A charitable bequest is a provision in a person's will or estate plan that designates a specific gift to a charitable organization upon the person's death. This gift can take various forms, including a fixed sum of money, a percentage of the estate's value, specific assets (such as real estate, stocks, or artwork), or the remainder of the estate after other bequests and expenses have been fulfilled. Charitable bequests are a way for individuals to continue their legacy of giving and make a meaningful difference even after their lifetime. Specific bequests involve the donor leaving a particular asset or a fixed sum of money to a charity. These gifts can include cash, real estate, stocks, or other valuable items. Examples: Leaving $10,000 to a local animal shelter Donating a piece of art to a museum Residuary bequests are gifts made from the remaining assets of an estate after all debts, expenses, and specific bequests have been satisfied. The donor can choose to leave a percentage or the entire residue to a charity. Examples: Allocating 50% of the remaining estate to a university Bequeathing the entire residue to a medical research foundation Contingent bequests are conditional gifts that only take effect if certain circumstances occur or predetermined conditions are met. These conditions might involve the donor outliving other beneficiaries or the fulfillment of specific requirements. Examples: Leaving a sum of money to a non-profit organization if the donor's spouse predeceases them Donating assets to a charity if the intended recipient cannot accept the gift for any reason Percentage bequests involve the donor leaving a set percentage of their estate or specific assets to a charity. This type of bequest is often used when the donor wants to support multiple beneficiaries or organizations. Examples: Bequeathing 30% of an investment portfolio to a homeless shelter Allocating 10% of the estate's value to a religious institution Charitable bequests allow donors to create a lasting legacy by supporting causes that align with their values and interests. These gifts can have a significant impact on the recipient organization's ability to carry out its mission and serve the community. In many jurisdictions, charitable bequests are exempt from estate taxes and inheritance taxes, reducing the overall tax burden on the donor's estate and potentially leaving more assets available for other beneficiaries. Donors can change or revoke their bequests during their lifetime, providing flexibility in estate planning and the ability to adapt to changing circumstances. Charitable bequests can provide recipient organizations with a stable source of funding, allowing them to plan for the future and invest in long-term initiatives. Bequests can be directed toward specific programs or services, ensuring that the donor's funds are used in a way that aligns with their intentions and interests. Charitable bequests can have a significant impact on the communities served by the recipient organization, supporting vital programs and services that may not be possible without this type of financial support. Charitable bequests can be made through a will or trust, and it is essential to consult with an attorney or estate planning professional to ensure that the gift is structured correctly and complies with applicable laws. It is crucial to seek professional advice from an attorney, certified financial planner, or tax advisor to understand the implications of a charitable bequest and ensure that it aligns with the donor's overall estate planning goals. Charitable bequests can qualify for estate tax deductions, reducing the overall tax burden on the donor's estate. It is essential to consult with a tax advisor to understand the specific deductions available in your jurisdiction. In some jurisdictions, charitable bequests may also be exempt from inheritance taxes, benefiting both the donor's estate and the recipient organization. In certain cases, donating appreciated assets, such as stocks or real estate, can help donors avoid capital gains tax while still supporting their chosen charity. Before choosing a charity, it is essential to research the organization's mission, programs, and impact on the community. This information can help ensure that the donor's gift aligns with their values and intentions. Ensure that the chosen charity has tax-exempt status in your jurisdiction, as this will often impact the tax benefits associated with the bequest. Consider the types of bequests discussed earlier in this article (specific, residuary, contingent, or percentage), and choose the one that best suits your estate planning goals and desired impact. Work with an attorney or estate planning professional to draft the appropriate bequest language, ensuring that it accurately reflects your intentions and complies with applicable laws. Regularly review and update your estate planning documents, including your will or trust, to ensure that your bequest remains in line with your current wishes and circumstances. Notify the beneficiary organization of your intended bequest, as this allows them to plan for the future and express their gratitude for your support. If you have specific intentions for how your gift should be used, communicate these to the organization to ensure that your wishes are respected and carried out. Confirm that the organization has the capacity to accept and manage your gift, especially if it involves unique assets or requires ongoing management. Maintain open lines of communication with the organization's representatives to ensure a smooth transfer of assets and ongoing collaboration in the management of your gift. Charitable bequests hold immense potential for creating a lasting impact and supporting the causes that matter most to donors. By making a planned gift, individuals have the opportunity to not only shape their personal legacy but also contribute to the ongoing success of non-profit organizations and the communities they serve. The significance of charitable bequests in the world of philanthropy is undeniable. As non-profit organizations face an ever-evolving landscape of financial challenges, bequests provide a much-needed source of stability, enabling these organizations to plan and invest in long-term initiatives that drive positive change. In order to make the most of your charitable bequest and inspire others to follow suit, consider embracing the following calls to action: Spread awareness about the importance and benefits of charitable bequests. Share your insights with friends, family, and colleagues to inspire more individuals to explore planned giving as a means to support their favorite causes. Consult with professionals such as estate planning attorneys, financial planners, and tax advisors to ensure your charitable bequest is structured effectively and aligns with your overall estate planning goals. Research and choose organizations that resonate with your values and passions, and confirm their tax-exempt status to optimize the tax advantages associated with your gift. Establish open communication with your selected organization to inform them of your intended bequest, clarify your goals for the gift, and verify their ability to accept and manage the assets you plan to donate. Periodically review and update your estate planning documents, including your will or trust, to guarantee that your charitable bequest remains in harmony with your current objectives and life circumstances. By taking these proactive steps and embracing the call to action, you can play an essential role in bolstering non-profit organizations and fostering a lasting, positive impact in the world. As more people consider incorporating charitable bequests into their estate planning, together, we can fortify the philanthropic sector and work towards building a better future for generations to come.Charitable Bequests: Definition

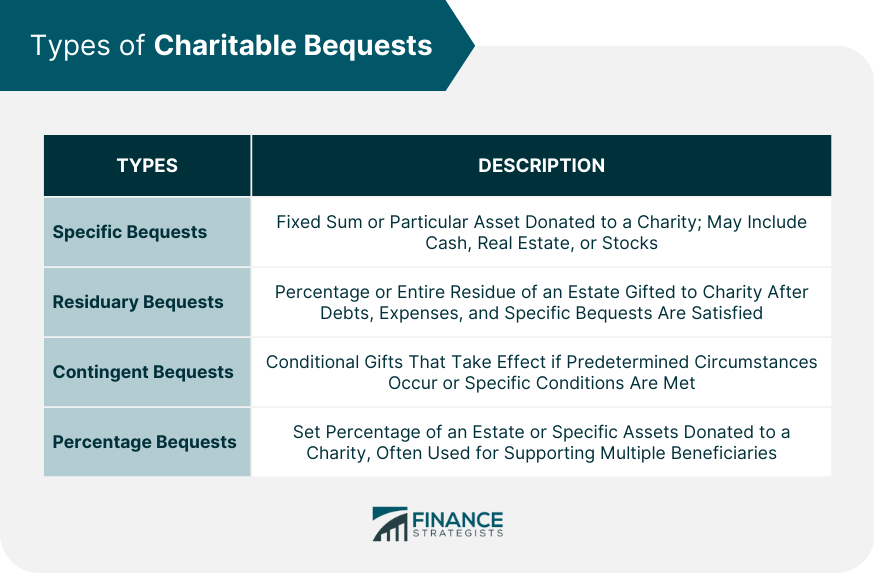

Types of Charitable Bequests

Specific Bequests

Residuary Bequests

Contingent Bequests

Percentage Bequests

Benefits of Charitable Bequests

For the Donor

Legacy and Impact

Estate Tax Benefits

Flexibility

For the Recipient Organization

Long-Term Financial Stability

Support for Programs and Services

Community Impact

Legal and Tax Considerations

Estate Planning

Will or Trust

Professional Advice

Tax Implications

Estate Tax Deductions

Inheritance Tax Considerations

Capital Gains Tax Considerations

How to Establish a Charitable Bequest

Selecting a Charity

Assessing Mission and Impact

Verifying Tax-Exempt Status

Deciding on Bequest Type and Amount

Drafting the Bequest Language

Reviewing and Updating Estate Documents

Communication With the Beneficiary Organization

Informing the Organization of the Bequest

Specifying the Use of the Gift

Ensuring the Organization's Ability to Accept the Gift

Coordinating With Organization Representatives

Conclusion

Charitable Bequests FAQs

Charitable bequests refer to gifts of property or assets that an individual leaves to a charity in their will or trust, to be distributed after their death.

You can include charitable bequests in your estate plan by specifying the charity or charities you wish to donate to in your will or trust. You can also consult with a lawyer or financial advisor to determine the best way to structure your bequest to maximize the tax benefits.

Charitable bequests can provide significant tax benefits, including reducing the amount of estate tax that may be owed upon your death, as well as providing income tax deductions for the value of the bequest.

Yes, you can change your charitable bequest at any time by updating your will or trust. It is recommended to consult with a lawyer or financial advisor to ensure that the changes are made correctly.

Common types of charitable bequests include leaving a specific amount of money or property to a charity, leaving a percentage of your estate to a charity, or designating a charity as the beneficiary of a life insurance policy or retirement account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.