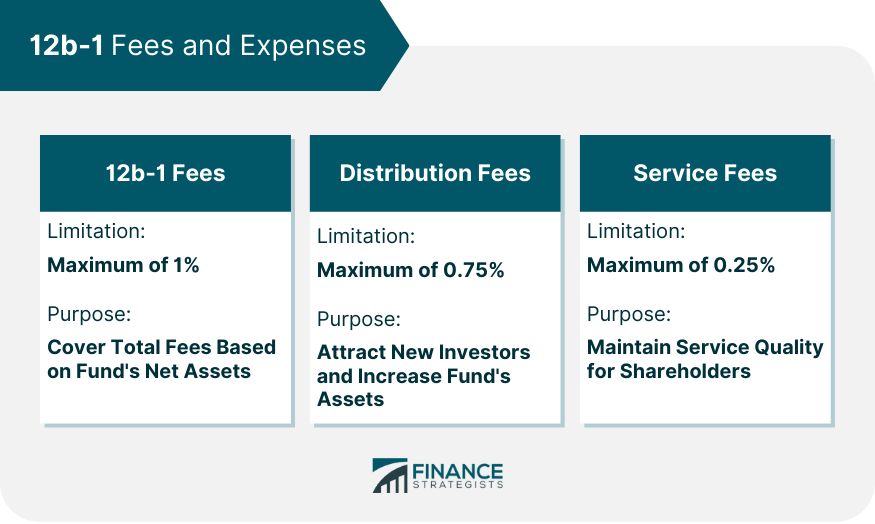

12b-1 funds are a class of mutual funds that charge a 12b-1 fee, an annual marketing or distribution fee. The fee is named after Rule 12b-1, which allows funds to charge these fees to cover promotional expenses. Introduced by the SEC in 1980, the purpose of 12b-1 fees is to support the marketing and distribution efforts of mutual funds and attract new investors. These fees cover activities like advertising, broker compensation, sales commissions, shareholder services, and ongoing fund expenses. By using the fees to fund promotional activities and increase assets, the hope is to lower costs per investor and potentially decrease the expense ratio. 12b-1 fees serve as a way for mutual funds to finance their marketing efforts and expand their investor base. The structure of 12b-1 fees is fairly straightforward. The SEC caps the total 12b-1 fees that a fund can charge at 1% per year of a fund's net assets. Within this total, the SEC also limits the portion of the fee that can be used for distribution expenses to 0.75%. The remaining 0.25% can be allocated towards other service fees. Distribution fees are the portion of the 12b-1 fees that are allocated toward marketing and distribution costs. These include expenses related to advertising the fund, compensating brokers, and paying sales commissions. The aim of these fees is to attract new investors and increase the fund’s total assets. Service fees are the other component of 12b-1 fees. These fees cover the cost of services provided to shareholders, such as customer support and statement mailing. Service fees are meant to maintain a high level of service for current shareholders and encourage them to retain their investment in the fund. The calculation of 12b-1 fees is based on a percentage of a fund's net assets. For instance, if a fund has net assets of $100 million and charges a 12b-1 fee of 1%, it would collect $1 million in fees over the course of a year. These fees are deducted directly from the fund's assets, reducing the fund's total returns. One of the primary advantages of 12b-1 fees is that they provide a source of funding for marketing and distribution. This can help to attract new investors, leading to an increase in the fund's total assets and potentially a decrease in the cost per investor. Another advantage of 12b-1 fees is that they can be used to cover the cost of shareholder services. This includes customer support, statement mailing, and other services that are essential for maintaining a high level of satisfaction among current shareholders. 12b-1 fees can potentially lead to higher fund assets. If the marketing and distribution efforts funded by these fees are successful, they can attract more investors to the fund. As the fund's total assets increase, the cost of managing the fund is spread over a larger asset base, potentially lowering the expense ratio for each individual investor. One of the main disadvantages of 12b-1 fees is that they can increase a fund's expense ratio. These fees are deducted directly from the fund's assets, reducing the overall returns. Over time, even a small increase in fees can have a significant impact on an investor's total returns, particularly in a low-return environment. Another concern with 12b-1 fees is the potential for conflicts of interest. Because these fees are often used to compensate brokers and other salespersons, they may incentivize these individuals to recommend funds that charge higher fees, even if those funds are not in the best interest of the investor. This is a significant concern and one that investors should be aware of when considering 12b-1 funds. Finally, the most significant drawback of 12b-1 fees is their potential impact on long-term returns. While these fees may provide short-term benefits in terms of marketing and distribution, they also reduce the amount of money that can be reinvested in the fund. Over the long term, this can have a compounding effect, leading to significantly lower returns for investors. As mentioned earlier, 12b-1 fees are governed by the SEC under Rule 12b-1. The SEC sets the maximum amount of 12b-1 fees that a fund can charge and specifies how these fees can be used. The SEC also requires that funds disclose their 12b-1 fees in their prospectus and other disclosure documents. In addition to SEC regulations, the Financial Industry Regulatory Authority (FINRA) has issued guidelines on the use of 12b-1 fees. FINRA requires that brokers and financial advisors disclose the 12b-1 fees associated with a particular fund and explain how these fees impact the overall cost of the investment. Both the SEC and FINRA require that 12b-1 fees be disclosed to investors. Fund companies are required to disclose the fees in the fund's prospectus and other disclosure documents. Financial advisors and brokers are also required to disclose these fees to their clients. No-load funds are mutual funds that do not charge a sales commission or 12b-1 fee. These funds typically have lower expense ratios than load funds, making them an attractive alternative for investors who are looking to minimize costs. Fee-based advisory accounts are another alternative to 12b-1 funds. In these accounts, investors pay an ongoing fee to a financial advisor or investment manager, who manages their investments for them. Unlike 12b-1 funds, fee-based advisory accounts typically do not charge a separate marketing or distribution fee. Finally, passive investment options, such as index funds and exchange-traded funds (ETFs), offer another alternative to 12b-1 funds. These investments typically have lower expense ratios than actively managed mutual funds and do not charge marketing or distribution fees. 12b-1 funds are a class of mutual funds that charge an annual marketing or distribution fee, named after Rule 12b-1. These fees support marketing and distribution efforts, attract new investors, and cover shareholder services. However, they can increase the fund's expense ratio and potentially create conflicts of interest. Investors have alternatives to 12b-1 funds, such as no-load funds with lower expenses, fee-based advisory accounts without marketing fees, and passive investment options like index funds and ETFs with lower costs. The regulatory framework includes SEC regulations and FINRA guidelines that require disclosure of 12b-1 fees in prospectuses and by brokers and financial advisors. Understanding the fee structure, pros, cons, and alternatives can help investors make informed decisions about their investments.What Are 12b-1 Funds?

12b-1 Fees and Expenses

Fee Structure

Types of Fees

Distribution Fees

Service Fees

Fee Calculation

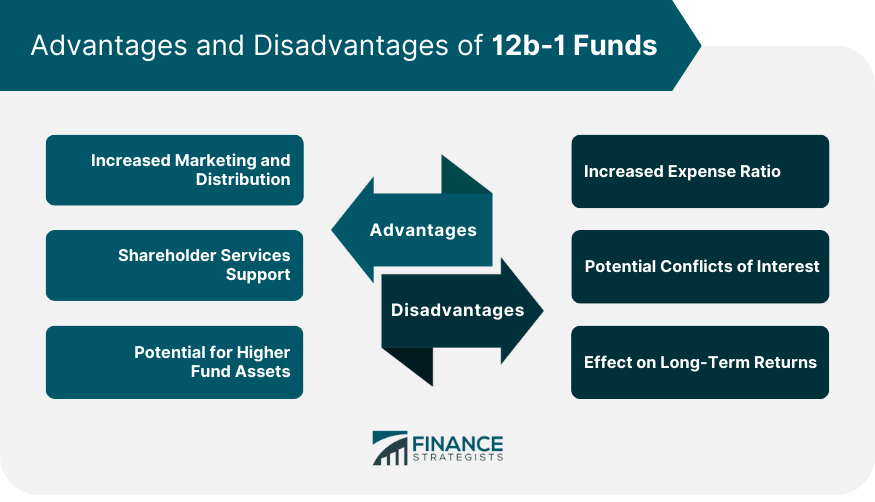

Advantages of 12b-1 Funds

Increased Marketing and Distribution

Shareholder Services Support

Potential for Higher Fund Assets

Disadvantages of 12b-1 Funds

Increased Expense Ratio

Potential Conflicts of Interest

Effect on Long-Term Returns

Regulatory Framework

SEC Regulations

FINRA Guidelines

Disclosure Requirements

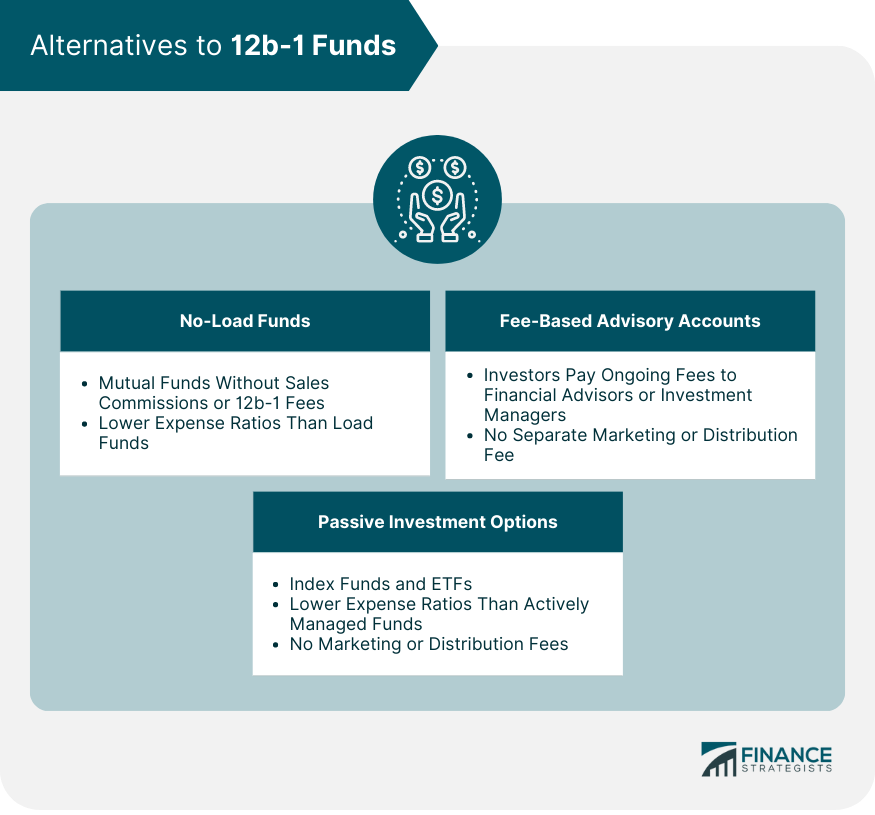

Alternatives to 12b-1 Funds

No-Load Funds

Fee-Based Advisory Accounts

Passive Investment Options

Final Thoughts

12b-1 Funds FAQs

12b-1 funds are a type of mutual fund that charges a 12b-1 fee, a type of annual marketing or distribution fee, to cover promotional expenses.

The purpose of a 12b-1 fee is to cover the costs associated with marketing and distributing a mutual fund. These fees help fund promotional activities such as advertising, broker compensation, and sales commissions.

12b-1 fees are calculated as a percentage of a fund's net assets. The SEC limits the total 12b-1 fees that a fund can charge at 1% per year of a fund's net assets, with a maximum distribution fee of 0.75%.

Investing in 12b-1 funds can provide increased marketing and distribution efforts, shareholder services support, and potential for higher fund assets.

Investors may consider alternative investment options, such as no-load funds, fee-based advisory accounts, and passive investment options, such as index funds and exchange-traded funds (ETFs), to determine which investment is best suited to their individual needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.