A Qualified Trust is a legally recognized financial instrument that enables individuals to protect, manage, and distribute their assets for their own benefit or for designated beneficiaries. These trusts play a pivotal role in financial planning by offering asset protection, minimizing tax liabilities, streamlining wealth transfer, and assisting in estate planning. Qualified Trusts can be structured as either revocable or irrevocable, with each type offering varying degrees of control, flexibility, and potential tax benefits. There are two main types of qualified trusts: This type of trust can be amended or revoked by the grantor (the person who establishes the trust) during their lifetime. Revocable trusts offer more flexibility and control for the grantor but may not provide the same level of asset protection and tax benefits as irrevocable trusts. This type of trust cannot be amended or revoked once established. Irrevocable trusts offer greater asset protection and potential tax benefits, but grantors relinquish control over the trust assets. The tax treatment of a qualified trust depends on its type and structure. Key tax considerations include: Generally, revocable trusts are considered "grantor trusts" for income tax purposes, meaning that the grantor is responsible for paying taxes on the trust's income. On the other hand, irrevocable trusts are considered separate tax entities and are subject to their own income tax rates. Assets held in a revocable trust are included in the grantor's estate for estate tax purposes, whereas assets in an irrevocable trust are generally excluded from the grantor's estate. Additionally, transfers to an irrevocable trust may be subject to gift tax, depending on the value of the assets transferred and the grantor's lifetime gift tax exemption. Qualified trusts can provide a structured and controlled way to transfer wealth to beneficiaries, including minor children or individuals with special needs. Trusts can also be used to ensure that wealth is preserved and managed responsibly for future generations. The trustee is responsible for managing the trust assets and ensuring that the terms of the trust agreement are followed. The trustee has a fiduciary duty to act in the best interests of the trust beneficiaries. When selecting a trustee, individuals should consider factors such as the trustee's financial expertise, trustworthiness, and willingness to serve. In some cases, a professional trustee or trust company may be an appropriate choice. A trust agreement should clearly outline the terms of the trust, including the trust's purpose, the assets to be held in the trust, the identification of beneficiaries, and the powers and responsibilities of the trustee. In order to establish a valid trust, the trust agreement must comply with the legal requirements of the jurisdiction in which it is created. These requirements may include specific language, the need for witnesses, and proper execution by the grantor. Once the trust agreement is established, the grantor must transfer the assets they wish to include in the trust. This process may involve retitling assets, such as real estate or bank accounts, in the name of the trust. A wide variety of assets can be held in a qualified trust, including real estate, stocks, bonds, mutual funds, life insurance policies, and personal property. Each type of asset may have unique considerations and requirements when it comes to transferring them into the trust. The trustee is responsible for ongoing trust administration, which includes managing trust assets, making distributions to beneficiaries as required by the trust agreement, and fulfilling any reporting or tax-filing requirements. Trustees must maintain accurate records of trust activities and may be required to provide regular accountings to beneficiaries or regulatory authorities. Additionally, trustees may need to file annual trust income tax returns and any other required tax forms. The conditions under which a trust can be modified depend on the type of trust and the specific terms of the trust agreement. Generally, revocable trusts can be modified or amended by the grantor during their lifetime, while irrevocable trusts are more difficult to change. A trust may be terminated under specific circumstances outlined in the trust agreement, such as the completion of its purpose, the death of the grantor, or the exhaustion of trust assets. In some cases, a court order may be required to terminate a trust. Qualified trusts offer several advantages, including: A qualified trust can shield assets from creditors and lawsuits, particularly when an irrevocable trust is used. This protection is especially important for individuals with significant wealth or those in high-risk professions. Qualified trusts can help individuals manage the distribution of their assets upon their death, ensuring that their wishes are carried out and reducing the potential for family disputes. Trusts can also help to minimize estate taxes and avoid the probate process, which can be time-consuming and costly. As mentioned earlier, qualified trusts can offer significant tax benefits, depending on their structure. By strategically utilizing trusts, individuals can minimize their income, estate, and gift tax liabilities. A qualified trust can be an effective tool for retirement planning, as it can provide tax-deferred growth, asset protection, and a structured plan for the distribution of retirement assets. Qualified trusts can hold various types of retirement accounts, including Individual Retirement Accounts (IRAs), 401(k) plans, and other employer-sponsored retirement plans. The process of transferring these accounts into a trust may require the assistance of a financial professional. Trustees must ensure that Required Minimum Distributions (RMDs) are taken from the retirement accounts held in the trust, as required by law. Failure to take RMDs can result in substantial tax penalties. Distributions from retirement accounts held in a qualified trust are generally subject to income tax at the beneficiary's tax rate. Careful planning is necessary to minimize the tax burden associated with these distributions. Qualified Trusts play a crucial role in financial planning, offering asset protection, tax benefits, and streamlined wealth transfer. They can be structured as revocable or irrevocable trusts, each with its own advantages. Revocable trusts provide flexibility and control but may have limited asset protection and tax benefits. Irrevocable trusts offer greater protection and potential tax advantages but involve relinquishing control. Tax implications vary depending on trust type, including income tax considerations for revocable trusts and separate tax entities for irrevocable trusts. Setting up a qualified trust involves selecting a trustee, drafting a trust agreement, and funding the trust with appropriate assets. Ongoing trust administration, record-keeping, and reporting are necessary, and modifying or terminating a trust depends on specific conditions. Benefits of qualified trusts include asset protection, estate planning, and minimizing tax liabilities. In retirement planning, qualified trusts can provide tax-deferred growth, asset protection, and structured distribution of retirement assets, subject to distribution rules and tax implications.What Is a Qualified Trust?

Key Features of Qualified Trust

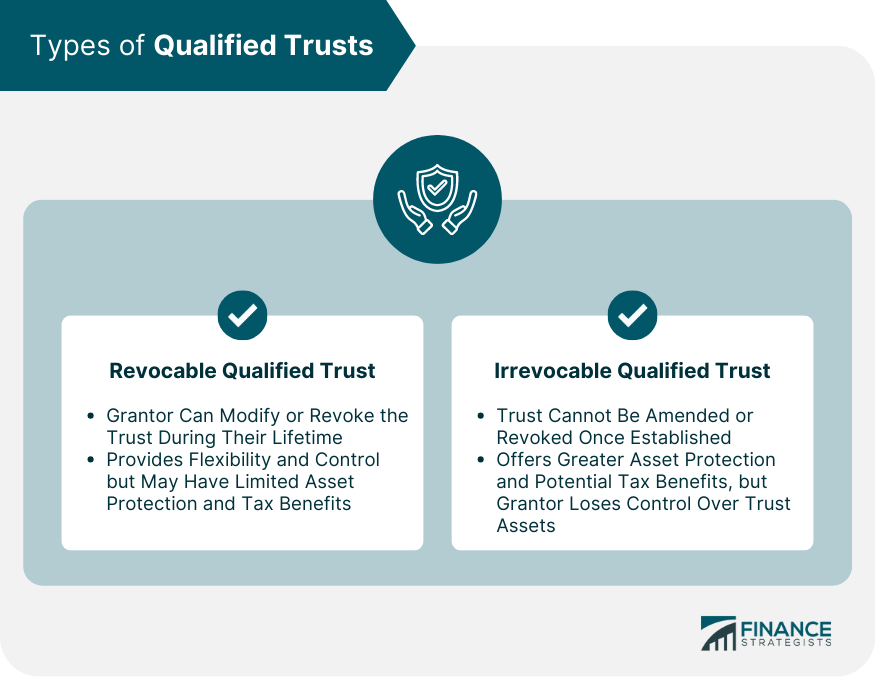

Types of Qualified Trusts

Revocable Qualified Trust

Irrevocable Qualified Trust

Tax Implications of Qualified Trusts

Income Tax Considerations

Estate and Gift Tax Considerations

Facilitating Wealth Transfer

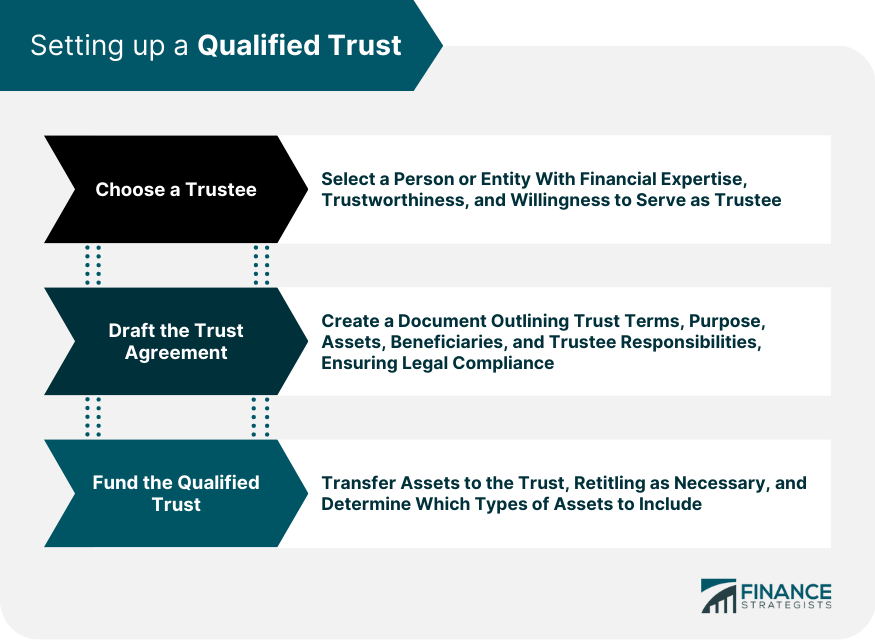

Setting up a Qualified Trust

Choosing a Trustee

Role of the Trustee

Criteria for Selecting a Trustee

Drafting the Trust Agreement

Essential Elements of a Trust Agreement

Legal Requirements

Funding the Qualified Trust

Transferring Assets to the Trust

Types of Assets That Can Be Held in a Trust

Managing a Qualified Trust

Ongoing Trust Administration

Trustee Responsibilities

Record-Keeping and Reporting Requirements

Modifying or Terminating a Qualified Trust

Conditions for Modifying a Trust

Conditions for Terminating a Trust

Benefits of Establishing a Qualified Trust

Asset Protection

Estate Planning

Minimizing Tax Liabilities

Qualified Trust and Retirement Planning

Using a Qualified Trust for Retirement Savings

Advantages of Using a Qualified Trust for Retirement Savings

Types of Retirement Accounts That Can Be Held in a Trust

Distribution Rules for Retirement Assets in a Qualified Trust

Required Minimum Distributions (RMDs)

Tax Implications of Distributions

Conclusion

Qualified Trust FAQs

A Qualified Trust is a legal arrangement that allows individuals to protect and manage their assets for their own benefit or that of designated beneficiaries. It plays a crucial role in financial planning by providing asset protection, minimizing tax liabilities, facilitating wealth transfer, and assisting in estate planning.

A Revocable Qualified Trust can be amended or revoked by the grantor during their lifetime, providing more flexibility and control. However, it may not offer the same level of asset protection and tax benefits as an Irrevocable Qualified Trust. An Irrevocable Qualified Trust cannot be amended or revoked once established, providing greater asset protection and potential tax benefits, but at the cost of the grantor relinquishing control over the trust assets.

A Qualified Trust can help minimize tax liabilities depending on its structure. For instance, irrevocable trusts are considered separate tax entities and may be subject to lower income tax rates. Additionally, assets held in an irrevocable trust are generally excluded from the grantor's estate for estate tax purposes, and strategic use of trusts can help minimize income, estate, and gift tax liabilities.

Yes, a Qualified Trust can be an effective tool for retirement planning. It can provide tax-deferred growth, asset protection, and a structured plan for the distribution of retirement assets. Qualified trusts can hold various types of retirement accounts, such as IRAs, 401(k) plans, and other employer-sponsored retirement plans.

Some common misconceptions about Qualified Trusts include the belief that they are only for the wealthy, are too complex to manage, and are inflexible. In reality, Qualified Trusts can benefit individuals with modest estates, can be effectively managed with professional assistance, and offer varying degrees of flexibility depending on the type of trust and its specific terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.