A joint will is a legal document that is created and signed by two or more people, usually a married couple. It contains their final wishes regarding how they want their assets to be distributed after they die. A joint will is different from individual wills because it combines the wishes and assets of both parties into one document. Unlike individual wills, which are created and signed by one person, joint wills are created and signed by multiple people. This means that the document covers the assets of both parties, rather than each person having their own separate will. The main reason for creating a joint will is to ensure that the assets of both parties are distributed according to their wishes after they die. Joint wills are often used by married couples who want to make sure that their combined assets go to specific beneficiaries, such as children from a previous marriage. By creating a joint will, they can simplify the estate planning process and ensure that their wishes are carried out after their deaths. To create a joint will, all parties must agree on the terms, including which assets are included and what will happen to them upon their passing. The joint will can be altered or revoked while all parties are alive and in agreement. However, once one party passes away, the joint will becomes irrevocable. Typically, the surviving party inherits all assets upon the passing of the first party, and the remaining assets are distributed to the named beneficiaries after the surviving party passes away. The beneficiaries are often the children of the parties involved. Like any other will, a joint will is subject to the probate process, which involves the probate court assessing the value of the assets, paying off any outstanding debts, and distributing the remaining assets to the beneficiaries named in the will after both parties have passed away. Making a will involves several steps, and it is important to seek the advice of a professional, such as an attorney or financial planner, to ensure that the process is done properly. Here are some steps to consider when creating a joint will: Before creating a joint will, you and your partner should have a frank discussion about your wishes for the distribution of your assets. You may wish to consult with a financial planner or attorney to help you determine the best way to structure your will. You will need to choose an executor for your will. This person will be responsible for managing your estate after you pass away. It is important to choose someone who is trustworthy and who has the knowledge and experience to handle this responsibility. You and your partner will need to work with an attorney to draft the joint will. The will should outline how you want your assets to be distributed after both of you pass away. You may also wish to include any specific instructions or requests, such as the care of any pets or the donation of certain assets to charity. Once the joint will has been drafted, you and your partner will need to sign it in the presence of witnesses and a notary public. The notary will then add their official seal to the document to certify that it has been properly executed. It is important to keep the joint will in a safe and secure place, such as a fireproof safe or a safety deposit box. You should also make sure that your executor knows where the will is stored so that they can easily access it when the time comes. When one person passes away, a joint will become an unalterable legal document that the surviving spouse cannot change. This can create difficulties when the surviving spouse needs to make changes due to changing circumstances. One example is when the surviving spouse requires funds to pay for medical bills or elder care, but if the family home was included in the joint will, the surviving spouse cannot sell it to generate the necessary funds. This may cause financial distress for the surviving spouse. Another issue with a joint will is that the surviving spouse is unable to modify the beneficiaries of the estate. Typically, beneficiaries are named heirs who inherit the assets from the estate, often the children. If the surviving spouse remarries, the new spouse cannot inherit any assets included in the joint will. Additionally, the surviving spouse cannot include any new children or stepchildren as beneficiaries, which could create complications if family dynamics change. Lastly, it is worth noting that the surviving spouse cannot modify how assets are distributed in the joint will. This can lead to difficulties if a beneficiary develops a condition that requires a modification to the will, such as an addiction, mental illness, or disability. For instance, a parent may wish to set up a trust to ensure that the child cannot spend their inheritance recklessly. Unfortunately, the irrevocable nature of the joint will make such changes impossible. Creating a joint will provides various benefits. These include: A joint will provides a sense of finality when it comes to the distribution of assets after both partners pass away. The will cannot be changed or revoked without the consent of both parties. This ensures that both parties have complete control over the distribution of their assets, and neither party can change the terms of the will without the agreement of another party. Joint wills are generally less expensive than two separate wills. This is because the will covers both parties' assets and wishes, and there is no need to create two separate documents. Furthermore, since a joint will involve only one legal document, the legal fees are often lower than if two separate wills were created. Joint wills can ensure that the wishes of both parties are honored after they pass away. For example, if one partner wants to leave their assets to a particular charity, and the other partner agrees, the joint will include this provision. Joint wills can help avoid disputes between family members over an inheritance. Since the terms of the will are set out clearly, there is less room for misunderstandings or disagreements. This can also reduce the likelihood of costly legal battles over the estate after both parties have passed away. A joint will can provide some reassurance to a surviving spouse that they will be able to retain property and assets accumulated during the marriage. This is particularly important in second marriages, where there may be children from previous marriages. Joint wills can simplify estate planning, particularly if the couple has similar wishes for the distribution of their assets. By creating a joint will, the couple can ensure that their wishes are clearly laid out and that there is no confusion about their intentions. A joint will also come with potential disadvantages. These include: One of the biggest drawbacks of joint wills is that they become irrevocable after one of the parties passes away. This means that the surviving party cannot change the terms of the will, even if their circumstances change or they change their mind about how they want to distribute their assets. Joint wills can limit the control that each party has over their own assets. For example, if one party wants to sell their share of the marital home, they may not be able to do so without the consent of the other party. Naming someone other than an individual as a beneficiary in a joint will can create issues. For example, if the couple plans to leave assets to a charity, and that charity shuts down, it could cause problems during the probate process when it comes time to distribute the estate. Joint wills may not be appropriate for couples with different or unique needs. For example, if one party has children from a previous marriage, they may need to have a separate will to ensure that their children are adequately provided for. Joint wills may not allow for flexibility in the distribution of assets. For example, if one party wants to change how their assets will be distributed, they may not be able to do so without the agreement of the other party. Joint wills and mirror wills are both types of wills that are commonly used by married couples. However, there are some key differences between the two. A joint will is a single document that is executed by two or more people. It serves as the last will and testament for all parties involved and designates how assets should be distributed upon the death of one or both parties. The main advantage of a joint will is that it ensures that both parties are in complete agreement with the terms of the will. However, once one party passes away, the joint will becomes irrevocable, meaning that it cannot be changed or modified. This can be a disadvantage if one party wishes to make changes to the will after the death of the other party. On the other hand, mirror wills are two separate wills that contain nearly identical provisions. The will of one spouse “mirrors” the contents of the will of the other spouse. This means that either spouse can independently alter their own will without consulting the other. The main advantage of mirror wills is that they offer more flexibility compared to joint wills. If one spouse wishes to make changes to their will after the death of the other spouse, they are free to do so. However, this can also be a disadvantage, as it may lead to disagreements between the surviving spouse and the beneficiaries of the deceased spouse. The choice between a joint will and a mirror will depend on the individual circumstances of each couple. Joint will provide more certainty and agreement, but less flexibility, while mirror will offer more flexibility but less agreement. It is necessary to carefully consider the advantages and disadvantages of each option before making a decision. A joint will is a legal document created and signed by two or more people, typically a married couple, to distribute their assets after they die. While it provides finality and control, cost-effectiveness, and ensures wishes are honored, it also has potential disadvantages such as irrevocability, limited control, and complications when one party dies. Therefore, it is essential to weigh the pros and cons before deciding to create a joint will. If you are considering creating a joint will or any other estate planning document, it is highly recommended that you seek advice from an estate planning attorney or a financial advisor.What Is a Joint Will?

How Does a Joint Will Work?

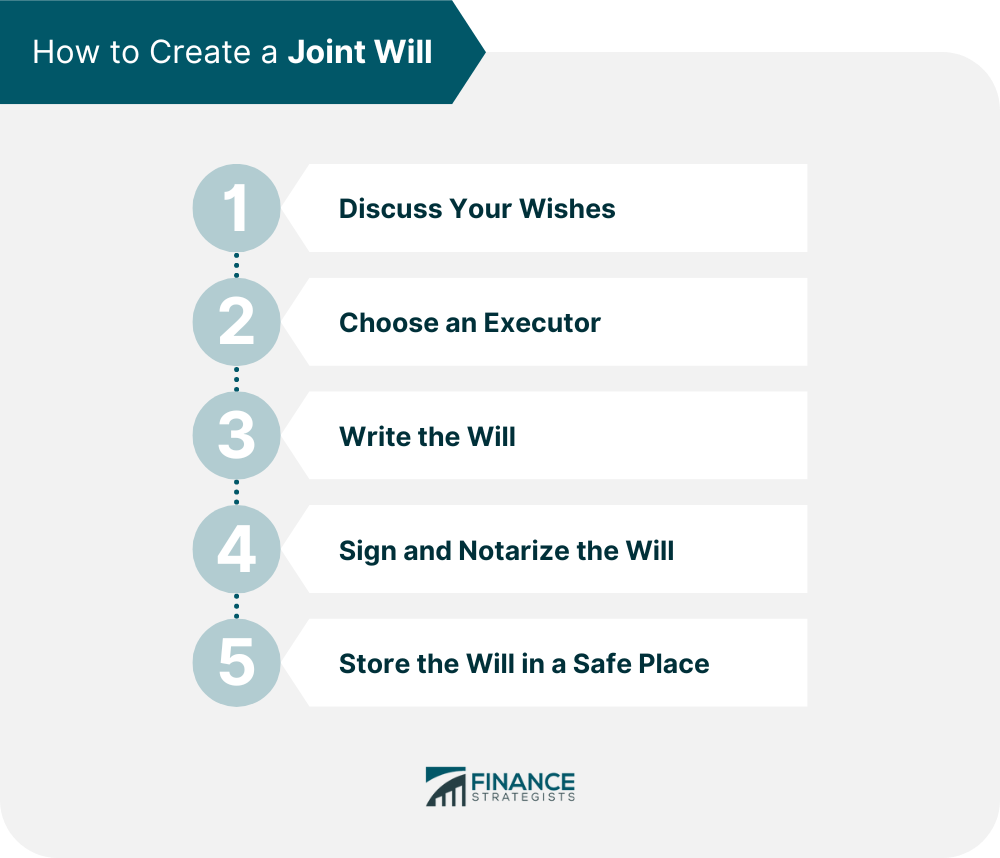

How to Create a Joint Will

Step 1: Discuss Your Wishes

Step 2: Choose an Executor

Step 3: Write the Will

Step 4: Sign and Notarize the Will

Step 5: Store the Will in a Safe Place

What Happens With a Joint Will When One Person Dies?

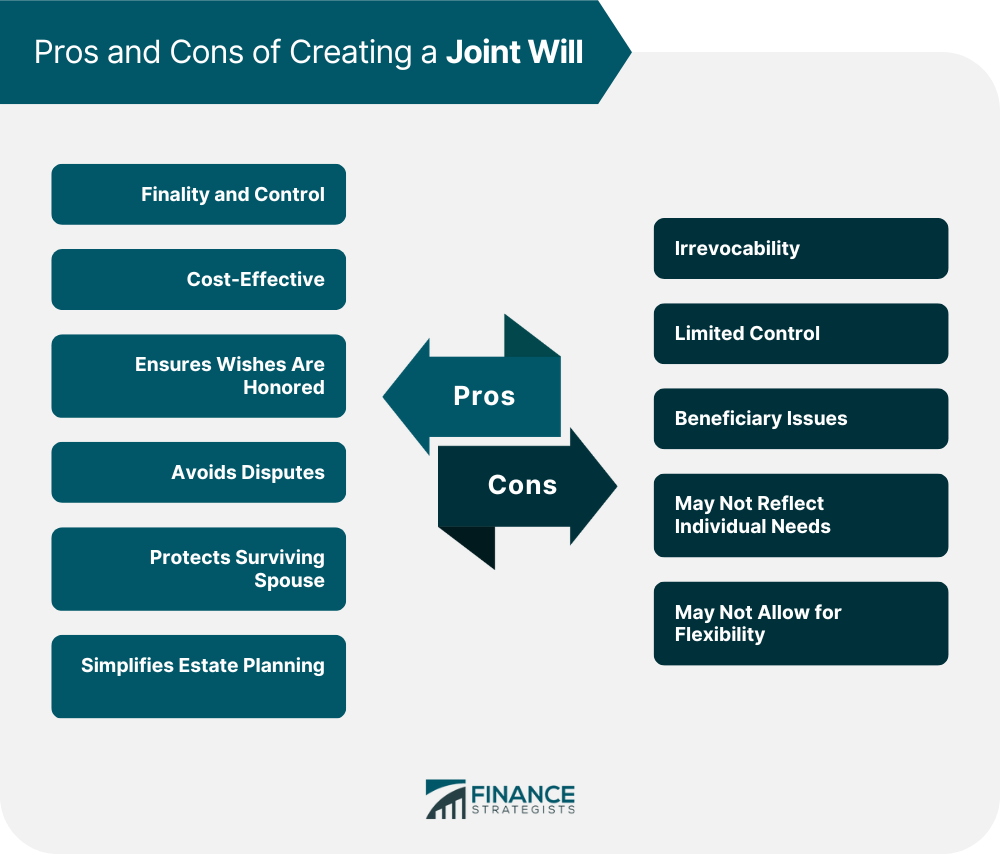

Pros of Creating a Joint Will

Finality and Control

Cost-Effective

Ensures Wishes are Honored

Avoids Disputes

Protects Surviving Spouse

Simplifies Estate Planning

Cons of Creating a Joint Will

Irrevocability

Limited Control

Beneficiary Issues

May Not Reflect Individual Needs

May Not Allow for Flexibility

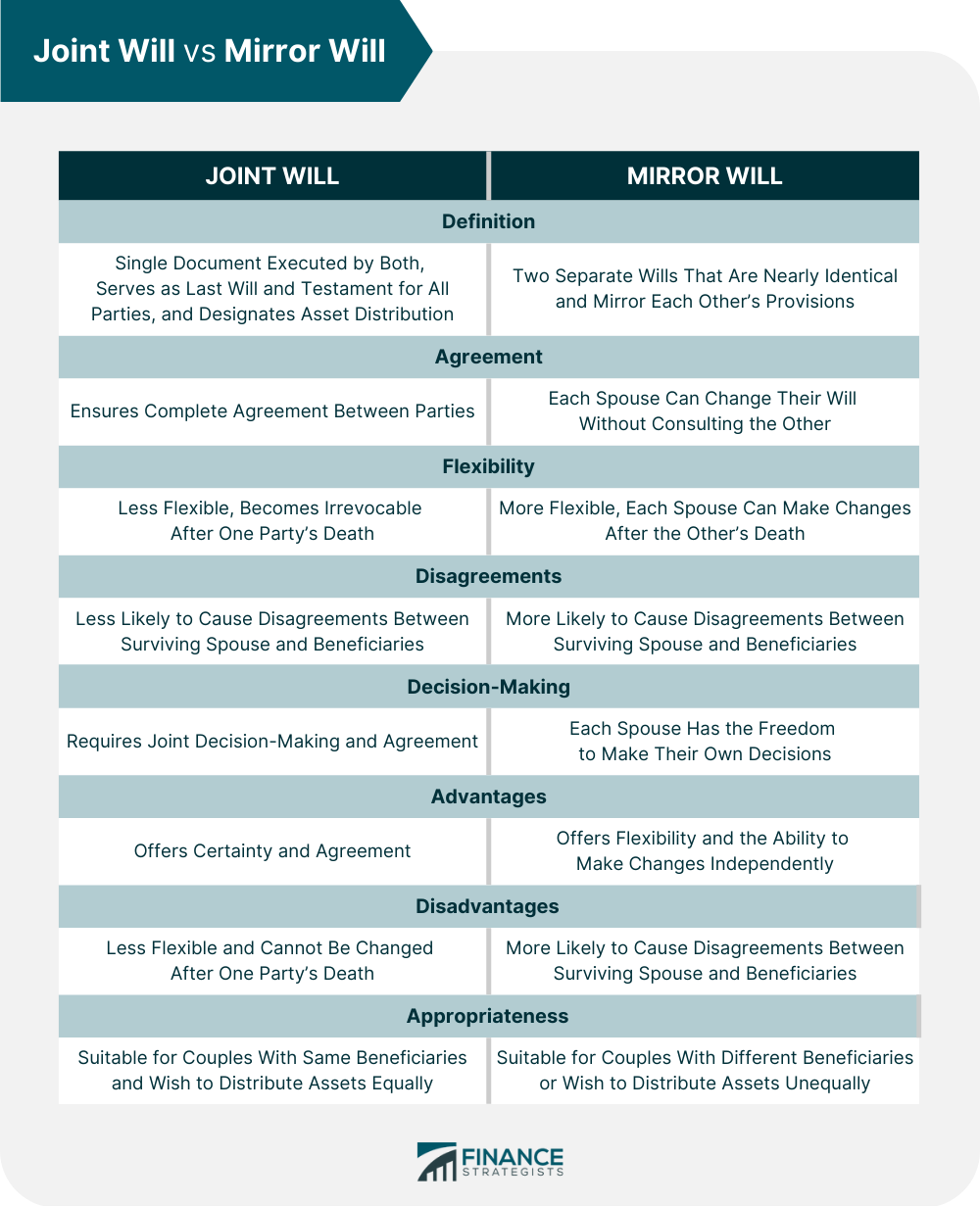

Joint Will vs Mirror Will

Final Thoughts

Joint Will FAQs

A joint will is a legal document created by two parties in which they agree on how their assets will be distributed after both of them die. The will is binding on both parties and cannot be changed after one of the party dies.

No, a joint will is a single document that is binding on both parties, while a mirror will is essentially two separate wills that mirror the terms of one of the wills.

The benefits of creating a joint will include simplification of estate planning, cost-saving, and preventing disputes between family members after both spouses pass away.

The downsides of creating a joint will include limiting the control of the surviving spouse over assets, complicating the probate process, and not being able to change the will after one spouse has died.

No, a joint will cannot be changed after one spouse has died. The will is binding on both parties and remains in effect until the second spouse dies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.