An asset protection trust is an irrevocable trust used to protect your assets from creditors, unjust lawsuits, and court decisions. Typically, they are funded with cash, real estate, commercial and recreational assets, and stocks. As an irrevocable trust, it cannot be modified or terminated. Once assets are moved into the trust, they belong to it and are no longer considered part of your estate. Asset protection removes the association between the owner and the assets and results in losing control over the use and distribution of the assets. The trustee, or person designated to manage the trust, has power over the trust's assets, and any modifications or distributions are at the trustee's discretion.

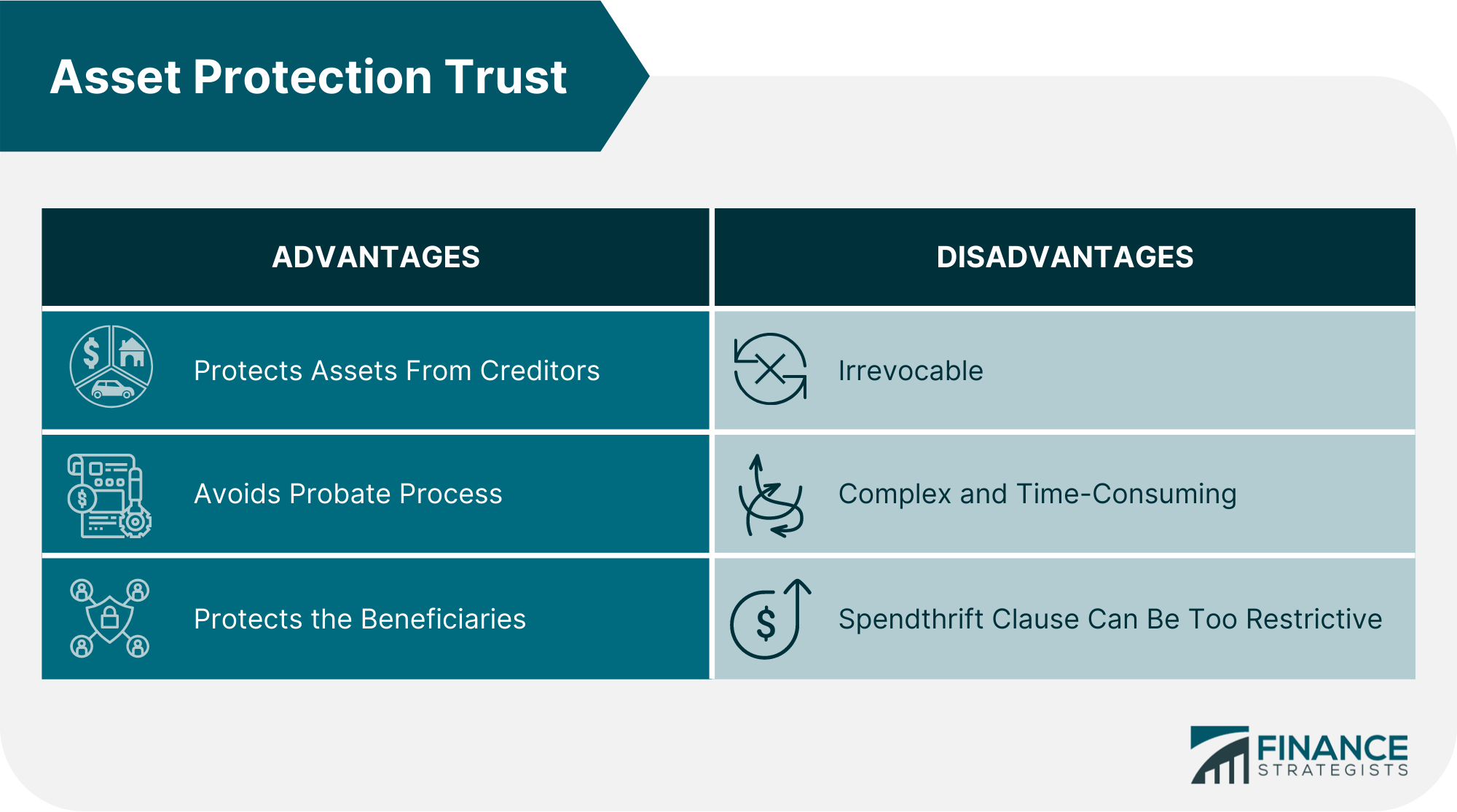

The goal of a properly established asset protection trust is to prevent creditors from accessing the trust's assets. It is a self-settled trust whose creator may be listed as a beneficiary. Asset protection trusts typically contain a spendthrift clause that can be both beneficial and disadvantageous. It is helpful because it can protect your estate from unwise spending habits. However, it also restricts the beneficiary's access to the trust principal. The beneficiary cannot access trust funds, and neither can the creditors. Similarly, it can also help you avoid probate. Including a trust in your estate plan can be an excellent way to safeguard your legacy and protect your family. The trust you use will affect how much protection is provided. Revocable living trusts are becoming increasingly popular but are not generally used for asset protection. There are three main types of asset protection trust that can safeguard your assets: Domestic asset protection trust can be critical if you have a lot of assets and huge liabilities. The primary rationale for establishing an asset protection trust is to shield your assets from creditors or individuals who may launch litigation to obtain immediate cash. Domestic asset protection trusts are only available in some states, but they are one of the simplest to set up in those that do. Non-domestic asset protection trust state courts may be hesitant to apply the laws of the domestic asset protection trust state in which a person has chosen to create their trust. Because of the conflict of laws, the domestic asset protection trust may be unenforceable and incapable of performing its primary function. The Full Faith and Credit Clause of the Constitution complicates matters even more by mandating that decisions made in one state be given full faith and credit in another. Domestic asset protection trusts are not created equal. Many state laws allow it to exempt some assets from creditor protection. Child support judgments, malpractice judgments, alimony, and certain taxes such as property or income are all excluded. The laws vary greatly from one state to the next in this regard. One disadvantage is that it is founded and retains your assets within the US legal system, making them less secure than a foreign trust. Domestic asset protection trusts are currently established in twenty states. A foreign asset protection trust, commonly known as an offshore trust, is established in a country other than where the grantor lives. Foreign asset protection trust is available in various jurisdictions, such as the Isle of Man, the Cayman Islands, and the Cook Islands. Most often, they are non-treaty nations meaning they do not enforce foreign judgments. It may give some protection and benefit to taxpayers even if their assets are not in that foreign jurisdiction. The most significant advantage of a foreign asset protection trust is that it can offer complete asset protection from all creditors, including those arising from bankruptcy. In a typical case, the foreign jurisdiction will require a person attempting to pursue enforcement against a foreign asset protection trust within their authority to jump through a series of difficulties. A creditor in the US may be able to fulfill the majority of the evidence standards to secure a civil judgment. But a foreign jurisdiction may require substantially more proof to counter the foreign asset protection trust. The procedures for bringing an action against a foreign asset protection trust vary depending on the jurisdiction in which it is established. They cost more to set up, but they offer better privacy, asset protection, and tax benefits, which makes them preferable. Even so, there are risks associated with it. A foreign trustee is required, and the trust is subject to foreign rules that change at any time. A Medicaid asset protection trust is intended to minimize or remove the inclusion of assets in your estate value. A large estate might significantly affect your eligibility for Medicaid. This specific asset protection trust permits a person to qualify for Medicaid benefits while shielding assets from depletion if long-term care is required. A household's assets must fall below a particular threshold to be eligible for Medicaid. The asset level rules are tight, and there is a five-year look-back period to determine eligibility. Medicaid will not penalize the donor for transferring assets if the trust is established and assets moved five years before the donor applies for Medicaid long-term care benefits. Medicaid asset protection trust make you eligible for Medicaid benefits while allowing you to continue living in your principal house and earning money from investments. Below are some of the advantages that you can get from setting up an asset protection trust: One of the primary advantages of asset protection trust is that they can protect assets from creditors and lawsuits. If you lose a court case, one filed by a creditor seeking to reclaim the money you owe—you could lose your home, car, and cash in your bank and savings accounts. Furthermore, a lawsuit can drain your bank account with legal bills, consume your time and energy, create worry, and tarnish your reputation. Starting early is essential for an effective asset protection strategy; the more time you have before a lawsuit, your assets will be safer. Asset protection trusts can also protect your assets for your family after your death by bypassing the probate process. You might save thousands of dollars in legal fees and avoid the typically time-consuming probate process. The appointed trustees can distribute the assets to beneficiaries immediately or be left within the trust for management. If you want to ensure that the money is utilized for a specific purpose after your death, then it can serve so. Assets held in the asset protection trust are not included in your beneficiaries' taxable estate. Assets inherited by your son or daughter will not be taxed upon death, possibly saving your grandchildren tens of thousands of pounds in inheritance tax. Your grandkids will inherit from your trust, not their parents' estate. The following are some disadvantages that you should be mindful of before deciding to set one up: An asset protection trust is irrevocable, meaning you cannot change or cancel it once it is set up. This can be a disadvantage if your circumstances change and you need to access the assets in the trust. You will need to work with an attorney to draft the trust documents and ensure that everything is appropriately set up. While it can help protect from unwise spending, spendthrift clauses can be overly restrictive, making it more difficult to access the funds in the trust. Without specific stipulations, a beneficiary may be unable to do anything with the assets in the trust. Wealth managers and estate planning attorneys understand how to set up an asset protection trust to benefit your goals, save you money on taxes, and limit potential hazards. There are two basic steps to setting up one: The trust document will specify the terms of the trust, along with the trustees, beneficiaries, and assets being placed in the trust. Describe how the trustee should manage the assets in the trust to be managed on behalf of your beneficiaries. You can fund your asset protection trust with cash, securities, intellectual property, real estate, and other assets. There are tax consequences to funding a trust, so be sure to discuss them with your estate planning lawyer. An asset protection trust is an irrevocable trust used to protect your assets from creditors and lawsuits. The idea behind the concept is to break the connection between you and your trust so that if you are sued, creditors can not take your property. But this also means that you as the owner lose control over how the assets are used and only the beneficiaries of the trust can access them. The advantages of asset protection trusts include their ability to protect assets from creditors and lawsuits. They can avoid the probate process and protect beneficiaries Asset protection trusts have spendthrift clauses and are extremely difficult to change once set up. Also, they are complex, costly and time-consuming to set up. For someone who is sure that asset protection trust is the right choice for them, they must create the trust documents with a lawyer and then fund the trust depending on the asset that they want to put into it. Asset protection trusts are a complex financial tool and, as such, require the assistance of qualified financial professionals.What Is an Asset Protection Trust?

How Asset Protection Trust Works

Types of Asset Protection Trust

Domestic Asset Protection Trust

Foreign Asset Protection Trust

Medicaid Asset Protection Trust

Advantages of Asset Protection TrustProtects Assets From Creditors and Lawsuits

Avoids Probate Process

Protects the Beneficiaries

Disadvantages of Asset Protection Trust

Irrevocable

Complex and Time-Consuming to Set Up

Spendthrift Clause Can Be Too Restrictive

How to Establish an Asset Protection Trust

Step 1: Create the Trust Document

Step 2: Fund the Trust

Final Thoughts

Asset Protection Trust FAQs

Legal fees could be anywhere from $2,000 to $4,000 for a simple domestic plan. Trusts that are more complicated could cost up to $5,000. An offshore asset protection trust could cost anywhere between $20,000 and $50,000. Also, administration and asset management fees are usually between $2,000 and $5,000 per year, plus about 1% of the value of the assets.

The different types of asset protection trust are domestic asset protection trust, foreign asset protection trust, and Medicaid asset protection trust.

Anyone who wants to protect their assets from future lawsuits, judgments, or creditors can benefit from an asset protection trust. If your goal is to protect your assets more securely than some other types of estate plans can allow, you might want to look into an asset protection trust.

An asset protection trust can help protect your assets from creditors, and lawsuits. It can also help you avoid probate and protect your beneficiaries. It can also secure Medicaid benefits.

You will need to work with an attorney to draft the trust document. This document will list the terms of the trust, such as who will benefit from it, who will be in charge of it, and what assets will be put into it. Then fund the trust and specify how the trustee will manage the assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.