to act in the best interests of the beneficiaries while carrying out the trustor's wishes. A beneficiary is a person or entity who benefits from the trust. They receive income, assets, or other distributions as specified in the trust document, based on the trustor's intentions. A trust protector is an optional party who oversees the trustee's actions and may have the power to remove or replace the trustee. This role provides an additional layer of protection for the trustor's interests and ensures proper trust administration. A trust attorney is a legal professional who provides guidance to the trustee and other parties involved in trust administration. They ensure compliance with trust laws, help resolve disputes, and advise on tax and other legal matters. The first step in trust administration is for the trustee to review the trust document thoroughly. This helps the trustee understand the trustor's wishes, the trust's terms, and their responsibilities as the trustee. The trustee must gather necessary documents, such as deeds, bank statements, and insurance policies, and take control of the trust's assets. This ensures a comprehensive understanding of the trust's property and resources for proper management. The trustee must notify beneficiaries and other interested parties about the trust's existence, their rights, and any pertinent information. This step ensures transparency and keeps relevant parties informed of the trust's status. The trustee is responsible for managing the trust's assets prudently, including investment decisions and property maintenance. This ensures the preservation and growth of the trust's assets for the benefit of the beneficiaries. Trustees must maintain accurate and detailed records of the trust's financial transactions, asset values, and distributions. Proper recordkeeping is crucial for fulfilling tax obligations, providing transparency, and demonstrating the trustee's fiduciary duty. Trustees must file necessary federal and state tax returns and pay taxes owed by the trust. Timely and accurate tax filings help avoid penalties, ensure compliance with tax laws, and protect the trust's assets. The trustee must make distributions to beneficiaries according to the trust document's terms. This may include periodic income payments, disbursements for specific purposes, or lump sum distributions upon certain conditions. Trustees must maintain open communication with beneficiaries and other interested parties, keeping them informed of the trust's progress, decisions, and any changes. This helps foster trust, avoid misunderstandings, and ensure the trustor's wishes are carried out effectively. Upon the trust's termination, the trustee is responsible for distributing the remaining assets to the beneficiaries according to the trust document. This final distribution ensures that the trustor's intentions are fulfilled and the trust's purpose is met. Before closing the trust, the trustee must file any required final tax returns and pay outstanding taxes. This ensures the trust's compliance with tax laws and avoids any potential penalties or legal issues. Once all assets are distributed, and tax obligations are met, the trustee formally closes the trust. This process may involve filing the necessary paperwork and providing a final accounting to beneficiaries and interested parties. Trust administration is governed by a combination of federal and state laws that dictate the formation, operation, and termination of trusts. Trustees must ensure compliance with these laws to avoid legal disputes and protect the trust's assets. Trusts have unique tax implications, including federal and state income taxes, estate taxes, and gift taxes. Trustees must understand and address these tax issues to ensure proper tax planning and compliance. Trustees have fiduciary responsibilities to act in the best interest of the beneficiaries, manage trust assets prudently, and follow the trust document's terms. Fulfilling these duties is essential for effective trust administration and avoiding legal disputes. Disputes and litigation may arise during trust administration due to disagreements, mismanagement, or breach of fiduciary duties. Trustees and other parties may need to engage in mediation, arbitration, or court proceedings to resolve these issues. Maintaining transparency and open communication with beneficiaries and other interested parties is essential for building trust and avoiding misunderstandings. This involves sharing relevant information, providing updates, and addressing concerns. Trustees should seek professional advice and assistance from trust attorneys, accountants, and financial advisors to navigate complex legal, tax, and investment issues. This ensures proper trust administration and compliance with applicable laws. Trustees must manage the trust's assets prudently, including making sound investment decisions and ensuring proper asset maintenance. This helps preserve and grow the trust's assets for the benefit of the beneficiaries. Maintaining accurate and detailed records of the trust's financial transactions, asset values, and distributions is essential for demonstrating fiduciary duty, fulfilling tax obligations, and providing transparency. Proper documentation also supports effective decision-making and future planning. Trustees should regularly review and update the trust's terms, assets, and administration processes to ensure ongoing effectiveness and compliance with changing laws and circumstances. This helps maintain the trust's relevance and alignment with the trustor's intentions. Conflicts of interest may arise when the trustee's personal interests conflict with their fiduciary responsibilities. This can lead to mismanagement, disputes, or breaches of trust, and must be addressed to protect the trust and its beneficiaries. Mismanagement or negligence by the trustee can harm the trust's assets, result in legal disputes, and undermine the trustor's intentions. Proper oversight, adherence to best practices, and professional assistance can help mitigate these risks. Disputes among beneficiaries or interested parties can arise due to disagreements over asset distribution, trust management, or interpretation of the trust document. Effective communication, mediation, and legal assistance can help resolve these conflicts and maintain the trust's integrity. The legal and tax landscape surrounding trusts is subject to change due to new legislation, court rulings, and tax regulations. Trustees must stay informed of these changes and adapt the trust administration accordingly to ensure ongoing compliance and effectiveness. Trust administration is the management and oversight of a trust, which includes managing assets, making distributions, and fulfilling legal and tax obligations. Effective trust administration is crucial for fulfilling the trustor's wishes, preserving assets, and ensuring beneficiaries receive their intended benefits. Proper administration also helps avoid disputes, reduce risks, and comply with legal and tax requirements. The quality of trust administration directly impacts beneficiaries and the trust's overall objectives. Competent administration ensures the trustor's intentions are carried out, beneficiaries' needs are met, and trust assets are protected and grown over time. Trust administration requires ongoing monitoring and adjustments to adapt to changing circumstances, laws, and regulations. Regular reviews and updates help maintain the trust's relevance, effectiveness, and alignment with the trustor's intentions. To ensure proper trust administration, consider seeking the guidance of an experienced estate planning lawyer. They can provide valuable advice, help navigate complex legal issues, and ensure the trust is managed in the best interests of beneficiaries and the trustor.What Is Trust Administration?

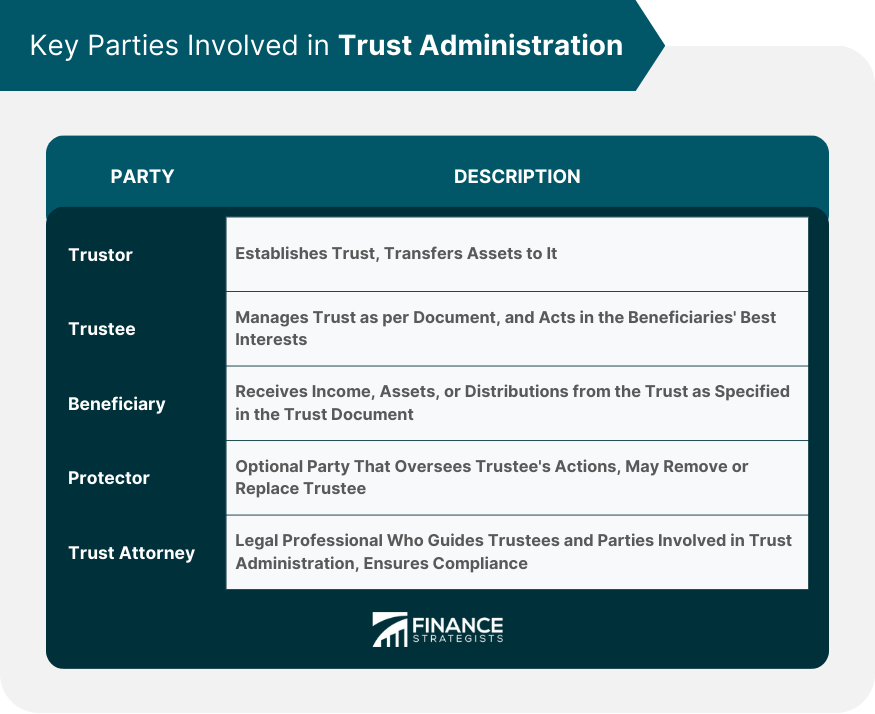

Key Parties Involved in Trust Administration

Trustor (Grantor/Settlor)

Trustee

Beneficiary

Protector (Optional)

Trust Attorney

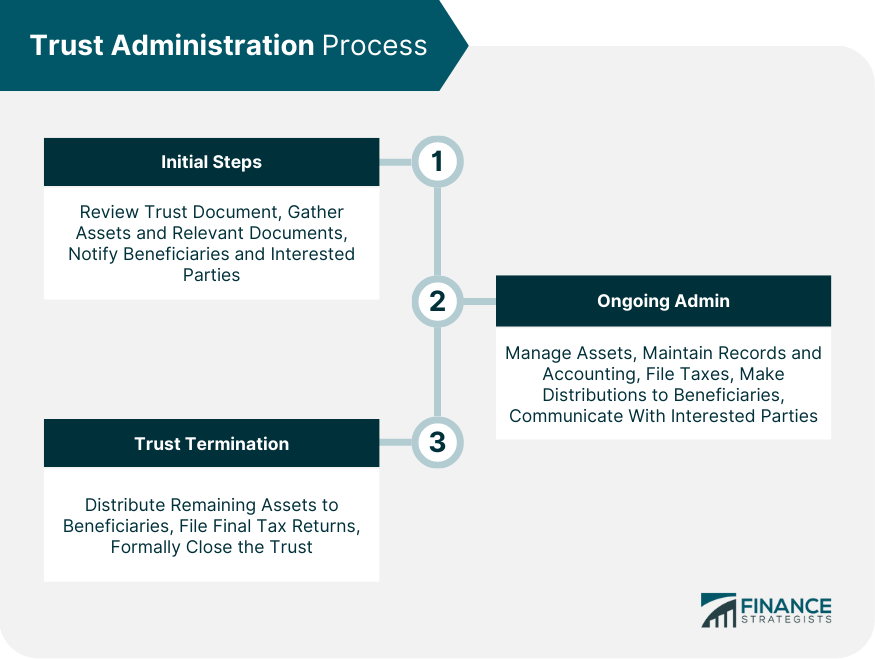

Trust Administration Process

Initial Steps

Reviewing the Trust Document

Gathering Relevant Documents and Assets

Notification of Beneficiaries and Interested Parties

Ongoing Administration

Asset Management

Recordkeeping and Accounting

Tax Reporting and Filing

Distributions to Beneficiaries

Communicating with Beneficiaries and Interested Parties

Trust Termination

Distribution of Remaining Assets

Final Tax Filings

Closing the Trust

Legal and Regulatory Framework of Trust Administration

Federal and State Trust Laws

Tax Implications

Fiduciary Responsibilities

Dispute Resolution and Litigation

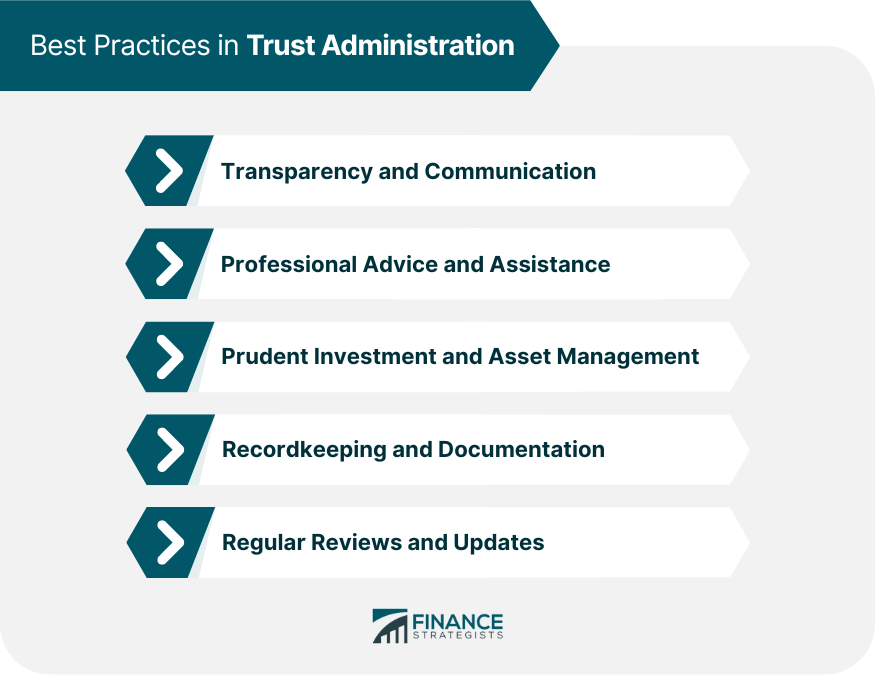

Best Practices in Trust Administration

Transparency and Communication

Professional Advice and Assistance

Prudent Investment and Asset Management

Recordkeeping and Documentation

Regular Reviews and Updates

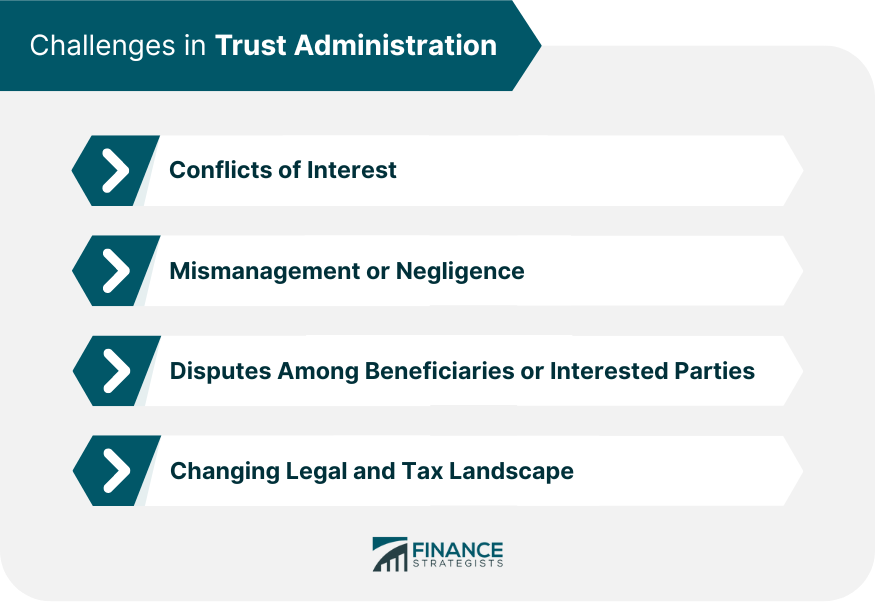

Challenges in Trust Administration

Conflicts of Interest

Mismanagement or Negligence

Disputes Among Beneficiaries or Interested Parties

Changing Legal and Tax Landscape

Final Thoughts

Trust Administration FAQs

Trust administration is the process of managing and overseeing a trust by a trustee, ensuring the terms are executed according to the trust document. It is important because it helps preserve assets, ensures beneficiaries receive their intended benefits, and complies with legal and tax requirements.

The key parties involved in trust administration include the trustor (grantor/settlor) who creates the trust, the trustee who manages the trust, the beneficiaries who receive benefits from the trust, an optional trust protector who oversees the trustee, and a trust attorney who provides legal guidance.

The trust administration process includes initial steps such as reviewing the trust document, gathering relevant documents and assets, and notifying beneficiaries and interested parties. Ongoing administration involves asset management, recordkeeping, tax reporting and filing, distributions to beneficiaries, and communication. Trust termination includes distributing remaining assets, filing final tax returns, and closing the trust.

Challenges that can arise during trust administration include conflicts of interest, mismanagement or negligence by the trustee, disputes among beneficiaries or interested parties, and adapting to a changing legal and tax landscape. Effective communication and professional assistance can help address these challenges.

Best practices for successful trust administration include maintaining transparency and open communication with beneficiaries and interested parties, seeking professional advice and assistance from trust attorneys and financial advisors, prudently managing investments and assets, maintaining accurate records and documentation, and regularly reviewing and updating the trust's terms and administration processes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.