Achieving a Better Life Experience (ABLE) accounts are tax-advantaged savings accounts for individuals with disabilities, established by the ABLE Act of 2014 in the United States. ABLE accounts are designed to help individuals with disabilities and their families save and pay for disability-related expenses without jeopardizing their eligibility for public benefits such as Medicaid and Supplemental Security Income (SSI). To be eligible for an ABLE account, the individual must have a qualifying disability that began before the age of 26. The disability must meet the Social Security Administration's definition of significant functional limitations. ABLE accounts offer several tax advantages, including tax-free earnings on investments and tax-free withdrawals for qualified disability expenses. Funds held in an ABLE account generally do not count as a resource for determining eligibility for means-tested public benefits, such as Medicaid and SSI, up to certain limits. ABLE account owners can use the funds for a wide range of qualified disability expenses, providing flexibility in meeting their unique needs and goals. The total annual contribution limit for an ABLE account is currently set at $17,000 per year from all sources, including family, friends, and the account beneficiary. Lifetime contribution limits for ABLE accounts are determined by each state and are generally equal to the state's limit for 529 college savings plans. ABLE account owners can roll over funds from one ABLE account to another, including across state lines, without tax consequences, subject to certain restrictions. Qualified disability expenses are any expenses related to the account beneficiary's disability that help maintain or improve their health, independence, or quality of life. Examples of qualified disability expenses include, but are not limited to, education, housing, transportation, employment support, assistive technology, personal support services, and health care expenses. Non-qualified expenses may be subject to income tax and a 10% additional tax on the earnings portion of the withdrawal. Individuals and families can compare different state ABLE programs and choose the one that best meets their needs. Each state's ABLE program has different fees, investment options, and features, so it is important to compare them carefully. To open an ABLE account, the eligible individual or their authorized representative must provide personal information, including their name, address, Social Security number, and disability-related information. To open the account, an initial deposit is typically required. The amount required may vary by state and program. ABLE account owners or their authorized representatives can select an investment option that meets their goals and risk tolerance. Investment options may include mutual funds, exchange-traded funds (ETFs), and other investment vehicles. Account owners or their authorized representatives can manage the ABLE account, including selecting investment options, tracking contributions, and making withdrawals for qualified disability expenses. It is important to regularly review and adjust investment options and contributions as needed. Special Needs Trust is a legal arrangement in which a trustee holds and manages assets for the benefit of a person with a disability. A Special Needs Trust can hold a variety of assets, including cash, stocks, real estate, and other investments. The trustee has the authority to use the trust funds to pay for the beneficiary's needs that are not covered by government benefits or insurance. SNTs can be created by a parent, grandparent, or legal guardian of the beneficiary, or by the beneficiary themselves, if they have the legal capacity to do so. The key difference between ABLE accounts and Special Needs Trusts is that ABLE accounts are savings accounts that can be used for a limited set of disability-related expenses. On the other hand, Special Needs Trusts are legal arrangements that can hold a wide range of assets and can be used to pay for a broader range of expenses. Additionally, ABLE accounts are typically more accessible and less expensive to set up and maintain than SNTs. However, SNTs can offer more flexibility and control over how the trust funds are managed and distributed. Here are some general guidelines to help you decide which option may be best for your situation: If you anticipate saving less than $100,000 for the benefit of the person with a disability, an ABLE account may be the most appropriate choice. ABLE accounts have annual contribution limits, and the total balance in the account cannot exceed a certain amount (currently $529,000 in most states). If you need to save more than this, a Special Needs Trust may be a better option. ABLE accounts are specifically designed to pay for certain disability-related expenses, such as education, housing, transportation, healthcare, and assistive technology. If you need to save for other expenses, such as legal fees or travel, a Special Needs Trust may be a more flexible option. ABLE accounts are available only to individuals who were diagnosed with a qualifying disability before age 26. If the beneficiary is older than 26 or does not meet the disability criteria for an ABLE account, a Special Needs Trust may be the only option. Special Needs Trusts offer more flexibility and control over how the funds are managed and distributed. The trustee can invest the funds in a variety of assets and can use the funds to pay for a broader range of expenses. If you want more control over the funds, or if the beneficiary has complex financial needs, a Special Needs Trust may be the better choice. ABLE accounts play a crucial role in helping individuals with disabilities and their families save for disability-related expenses without jeopardizing their eligibility for essential public benefits. The tax advantages and flexibility in the use of funds make ABLE accounts an important financial planning tool for those with disabilities. When opening and managing an ABLE account, individuals and families should carefully consider factors such as eligibility, contribution limits, qualified disability expenses, and available investment options. Comparing different state ABLE programs and seeking professional financial advice can help ensure the account is tailored to the unique needs and goals of the individual with disabilities. As legislative efforts continue to expand and improve ABLE accounts, individuals with disabilities and their families should stay informed about potential changes and how they may impact their financial planning. Being proactive and knowledgeable about ABLE accounts can help ensure a more secure financial future for those with disabilities.What Are ABLE Accounts?

Benefits of ABLE Accounts

Tax Advantages

Impact on Public Benefits

Flexibility in Use of Funds

ABLE Accounts Contribution Limits and Rules

Annual Contribution Limits

Lifetime Contribution Limits

Rollover Rules

Qualified Disability Expenses

Definition of Qualified Disability Expenses

Examples of Qualified Disability Expenses

Non-qualified Expenses and Consequences

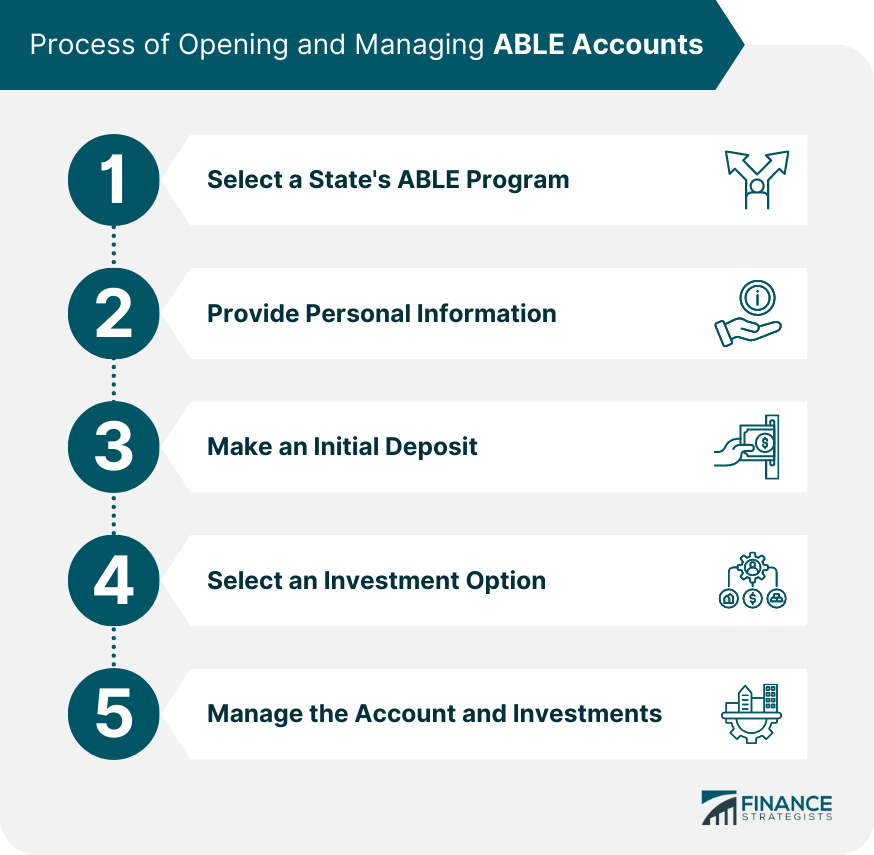

Process of Opening and Managing ABLE Accounts

Select a State's ABLE Program

Provide Personal Information

Make an Initial Deposit

Select an Investment Option

Manage the Account and Investments

ABLE Account and Special Needs Trusts

Differences Between ABLE Accounts and Special Needs Trusts

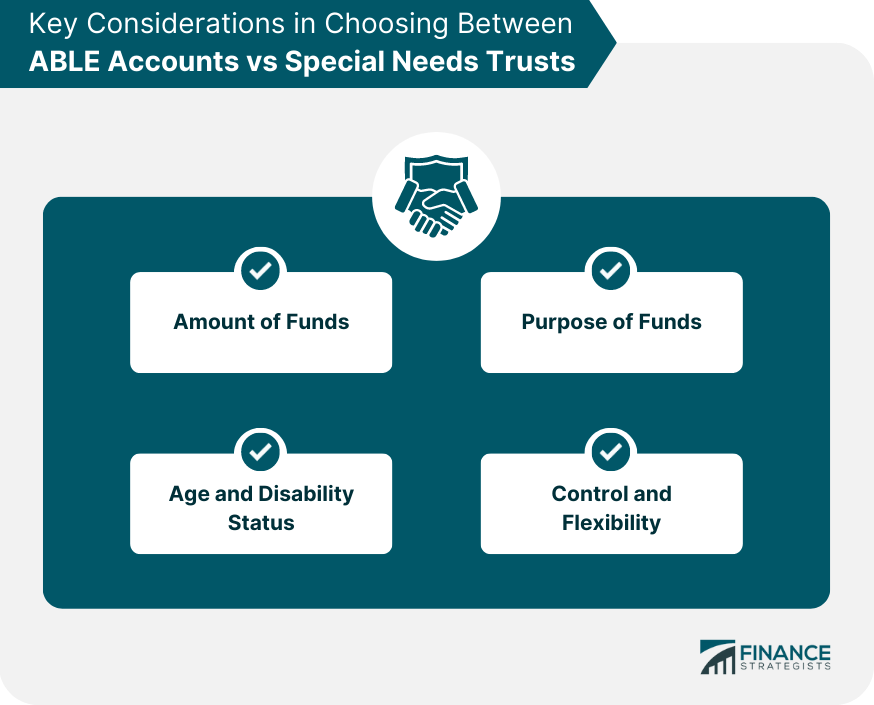

When to Consider an ABLE Account vs a Special Needs Trust

Amount of Funds

Purpose of Funds

Age and Disability Status

Control and Flexibility

Conclusion

ABLE Accounts FAQs

An ABLE account is a tax-advantaged savings account for people with disabilities that was created by the Achieving a Better Life Experience (ABLE) Act of 2014.

To be eligible to open an ABLE account, a person must have a significant disability that was present before age 26.

The benefits of an ABLE account include tax-free growth on savings, tax-free withdrawals for qualified disability expenses, and the ability to save without jeopardizing eligibility for means-tested benefits such as Medicaid and Supplemental Security Income (SSI).

ABLE account funds can be used for a variety of expenses related to the beneficiary’s disability, including education, housing, transportation, assistive technology, personal support services, and more.

Yes, there are annual contribution limits for ABLE accounts, which vary by state. As of 2024, the annual contribution limit for most states is $18,000 per year, but some states have higher limits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.