A Rabbi trust is a type of irrevocable trust established by an employer to provide deferred compensation benefits to select employees. Named after the first IRS Private Letter Ruling issued for such a trust, Rabbi trusts are typically used to supplement retirement income for executives and key employees. In the context of estate planning, Rabbi trusts can help protect assets and provide financial security for beneficiaries. Estate planning involves the process of organizing one's assets and making arrangements for their distribution upon one's death. Trusts are a common tool used in estate planning, and Rabbi trusts are one of the many types of trusts that can be utilized to achieve a variety of financial goals. To establish a Rabbi trust, an employer must draft a trust agreement and appoint a trustee. The trust agreement should outline the terms and conditions of the trust, including the purpose, funding mechanisms, and distribution of benefits to the beneficiaries. The trustee plays a crucial role in managing and administering the Rabbi trust. As a result, the employer must carefully select a trustee who is capable of fulfilling these responsibilities and acting in the best interests of the trust's beneficiaries. A Rabbi trust can be funded using various methods, such as cash contributions, life insurance policies, or investment assets. The employer must ensure that the trust is adequately funded to meet the future needs of the beneficiaries. Rabbi trusts can offer tax advantages to both employers and beneficiaries. However, they are subject to complex tax regulations, and it's essential to consult with a tax professional or estate planning lawyer to ensure compliance with these regulations. A Rabbi trust can protect assets from the claims of the employer's creditors, providing financial security for the trust's beneficiaries. By deferring the payment of compensation until a future date, Rabbi trusts can help minimize taxes for both employers and beneficiaries. Rabbi trusts offer flexibility in terms of how and when benefits are distributed to beneficiaries, allowing for tailored distribution plans that meet individual needs and circumstances. Rabbi trusts can provide a level of confidentiality and privacy, as the trust's assets and distributions are not subject to public disclosure. While Rabbi trusts offer some protection from the employer's creditors, they may not provide complete protection from the claims of the beneficiary's creditors. It's essential to understand the limitations of asset protection provided by a Rabbi trust when considering its use in estate planning. Rabbi trusts are subject to intricate tax regulations that can be challenging to navigate. Failing to comply with these regulations can result in significant tax liabilities for both employers and beneficiaries. Once a Rabbi trust is established, the employer relinquishes control over the trust's assets. The trustee is responsible for managing and administering the trust, which may limit the employer's ability to make changes to the trust's terms or conditions. Rabbi trusts differ from other types of trusts in their primary purpose, which is to provide deferred compensation benefits to select employees. However, they share similarities with other trusts in terms of asset protection, tax advantages, and flexibility in distribution. When considering the use of a Rabbi trust or any other type of trust in estate planning, it's important to take into account various factors, such as: Purpose of the trust Level of asset protection needed Desired tax advantages Level of control and flexibility required An estate planning lawyer can provide valuable guidance and advice when establishing a Rabbi trust. They can help you navigate the complex legal and tax implications and ensure that your trust is set up in compliance with relevant laws and regulations. A skilled estate planning lawyer can draft and review the trust agreement and other necessary documents, ensuring that your Rabbi trust is established correctly and in accordance with your specific needs and goals. An estate planning lawyer can help you stay informed about any changes in laws or regulations that may impact your Rabbi trust, ensuring that your trust remains compliant and effective over time. Rabbi trusts are irrevocable trusts established by employers to provide deferred compensation benefits to select employees. They play a crucial role in estate planning by protecting assets, offering tax advantages, providing flexibility in distribution, and ensuring confidentiality. However, there are potential risks, including limited protection from creditors, complex tax regulations, and loss of control over trust assets. When establishing a Rabbi trust, it's important to fulfill legal requirements, select a capable trustee, adequately fund the trust, and consult with a tax professional or estate planning lawyer. These professionals can provide guidance, draft trust documents, and ensure compliance with laws and regulations, maximizing the benefits of a Rabbi trust in estate planning.Definition and Purpose of Rabbi Trusts

Role of Rabbi Trusts in Estate Planning

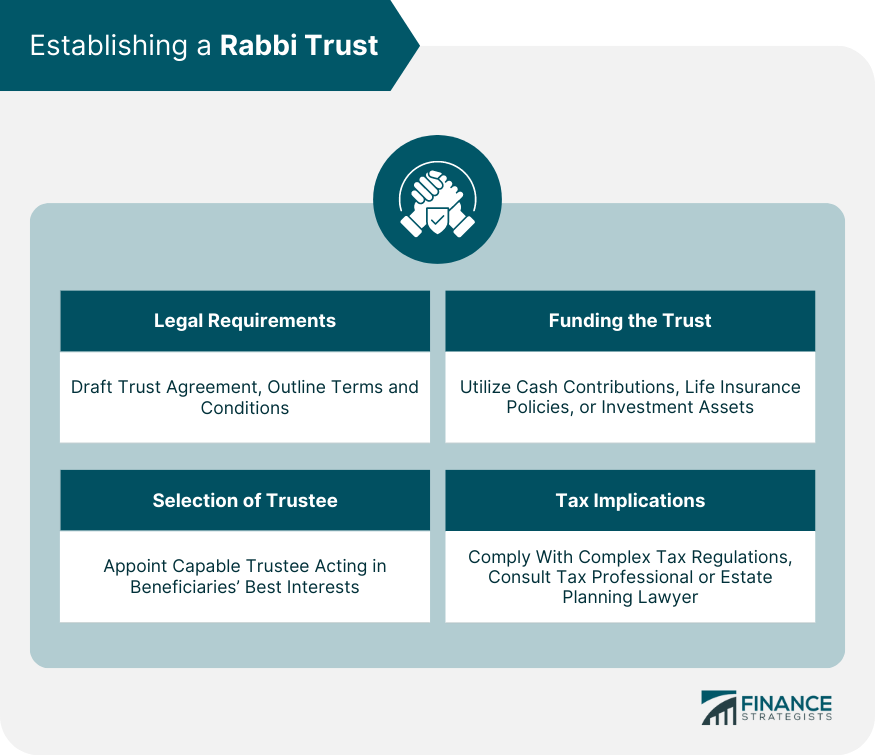

Establishing a Rabbi Trust

Legal Requirements

Selection of Trustee

Funding the Trust

Tax Implications

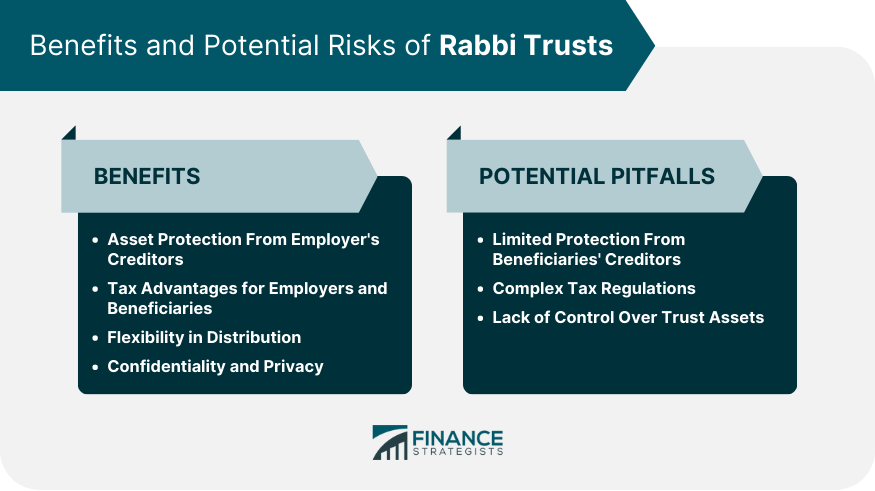

Benefits of Rabbi Trusts in Estate Planning

Protection of Assets

Tax Advantages

Flexibility in Distribution

Confidentiality and Privacy

Potential Risks of Rabbi Trusts

Limited Protection from Creditors

Complex Tax Regulations

Lack of Control Over Trust Assets

Comparing Rabbi Trusts to Other Types of Trusts

Differences and Similarities

Factors to Consider When Choosing a Trust

Role of an Estate Planning Lawyer in Establishing a Rabbi Trust

Legal Guidance and Advice

Drafting and Reviewing Trust Documents

Ensuring Compliance With Laws and Regulations

Conclusion

Rabbi Trusts FAQs

Rabbi trusts are a type of irrevocable trust created by employers to provide deferred compensation benefits to select employees, typically executives and key personnel. In estate planning, Rabbi trusts can help protect assets, provide financial security for beneficiaries, and offer tax advantages.

The primary benefits of using Rabbi trusts in estate planning include asset protection from the employer's creditors, tax advantages for employers and beneficiaries, flexibility in the distribution of benefits, and confidentiality and privacy regarding the trust's assets and distributions.

Rabbi trusts primarily serve to provide deferred compensation benefits to select employees, whereas other trusts in estate planning may focus on asset protection, tax planning, or specific goals like supporting a disabled beneficiary or charitable cause. However, Rabbi trusts share similarities with other trusts in terms of asset protection, tax advantages, and flexibility in distribution.

Potential disadvantages and risks of Rabbi trust include limited protection from the claims of beneficiaries' creditors, complex tax regulations that may result in tax liabilities if not properly addressed, and a lack of control over trust assets once the trust is established.

An estate planning lawyer can provide legal guidance and advice on Rabbi trusts, draft and review trust documents, and ensure compliance with relevant laws and regulations. They can also help you stay informed about any changes in laws or regulations that may impact your Rabbi trust, ensuring its continued effectiveness over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.