A personal accountant is a finance professional specializing in handling individual clients' finances rather than business entities. Their role involves managing various aspects of personal finance such as tax planning, budgeting, investment advising, and financial planning. They operate on an in-depth understanding of their client's financial situations, goals, and concerns, enabling them to provide personalized advice and strategic financial solutions. Personal accountants can help individuals optimize their wealth, navigate complex tax laws, plan for future financial needs like retirement, and make informed financial decisions. Their expertise not only enhances financial stability but also contributes to long-term financial success. The importance of a personal accountant cannot be overstated. They serve as trusted financial advisors, offering personalized advice tailored to your financial situation and goals. This goes beyond merely crunching numbers; it involves understanding your life, ambitions, and concerns, and mapping out a financial plan that aligns with these factors. One of the primary responsibilities of a personal accountant is tax management. They guide you through the maze of tax laws, helping you understand your obligations and opportunities. With their expertise, they can identify potential tax deductions and credits, minimizing your tax liability. Financial planning and budgeting are also crucial aspects of a personal accountant's role. They help you analyze your income and expenditures, set financial goals, and create a comprehensive budget to guide your spending. This allows you to control your finances and achieve financial stability. A personal accountant also provides investment advice. They assist in building an investment portfolio that matches your financial objectives and risk tolerance, ensuring your money works for you. Hiring a personal accountant involves identifying your financial needs, searching for potential candidates, evaluating their qualifications and experience, having an initial consultation, and finally making a hiring decision. A personal accountant brings in-depth knowledge of tax laws to the table. They take the complexity out of tax planning and deductions, ensuring you comply with all regulations while benefiting from eligible deductions and credits. A personal accountant offers advice on budgeting and savings and guides you in creating effective investment strategies. With their help, you can make informed financial decisions that promote wealth accumulation. Managing personal finances can be time-consuming and stressful, especially for those unfamiliar with financial management. A personal accountant takes over this burden, enabling you to focus on other aspects of life while enjoying peace of mind knowing your finances are in good hands. Whether it's planning for retirement or estate planning, a personal accountant assists in mapping out long-term financial strategies. This ensures financial security and peace of mind for the future. The cost of hiring a personal accountant can be significant. You need to weigh the fees and charges against the potential financial benefits derived from their services. Hiring a personal accountant involves sharing sensitive financial information. While professional accountants adhere to strict confidentiality standards, there is always a risk of data breach or misuse of information. Relying on a personal accountant can lead to dependence, with potential drawbacks such as human error or availability and reliability issues. A personal accountant must have the necessary education and certifications, such as a degree in accounting or a certified public accountant (CPA) designation. A good personal accountant must have attention to detail, adhere to ethical practices, and have knowledge of relevant accounting software and tools. Aside from technical expertise, a personal accountant must possess excellent communication skills, be trustworthy, and demonstrate empathy and understanding. A personal accountant is a valuable asset in managing individual finances, offering expertise in areas like tax planning, budgeting, investment advising, and financial planning. They transform complex financial matters into manageable tasks, promoting financial stability and success. The benefits of having a personal accountant are numerous, including efficient tax management, expert financial guidance, time savings, and assistance in future planning. However, considerations like costs, confidentiality, and dependence on a single individual must also be taken into account. The process of hiring a personal accountant should be carried out meticulously, factoring in financial needs, the accountant's qualifications and experience, cost considerations, and your comfort level. The ideal personal accountant must hold relevant education and certifications, have keen attention to detail, uphold ethical practices, be proficient in accounting software, and possess excellent interpersonal skills. Understanding the role, benefits, challenges, and qualifications of a personal accountant empowers individuals to make informed decisions about managing their finances.What Is a Personal Accountant?

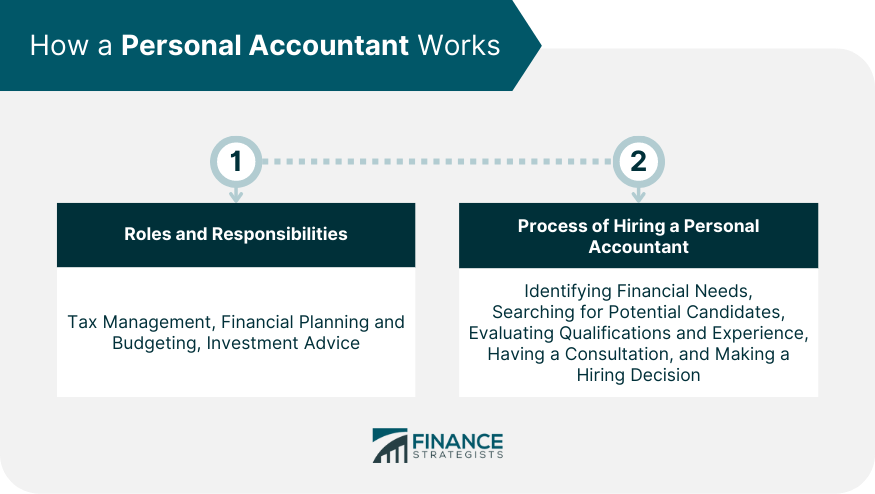

How a Personal Accountant Works

Roles and Responsibilities

Process of Hiring a Personal Accountant

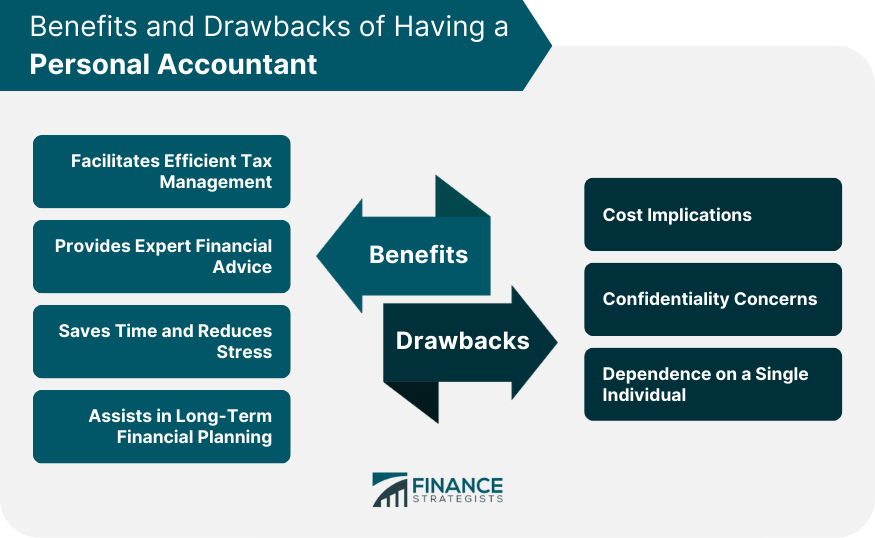

Benefits of Having a Personal Accountant

Facilitates Efficient Tax Management

Provides Expert Financial Advice

Saves Time and Reduces Stress

Assists in Long-Term Financial Planning

Drawbacks of Hiring a Personal Accountant

Cost Implications

Confidentiality Concerns

Dependence on a Single Individual

Essential Skills and Qualifications for a Personal Accountant

Education and Certifications

Practical Skills

Interpersonal Skills

Conclusion

Personal Accountant FAQs

A personal accountant manages an individual's finances, providing services such as tax management, financial planning and budgeting, and investment advice. They help individuals navigate complex financial scenarios and make informed decisions.

Hiring a personal accountant can provide numerous benefits, including efficient tax management, expert financial advice, time-saving, stress reduction, and assistance in long-term financial planning. They bring expertise and personalized attention to your financial situation.

Potential drawbacks of hiring a personal accountant include cost implications, confidentiality concerns, and potential dependence on a single individual. It's essential to weigh these against the benefits before making a decision.

When choosing a personal accountant, consider factors such as your financial needs, the accountant's qualifications and experience, references and reviews, cost considerations, and your comfort and trust level with them.

A personal accountant should have the necessary education and certifications, such as a degree in accounting or a CPA designation. They should also possess practical skills like attention to detail, ethical practices, and familiarity with accounting software, along with interpersonal skills like communication, trustworthiness, and empathy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.