Directed trusts are a specialized form of trust arrangement that provides greater flexibility and control to trust beneficiaries. Unlike traditional trusts, where the trustee has complete discretion and authority over trust assets, directed trusts allow the beneficiaries to play a more active role in the administration and management of the trust. In a directed trust, the trustee's responsibilities are divided into two distinct roles: the administrative trustee and the directing trustee. The administrative trustee is responsible for the traditional fiduciary duties, such as record-keeping, tax filings, and distribution of trust assets. The directing trustee, on the other hand, takes instructions from the beneficiaries or other designated parties regarding the investment decisions and other aspects of trust administration. Directed trusts are particularly popular in situations where trust assets are diverse or complex, such as when the trust holds various types of investments, real estate properties, or business interests. By allowing beneficiaries to direct the trustee's actions within predefined boundaries, directed trusts facilitate a more tailored approach to managing trust assets. 1. Trustor/Settlor/Grantor: The individual who establishes and funds the trust. 2. Trustee: The person or institution responsible for managing the trust assets according to the terms of the trust. 3. Trust Protector: An individual or entity appointed to oversee the trust and ensure that the trustee and other parties are acting in the best interests of the beneficiaries. 4. Beneficiary: The person or persons who are intended to benefit from the trust assets. Directed trusts offer several benefits over traditional trust arrangements, making them an attractive option for many individuals and families. Directed trusts allow the trustor to appoint an investment advisor who is responsible for managing the trust's assets. This enables the trustor to select an advisor with specific expertise in a particular asset class or investment strategy. Directed trusts can provide increased asset protection from creditors, divorce settlements, and other potential liabilities. By separating the management of trust assets from the distribution of assets to beneficiaries, directed trusts can create an additional layer of protection. Directed trusts enable trustors to delegate specific decision-making powers to different parties, such as investment management to an investment advisor and distribution decisions to a distribution advisor. This allows for more targeted and efficient decision-making within the trust. Directed trusts can be an effective tool for tax planning, as they can be established in jurisdictions with favorable trust laws and tax regulations. Directed trusts can provide greater privacy and confidentiality for trustees and beneficiaries, as trust documents and assets can be kept private and out of public records. There are several types of directed trusts, each with different roles and responsibilities for the parties involved. In an administrative directed trust, the trustee is responsible for the administrative functions of the trust, such as record-keeping and tax filings, while the trust protector or other party retains control over investment and distribution decisions. In an investment directed trust, the trustee delegates investment management responsibilities to an investment advisor, who is responsible for managing the trust's assets according to the trust's investment strategy. In a distribution directed trust, the trustee delegates the power to make distribution decisions to a distribution advisor, who is responsible for determining when and how trust assets should be distributed to beneficiaries. Hybrid directed trusts combine elements of administrative, investment, and distribution directed trusts. This type of trust allows for the greatest level of flexibility in decision-making and asset management. The different parties involved in a directed trust each have specific roles and responsibilities. The trustee has a fiduciary duty to act in the best interests of the trust beneficiaries and to follow the terms of the trust document. The trustee is responsible for the administrative functions of the trust, including record-keeping, tax filings, and ensuring compliance with legal and regulatory requirements. The trust protector oversees the activities of the trustee, investment advisor, and distribution advisor to ensure they are acting in the best interests of the beneficiaries and in accordance with the trust document. The trust protector may have the authority to remove and replace trustees or advisors, resolve disputes, and approve or veto trust actions. The investment advisor is responsible for managing the trust's assets according to the investment strategy outlined in the trust document. The investment advisor should develop and implement investment strategies that align with the trust's objectives and risk tolerance. The distribution advisor is responsible for making decisions regarding the distribution of trust assets to beneficiaries. The distribution advisor should consider the needs of the beneficiaries, as well as the trust's overall objectives when making distribution decisions. Creating a directed trust involves several steps, including selecting the appropriate jurisdiction, drafting the trust document, choosing the right trustee and trust protector, and funding the trust. Choosing the right jurisdiction for a directed trust is important, as trust laws and tax regulations can vary significantly between jurisdictions. Trustors should consider factors such as asset protection, tax benefits, and the reputation of the jurisdiction when making this decision. The trust document should clearly outline the purpose of the trust, the roles and responsibilities of the trustee, trust protector, investment advisor, and distribution advisor, and any specific instructions regarding investment management and distributions. Selecting a trustworthy and experienced trustee and trust protector is crucial for the successful administration of a directed trust. Trustors should carefully consider the qualifications, experience, and reputation of potential candidates. Once the trust document has been drafted and the parties have been selected, the trustor must fund the trust with assets. This can include cash, investments, real estate, or other types of assets. Directed trusts can present certain challenges and risks, including potential conflicts of interest, liability concerns, regulatory and compliance issues, and complexities in trust administration. Conflicts of interest can arise when the interests of the trustee, trust protector, investment advisor, or distribution advisor conflict with the best interests of the trust beneficiaries. Directed trusts can create liability concerns for the trustee and other parties, particularly if they fail to fulfill their fiduciary duties or act in the best interests of the beneficiaries. Directed trusts must adhere to all applicable trust laws and regulations, which can vary by jurisdiction. Failure to comply with these requirements can result in legal and financial consequences for the trust and its parties. The administration of a directed trust can be complex, particularly when multiple parties are involved in decision-making and asset management. This complexity can create challenges in trust administration and increase the potential for disputes and litigation. Directed trusts offer a flexible and innovative approach to estate planning and asset management. By dividing roles and responsibilities among different parties, trustors can create a tailored investment strategy, enhance asset protection, and maintain greater control over trust decisions. However, it is important to be aware of the potential challenges and risks associated with directed trusts, including conflicts of interest, liability concerns, and regulatory and compliance issues. When considering the use of directed trusts, it is essential to carefully select the appropriate jurisdiction, draft a clear and detailed trust document, and choose experienced and trustworthy parties to serve as trustees, trust protectors, and advisors. As directed trusts continue to evolve, trustors and practitioners should stay informed about future trends and developments in this area to maximize the benefits and minimize the risks associated with this powerful estate planning tool.Definition of Directed Trusts

Key Parties Involved in Directed Trusts

Purpose and Advantages of Directed Trusts

Tailored Investment Management

Enhanced Asset Protection

Flexibility in Decision-Making

Efficient Tax Planning

Privacy and Confidentiality

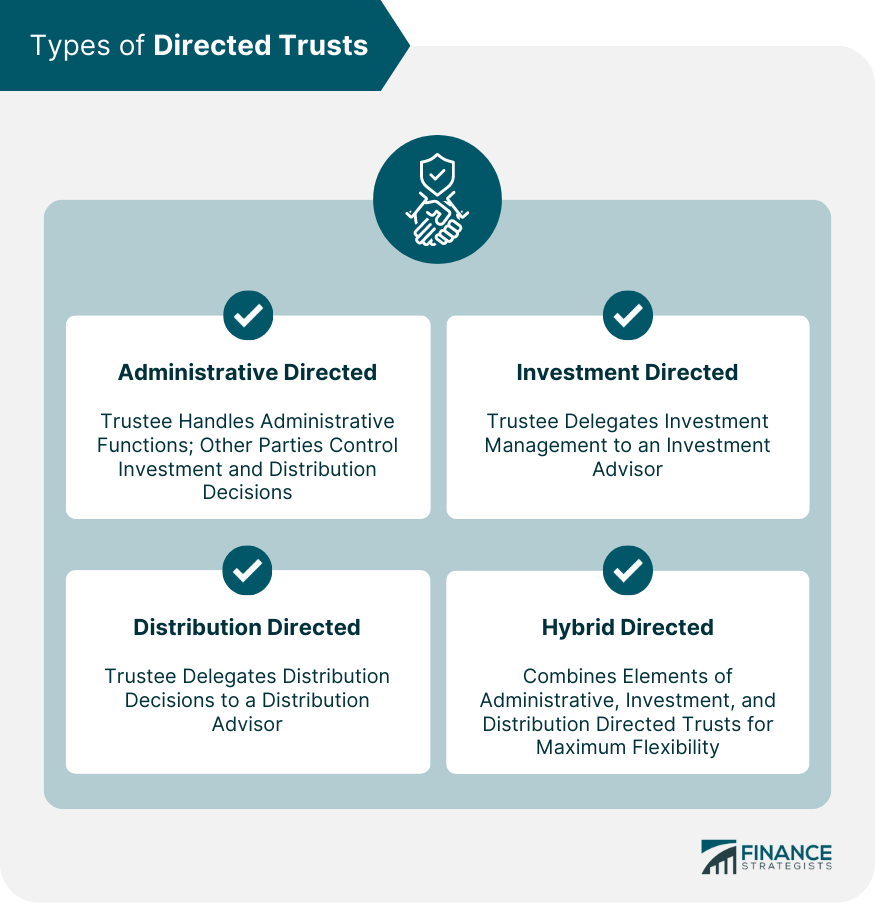

Types of Directed Trusts

Administrative Directed Trusts

Investment Directed Trusts

Distribution Directed Trusts

Hybrid Directed Trusts

Roles and Responsibilities in Directed Trusts

Trustee

Fiduciary Duties

Administrative Functions

Trust Protector

Role in Overseeing Trust Activities

Powers and Responsibilities

Investment Advisor

Asset Management

Investment Strategies

Distribution Advisor

Discretionary Distributions

Assessing Beneficiary Needs

Establishing a Directed Trust

Selecting the Appropriate Jurisdiction

Drafting the Trust Document

Choosing the Right Trustee and Trust Protector

Funding the Trust

Challenges and Risks of Directed Trusts

Potential Conflicts of Interest

Liability Concerns

Regulatory and Compliance Issues

Complexities in Trust Administration

Conclusion

Directed Trusts FAQs

Directed trusts are a type of legal arrangement in which the powers and responsibilities are divided among different parties, such as the trustee, trust protector, and investment or distribution advisors. This division allows for tailored investment management, enhanced asset protection, and greater flexibility in decision-making compared to traditional trusts.

Directed trusts offer several advantages, including tailored investment management, enhanced asset protection, flexibility in decision-making, efficient tax planning, and privacy and confidentiality for trustors and beneficiaries.

There are four main types of directed trusts: administrative directed trusts, investment directed trusts, distribution directed trusts, and hybrid directed trusts. Each type has distinct roles and responsibilities for the trustee, trust protector, investment advisor, and distribution advisor, allowing for varying levels of control and flexibility in trust management.

The key roles in directed trusts include the trustee, trust protector, investment advisor, and distribution advisor. The trustee is responsible for the trust's administrative functions and has a fiduciary duty to act in the best interests of the beneficiaries. The trust protector oversees the actions of the other parties to ensure they follow the trust's terms. The investment advisor manages the trust's assets, while the distribution advisor makes decisions regarding asset distribution to beneficiaries.

When establishing directed trusts, it is important to consider potential challenges and risks, such as conflicts of interest, liability concerns, regulatory and compliance issues, and complexities in trust administration. To mitigate these risks, trustors should carefully select the appropriate jurisdiction, draft a clear trust document, and choose experienced and trustworthy parties to serve as trustee, trust protector, and advisors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.