A trust is a fiduciary relationship in which a grantor gives a trustee the authority to hold assets for the benefit of one or more beneficiaries. By law, trustees must disperse these assets following the grantor's instructions. Real estate, financial accounts, life insurance, annuity certificates, personal property, business interests, and other assets are frequently used to establish a trust. Trusts can be organized in various ways, defining how and when assets are transferred to beneficiaries. The grantor and trustee have a legal obligation to operate in the beneficiary's best interests. The beneficiary then receives any income generated by those assets, including the benefits provided by the trust.

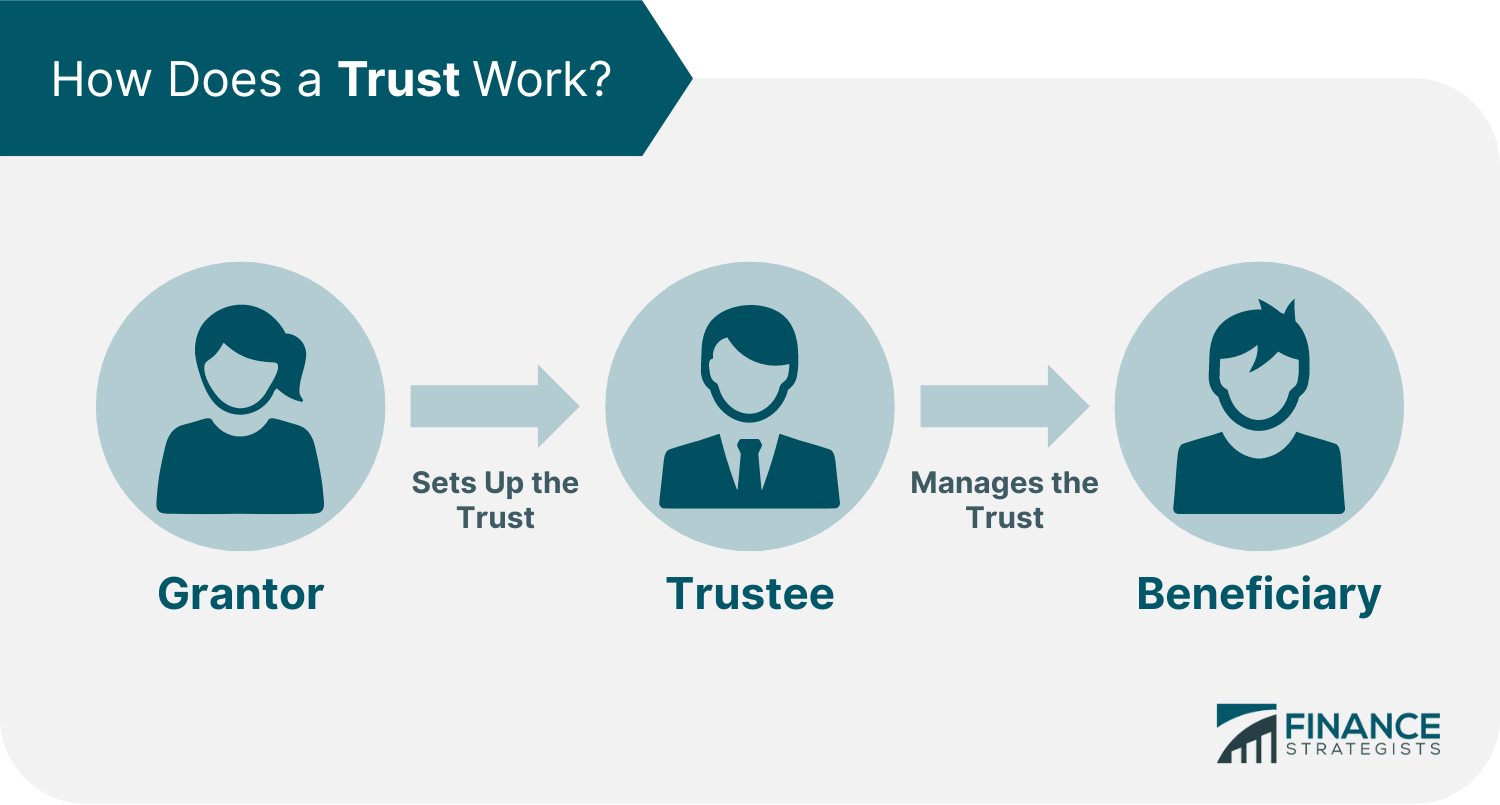

Trusts comprise three components: the grantor, the trustee, and the beneficiaries. The grantor is the individual or organization that sets up the trust. The grantor controls how their assets will be distributed and managed. The grantor's responsibilities are as follows: If the original trustee dies or cannot function, a successor trustee will assume their duties. In the case of a grantor trust, the grantor may serve as trustee. The trustee is the person or entity in charge of managing the trust. The grantor frequently appoints the trustee from among family members, friends, an attorney, an accountant, or a financial professional. It is vital to select someone you can rely on to manage the trust funds responsibly. Among the trustee's responsibilities are: The beneficiary is the individual or organization that benefits from the trust. They are entitled to income from the trust’s assets and other benefits such as health care coverage. There are two types of beneficiaries: All proceeds would automatically go to any named contingent beneficiary if the primary beneficiary passed away before the one who created the Will or held the insurance policy. Trusts are categorized into numerous types. The most common of which are revocable and irrevocable trusts. A revocable trust permits you to make adjustments anytime for as long as the grantor is mentally competent. Individuals who want to avoid probate and pass on their assets promptly and efficiently typically employ revocable trusts. An irrevocable trust is a more permanent arrangement that cannot be changed or revoked once it has been set up. An irrevocable trust protects assets from creditors, lawsuits, or taxes. High-net-worth individuals who want to ensure that their assets are passed on to a chosen beneficiary after death prefer this option. There are other types of trusts that offer unique benefits for different assets or beneficiaries. The grantor's objectives will determine the type of trust to choose. Some of the most popular types of trusts are as follows: Living trusts enable you to transfer assets into a trust throughout your lifetime and retain control until death. By then, the trustee will distribute the assets following your instructions. Suppose you have substantial real estate holdings or other property that may require an estate settlement process. In that case, this can be a practical approach to avoid probate after death. A testamentary trust is a form of trust established as part of a will. A grantor makes instructions in their will for a named executor outlining how their assets should be managed by a trustee and transferred to beneficiaries. Asset protection trusts are designed to protect a grantor’s assets from creditors and other parties entitled to claim against them. A-B trusts are also known as credit shelter trusts. Married couples commonly use these trusts to reduce their estate taxes and provide for both spouses after one of them passes away. Blind trusts are set up to conceal the grantor's assets and limit the grantor's involvement in their management. These trusts are frequently employed by politicians or public officials who wish to avoid the appearance of a conflict of interest. Credit shelter trusts are another name for bypass trusts. Married couples widely use these trusts to cut estate taxes and pay for both spouses if one dies. The IRS (Internal Revenue Service) permits married couples to avoid paying inheritance taxes by leaving their estates to each other. Charitable trusts are established to provide financial assistance to a specific charitable organization or cause. These trusts are intended to allow donors to provide money while still having some say over how it is spent. Generation-skipping trusts are designed to provide for grandchildren or other remote descendants without subjecting the assets to taxes. Insurance trusts are established to keep life insurance policies and ensure that the earnings flow straight to the trust's beneficiaries rather than becoming part of the estate. Marital trusts are intended to provide for a spouse following their partner's death. This trust transfers assets to the surviving spouse without subjecting them to federal estate taxes. The QTIP trust is established in various ways, the most common of which is when a spouse already has children from a prior marriage. In this situation, the grantor may wish to leave assets to their present spouse or partner while also providing for former family members. Special needs trusts are intended to safeguard the assets of people with disabilities. These trusts enable beneficiaries to obtain government benefits while retaining their inheritance or other assets. Spendthrift trusts are established to preserve the trust's assets from creditors and imprudent spending by trustees and beneficiaries. A Totten trust is a bank account opened by the depositor as trustee for a named beneficiary. A Totten trust can be canceled by: Trusts can primarily ensure that assets are competently managed and dispersed following the grantor's objectives throughout generations. The following benefits can help you decide whether to have them. A trust can be an excellent strategy to keep assets out of the reach of creditors. The property in the trust will not be subject to attachment by creditors, which means it cannot be seized by judgment holders or other third parties as payment for debts owed. In 2024, you can avoid estate tax altogether if the estate is below the $13,610,000 federal exemption ($13,990,000 in 2025) and if you do not live in the states that impose an estate tax. State-level exemptions are at least half the size of the federal exemption, with some as low as $1 million. When you place your assets in an irrevocable trust, they become the trust's property. The trust owns the assets and is not subject to estate taxes. You will maintain control of your assets since you can specify how they are dispersed and utilized. However, revocable trusts do not provide the same level of security. When it comes to estate planning, trusts provide much flexibility. They can be tailored to almost any situation and do not have to remain constant over time; you can modify a trust to achieve a specified goal. While assets governed by your will must be validated and dispersed following your preferences; trust assets typically need not. A will enters the public record. However, a trust arrangement remains private. When you create a trust during your lifetime, you only need to interact with your attorney and your trustee to see that the agreement is carried out. While probate is not always bad, it can be costly and time-consuming. This process can help ensure that families are timely in receiving the assets they are entitled to after someone passes away. The main disadvantages of trusts are their perceived irrevocability and the loss of authority over assets placed in trust. Trusts can be made revocable; however, this has a negative impact on taxation, estate duty, asset protection, and stamp duty. When considering the trust's terms, revocability should be explored. Aside from worries about control, there are also questions about the complexity and costs of establishing one. Setting up a trust is simple, but complex trusts will necessitate the assistance of an estate planning lawyer. A complex trust is the polar opposite of a simple trust. To be designated as a complex trust, it must engage in at least one of the following activities within the calendar year: The cost of a trust can vary greatly depending on various criteria. One crucial factor is where you live, as estate planning attorneys typically charge more in densely populated areas than in less densely populated areas. Lawyers with more experience or specialization will charge a higher fee. A large estate with several assets can raise your trust charges. Leaving assets to a corporation or establishing a charitable trust can also necessitate more planning and legal effort, which can increase the cost of the trust. Particular beneficiaries, such as those with disabilities or under the care of a legal guardian, may require more planning, and establishing a trust for them may be more costly. The cost of establishing a trust extends beyond preparing a trust agreement. Transferring asset ownership to the trust may need the payment of filing fees. It is essential to factor these costs into any estate planning decisions to ensure that the benefits of a trust outweigh its drawbacks. A trust is a fiduciary relationship in which a grantor gives a trustee the authority to hold assets for the benefit of one or more beneficiaries. The trustor creates the trust, the trustee manages the trust, and the beneficiaries receive the benefit of the trust. There are different types of trusts that can be used depending on the goals of the estate plan. The two common types of trusts are revocable and irrevocable. Some special types of trusts offer unique benefits for different kinds of assets or beneficiaries. The significant benefits of using a trust are creditor protection, help to avoid probate, and possibly reduced estate taxes. While there are many benefits to using a trust, it is essential to consider the cost and complexity associated with setting up and maintaining one before making any decisions. You may seek the help of an estate planning lawyer for trust options.What Is a Trust?

Components of Trusts

Grantor

Trustee

Beneficiary

Types of Trusts

Revocable Trusts

Irrevocable Trusts

Special Types of Trusts

Living Trusts

Testamentary Trusts

Asset Protection Trusts

A-B Trusts

Blind Trusts

Bypass Trusts or Credit Shelter Trusts

Charitable Trusts

Generation-Skipping Trusts

Insurance Trusts

Marital Trusts

Qualified Terminable Interest Property (QTIP) Trusts

Special Needs Trusts

Spendthrift Trusts

Totten Trusts

Benefits of a Trust

Creditor Protection

Estate Taxes Reduction

Flexibility

Probate Process Prevention

Drawbacks of a Trust

Complicated and Time-Consuming

Costs To Set Up and Maintain

Final Thoughts

Types of Trusts FAQs

The two most common types of trusts are revocable and irrevocable trusts. A revocable living trust allows the grantor to maintain control over their assets. In contrast, an irrevocable trust prevents any changes to the trust once it is established.

The disadvantages of a trust include complex and time-consuming processes for establishing and maintaining it. The costs associated with creating one can also be a concern. Furthermore, trusts must still go through the legal system to remain active.

Trusts can help to reduce or even eliminate estate taxes by transferring assets outside of an individual's estate. Families can preserve their wealth and pass more money to future generations without paying significant estate taxes.

The best person to manage a trust depends on several factors, such as the person's qualifications, experience, and trustworthiness. Generally, an estate planning lawyer or financial advisor is best suited to manage a trust's responsibilities.

The cost of setting up and maintaining a trust can vary significantly depending on the complexity of the trust and other factors. To get a cost estimate of a trust, you may speak with an attorney or financial advisor. There will be legal fees for creating the trust, filing paperwork with the court system, and ongoing administrative fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.