An accounting specialist, often called accounts payable or receivable clerk, is a finance professional who keeps track of financial transactions within a company. This role involves recording, summarizing, and analyzing a business's financial transactions to ensure efficiency and regulatory compliance. They hold an essential position in the finance team, and their work contributes significantly to a company's financial health. An accounting specialist is adept at using various accounting software and systems, reconciling bank statements, and managing invoices and tax payments. Additionally, they liaise with other departments to address discrepancies, create and present reports to senior management, and assist in budget planning and auditing processes. Accounting specialists must have excellent numerical proficiency and strong data analysis skills, enabling them to interpret complex financial data effectively. This role requires them to be adept at using a variety of accounting software, spreadsheets, and databases for managing and reporting financial information. Additionally, they need to have a deep understanding of financial principles and accounting procedures, allowing them to maintain accurate financial records. Moreover, proficiency in Generally Accepted Accounting Principles (GAAP) is critical because these standards form the backbone of all accounting practices and financial reporting. An accounting specialist should also be familiar with tax laws and regulations to ensure that the company's accounting processes are compliant with the law. While accounting is undoubtedly number-centric, the human element is also a vital part of the equation. Accounting specialists often need to coordinate with different departments, making strong verbal and written communication skills essential for explaining complex financial concepts in easy-to-understand terms. Problem-solving abilities are also crucial as accounting specialists are likely to encounter a range of challenges, such as discrepancies in financial data, and they must have the analytical acumen to resolve these efficiently. They must also possess a keen attention to detail to spot any errors or inconsistencies in financial reports. An aspiring accounting specialist typically needs at least a bachelor's degree in accounting or a related field. This formal education equips them with the fundamental knowledge of accounting principles and business practices. Professional certifications can bolster the credibility of an accounting specialist. Certified Public Accountants (CPAs) or Certified Management Accountants (CMAs) are among the preferred credentials in this field. These certifications showcase an individual's commitment to professional growth and their adeptness at complex accounting tasks. The cornerstone of an accounting specialist's role is the management of financial records. They are responsible for accurately recording all financial transactions, whether they are sales revenues, purchase expenses, or operational costs. These records form the basis of a company's financial health and play a crucial role in decision-making processes. Accounting specialists play an instrumental role in preparing and maintaining important financial reports. These reports can vary from profit and loss statements, and balance sheets, to cash flow statements. Accurate and timely reports aid management in making strategic decisions and provide transparency to stakeholders. In the day-to-day operations, an accounting specialist is tasked with processing transactions which include invoicing, payments, and adjustments. Following the processing, they ensure the company's ledgers are updated. This not only aids in keeping track of financial transactions but also ensures financial data integrity. The remit of an accounting specialist's role extends to tasks such as invoice processing, bank reconciliations, and payroll administration. These tasks are vital to the smooth operation of an organization's finance department. They ensure all parties involved with the organization, be it vendors, banks, or employees, are satisfied timely and accurate. On occasion, an accounting specialist may be called upon to assist with internal audits. This task involves scrutinizing the organization's financial operations to ensure compliance with standard accounting practices and regulatory requirements. Their keen eye for detail and extensive knowledge of accounting makes them an invaluable resource during these audits. When it comes to financial forecasting and budgeting, the expertise of an accounting specialist is indispensable. They use their understanding of financial trends and company performance to predict future financial outcomes. This forecast then aids in devising budgets that align with the organization's goals and objectives. An accounting specialist may also assist with financial planning and analysis, tasks that require a high level of expertise and experience in the field. They may be asked to analyze the financial status of the company and provide insights to guide strategic planning. Their analysis can shed light on potential risks and opportunities, shaping the financial strategy of the company. An accounting specialist's day usually starts with checking and updating the company's financial records. This process involves going through the transactions recorded from the previous day, verifying their accuracy, and making any necessary adjustments. This ensures the company's financial data is always up-to-date and accurate, paving the way for informed financial decision-making. An essential part of the accounting specialist's day revolves around handling a multitude of financial transactions. These transactions may include sales, purchases, expense reports, and other forms of financial activities. The goal is to ensure all transactions are recorded properly, contributing to the overall accuracy of the company's financial records. The daily routine of an accounting specialist also involves invoice reconciliation. They compare invoices with the corresponding purchase orders and delivery notes to ensure they match. If any discrepancies arise, the specialist is responsible for resolving them, which often involves contacting the supplier or the concerned department within the company. Accounting specialists spend a significant part of their day liaising with suppliers and customers. This might involve answering queries about invoices, addressing concerns about payments, or negotiating terms. Through their effective communication, they ensure that all financial obligations are met and maintain good relationships with the company's suppliers and customers. Every once in a while, an accounting specialist may face the challenge of overdue payments. Whether it's a customer who has not paid their invoice or a pending payment to a supplier, these scenarios require the specialist to put their negotiation skills into action. They need to communicate effectively, negotiate payment terms, and find a solution that suits both parties. Budget overruns are another unique challenge that an accounting specialist may encounter. This requires a keen eye for detail and a strong understanding of financial planning. The specialist needs to identify the cause of the overrun, work with the relevant department to adjust plans, and put measures in place to prevent future overruns. Financial discrepancies can arise in any organization, and when they do, the accounting specialist is often the first to spot them. These discrepancies may indicate errors in recording transactions, potential fraud, or non-compliance with financial regulations. Tackling such situations requires critical thinking and a comprehensive understanding of financial regulations and company policies. They need to investigate the issue, correct the error, and implement controls to prevent similar discrepancies in the future. Accounting specialists help a business maintain financial health by accurately tracking income and expenses, ensuring timely payments, and keeping a close eye on cash flow. They contribute to financial stability and help identify areas for cost reduction or revenue growth. Accounting specialists play a crucial role in ensuring a company adheres to financial regulations. They assist in preparing for external audits and ensure that financial reports comply with local, state, and federal law. Entry-level roles in the accounting field can range from junior accounting clerks to accounts payable/receivable associates. These roles offer a stepping stone to the position of an accounting specialist. With experience, accounting specialists can progress to roles such as senior accountant, accounting manager, or even controller. They might also branch out into specialized roles like tax specialists or financial analysts. The base salary forms the foundation of an accounting specialist's remuneration. While this varies based on the role, experience, and location, these professionals can generally expect a competitive salary that is in line with their technical skills and experience. For instance, specialists working in metropolitan cities may have a higher base salary compared to those in less urbanized areas due to the difference in cost of living. In addition to the base salary, an accounting specialist's compensation package may also include various benefits, bonuses, and potential profit-sharing. Benefits often comprise health insurance, retirement plans, and paid time off. Bonuses and profit-sharing, on the other hand, are performance-based and dependent on both the individual's and the company's performance. The educational background and certifications of an accounting specialist can considerably influence their earning potential. Specialists who have obtained advanced degrees in accounting, finance, or related fields are often in a position to command higher salaries. Similarly, professional certifications such as CPA or CMA can boost the earning prospects of an accounting specialist. These qualifications demonstrate a high level of competency and expertise in the field, which employers value highly. Accounting specialists with particular areas of expertise, especially in high-demand fields, often enjoy increased earning potential. Those specializing in areas like tax compliance, financial analysis, or financial forecasting, for example, can typically command higher salaries. This increased earning potential is due to the additional skills and training required in these specializations, which increase their value within a company. The extent of an accounting specialist's professional experience is another crucial factor that affects their earnings. As these professionals progress in their careers, they accumulate valuable knowledge and skills that equip them to handle complex responsibilities more efficiently. As such, accounting specialists with more years of experience under their belt are often better compensated compared to those in the early stages of their careers. This trend reflects the value that organizations place on experienced professionals in maintaining and enhancing their financial health. An accounting specialist, also known as accounts payable or receivable clerk, tracks financial transactions, ensures regulatory compliance, and contributes to a company's financial health. They possess technical skills such as numerical proficiency, accounting software proficiency, and knowledge of financial principles and GAAP. Interpersonal skills like strong communication, problem-solving, and attention to detail are vital. Academic requirements include a bachelor's degree in accounting, while professional certifications like CPA or CMA enhance credibility. Their roles encompass financial records management, report preparation, transaction processing, invoice reconciliation, and payroll administration. They handle unique scenarios like overdue payments, budget overruns, and financial discrepancies. Accounting specialists play a significant role in maintaining financial health, regulatory compliance, and offer career growth opportunities. Remuneration depends on factors like education, certifications, specialized expertise, and experience.What Is an Accounting Specialist?

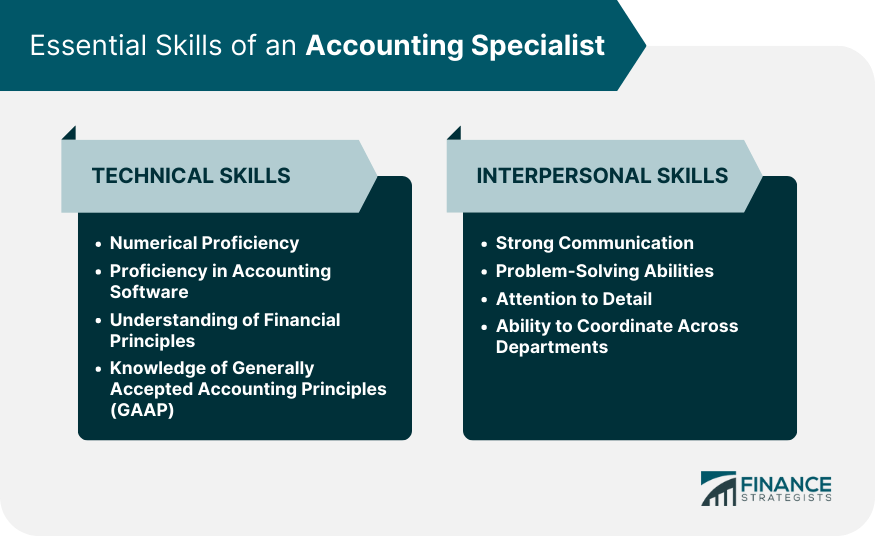

Essential Skills of an Accounting Specialist

Technical Skills

Interpersonal Skills

Requirements and Certifications

Academic Requirements

Professional Certifications

Roles and Responsibilities of an Accounting Specialist

Key Duties

Financial Records Management

Preparation and Maintenance of Financial Reports

Transaction Processing and Ledger Updates

Invoice Processing, Bank Reconciliation, and Payroll Administration

Special Tasks and Assignments

Internal Audits

Financial Forecasting and Budgeting

Assisting With Financial Planning and Analysis

Daily Life of an Accounting Specialist

Routine Operations

Checking and Updating Financial Records

Transaction Management

Invoice Reconciliation and Discrepancy Resolution

Communication With Suppliers and Customers

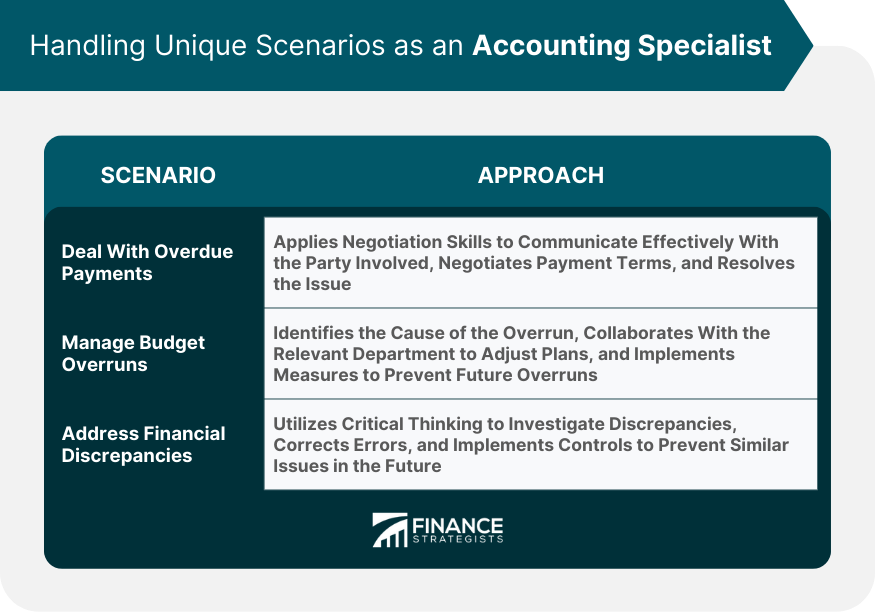

Handling Unique Scenarios

Dealing With Overdue Payments

Managing Budget Overruns

Addressing Financial Discrepancies

Significance of an Accounting Specialist in Business Operations

Enhance Financial Health

Ensure Regulatory Compliance

Exploring the Career Path for an Accounting Specialist

Beginning the Journey: Entry-Level Roles

Climbing the Ladder: Opportunities for Growth

Remuneration Expectations for an Accounting Specialist

Understanding the Pay Structure

Base Salary

Benefits, Bonuses, and Profit-Sharing

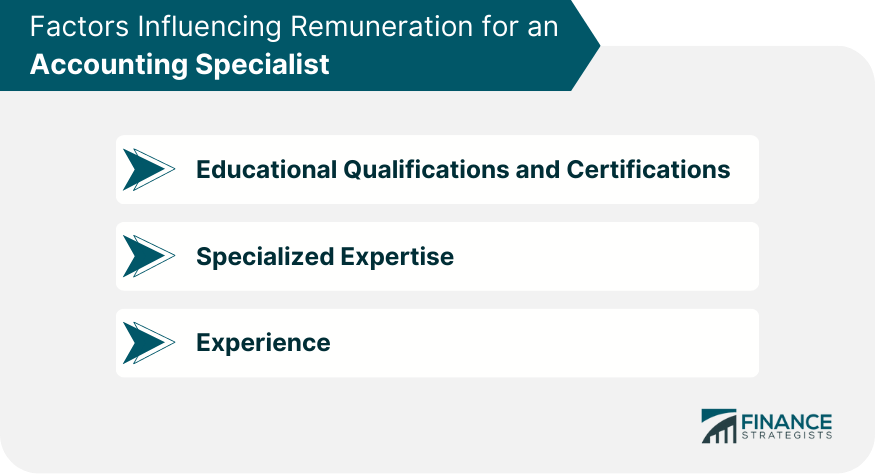

Factors That Impact Earnings

Educational Qualifications and Certifications

Specialized Expertise

Experience

Final Thoughts

Accounting Specialist FAQs

An accounting specialist manages financial records, prepares financial reports, processes transactions, and handles tasks like invoice processing and payroll administration.

An accounting specialist needs strong numerical proficiency, data analysis skills, proficiency in accounting software, an understanding of financial principles, and good interpersonal skills.

An accounting specialist typically needs a bachelor's degree in accounting or a related field. Professional certifications like CPA or CMA are also beneficial.

An accounting specialist helps enhance a business's financial health by accurately tracking income and expenses. They also ensure compliance with financial regulations.

The earnings of an accounting specialists are influenced by their level of experience, geographical location, level of education, professional certifications, and area of specialization.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.