Non-grantor trusts are legal entities established to hold and manage assets for the benefit of designated beneficiaries. Unlike grantor trusts, where the grantor retains control and is treated as the owner for income tax purposes, non-grantor trusts are considered separate taxable entities, with their own tax identification numbers and filing requirements.

Non-grantor trusts serve various purposes, including estate planning, asset protection, tax minimization, and charitable giving. They offer privacy, flexibility, and control over the distribution of assets while safeguarding them from creditors and potential legal liabilities. Grantor trusts, in contrast, are designed to provide more control to the grantor, who retains certain rights and powers. This control comes at the cost of grantor trusts being treated as "owned" by the grantor for income tax purposes, potentially resulting in higher taxes. Irrevocable trusts are trusts that cannot be altered or revoked by the grantor once established. They offer various tax benefits and asset protection features. Some common types of irrevocable trusts include: An ILIT is designed to hold a life insurance policy, with the trust as the policy owner and beneficiary. It helps exclude the policy's proceeds from the grantor's taxable estate. A CRT provides an income stream to beneficiaries for a specified period, after which the remaining assets are transferred to a designated charity. A QPRT allows a grantor to transfer a personal residence to beneficiaries at a reduced gift tax cost while retaining the right to live in the residence for a specified term. A GRAT provides the grantor with a fixed annuity income for a specified term, after which the remaining trust assets are transferred to the beneficiaries. These trusts are designed to provide financial support to a beneficiary with special needs without jeopardizing the beneficiary's eligibility for government assistance programs. Spendthrift trusts protect trust assets from being seized by creditors and help ensure that beneficiaries use the assets in a fiscally responsible manner. These trusts enable the grantor to transfer assets directly to future generations while minimizing estate, gift, and generation-skipping transfer taxes. The grantor must appoint a trustee or trustees who will be responsible for managing the trust assets, making distributions, and handling administrative tasks. A trust agreement is a legal document that outlines the terms and conditions governing the trust, including the rights and responsibilities of the trustee(s) and beneficiaries. The grantor must transfer assets to the trust, which can include cash, real estate, securities, and other types of property. A non-grantor trust must obtain a tax identification number (EIN) from the IRS and file annual tax returns. Non-grantor trusts are subject to income tax on their undistributed income and may be subject to tax at higher rates than individuals. Non-grantor trusts can claim deductions for distributions made to beneficiaries, reducing the trust's taxable income. Beneficiaries may be required to include trust distributions in their taxable income, potentially subjecting them to higher income tax rates. However, in some cases, trust distributions may carry tax benefits, such as reduced tax liability. Transferring assets to a non-grantor trust may be subject to federal gift tax. However, the grantor can utilize the annual exclusion and lifetime exemption to minimize or eliminate gift tax liability. Generation-skipping trusts may be subject to the generation-skipping transfer (GST) tax. The grantor can allocate their GST tax exemption to help minimize or avoid this tax. By using certain non-grantor trust structures, such as GRATs and QPRTs, grantors can benefit from valuation discounts, which help to reduce gift tax liability. Non-grantor trusts help protect assets from creditors, lawsuits, and other legal liabilities by placing assets under the control of an independent trustee. Non-grantor trusts can offer various tax benefits, such as the exclusion of assets from the grantor's taxable estate and reduced gift tax liability. Charitable trusts, such as CRTs, allow grantors to combine philanthropy with tax and estate planning benefits. Non-grantor trusts can help grantors achieve their estate planning goals by providing for beneficiaries, minimizing taxes, and controlling the distribution of assets. Special needs trusts ensure that beneficiaries with special needs maintain their eligibility for government assistance programs while receiving financial support from the trust. Generation-skipping trusts allow grantors to transfer assets directly to future generations, minimizing estate, gift, and generation-skipping transfer taxes. Once a non-grantor trust is established, the grantor typically loses control over the trust assets and cannot alter or revoke the trust. Non-grantor trusts can be complex to administer, requiring professional advice and ongoing management by trustees. Establishing and maintaining a non-grantor trust may involve significant legal and accounting fees, which should be weighed against the potential benefits. Conflicts may arise among beneficiaries, particularly when the trust assets are not distributed equally or when beneficiaries have differing interests. Non-grantor trusts play a crucial role in estate and tax planning, providing numerous benefits and helping individuals achieve their financial and personal goals. Each non-grantor trust should be tailored to the grantor's specific needs and objectives, taking into account factors such as family dynamics, asset types, and tax considerations. Professional advisors, such as attorneys, accountants, and financial planners, can provide valuable guidance and assistance in establishing and managing non-grantor trusts, ensuring that they are structured and administered effectively to achieve the grantor's goals.Definition of Non-Grantor Trusts

Purpose and Benefits of Non-Grantor Trusts

Comparison With Grantor Trusts

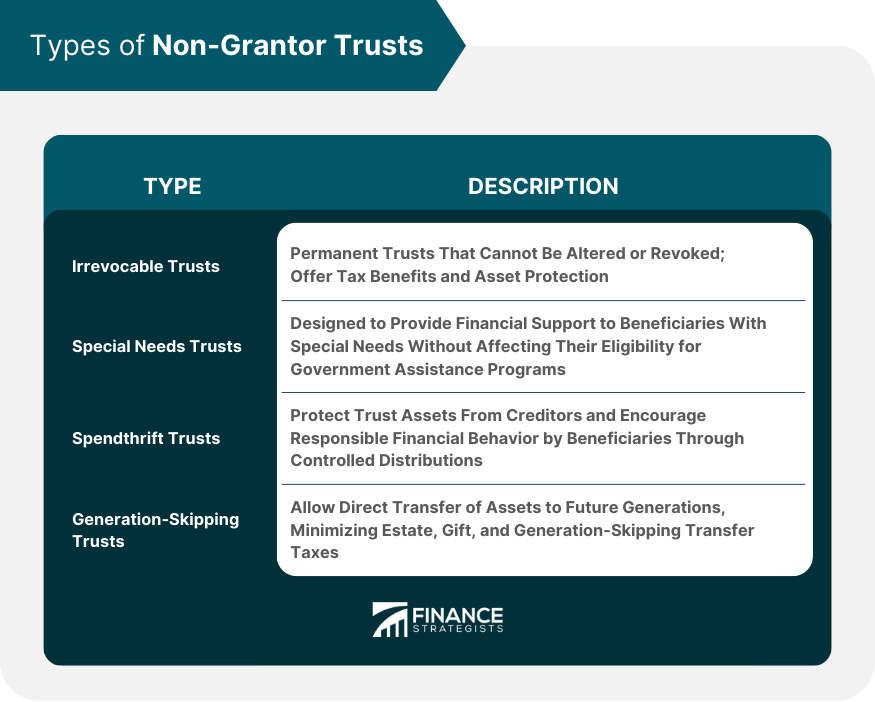

Types of Non-Grantor Trusts

Irrevocable Trusts

Irrevocable Life Insurance Trust (ILIT)

Charitable Remainder Trust (CRT)

Qualified Personal Residence Trust (QPRT)

Grantor Retained Annuity Trust (GRAT)

Special Needs Trusts

Spendthrift Trusts

Generation-Skipping Trusts

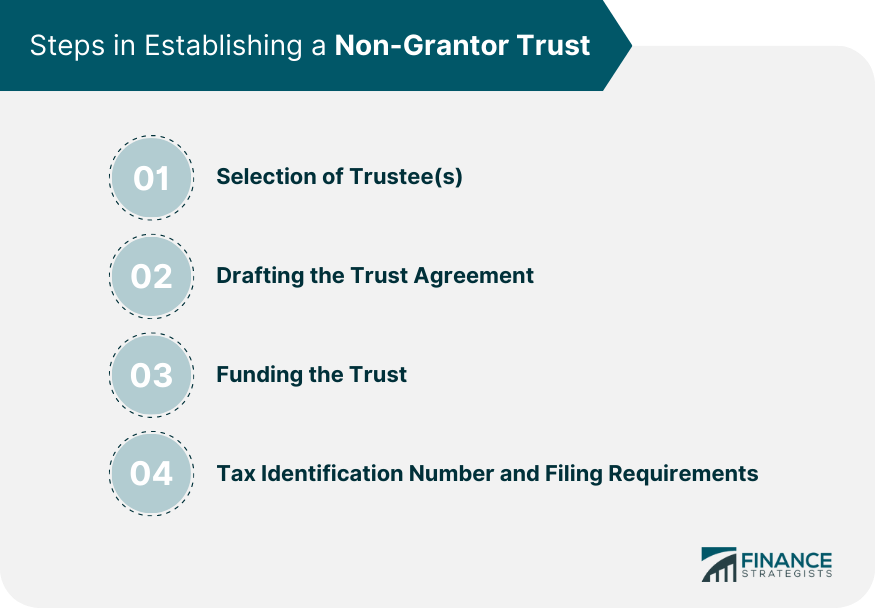

Establishing a Non-Grantor Trust

Selection of Trustee(s)

Drafting the Trust Agreement

Funding the Trust

Tax Identification Number and Filing Requirements

Tax Implications

Income Tax Consequences

Trust Income Taxation

Distribution Deductions

Taxation of Trust Beneficiaries

Estate and Gift Tax Considerations

Exclusions and Exemptions

Generation-Skipping Transfer Tax

Valuation Discounts

Uses of Non-Grantor Trusts

Asset Protection

Tax Minimization

Charitable Giving

Estate Planning

Special Needs Planning

Generational Wealth Transfer

Challenges and Potential Drawbacks

Loss of Control

Trust Administration Complexity

Legal and Accounting Fees

Potential Conflicts Among Beneficiaries

The Bottom Line

Non-Grantor Trusts FAQs

Non-grantor trusts are separate taxable entities that provide tax benefits, asset protection, and estate planning advantages. Grantor trusts, on the other hand, are treated as owned by the grantor for income tax purposes, offering more control but potentially higher taxes.

Common types of non-grantor trusts include irrevocable trusts (such as ILITs, CRTs, QPRTs, and GRATs), special needs trusts, spendthrift trusts, and generation-skipping trusts.

Non-grantor trusts can help minimize taxes by excluding assets from the grantor's taxable estate, reducing gift tax liability, and providing valuation discounts. They also protect assets from creditors and legal liabilities by placing them under the control of an independent trustee.

Some potential drawbacks of using non-grantor trusts include loss of control over trust assets, complexity in trust administration, significant legal and accounting fees, and potential conflicts among beneficiaries.

Professional advisors, such as attorneys, accountants, and financial planners, can provide valuable guidance and assistance in establishing and managing non-grantor trusts. They ensure that the trusts are structured and administered effectively to achieve the grantor's goals and comply with all legal and tax requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.