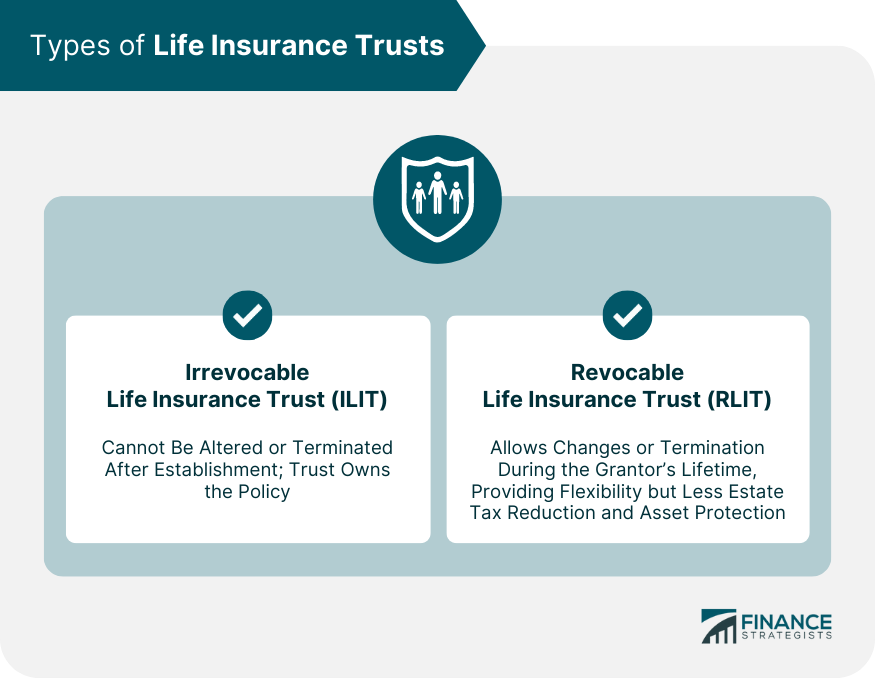

Life Insurance Trusts are specialized legal arrangements that are designed to own and manage life insurance policies. These trusts are commonly used as estate planning tools to help individuals preserve and manage the proceeds of life insurance policies for the benefit of their chosen beneficiaries. The primary purpose of a Life Insurance Trust is to remove the life insurance policy from the insured's taxable estate. When a person owns a life insurance policy in their individual capacity, the death benefit is typically included in their estate for estate tax purposes. By transferring ownership of the policy to an irrevocable trust, the policy proceeds can be excluded from the insured's estate, potentially reducing estate tax liabilities. An irrevocable life insurance trust is a trust that cannot be altered or terminated once it has been established. The grantor gives up control of the life insurance policy, and the trust becomes the legal owner. ILITs are often used to minimize estate taxes and protect the policy proceeds from creditors. A revocable life insurance trust is a trust that allows the grantor to make changes or terminate the trust during their lifetime. While RLITs provide more flexibility than ILITs, they typically do not offer the same level of estate tax reduction and asset protection benefits. Both ILITs and RLITs serve as vehicles to hold and manage life insurance policies. However, ILITs generally provide more tax benefits and asset protection while sacrificing flexibility. In contrast, RLITs offer greater control and adaptability at the expense of reduced estate tax savings and creditor protection. The trustor, or grantor, is the individual who establishes the trust and transfers ownership of the life insurance policy to the trust. The trustee is the person or institution responsible for managing the trust and distributing the policy proceeds to the beneficiaries, who are the individuals or entities designated to receive the benefits. To fund the trust, the grantor can transfer ownership of an existing life insurance policy. The transfer may be subject to gift tax consequences, depending on the policy's value and the grantor's lifetime exemption. Alternatively, the trust can purchase a new life insurance policy on the life of the grantor. This method avoids potential gift tax issues associated with transferring an existing policy. The trust document outlines the terms and conditions of the trust, including the roles and responsibilities of the trustee, the distribution of proceeds, and any provisions for trust termination. Establishing a life insurance trust requires careful planning to ensure compliance with legal requirements and tax regulations. Consulting with an attorney and a financial advisor is essential to navigate the complexities involved in creating a trust. By transferring the ownership of a life insurance policy to a trust, the policy proceeds are generally excluded from the grantor's taxable estate, reducing potential estate tax liabilities. Trusts can provide protection from creditors, lawsuits, and divorce settlements by separating policy proceeds from the grantor's personal assets. The trust document allows the grantor to specify the distribution of policy proceeds, ensuring that the funds are used according to their wishes. Life insurance trusts bypass the probate process, enabling beneficiaries to receive the policy proceeds more quickly and without the costs associated with probate. Trusts maintain a level of privacy by keeping the details of the life insurance policy and the distribution of proceeds confidential. Once an ILIT is established, it cannot be changed or terminated, which means the grantor loses control over the life insurance policy. This lack of flexibility may not be suitable for everyone, especially if circumstances change. Trustees may charge fees for their services, and there may be additional costs associated with the administration and maintenance of the trust. These expenses should be considered when evaluating the benefits of a life insurance trust. The tax implications of life insurance trusts can be complicated, particularly when transferring existing policies or dealing with the generation-skipping transfer tax. Professional guidance is essential to avoid potential tax pitfalls. Disputes may arise among beneficiaries regarding the distribution of policy proceeds, which could lead to legal battles and undermine the grantor's intentions. One alternative to a life insurance trust is to designate specific beneficiaries on the life insurance policy. This method bypasses probate but does not provide the same level of control, asset protection, or tax benefits as a trust. Jointly owning a life insurance policy with a spouse or other family members can help avoid probate and provide some level of asset protection. However, this approach lacks the flexibility and control offered by a trust. A testamentary trust is a trust created within a will that becomes effective upon the grantor's death. This type of trust can provide some control over the distribution of policy proceeds but does not offer the same tax benefits or asset protection as a life insurance trust. The grantor can choose to gift the life insurance policy directly to the beneficiaries, removing it from their estate. This method may have gift tax consequences and does not provide the same level of control or asset protection as a trust. Before establishing a life insurance trust, it is essential to evaluate your financial goals and objectives, taking into consideration factors such as estate tax reduction, asset protection, and control over policy proceeds. Understanding your family's needs and dynamics is crucial in selecting the right type of trust. Consider the relationships among your beneficiaries and potential conflicts that may arise when distributing the policy proceeds. Attorneys, financial advisors, and other professionals can provide valuable guidance in selecting the right trust structure and navigating the complexities involved in establishing a life insurance trust. Life insurance trusts serve as valuable tools in estate planning by offering increased control over policy proceeds, tax benefits, and asset protection. It is crucial to understand the differences between irrevocable and revocable life insurance trusts, as well as the advantages and disadvantages associated with each type. Additionally, considering alternatives to life insurance trusts, such as beneficiary designations, joint ownership of policies, testamentary trusts, and gifting policies, can help in determining the most suitable option for your needs. Assessing your financial goals, family dynamics, and consulting with professionals, including attorneys and financial advisors, is essential to ensure that the chosen trust aligns with your objectives and provides the desired benefits for your beneficiaries.Definition of Life Insurance Trusts

Types of Life Insurance Trusts

Irrevocable Life Insurance Trust (ILIT)

Revocable Life Insurance Trust (RLIT)

Comparison Between ILIT and RLIT

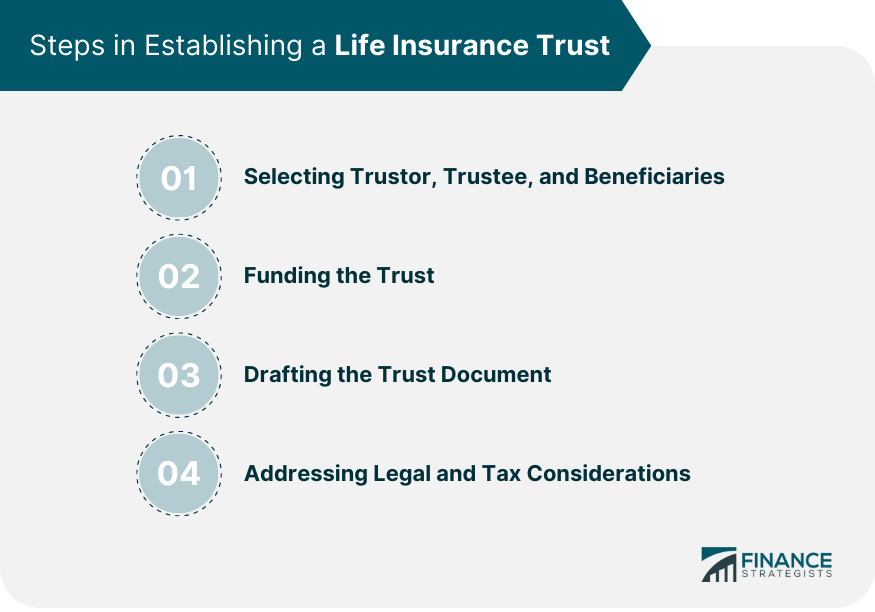

Establishing a Life Insurance Trust

Selecting a Trustor, Trustee, and Beneficiaries

Funding the Trust

Transferring Existing Policies

Purchasing New Policies

Drafting the Trust Document

Legal and Tax Considerations

Advantages of Life Insurance Trusts

Estate Tax Reduction

Asset Protection

Control Over Policy Proceeds

Avoidance of Probate

Privacy and Confidentiality

Potential Disadvantages and Risks

Irrevocability of ILIT

Trust Management Costs

Complex Tax Implications

Conflicts Among Beneficiaries

Alternatives to Life Insurance Trusts

Beneficiary Designations

Joint Ownership of Policies

Testamentary Trusts

Gifting Policies to Beneficiaries

Choosing the Right Trust for Your Needs

Assessing Personal Financial Goals

Evaluating Family Dynamics

Consulting With Professionals

Conclusion

Life Insurance Trusts FAQs

Life insurance trusts are designed to provide more control over the distribution of policy proceeds, reduce potential tax consequences associated with life insurance benefits, and protect the proceeds from creditors.

By transferring ownership of a life insurance policy to a trust, the policy proceeds are generally excluded from the grantor's taxable estate, reducing potential estate tax liabilities.

Irrevocable life insurance trusts (ILITs) cannot be altered or terminated once established, providing more tax benefits and asset protection while sacrificing flexibility. Revocable life insurance trusts (RLITs) can be changed or terminated during the grantor's lifetime, offering greater control and adaptability at the expense of reduced estate tax savings and creditor protection.

Some potential disadvantages and risks of life insurance trusts include the irrevocability of ILITs, trust management costs, complex tax implications, and conflicts among beneficiaries.

To determine if a life insurance trust is suitable for your needs, assess your personal financial goals, evaluate your family dynamics, and consult with professionals such as attorneys and financial advisors to help you navigate the complexities of establishing a life insurance trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.