A Personal Residence Trust, also known as a Qualified Personal Residence Trust, is an estate planning tool that allows an individual to transfer ownership of their primary residence or vacation home to a trust while retaining the right to live in the property for a predetermined period. The purpose of a PRT is to reduce the value of an individual's taxable estate and potentially minimize or eliminate estate taxes upon their death. It's important to note that PRTs have specific rules and limitations, and they may not be suitable for everyone. Additionally, PRTs may be subject to certain restrictions or limitations based on local laws and regulations.

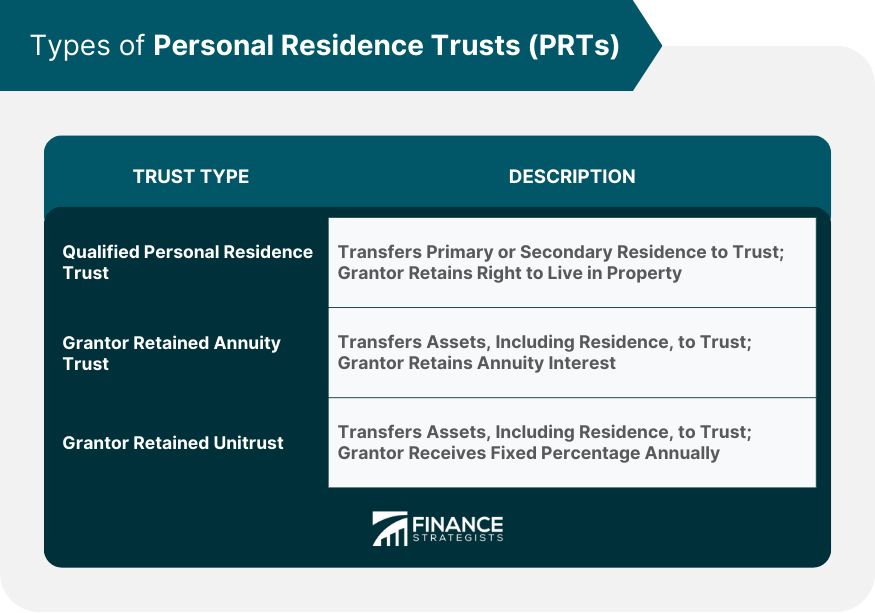

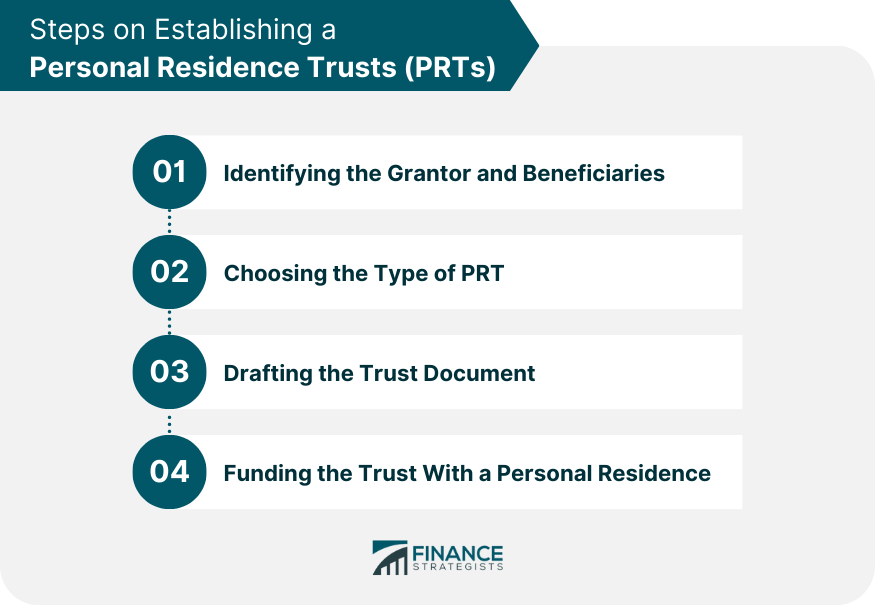

A Qualified Personal Residence Trust allows the grantor (the person creating the trust) to transfer a primary or secondary residence to a trust while retaining the right to live in the property for a specified term. At the end of the term, the residence passes to the beneficiaries, typically family members. A Grantor Retained Annuity Trust is another type of PRT where the grantor transfers assets, including a personal residence, to the trust and retains an annuity interest for a specified term. Once the term ends, the remaining trust assets pass to the beneficiaries. A Grantor Retained Unitrust is similar to a GRAT but differs in the way the grantor's retained interest is calculated. In a GRUT, the grantor receives a fixed percentage of the trust assets' value, recalculated annually, for a specified term. Upon the term's expiration, the remaining trust assets are distributed to the beneficiaries. The first step in creating a PRT is to identify the grantor and the intended beneficiaries. The grantor is the person who establishes the trust and contributes to the personal residence, while the beneficiaries are the individuals who will receive the residence once the trust term ends. The grantor must decide which type of PRT best suits their needs and objectives. This decision should be made in consultation with an estate planning attorney who can provide guidance on the advantages and disadvantages of each trust type. The trust document must be drafted, outlining the terms and conditions of the trust, including the trust's purpose, the length of the term, and the beneficiaries. An experienced estate planning attorney should draft the document to ensure it meets legal requirements and achieves the grantor's goals. Once the trust document is completed, the grantor must transfer the personal residence into the trust. This transfer typically involves signing a deed that conveys the property to the trustee, who holds legal title to the residence for the trust's benefit. When the grantor transfers a residence into a PRT, it is considered a gift to the beneficiaries. The value of the gift is determined by the IRS using actuarial tables, which take into account the grantor's age, the trust term, and applicable interest rates. The grantor may need to file a gift tax return and use a portion of their lifetime gift tax exemption to offset the gift's value. If the grantor survives the trust term, the residence is removed from their estate, potentially reducing estate tax liability. However, if the grantor dies before the term ends, the full value of the residence may be included in their estate for estate tax purposes. While the trust is in effect, the grantor is responsible for paying income taxes on any income generated by the residence, such as rental income. Additionally, the grantor remains eligible for the mortgage interest deduction and any applicable property tax deductions. If the PRT beneficiaries are considered "skip persons," such as grandchildren or more remote descendants, the GSTT may apply. The grantor should consult with an estate planning attorney to determine if GSTT applies and plan accordingly. By removing the residence from the grantor's estate, a PRT can potentially reduce estate tax liability. This can be especially beneficial for individuals with estates that exceed the federal estate tax exemption amount. Since the value of the gift is calculated using actuarial tables, the residence may be transferred to beneficiaries at a reduced value, resulting in lower gift tax liability and utilizing less of the grantor's lifetime gift tax exemption. A PRT allows the grantor to continue living in the residence during the trust term. This can provide the grantor with peace of mind and financial stability while still achieving their estate planning goals. A PRT can provide some degree of asset protection by placing the residence outside the grantor's direct control. This can make it more difficult for creditors to seize the property in the event of a lawsuit or financial setback. Once the residence is transferred to a PRT, the grantor loses direct control over the property. This means they cannot sell or refinance the residence without the trustee's cooperation, which could be an issue if the grantor's circumstances change. PRTs are generally irrevocable, meaning they cannot be easily modified or terminated. This can create challenges if the grantor's situation or objectives change after establishing the trust. If the grantor dies before the trust term ends, the full value of the residence may be included in their estate for estate tax purposes, negating the intended tax benefits. Selling or refinancing the residence within a PRT can be complicated and may require the cooperation of the trustee and beneficiaries. This could lead to potential delays or disagreements that impact the grantor's financial plans. The trustee is responsible for managing the trust assets, including the personal residence, for the benefit of the beneficiaries. This includes paying property taxes, maintaining insurance, and handling any necessary repairs or maintenance. When choosing a trustee, the grantor should consider factors such as the individual's trustworthiness, financial acumen, and willingness to serve in this role. A professional trustee, such as a bank or trust company, can also be an option for those who want an experienced and impartial party to manage the trust. Professional trustee services can provide expertise in trust administration and asset management. These services typically charge fees based on a percentage of the trust's assets or a flat fee for their services. Personal Residence Trusts serve as a valuable estate planning tool for individuals seeking to transfer their personal residences to beneficiaries while reducing potential estate tax liability. With different types of PRTs available, such as Qualified Personal Residence Trusts, Grantor Retained Annuity Trusts, and Grantor Retained Unitrusts, it is essential to choose the right trust type based on individual needs and objectives. Establishing a PRT involves identifying the grantor and beneficiaries, choosing the trust type, drafting the trust document, and funding the trust with the residence. PRTs have various tax implications, including gift tax, estate tax, income tax, and generation-skipping transfer tax considerations. While PRTs offer advantages like reducing estate tax liability and allowing grantors to retain the use of the residence, they also have potential drawbacks, such as loss of control over the property and complications with selling or refinancing. Selecting a trustworthy trustee is crucial for the successful management of a PRT. Consulting with a qualified estate planning attorney can help individuals determine if a PRT is suitable for their situation and guide them through the process of establishing and managing the trust.Definition of Personal Residence Trusts (PRTs)

Types of Personal Residence Trusts

Qualified Personal Residence Trusts (QPRTs)

Grantor Retained Annuity Trusts (GRATs)

Grantor Retained Unitrusts (GRUTs)

Steps on Establishing a Personal Residence Trust

Identifying the Grantor and Beneficiaries

Choosing the Type of PRT

Drafting the Trust Document

Funding the Trust With a Personal Residence

Tax Implications of Personal Residence Trusts

Gift Tax Considerations

Estate Tax Considerations

Income Tax Considerations

Generation-Skipping Transfer Tax (GSTT) Implications

Advantages of Personal Residence Trusts

Reducing Estate Tax Liability

Transferring Assets at a Reduced Value

Retaining Use of the Residence

Asset Protection

Potential Drawbacks and Risks of Personal Residence Trusts

Loss of Control Over the Residence

Irrevocability of the Trust

Tax Consequences if the Grantor Dies Before the Trust Term Ends

Possible Complications With Selling or Refinancing the Residence

Choosing a Trustee for a Personal Residence Trust

Responsibilities of the Trustee

Factors to Consider When Selecting a Trustee

Professional Trustee Services

Conclusion

Personal Residence Trusts (PRTs) FAQs

Personal Residence Trusts (PRTs) are estate planning tools that allow individuals to transfer their personal residences to beneficiaries while reducing potential estate tax liability. PRTs let the grantor retain the right to live in the property for a specified term, after which the residence passes to the beneficiaries.

There are three main types of Personal Residence Trusts (PRTs): Qualified Personal Residence Trusts (QPRTs), Grantor Retained Annuity Trusts (GRATs), and Grantor Retained Unitrusts (GRUTs). Each type has specific features and serves different purposes in estate planning.

When a grantor transfers a residence into a PRT, it is considered a gift to the beneficiaries, potentially requiring a gift tax return and utilization of the grantor's lifetime gift tax exemption. If the grantor survives the trust term, the residence is removed from their estate, reducing potential estate tax liability. If the grantor dies before the term ends, the full value of the residence may be included in their estate for estate tax purposes.

Advantages of PRTs include reducing estate tax liability, transferring assets at a reduced value, retaining use of the residence, and providing some asset protection. Drawbacks include loss of control over the residence, the irrevocability of the trust, potential tax consequences if the grantor dies before the trust term ends, and complications with selling or refinancing the residence.

When selecting a trustee for a PRT, consider factors such as trustworthiness, financial acumen, and willingness to serve in the role. A professional trustee, like a bank or trust company, can be an option for those who want an experienced and impartial party to manage the trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.