The Association of Chartered Certified Accountants (ACCA) is a highly esteemed professional accountancy body based in the United Kingdom. It offers the Chartered Certified Accountant qualification (ACCA or FCCA), renowned worldwide as one of the most prestigious designations in accountancy. ACCA provides a robust framework for education and support to its members, ensuring their ongoing professional development and upholding the highest standards of professionalism and ethics. With its global recognition, ACCA benefits its members and contributes significantly to the global economy. ACCA's educational structure is designed to equip aspiring accountants with a comprehensive knowledge of various accountancy, finance, and management areas. The qualification involves a series of examinations that rigorously test candidates' understanding and application of these subjects. The exams cover various topics, including financial accounting, management accounting, taxation, and auditing. Individuals become ACCA members after completing the ACCA exams and fulfilling the practical experience requirement. The designation of Chartered Certified Accountant (ACCA or FCCA) is bestowed upon them. As members, accountants have access to a wealth of resources, networking opportunities, and professional support provided by ACCA. ACCA places a strong emphasis on ethical standards and professionalism. All members are expected to adhere to a professional code of ethics that outlines the principles of integrity, objectivity, professional competence, confidentiality, and professional behavior. By maintaining these high ethical standards, ACCA members contribute to the reputation and trustworthiness of the accounting profession. ACCA has a widespread global presence, with over 200,000 members and 500,000 students in over 180 countries. The qualification is highly respected and recognized worldwide, enabling ACCA members to pursue rewarding career opportunities internationally. The global recognition of ACCA facilitates mobility and enhances the professional reputation of its members. One of the significant benefits of attaining the ACCA qualification is the acquisition of a comprehensive skill set. The program encompasses various subjects, enabling accountants to develop expertise in various business areas, including financial management, strategic planning, and risk management. This diverse skill set equips ACCA members to contribute effectively to the growth and success of organizations in different sectors. The ACCA qualification is internationally recognized and respected by employers across the globe. It is valued for its rigorous curriculum and high standards of professionalism. Holding the ACCA designation enhances an accountant's employability and provides opportunities to work in different countries and industries. The global recognition of ACCA opens doors to many job prospects and career advancement. ACCA offers flexibility in terms of career choices and job roles. Accountants with ACCA qualifications can work in diverse sectors, including public practice, commerce and industry, government organizations, and the nonprofit sector. ACCA's versatility opens up many career opportunities, from financial accounting and auditing to management accounting, taxation, and consultancy. ACCA members can adapt their expertise to suit various roles and industries, making them highly sought after by employers. Being part of ACCA grants accountants access to a vast professional network. ACCA provides numerous networking events, conferences, and online platforms where members can connect and engage with fellow professionals, employers, and industry experts. This network fosters collaboration, knowledge sharing, and career development opportunities. By leveraging this extensive professional network, ACCA members can broaden their horizons, gain insights, and establish valuable connections within the global accounting community. Pursuing the ACCA qualification requires a significant investment of both time and finances. The rigorous program means that candidates must devote substantial time to study and prepare for the exams. Additionally, registration fees, examination fees, and costs are associated with study materials and resources. Aspiring ACCA members must carefully consider the time and financial commitment required before embarking on the journey. ACCA exams are renowned for their difficulty. The comprehensive coverage of subjects and the depth of knowledge required make them challenging to pass. Candidates need to thoroughly understand the concepts and demonstrate the ability to apply them in practical scenarios. It is essential to allocate sufficient time for exam preparation and adopt effective study strategies to increase the chances of success. Many individuals pursuing the ACCA qualification are working professionals simultaneously. Balancing the demands of work and study can be demanding and require strong time management skills. The commitment to both professional responsibilities and exam preparation can create challenges, and individuals need to find a suitable balance to ensure they can excel in both areas. To maintain ACCA membership, accountants are required to undertake Continuous Professional Development (CPD). This involves regularly updating their knowledge and skills through relevant training, seminars, and other learning opportunities. While CPD ensures that ACCA members stay up-to-date with industry developments, it requires additional time, effort, and sometimes financial investment. ACCA plays a significant role in shaping and influencing accounting standards globally. The association actively participates in discussions and consultations on developing international accounting standards and regulations. ACCA's insights and contributions help ensure that accounting standards reflect the needs of businesses and stakeholders, promoting transparency, comparability, and reliability in financial reporting. ACCA is a strong advocate for ethical practices within the accounting profession. The association places great importance on its members adhering to high ethical standards. ACCA's Code of Ethics and Conduct provides clear guidelines and principles that members must follow. By promoting ethical behavior and integrity, ACCA maintains public trust in accounting. ACCA's global presence and its members' expertise significantly impact the global business environment. ACCA professionals contribute to the effective functioning of organizations by providing sound financial management, strategic advice, and risk assessment. The skills and knowledge possessed by ACCA members enable them to play a vital role in driving business growth, economic stability, and financial decision-making worldwide. ACCA's commitment to maintaining high ethical standards and professionalism among its members contributes to public trust in the accounting profession. The association's rigorous qualification process and focus on ethical conduct help build confidence in financial reporting and business practices. ACCA members are seen as trusted advisors, providing assurance and ensuring the integrity of financial information. Before embarking on the ACCA qualification journey, it is crucial to understand its structure. Familiarize yourself with the various examination levels, the number of papers, and the specific subjects covered in each level. Understanding the qualification structure will help you plan your study schedule and track your progress effectively. Preparing for ACCA exams requires a structured and disciplined approach. Allocate sufficient time for studying each subject and create a study plan that suits your learning style. Utilize study resources such as textbooks, online materials, and practice questions to enhance your understanding of the topics. It is also beneficial to join study groups or seek guidance from experienced professionals to gain insights and tips for exam preparation. A well-structured study plan is crucial for success in ACCA exams. Consider the exam timetable and allocate appropriate study time for each subject. Break down the topics into manageable sections and create a study schedule that allows for revision and practice. Regularly evaluate your progress and make adjustments to your study plan as needed. Additionally, adopt effective study techniques such as active learning, practicing past exam questions, and seeking clarification on challenging topics. ACCA strongly emphasizes maintaining high ethics and professional conduct among its members. The association has a robust disciplinary process to address any breaches of ethical standards. ACCA members are expected to uphold integrity, objectivity, professional competence, confidentiality, and professional behavior in all their professional endeavors. ACCA's Code of Ethics and Conduct provides clear guidelines for members to follow in their professional practice. It outlines the fundamental principles that underpin ethical behavior in the accounting profession. The code is a reference for ACCA members when making ethical decisions and ensures consistency and integrity in their professional conduct. ACCA actively promotes ethical decision-making among its members through various initiatives. The association provides ethics-focused training and workshops to enhance members' understanding of ethical issues and dilemmas in their professional roles. ACCA also emphasizes the importance of ethical behavior in its examinations, reinforcing the significance of ethical conduct in the accounting profession. The Association of Chartered Certified Accountants (ACCA) is a prestigious professional accountancy body that offers the highly respected Chartered Certified Accountant qualification. ACCA provides a comprehensive skill set, international recognition, flexibility in career opportunities, and access to an extensive professional network for its members. However, pursuing the ACCA qualification requires significant time and financial commitment, and the exams are known for their difficulty. Balancing studies with work can also pose challenges. Despite the drawbacks, ACCA plays a vital role in influencing accounting standards, advocating for ethical practices, impacting the global business environment, and contributing to public trust in the accounting profession. Proper preparation, understanding of the qualification structure, and adherence to ACCA's code of ethics are essential for success in the journey toward ACCA qualification.What Is the Association of Chartered Certified Accountants (ACCA)?

How the Association of Chartered Certified Accountants (ACCA) Works

Educational Structure and Examinations

Membership and Affiliation

Ethical Standards and Professionalism

Global Presence and Recognition

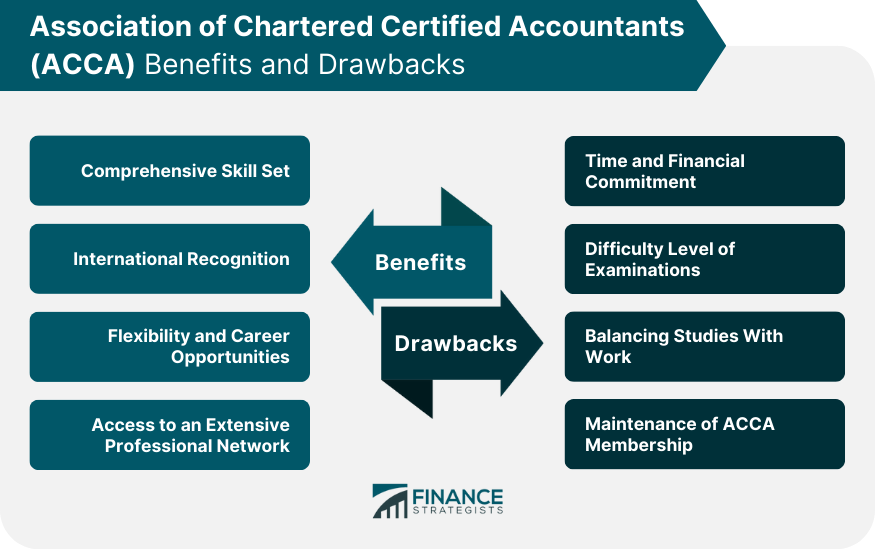

Benefits of ACCA Qualification

Comprehensive Skill Set

International Recognition

Flexibility and Career Opportunities

Access to an Extensive Professional Network

Drawbacks and Challenges ACCA Qualification

Time and Financial Commitment

Difficulty Level of Examinations

Balancing Studies With Work

Maintenance of ACCA Membership

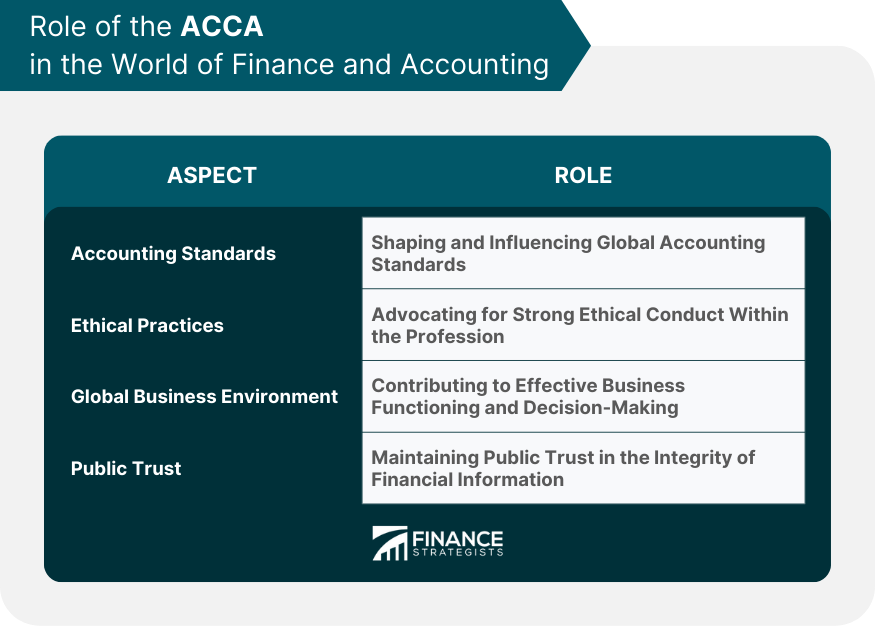

Role of the Association of Chartered Certified Accountants (ACCA) in the World of Finance and Accounting

Influence on Accounting Standards

Advocacy for Ethical Practices

Impact on Global Business Environment

Contribution to Public Trust in the Accounting Profession

Preparing for ACCA Qualification

Understanding the ACCA Qualification Structure

Preparation for Examinations

Developing a Study Plan

ACCA and Its Approach Towards Ethics and Professional Conduct

Conclusion

Association of Chartered Certified Accountants (ACCA) FAQs

The Association of Chartered Certified Accountants (ACCA) is a globally recognized professional accountancy body based in the UK. It provides the Chartered Certified Accountant qualification (ACCA or FCCA), which is respected worldwide as a leading designation in accountancy. The association supports its members through rigorous education and professional development, maintaining high ethical standards.

The ACCA qualification is structured around a series of examinations that cover a wide range of accounting, finance, and management topics. After passing the exams and fulfilling practical experience requirements, individuals are granted ACCA membership and the designation of Chartered Certified Accountant.

The ACCA qualification provides a comprehensive skill set covering a diverse range of business areas. It carries international recognition and respect from employers globally, offering career flexibility and opportunities in different industries. Members also have access to a vast professional network for collaboration, knowledge sharing, and career development.

Obtaining the ACCA qualification requires significant time and financial commitment, including preparation for the notoriously difficult examinations. Balancing professional responsibilities with study can be challenging. Additionally, maintaining ACCA membership requires ongoing professional development, which may involve additional time, effort, and cost.

ACCA influences global accounting standards and advocates for ethical practices within the profession. The association contributes to the global business environment by providing professionals skilled in various areas of business and finance. ACCA's commitment to professionalism and ethics also contributes to public trust in the accounting profession.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.