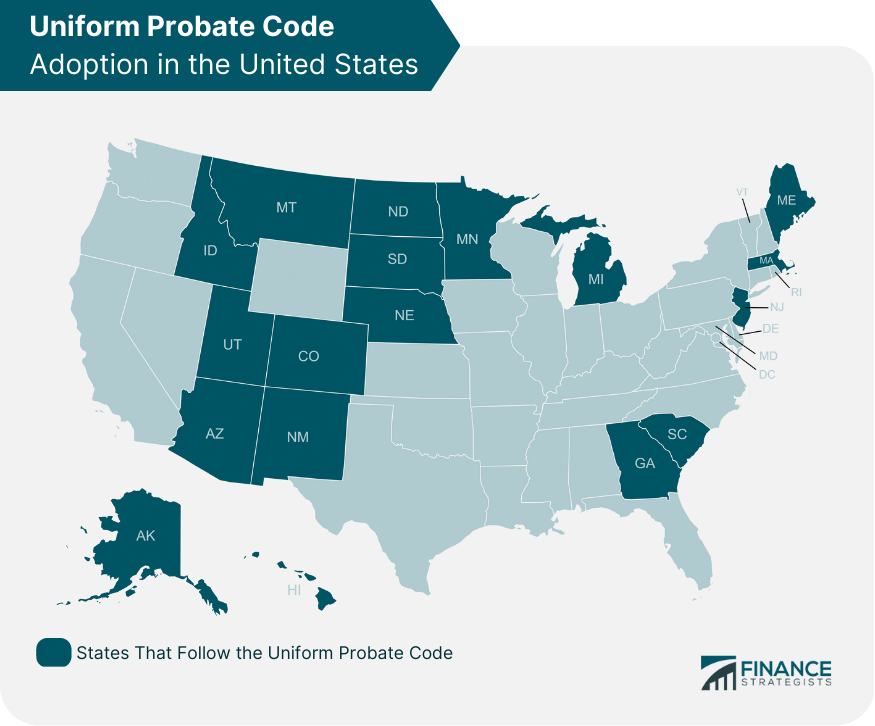

The Uniform Probate Code (UPC) is a model law that has been adopted by several U.S. states to standardize and simplify the process of probate, which is the legal process of administering a deceased person's estate. The main purpose of the UPC is to create a comprehensive and uniform set of rules for the probate process, which includes the handling of wills, trusts, and intestacy, which happens when someone dies without a will. The code provides guidelines for the distribution of property, payment of debts, and other matters related to the administration of estates. The UPC also aims to make the process more efficient and cost-effective by reducing the need for court involvement. One of the key features of the UPC is that it allows for the use of simplified procedures for small estates, which can save time and money for both the estate and the beneficiaries. The code provides for the appointment of a personal representative to manage the estate. Probate is a legal process that occurs after a person dies to transfer their assets and settle their debts. It involves several steps, including the identification of the deceased person's assets, the payment of debts and taxes, and the distribution of remaining assets to beneficiaries. The timing of probate varies depending on the circumstances of the case. In general, the process begins when the deceased person's will is submitted to the probate court. If the person died without a will, known as dying intestate, the court will appoint an administrator. Once the court has appointed an administrator, they are responsible for collecting the deceased person's assets, paying off any outstanding debts, and distributing the remaining assets to the beneficiaries. This process can take several months or even years, based on the complexity of the estate and any disputes that may arise. During the probate process, the court will also review the deceased person's will to ensure that it is valid and meets all legal requirements. If the will is contested, the court will hold a hearing to determine its validity. In addition to the distribution of assets, probate also involves the payment of taxes and other debts. Any taxes owed by the deceased person must be paid out of their estate before distribution. The law was first drafted by the National Conference of Commissioners on Uniform State Laws (NCCUSL) in 1964. The goal of the UPC was to create a standardized and simplified set of rules for the probate process across different states to improve efficiency. Before the UPC was introduced, probate laws varied significantly between states, with some having strict rules and others having minimal regulations. This inconsistency created confusion for estate executors who had to navigate different rules in different states. After five years of research and development, the UPC was finalized and introduced in 1969. States were given the option to adopt the UPC as statutory law in its entirety or select certain provisions from it. Initially, adoption of the UPC was slow, but over time, a majority of states have adopted at least some version of the code. A number of states have adopted the UPC in its entirety, while other states have adopted some provisions of the UPC but also have their own probate statutes. Over the years, the UPC has undergone several revisions to reflect changes in the law and society. Provisions for living wills, health care directives, digital assets, and electronic wills have been included. Since its inception in 1969, the UPC has been adopted by many states in different forms. Here is a list of states that have enacted the UPC: Alaska (1972) Arizona (1973) Colorado (1974) Hawaii (1996) Idaho (1971) Maine (1979) Massachusetts (2009) Michigan (1978) Minnesota (1974) Montana (1974) Nebraska (1974) New Jersey (2004) New Mexico (1975) North Dakota (1999) Pennsylvania (1979) South Carolina (1986) South Dakota (1974) Utah (1975) The Uniform Probate Code is composed of eight articles, each addressing specific aspects of probate law. This article defines key terms related to the probate process and outlines the jurisdiction of probate courts. It includes four parts: the short title, construction, general provisions, and definitions. Article II has nine parts covering topics such as intestate succession, when a person dies without a will, the elective share of surviving spouse, and exempt property and allowances. It also covers the requirements for creating a valid will and how to modify or revoke a will. This article is divided into twelve parts that outline general provisions, venue, priority, and notice requirements. It also discusses informal and formal probate proceedings, supervised administration, duties, and powers of personal representatives. Information on creditors' claims, special provisions relating to distribution, compromise of controversies, and collection of personal property are stipulated. It provides a comprehensive framework for the probate process and addresses legal matters during estate administration. Article IV addresses the appointment of personal representatives from outside the state and the process for administering estates with property in multiple states. In addition, it outlines the powers of foreign personal representatives and jurisdiction over foreign representatives. Article V discusses the protection of persons under disability and their property. It establishes guardianship and conservatorship procedures for incapacitated individuals and minors. It also addresses the protection of their assets and rights. Article VI covers non-probate transfers such as life insurance policies, retirement accounts, and trusts. Additionally, it deals with multiple-party accounts and provisions relating to the effect of death. Article VII outlines the requirements for creating a valid trust, how to modify or revoke a trust, and the duties of trustees. This has three parts dealing with trust registration, jurisdiction of court concerning trusts, and liabilities of trustees. Finally, Article VIII addresses the effective date and repealer of the Uniform Probate Code. This article establishes the effective date of the UPC and repeals any prior probate laws that are inconsistent with the UPC. The UPC offers several benefits for individuals engaged in estate planning. The UPC sets out a comprehensive framework for the administration of estates that covers all aspects of the probate process, including the appointment and removal of personal representatives, the distribution of assets, and the resolution of disputes. This uniformity helps to eliminate confusion and inconsistency in probate proceedings, which can arise when different jurisdictions have different laws and procedures. This can streamline the probate process by reducing the time, complexity, and expenses associated with probate. Additionally, the UPC eases the burden on the executor or executrix of an estate by providing clear guidelines for the administration of an estate. This can help prevent disputes and conflicts that can arise during the probate process. This can also help ease the adjustment process for individuals who have to administer an estate in a new state. If the new state has also adopted the UPC, the probate statutes are likely to be similar, making it easier for individuals to transition from one state to another. The probate process can be expensive for an executor, who may need to hire probate lawyers to navigate the complex laws of a state. However, the UPC offers a solution to this issue by simplifying potentially complicated statutes into 8 comprehensive articles. The UPC reduces probate costs for executors, as the uniformity and predictability of the code can make the process more efficient and less prone to legal challenges. The Uniform Probate Code is not without opposition and potential drawbacks. The implementation of the UPC may negatively impact attorneys and bonding companies, as the simplified probate process may reduce the need for legal services and bonding. This can lead to a decrease in revenue and job opportunities for these professionals. Critics argue that this may result in a lack of flexibility, and the uniformity may lead to a loss of diversity in probate law across states, which may not reflect the unique cultural, social, and economic conditions of each jurisdiction. The UPC may not effectively address certain issues, such as disputes over family heirlooms or other non-monetary assets. Critics also express concern over potential conflicts between state and federal law, as well as the potential for a decrease in state revenues from probate fees. The UPC is an essential law for ensuring that the probate process is fair, efficient, and consistent across different states. Its adoption by many states has helped to streamline the process and reduce the burden on courts and families alike. Probate is a complex and time-consuming process, but it is an important part of ensuring that an individual's assets are distributed according to their wishes and that all debts and taxes are properly paid. The history of the UPC is a story of ongoing evolution and refinement as legal experts and lawmakers work to create a more standardized and efficient process. There are 18 states that have enacted the UPC and many more that have adopted parts of the code. The UPC is comprised of eight articles, each addressing specific aspects of probate law that provides a comprehensive framework for estate planning that can simplify the probate process, reduce costs, and minimize conflicts among beneficiaries. Critics of the UPC worry about the potential effect on attorneys and bonding companies, conflicts between state and federal law in terms of authority, or a decrease in state revenue from probate fees. It is important to note that while the UPC has been widely adopted, each state still has its own unique laws and regulations related to probate. It is recommended to consult with an estate planning attorney for guidance on the probate process.What Is the Uniform Probate Code (UPC)?

Overview of Probate

History of the Uniform Probate Code (UPC)

States That Have Implemented the UPC

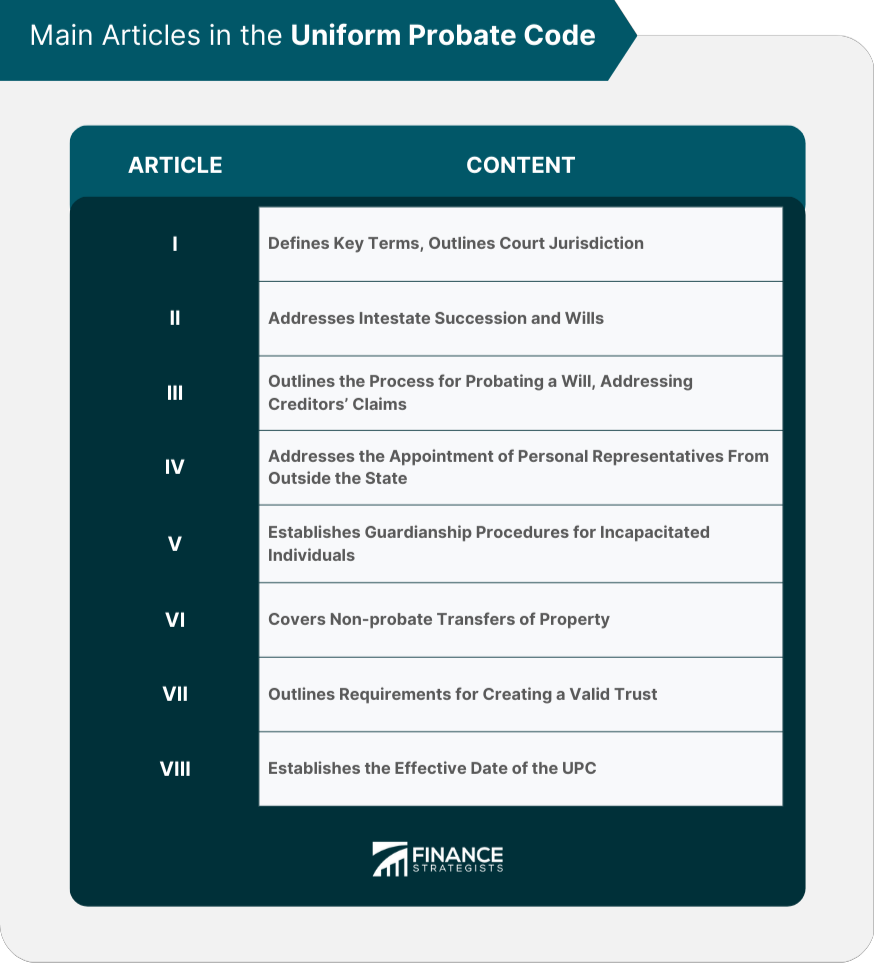

Main Articles in the UPC

Article I. General Provisions, Definitions, and Probate Jurisdiction of Court

Article II. Intestate Succession and Wills

Article III. Probate of Wills and Administration

Article IV. Foreign Personal Representatives; Ancillary Administration

Article V. Protection of Persons Under Disability and Their Property

Article VI. Non-probate Transfers

Article VII. Trust Administration

Article VIII. Effective Date and Repealer

Benefits of the UPC

Simplifies Probate Process

Eases Probate for Executor or Executrix

May Reduce Probate Costs

Oppositions to the UPC

Affects Attorneys and Bonding Companies

Removes State Authority to Create Probate Laws

Inability to Address All Issues

The Bottom Line

Uniform Probate Code (UPC) FAQs

The purpose of the UPC is to provide a comprehensive set of laws and procedures for the administration of an estate after a person's death. The code seeks to simplify the probate process, promote fairness and efficiency, and ensure that the decedent's property is distributed according to their wishes or the law. Additionally, the UPC aims to provide consistency and uniformity in probate laws across different states, thereby facilitating the administration of estates that have assets in multiple states.

It simplifies the probate process by providing a uniform set of rules and procedures, reducing the time, complexity, and expenses associated with probate. Additionally, it eases the burden on the executor or executrix of an estate by providing clear guidelines for the administration of an estate, which can help prevent disputes and conflicts that can arise during the probate process.

If you live in a state that has not adopted the Uniform Probate Code, the probate process in that state will be governed by its own state probate laws. This means that the process may be more complicated, time-consuming, and costly than if the state had adopted the UPC.

One common method is to establish a revocable living trust, which allows you to transfer ownership of your assets to the trust while you are still alive. Upon your death, the assets in the trust can be distributed to your beneficiaries without the need for probate. Other methods include joint ownership, beneficiary designations, and payable-on-death accounts.

Probate court is responsible for overseeing the administration of a deceased person's estate, including the distribution of their assets and the payment of their debts and taxes. The court determines the validity of the deceased person's will, appoint a personal representative or executor to manage the estate, and ensure that the estate is divided according to the terms of the will or state law if there is no will. The court also handles any disputes that may arise during the probate process, such as challenges to the will or disagreements among heirs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.