Trust spendthrift provisions are clauses included in a trust document to protect a beneficiary's interest in the trust from their own financial mismanagement or from being seized by creditors. These provisions restrict the beneficiary's access to trust funds and control the distribution of assets. Spendthrift provisions are crucial in cases where beneficiaries may be financially irresponsible or vulnerable to creditors. They provide a layer of protection for trust assets, ensuring that the funds are used according to the settlor's intentions and for the intended purpose. Trust spendthrift provisions are designed to safeguard trust assets by preventing beneficiaries from squandering their inheritance or having their share of the trust seized by creditors. They are particularly useful when a beneficiary has a history of poor financial management or is facing significant debt or legal judgments. When a trust includes a spendthrift provision, the trustee is given the authority to control and manage the distribution of trust assets to the beneficiary. This means the beneficiary cannot access the trust funds directly, and creditors cannot reach the funds, as long as they remain within the trust. The trustee may distribute assets according to the trust's terms or use discretion to determine the appropriate amount and timing of distributions, considering the beneficiary's needs and circumstances. Spendthrift provisions are not absolute, and there are some exceptions to the rule. For example, the trust may not protect assets from certain types of creditors, such as child support payments or federal tax liens. Additionally, a court may order the trustee to distribute trust assets to satisfy the beneficiary's debts or obligations in certain circumstances. In some cases, a trust may include a "support" provision, which requires the trustee to use the trust assets for the beneficiary's basic needs, such as food, clothing, and shelter. This provision may limit the trustee's discretion in distributing assets and may provide additional protection for the beneficiary from creditors. It's important to note that spendthrift provisions can have significant tax implications, particularly for irrevocable trusts. If the trust assets are not distributed to the beneficiary, they may be subject to higher tax rates and additional estate taxes upon the beneficiary's death. Spendthrift provisions protect beneficiaries from their own financial mismanagement or impulsive spending habits. By controlling the distribution of assets, the trustee can ensure that the beneficiary's needs are met, and the trust's funds are used responsibly. One of the main benefits of spendthrift provisions is their ability to shield trust assets from the reach of the beneficiary's creditors. Since the beneficiary cannot directly access the trust funds, creditors are unable to seize them to satisfy outstanding debts. Trust spendthrift provisions give the trustee the authority to control the distribution of trust assets. This allows the trustee to manage the trust according to the settlor's intentions and provide support to the beneficiary while minimizing the risk of financial mismanagement. The primary drawback of spendthrift provisions is the limitation they place on the beneficiary's access to trust assets. While this restriction is intended to protect the beneficiary and the trust, it may create difficulties if the beneficiary requires access to funds for legitimate reasons. Spendthrift provisions may result in increased administrative costs for the trust, as the trustee must closely monitor and manage the distribution of assets. This can lead to higher trustee fees or additional legal expenses. In some cases, spendthrift provisions may conflict with a beneficiary's lifestyle or personal values. For example, a beneficiary who values financial independence may resent the restrictions placed on their access to trust funds. By considering the important factors below when drafting spendthrift provisions, the settlor can create a trust that aligns with their intentions, provides for the beneficiary's well-being, and safeguards the trust assets appropriately. When drafting spendthrift provisions, it is crucial to consider the overall purpose of the trust. This involves aligning the provisions with the settlor's intentions for the trust and the type of support they wish to provide to the beneficiary. The provisions should reflect the trust's objectives and the settlor's desired outcomes. In creating spendthrift provisions, the settlor should carefully assess the specific needs of the beneficiary. Factors such as the beneficiary's age, financial situation, and potential future needs, such as education or healthcare expenses, should be taken into account. By tailoring the provisions to the beneficiary's circumstances, the trust can better serve its intended purpose. The level of creditor protection provided by the spendthrift provisions should be determined based on the beneficiary's financial situation and potential risks they may face. If the beneficiary has a history of debt or legal issues, the settlor may opt for stronger protections to shield the trust assets from potential creditors. Striking the right balance between protection and flexibility is crucial. While it is important to protect trust assets, it is equally important to provide flexibility for the beneficiary's changing needs. Spendthrift provisions should allow for some degree of discretion on the part of the trustee to adapt to evolving circumstances and meet the beneficiary's requirements. This flexibility ensures that the trust remains relevant and responsive to the beneficiary's changing circumstances over time. Trust spendthrift provisions are clauses in a trust document that protect a beneficiary's interest in the trust from their own financial mismanagement and creditors. They restrict access to trust funds and give the trustee control over asset distribution. The primary purpose of spendthrift provisions is to safeguard trust assets by preventing beneficiaries from squandering their inheritance or having it seized by creditors. Spendthrift provisions offer several advantages, such as protecting beneficiaries, shielding assets from creditors, and allowing control over distributions. However, they also have some drawbacks, including restrictions on the beneficiary's access to funds, increased administrative costs, and potential conflicts with the beneficiary's lifestyle. Given the complexities of trust law and the various factors to consider when drafting spendthrift provisions, it is crucial to consult with an experienced trust attorney. They can provide guidance on the best approach for your specific situation and ensure that the trust document is properly drafted to achieve your intended goals.What Are Trust Spendthrift Provisions?

How Trust Spendthrift Provisions Work

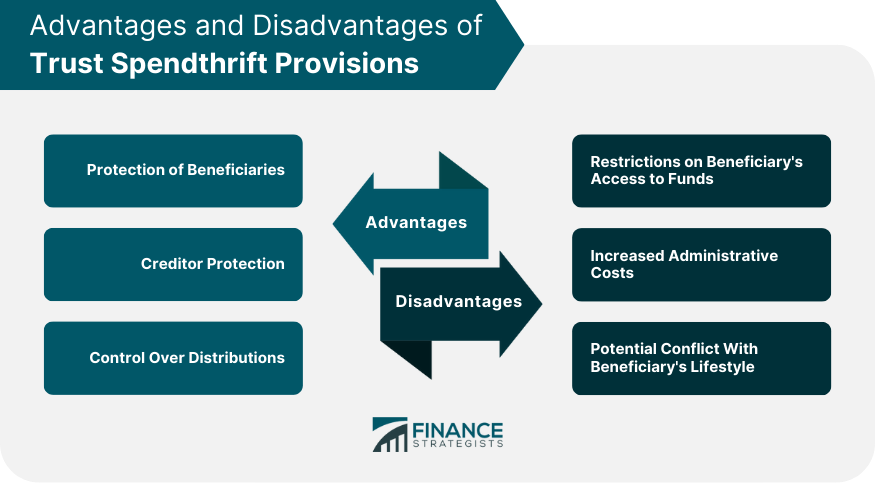

Advantages of Trust Spendthrift Provisions

Protection of Beneficiaries

Creditor Protection

Control Over Distributions

Disadvantages of Trust Spendthrift Provisions

Restrictions on Beneficiary’s Access to Funds

Increased Administrative Costs

Potential Conflict With Beneficiary’s Lifestyle

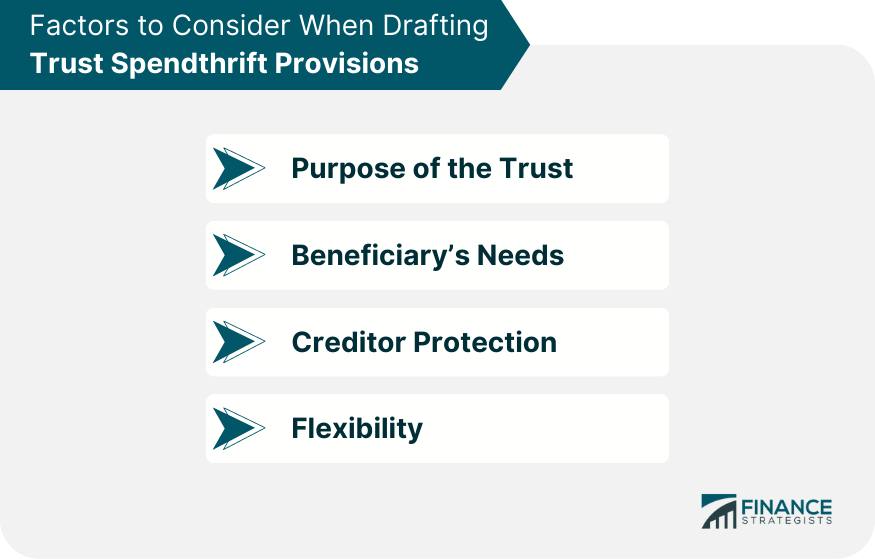

Factors to Consider When Drafting Trust Spendthrift Provisions

Purpose of the Trust

Beneficiary’s Needs

Creditor Protection

Flexibility

Bottom Line

Trust Spendthrift Provisions FAQs

Spendthrift provisions are clauses in a trust that restrict a beneficiary's ability to transfer their interest in the trust to creditors.

Spendthrift Provisions work by preventing creditors from reaching trust assets to satisfy a beneficiary's debts.

Spendthrift Provisions provide creditor protection for beneficiaries, allowing them to receive distributions from the trust without worrying about creditor collection.

Spendthrift Provisions can restrict a beneficiary's access to funds, resulting in increased administrative costs and potential conflicts with their lifestyle.

Individuals who want to protect their assets from potential creditors or want to ensure that their beneficiaries receive consistent income over time should consider using Spendthrift Provisions in their Trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.