A family trust is any trust used to pass on assets to one or multiple family members of the person setting up the trust. It determines who will get the assets when the grantor dies and how much the beneficiaries will get. Depending on the estate planning strategy, it is a type of living trust that can be revocable or irrevocable.

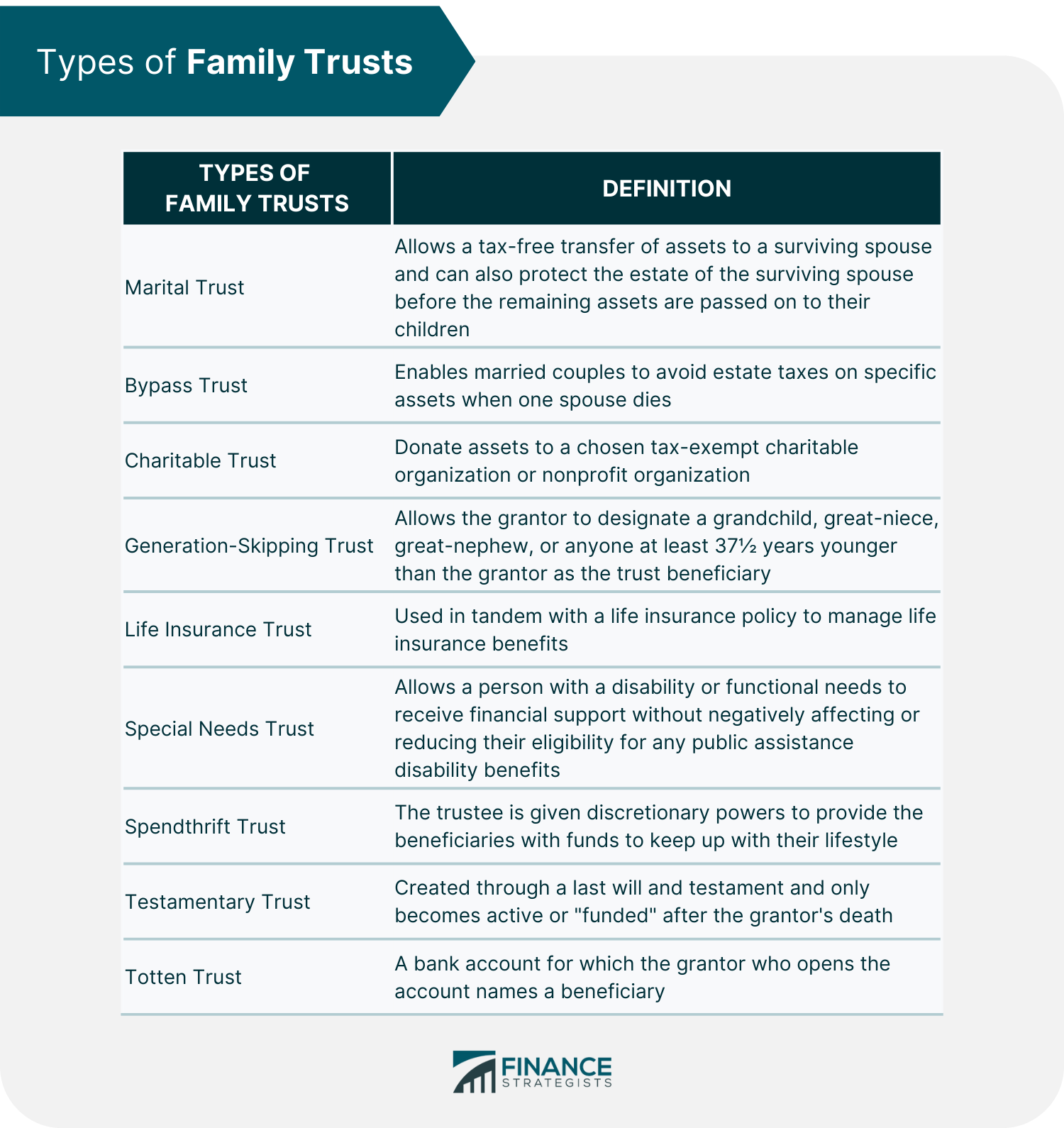

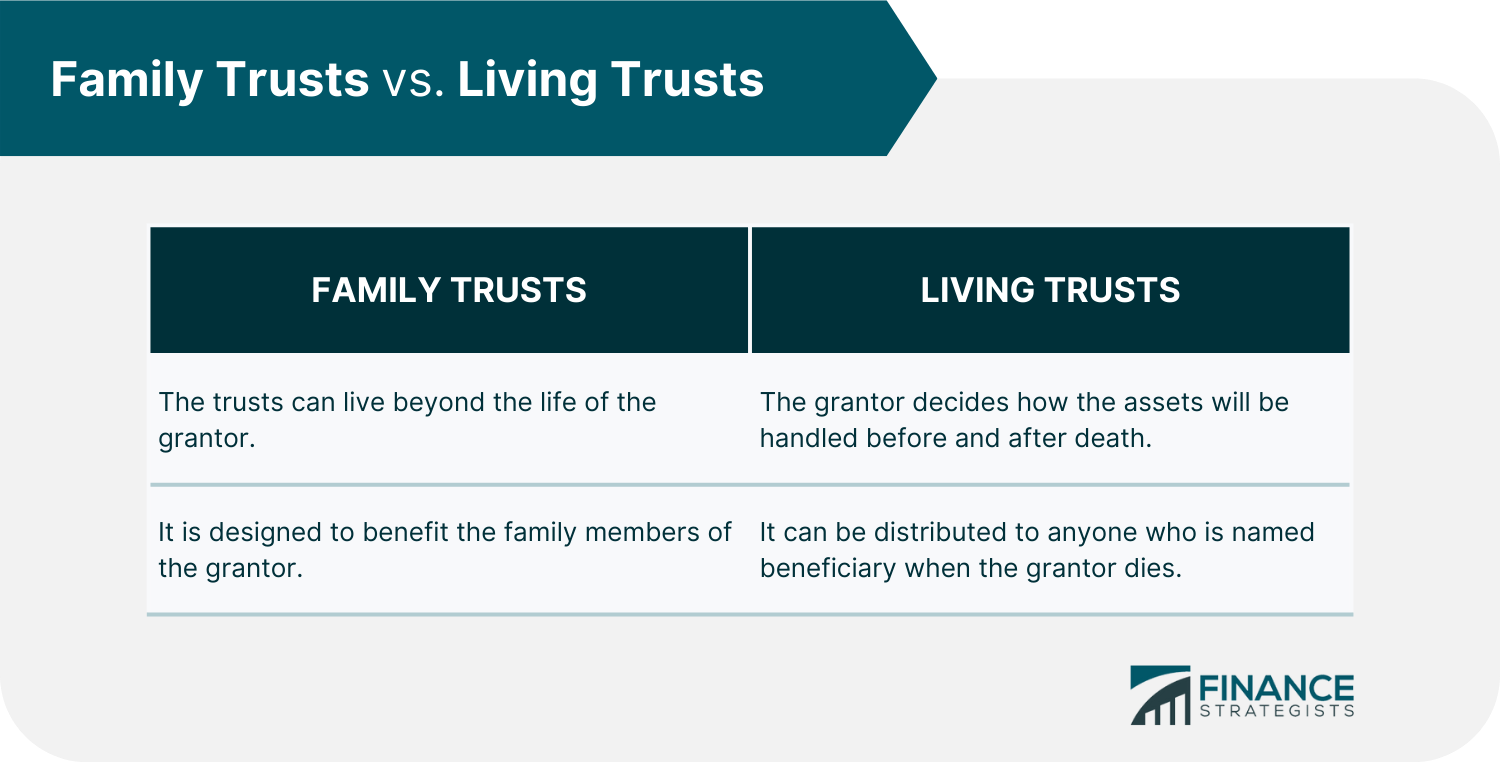

Three key parties are involved in a family trust: the grantor, the trustee, and the beneficiaries. The grantor is an individual or an entity who creates the trust and legally transfers ownership of its assets to the trustee. They are also referred to as the settlor, trustor, or trust maker. The trustee is the person or institution that manages the trust on behalf of the beneficiaries. The trustee has a fiduciary duty to act in the best interests of the beneficiaries. Trustees perform on behalf of the grantor and have the legal obligation to serve the current and future beneficiaries of the trust. The beneficiaries are persons or organizations that benefit from the trust. The grantor can be a beneficiary of their own trust. Generally, beneficiaries' rights depend on the type of trust created and state laws. Nevertheless, all beneficiaries usually have the responsibility to monitor the trust's activities and take legal action whenever they suspect that the trustee has neglected their fiduciary duty. Beneficiaries of a family trust can include your spouse, children, siblings, grandchildren, aunts, uncles, or any other family members. There are several family trusts, each with its purpose and advantages. The most common types of family trusts are: A marital trust is an irrevocable trust that allows a tax-free transfer of assets to a surviving spouse. It can also protect the surviving spouse's estate before the remaining assets are passed on to their children. Couples that prepare a marital trust benefit their heirs in paying less in estate taxes and avoiding probate court. A bypass trust is a legal arrangement that enables married couples to avoid estate taxes on specific assets when one spouse dies. Assets can be divided into two separate trusts when one spouse passes away. The first part is the A trust or marital trust, and the second part is the B trust or bypass trust. A charitable trust is a great way to donate assets to a chosen tax-exempt charitable organization or nonprofit organization. This trust can help you minimize what you might owe to the government and provide a reliable income stream for you and your beneficiaries. A generation-skipping trust allows the grantor to designate a grandchild, great-niece, great-nephew, or anyone at least 37½ years younger than the grantor as the trust beneficiary. The goal of a generation-skipping trust is to avoid paying one round of estate taxes on the assets that would otherwise be imposed on assets transferred to direct descendants. A life insurance trust is an irrevocable trust used in tandem with a life insurance policy to manage life insurance benefits. It is created with the grantor as the insured and the trust as the owner of the life insurance policy. When the insurance policy is already put in a trust, the grantor no longer owns the policy. When the grantor dies, this will be managed by a trustee on behalf of the policy beneficiaries. A special needs trust is also known as supplemental needs trust. It is a legal arrangement that allows a person with a disability or functional needs to receive financial support without negatively affecting or reducing their eligibility for any public assistance disability benefits like Supplemental Security Income (SSI) or Medicaid. A spendthrift trust is called as such because it is usually set up for someone who tends to spend money excessively or recklessly. The trustee of this type of trust is given the discretion to distribute funds to the beneficiary in a way that he or she deems necessary, and the beneficiary does not have direct control over how the money is spent. This can be helpful in protecting assets from being squandered to make sure that they will last long to continue providing funds to beneficiaries for the future. A testamentary trust is created through a last will and testament. It only becomes active or "funded" after the grantor's death. A testamentary trust can have many purposes, including providing income to a surviving spouse or giving funds to minors only when they reach a certain age. This type of trust can also be used to minimize estate tax liabilities and ensure professional asset management. Also known as a payable-on-death account, a Totten trust is a bank account for which the grantor who opens the account names a beneficiary. After the grantor who opens the account dies, the funds in the account go directly to the person named as the beneficiary. A Totten trust functions just like a regular bank account, with two exceptions: you name a beneficiary, and that beneficiary gets the money in the account when you die. There are many benefits that come with setting up a family trust. Some of these benefits include: One of the main benefits of setting up a family trust is asset protection. This means that the assets in the trust are protected from creditors and legal judgments. This can be especially helpful if you have a high net worth and are at risk for lawsuits. Family trusts help protect your assets from estate taxes. Family trusts are one of the best ways to reduce your estate tax liability. Once the assets are transferred to the trust, the income it generates is no longer part of the grantor's assets. It is allocated to the beneficiaries where the transferred assets are included in their tax returns. This results in income splitting and lower overall taxes. With a family trust, your assets are protected from the probate court. When you die, the assets in your estate will have to go through probate court before they can be distributed to your heirs. However, if those assets are held in a family trust, they will not have to go through probate court. This can save your heirs a lot of time and money. A family trust can help you control how and when your assets are distributed to your heirs. You can specify when and how much money your heirs will receive in the trust agreement. This can be helpful if you have young children or grandchildren. You can also use a family trust to set up a scholarship fund or make charitable donations. Family trusts are not without their drawbacks. Some of these include: Setting up a family trust can be costly and complex. You will need to hire an attorney to draft the trust agreement and help you transfer your assets into the trust. You will also need to file paperwork with the state where you live. There will also be ongoing fees for the trustee as compensation for managing the trust, and you may have to file taxes annually, which will result in preparation and filing costs. The costs of setting up a trust will vary depending on your location, the complexity of the trust, and which method is used to set them up. Hiring an attorney to build your trust will typically range from $1,500 to $2,500. For highly complex trusts of wealthy people, it would cost from $5,000 to $7,000. Another downside of family trusts is that you will lose control over the assets that are placed in the trust. Once the assets are transferred into the trust, you can no longer sell them or use them as collateral for a loan. Family trusts are subject to a high tax rate. The trust itself will be taxed on any income it earns. Additionally, when the assets are distributed to the beneficiaries, they may be subject to capital gains taxes. If you are interested in setting up a family trust, there are a few things you need to do: There are many types of family trusts, so it is essential to find the one that best suits your needs. Make sure to talk to a professional such as an attorney or financial advisor so you can compare different trust options. A trustee is the person who will be in charge of managing the trust and distributing the assets to the beneficiaries. You will need to choose someone trustworthy and who has experience with trusts and estate planning. You may also consider hiring a professional trustee such as a bank or trust company. Make sure to name an alternate trustee in case your original choice is unable or unwilling to serve. Beneficiaries are the recipient of the assets that are held in the trust. You can choose anyone you like, including your spouse, children, grandchildren, or friends. You can also specify how much money each beneficiary will receive. Also, you need to decide when they will receive the assets. For example, you can specify that they will receive the assets when they turn 18 or 21. The trust agreement will outline the terms of the trust, including how the assets will be managed and distributed. It is essential to have a lawyer help you draft this document so that it meets the legal requirements in your state. This also helps you avoid any potential problems in the future. A trust is funded by transferring assets into it. You will need to contact the institutions where you hold your assets and complete the necessary paperwork. The process can be complicated, so it will be worth it to have an attorney or financial advisor help you with this step. Assets you can place in your family trust include real estate, fine arts, vehicles, collectibles and heirlooms, bank accounts, stocks, and other investments. One common question is whether they should set up a family or a living trust. The answer to this question depends on your individual circumstances. Family trusts are typically used to protect assets for future generations while living trusts are typically used to manage assets during your lifetime. Living trusts are formal documents that can help reduce the need for probate when you pass away. They can save money by avoiding probate fees and reducing the potential for estate and gift taxes. A family trust is a legal document that can be used to create a financial legacy for your loved ones. A family trust is a type of living trust. Living trusts and family trusts can be either revocable or irrevocable, depending on how you and your advisors want to structure them. Here is a summary of the key differences between family trusts and living trusts: Family trusts refer to a legal arrangement where the property is held by one party for the benefit of another. Family trusts are commonly used to protect assets, minimize taxes, and provide financial support for loved ones. There are many different types of family trusts, so it is important to find the one that best suits your needs. You will need to choose a trustee and beneficiaries for your trust. You will also need to fund your trust by transferring your assets into it. Family trusts can be either revocable or irrevocable, depending on how you want to structure them. If you want to create a financial legacy for your loved ones, then a family trust might be the right option. Talk to an attorney or financial advisor to learn more about how family trusts work and see if setting one up suits you.What Is a Family Trust?

Parties Involved in a Family Trust

Grantor

Trustee

Beneficiaries

Types of Family Trusts

Marital Trust

Bypass Trust

Charitable Trust

Generation-Skipping Trust

Life Insurance Trust

Special Needs Trust

Spendthrift Trust

Testamentary Trust

Totten Trust

Benefits of a Family Trust

Asset Protection

Tax Planning

Estate Planning

Wealth Distribution Planning

Drawbacks of a Family Trust

Cost & Complexity

Loss of Ownership

High Tax Rate

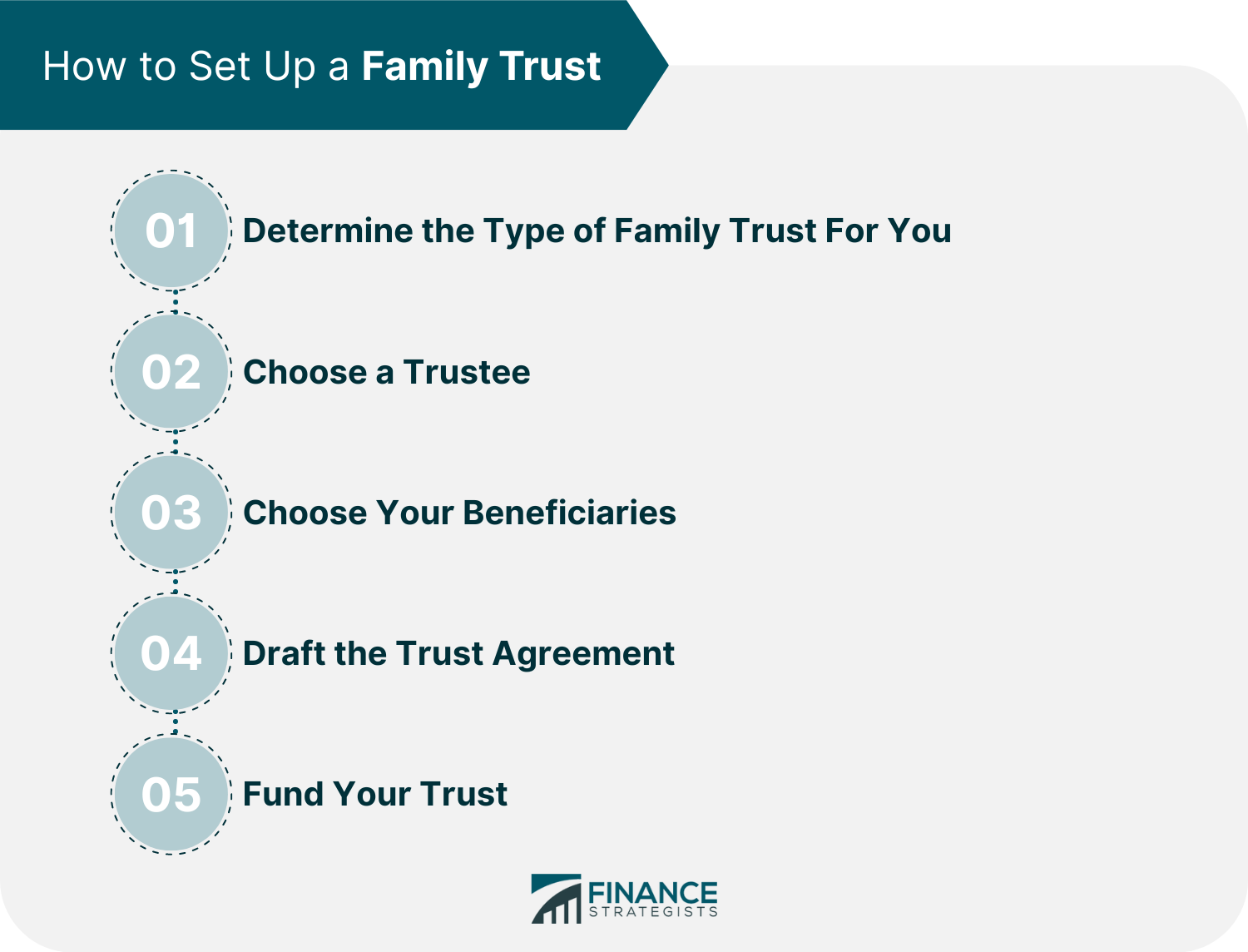

How to Set Up a Family Trust

Step 1: Determine the Type of Family Trust For You

Step 2: Choose a Trustee

Step 3: Choose Your Beneficiaries

Step 4: Draft the Trust Agreement

Step 5: Fund Your Trust

Family Trust vs Living Trust

Final Thoughts

Family Trust FAQs

A family trust is a legal arrangement where the property is held by one party for the benefit of another. Family trusts are commonly used to protect assets, minimize taxes, and provide financial support for loved ones.

Family trusts can provide many benefits, including asset protection, tax, estate, and wealth distribution.

Family trusts work by transferring ownership of your assets to a trustee. The trustee then manages the assets for the benefit of your chosen beneficiaries. Beneficiaries can immediately receive the trust right after the grantor's death, or it may also be given to them gradually over time or when the beneficiaries reach a specific age.

Family trusts can be used for various purposes, including asset protection, estate planning, tax planning, and wealth distribution. They can also be used to create a financial legacy for your loved ones and to avoid probate.

The grantor is the person who creates the trust and transfers their assets into it. The trustee is the person who manages the trust and its assets. The beneficiaries are the people who ultimately receive the benefits of the trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.