Educational trusts are legal entities designed to manage and distribute funds specifically for educational purposes. They are typically established by individuals, families, or organizations with the intention of providing financial support to beneficiaries, such as students or educational institutions. The trust is funded by contributions from the grantor and may also receive additional donations or investments over time. The trustee, appointed by the grantor, has the responsibility of managing the trust and ensuring that the funds are used solely for educational expenses. The trust may have specific guidelines and restrictions on how the funds can be utilized, such as tuition fees, scholarships, or educational program funding. Educational trusts aim to provide long-term financial stability and support for educational pursuits, helping individuals or institutions access quality education and fostering the development of knowledge and skills.

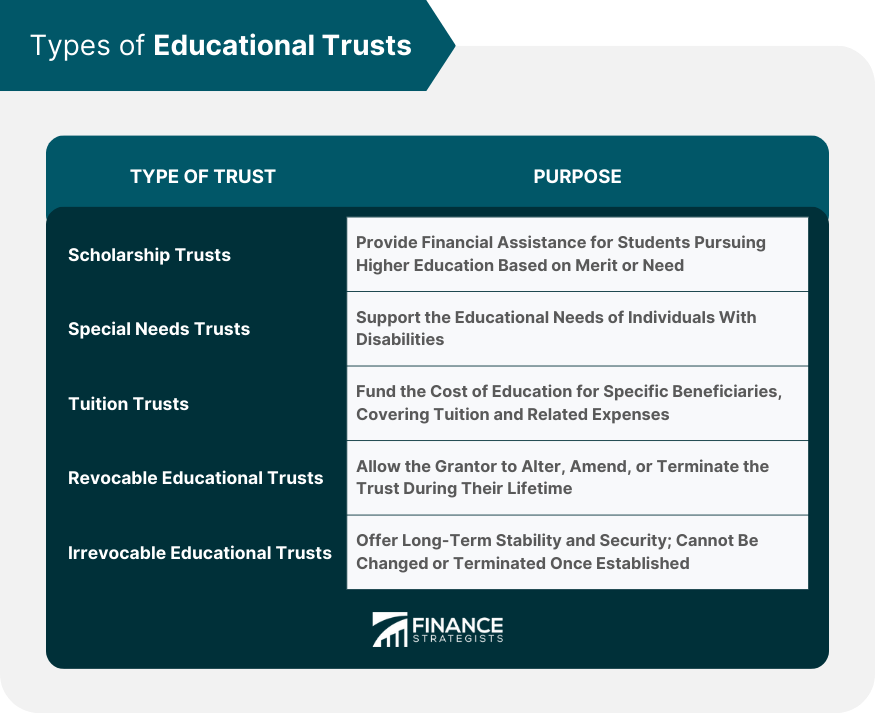

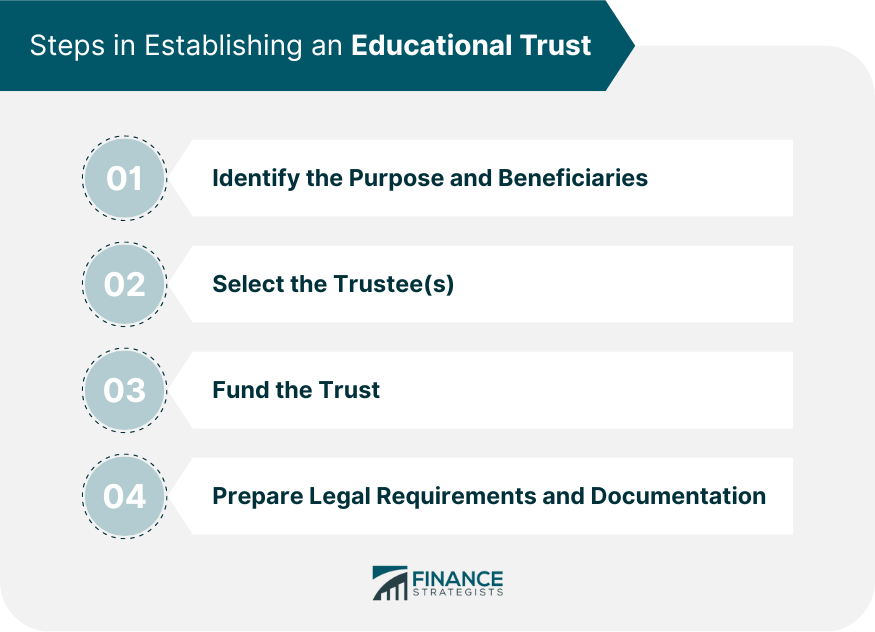

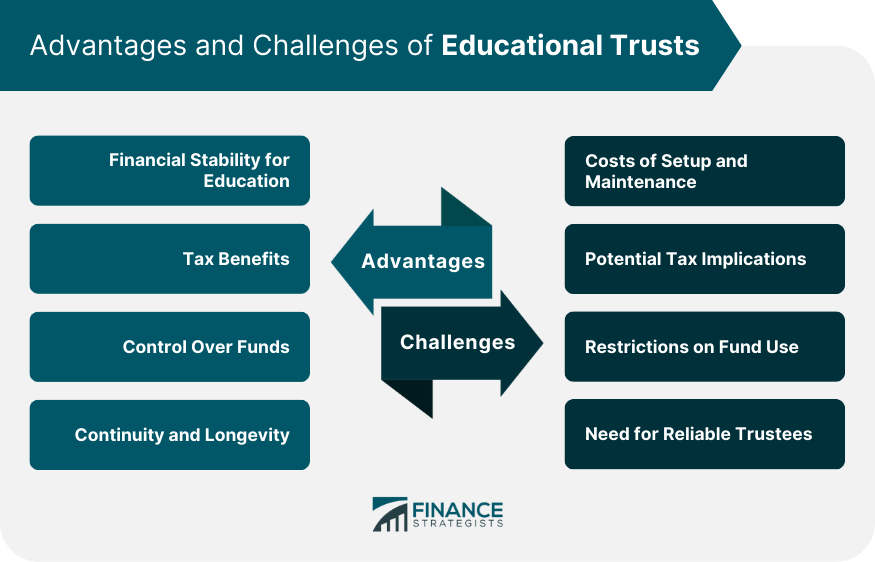

Scholarship trusts are a popular form of educational trust designed to provide financial assistance to students pursuing higher education. These trusts often cater to students demonstrating academic excellence, financial need, or exceptional talent in a particular field. Special needs trusts are specifically designed to support the educational needs of individuals with disabilities. These trusts ensure that the beneficiaries have the necessary resources to access tailored educational programs and services. Tuition trusts are established to fund the cost of education for a particular beneficiary or group of beneficiaries. These trusts often cover tuition fees and related expenses such as textbooks, uniforms, and extracurricular activities. Revocable educational trusts can be altered, amended, or terminated by the grantor during their lifetime. In contrast, irrevocable educational trusts cannot be changed or terminated once they are established, providing long-term stability and security for the beneficiaries. The first step in creating an educational trust is to clearly define its purpose and identify the intended beneficiaries. This could involve specifying the level of education to be funded or the eligibility criteria for potential recipients. Choosing a reliable and competent trustee is essential to ensure the proper administration of the trust. The trustee is responsible for managing the trust's assets, making decisions about distributions, and overseeing the trust's ongoing operations. Educational trusts can be funded through various means, such as cash, securities, real estate, or other assets. The grantor must decide on the initial funding amount, as well as any future contributions to the trust. Establishing an educational trust require compliance with legal requirements and the preparation of necessary documentation. This may include drafting a trust agreement, registering the trust with relevant authorities, and ensuring tax compliance. Educational trusts offer long-term financial stability for beneficiaries, ensuring that they can access quality education without financial constraints. Depending on the jurisdiction, educational trusts may offer tax benefits to the grantor and beneficiaries, such as reduced tax liability or tax deductions for contributions. Educational trusts allow the grantor to maintain control over the funds and ensure that they are used solely for the intended purpose. Irrevocable educational trusts can provide ongoing support to beneficiaries across multiple generations, creating a lasting educational legacy. Establishing and maintaining an educational trust can be costly, involving legal fees, trustee fees, and ongoing administration expenses. While educational trusts can offer tax benefits, they may also have potential tax implications, such as triggering gift or estate taxes. Educational trusts often impose restrictions on the use of funds, limiting the beneficiaries' flexibility in how they access and utilize the resources. The success of an educational trust depends heavily on the competency of the appointed trustee(s), making the selection process critical. Educational trusts play a pivotal role in providing access to quality education for individuals from various backgrounds. The different types of educational trusts include scholarship trusts, special needs trusts, tuition trusts, and revocable and irrevocable educational trusts. The process of establishing a trust involves identifying the purpose and beneficiaries, selecting a trustee, funding the trust, and complying with legal requirements. While educational trusts offer numerous benefits, such as financial stability, tax benefits, control over funds, and the potential for continuity, they also present challenges, including costs, tax implications, fund usage restrictions, and the need for competent trustees. By understanding these factors, individuals and organizations can make informed decisions about creating educational trusts that effectively support the educational needs of their beneficiaries.Definition of Educational Trusts

Types of Educational Trusts

Scholarship Trusts

Special Needs Trusts

Tuition Trusts

Revocable and Irrevocable Educational Trusts

Establishing an Educational Trust

Identifying the Purpose and Beneficiaries

Selection of Trustee(s)

Funding the Trust

Prepare Legal Requirements and Documentation

Benefits of Educational Trusts

Provide Financial Stability for Education

Tax Benefits

Control Over Educational Funds

Potential for Continuity and Longevity

Potential Challenges and Limitations of Educational Trusts

Costs of Setting Up and Maintaining the Trust

Potential Tax Implications

Restrictions on the Use of Funds

Need for Reliable and Competent Trustees

Bottom Line

Educational Trusts FAQs

There are several types of educational trusts, including scholarship trusts, special needs trusts, tuition trusts, and revocable and irrevocable educational trusts. Each serves a distinct purpose and caters to the specific needs of beneficiaries.

Educational trusts offer long-term financial stability by setting aside funds specifically for the beneficiaries' education. The trust ensures that the funds are used solely for the intended purpose, providing beneficiaries with the resources needed to access quality education without financial constraints.

Depending on the jurisdiction, educational trusts may offer tax benefits to the grantor and beneficiaries, such as reduced tax liability or tax deductions for contributions. However, it is essential to consult a tax professional to understand the specific tax implications in your situation.

Some challenges and limitations of educational trusts include the costs of setting up and maintaining the trust, potential tax implications, restrictions on the use of funds, and the need for reliable and competent trustees to manage the trust effectively.

Technological advancements can improve the efficiency of trust administration, increase transparency, and provide new opportunities for personalized and online learning. The changing educational landscape, with an emphasis on lifelong learning and skills development, may require educational trusts to adapt their objectives and strategies to continue supporting the educational needs of their beneficiaries effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.