A Crummey trust is a type of irrevocable trust that allows the donor to transfer assets to the trust while also taking advantage of the annual gift tax exclusion. The trust is named after Clifford Crummey, who won a landmark tax case that established the legitimacy of this type of trust. One key element distinguishing a Crummey trust from other types of trusts is the power of withdrawal granted to the trust beneficiaries. Specifically, beneficiaries are given the right to withdraw the gifted assets for a limited period of time. This power of withdrawal is critical because it makes the gifted assets eligible for the annual gift tax exclusion. The purpose of a Crummey trust is to enable the donor to make tax-free gifts to beneficiaries while ensuring that the gifted assets remain under the donor's control. The trust is often used as part of an estate planning strategy to reduce the donor's taxable estate while also providing a means of transferring wealth to future generations. Ultimately, a Crummy trust can be used to support beneficiaries while reducing taxable estate and providing controlled wealth transfer alternatives to future generations, and at the same time protecting assets from claims. The key feature of a Crummey trust is the power of withdrawal given to the beneficiaries. This power allows beneficiaries to withdraw the assets gifted to the trust for a limited period. This withdrawal power is the key to minimizing or avoiding gift taxes when gifting. It makes the gifted assets eligible for the annual gift tax exclusion. The donor must inform the beneficiaries of their right to withdraw the gifted assets within a specified period, usually 30 days from the date of the gift. This notice is known as the Crummey notice and must be provided in writing to the beneficiaries. Once the withdrawal period expires, the assets become part of the trust's permanent assets, and the beneficiaries no longer have the power to withdraw them. The assets in the trust are then managed by a trustee, who is typically appointed by the donor. The trustee has the responsibility to manage the assets in the trust according to the terms of the trust agreement and to distribute the assets to the beneficiaries as directed by the donor. The Crummey trust is commonly used in estate planning to transfer wealth to future generations while minimizing the impact of gift and estate taxes. It provides a tax-efficient means of transferring assets to beneficiaries while retaining control over the assets. By using a Crummey trust, a donor can make tax-free gifts to beneficiaries, reduce their taxable estate, and control and dictate how the assets are distributed and protected from creditors or other claims. The Crummey trust was first created in 1962 by Clifford Crummey. The idea behind the trust was to provide a way for parents to give money to their children as gifts without incurring gift taxes. Prior to the establishment of Crummey trusts, parents could only give their children up to a certain amount without being taxed, and any gifts over that amount were subject to gift tax. The Internal Revenue Service (IRS) initially attempted to deny Crummey the annual gift tax exclusion, claiming that the trust did not meet the provision of the gift tax exclusion. In 1968, the courts ultimately ruled in favor of the Crummey family, validating the use of this type of trust for making lifetime gifts to children while safeguarding against gift taxes. The trust allowed parents to transfer assets to their children while still retaining control over how and when the assets were used. Additionally, the Crummey trust could be structured in a way that would protect the gifted assets from creditors or other claims. Over time, Crummey trusts became popular with people beyond just parents who wanted to gift money to minors. Today, Crummey trusts are used by individuals and families as a means of estate planning and transferring wealth to future generations in a tax-efficient manner. Crummey trusts offer the following benefits: When a donor contributes money to a Crummey trust, the beneficiary has a set window of time in which they can withdraw assets, giving them a present interest in the financial gifts included in the trust. This feature allows the donor to minimize gift taxes or avoid them entirely when giving money to minor children or any other beneficiary. By taking advantage of the annual gift tax exclusion, donors can transfer wealth to their beneficiaries while reducing the size of their taxable estate. Another advantage of a Crummey trust is the control that it gives the donor over the distribution of assets to their beneficiaries. The donor can dictate how and when the assets are distributed, providing an opportunity to transfer wealth to future generations in a controlled manner. Additionally, a Crummey trust can be used to fund college expenses for the beneficiary. By setting up the trust in such a way that it is only accessible to the beneficiary once they have reached a certain age, parents can ensure that the funds will be used for their intended purpose. When considering a Crummey trust for estate planning purposes, it is important to be aware of its potential drawbacks: High administrative costs can be a drawback of a Crummey trust due to the need to send annual notices to beneficiaries. This process can be time-consuming and expensive, especially if there are many beneficiaries or multiple trusts. Also, hiring a trustee can add to the administrative costs of the trust on top of the cost of establishing and maintaining the trust, which can include legal fees for creating the trust. If the beneficiary withdraws the assets from the trust during the withdrawal period, the trust loses its tax benefits. The trustee must also keep track of the withdrawal period and ensure that the beneficiary is notified of their right to withdraw funds from the trust. The trustee may put specific provisions in place to discourage the beneficiary from withdrawing the assets prematurely. For example, the trust may stipulate that if the beneficiary withdraws during the withdrawal period, no further contributions will be made to the trust. A Crummey trust is a type of irrevocable trust that provides a tax-efficient means of transferring assets to beneficiaries while also retaining control over those assets. It offers the power of withdrawal granted to beneficiaries and the use of the annual gift tax exclusion. This type of trust can be a useful tool for estate planning and transferring wealth to future generations. It operates by granting beneficiaries the power of withdrawal over gifted assets for a limited time period, making the assets eligible for the annual gift tax exclusion. This type can be a good choice for individuals who want to make financial gifts to their children or other beneficiaries while minimizing gift taxes. It can also be a valuable tool for college planning and transferring wealth to future generations. However, it is important to consult with a financial advisor or estate planning attorney to determine if a Crummey trust is the right choice based on an individual's specific financial situation and estate planning goals. This helps to avoid the complexity and potential drawbacks of a Crummey trust, which include high administrative costs and potential beneficiary withdrawal risk. The estate planning attorney can provide guidance and explain the trust details.What Is a Crummey Trust?

How Crummey Trust Works

History of the Crummey Trust

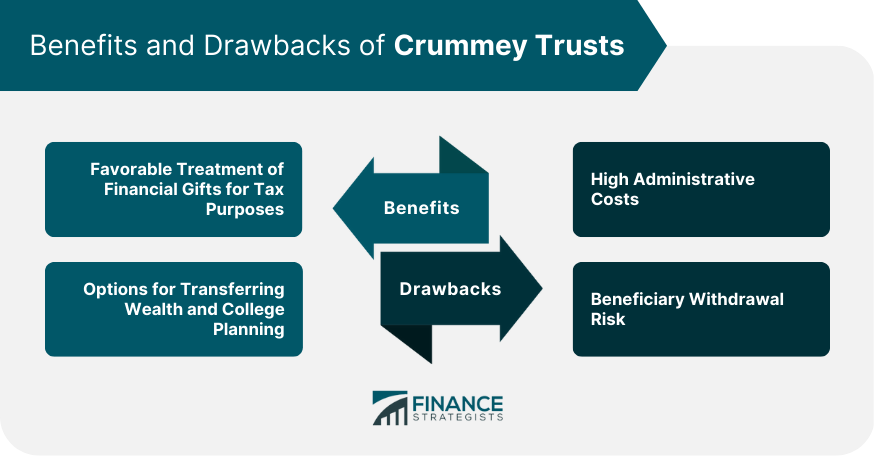

Benefits of Crummey Trusts

Favorable Treatment of Financial Gifts for Tax Purposes

Options for Transferring Wealth and College Planning

Drawbacks of the Crummey Trust

High Administrative Costs

Beneficiary Withdrawal Risk

Final Thoughts

Crummey Trust FAQs

The purpose of a Crummey trust is to provide a way for individuals to make tax-free gifts to their beneficiaries while still retaining some control over the gifted assets. It is a type of trust that allows the donor to take advantage of the annual gift tax exclusion without having to immediately give the funds outright to the beneficiary.

Crummey trusts are subject to certain tax rules. While contributions to the trust are not tax-deductible, they are eligible for the annual gift tax exclusion. The trust itself is subject to income taxes on any income that it generates.

A Crummey trust offers several benefits for asset transfer while reducing taxes. It enables annual gift tax exclusion, permitting tax-efficient wealth transfer over time. Grantors can maintain control over the gifted assets, specify usage, and remove assets from their taxable estate for tax savings. Additionally, beneficiaries can withdraw funds from the trust during a specific period, providing financial flexibility and security.

The potential disadvantages of a Crummey trust include high administrative costs and the risk of the beneficiary withdrawing funds during the withdrawal period. The administrative costs associated with setting up and maintaining a Crummey trust can be substantial, particularly if a third-party trustee is used. There is also a risk that the beneficiary may withdraw funds during the withdrawal period, which could negate any gift tax exclusion benefits that the grantor might have enjoyed by leaving the assets in the trust.

A Crummey trust can have multiple beneficiaries. However, the terms of the trust would need to specify how the gifted assets would be distributed among the beneficiaries and how the withdrawal period would apply to each beneficiary. It is important to note that adding additional beneficiaries to the trust can increase the administrative complexity and potentially impact the tax benefits of the trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.