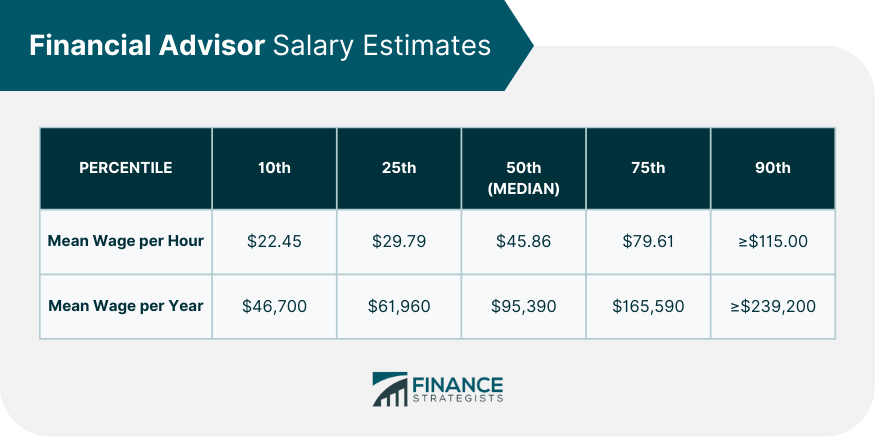

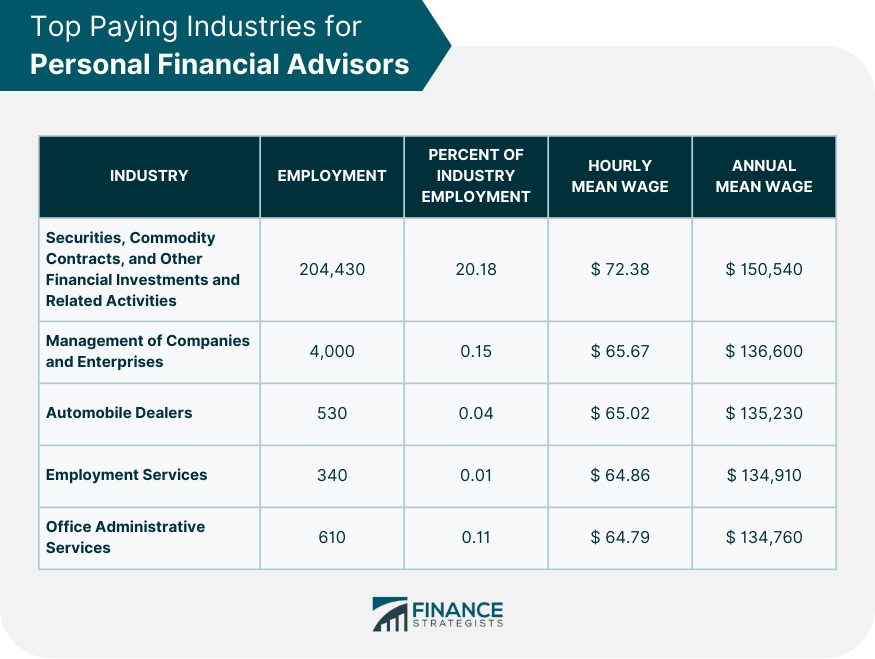

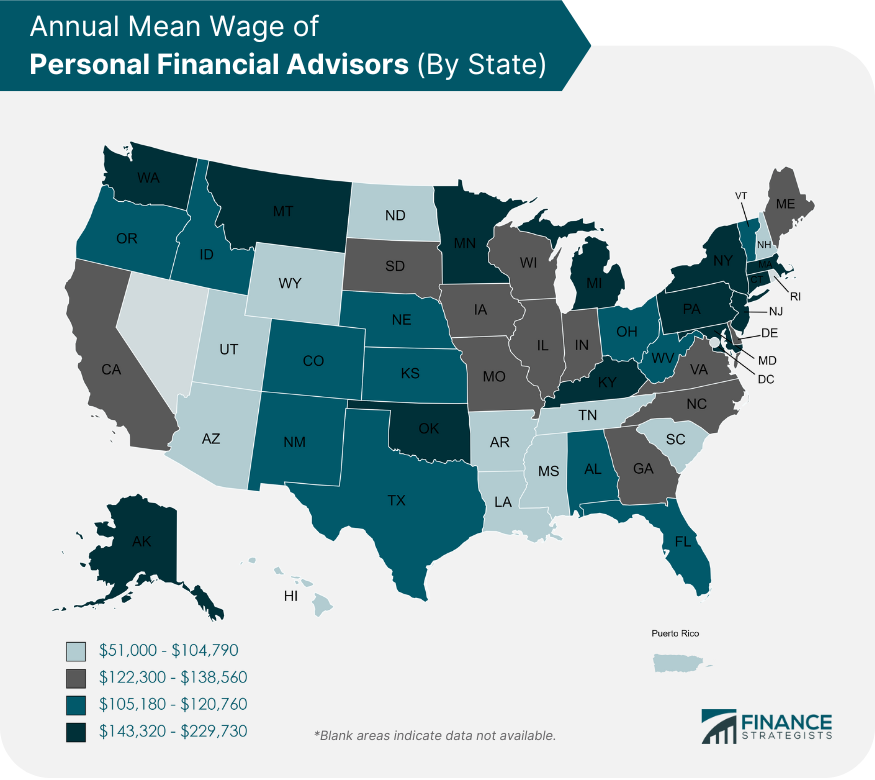

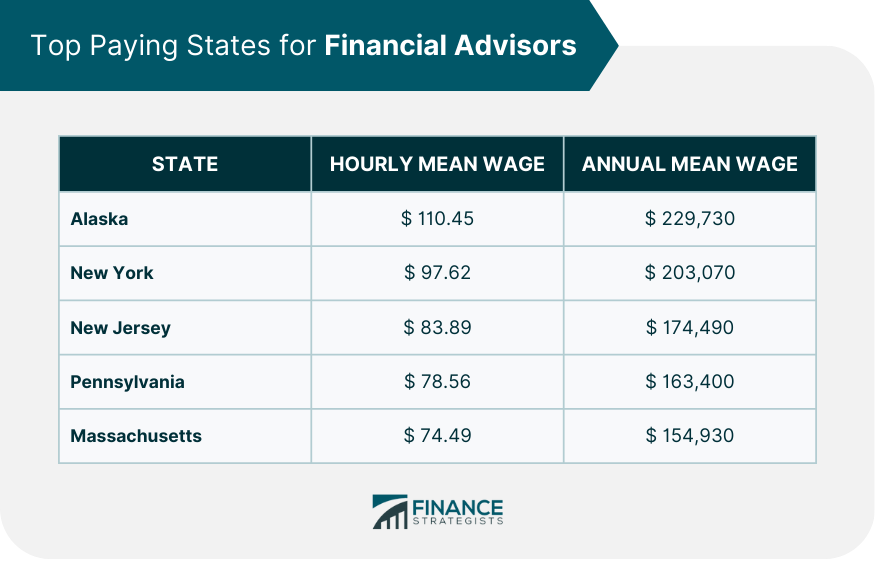

According to the most recent data from the Bureau of Labor Statistics (BLS), financial advisors have a median annual salary of $95,390 in 2022, which is significantly higher than the national average of $63,795.13. Salaries of financial advisors can differ significantly by their location and level of expertise. The client’s profile may also have an impact on their compensation. Have a financial question? Click here. The summary below from BLS shows the financial advisor's salary estimates for 2022 in terms of percentile for both mean wage per hour and mean wage per year. In terms of annual wage, the 50th percentile (median) at $95,1390 earns twice as much as the 10th percentile. The 90th percentile of financial advisors earned $239,000, nearly five times the 10th percentile income of $46,700. Overall, there is a significant variation in financial advisors' estimated wages from the 10th to the 90th percentile for different reasons. Industry specialization highlights inequality because financial advisors usually play numerous roles. BLS data below shows the financial advisor salaries per industry for the year 2022. The majority of financial advisors (20.18%) make an average yearly salary of $150,540 while working in the highest-paying sector, which includes securities, commodity contracts, and other financial investments. Financial advisors employed by the management of companies and enterprises are the second highest earners with a mean annual salary of $136,600, but only 0.15% of them work in the industry. The average salary of a financial advisor is also influenced by the state where they serve. Alaska, New York, New Jersey, Pennsylvania, and Massachusetts are the highest-paying states for financial advisors in 2022, according to BLS. Alaska tops the list with $229,730 per year, followed by New York with $203,070, and the third is New Jersey with $174,490. Top Paying States for Financial Advisors The scope of services agreed upon with the client influences financial advisor compensation. A fee-only financial advisor is directly paid for their services. They operate on a fee-only basis to cater to specific services like creating budgets, retirement planning, paying down debt, and setting goals to reach other financial milestones. In 2022, a stand-alone financial plan's average fee-only price is $2,500. Financial advisors that are paid a fee and sometimes a commission are known as fee-based advisors. Some advisors prefer one of the following payment options: a flat rate, an hourly rate, a fixed fee, or a percentage of the assets under management (AUM). Hourly or time-based counsel is quite flexible. It makes the most sense for someone who can execute advice on their own or someone practical with their money. For instance, when a client is only interested in a second opinion on their investment portfolio or only requires one-time financial guidance, a time-based price for service may be suitable. On average, 2023 data shows that advisors charge a rate of $200 to $400 per hour. Some advisors base their fees on a fixed amount determined by the performance of the assets they choose for their clients. This implies that the advisor only receives payment from the client when the chosen investments go above a predetermined threshold established in the contract. Financial advisors whose fees are based on AUM will bill their clients a percentage of the overall asset value. The typical annual fee is between 0.5% and 2% of the managed assets. In 2023, financial advisors were paid an average of 1% of AUM. Commission-based advisors are compensated depending on the investments they can market. The investment provider will pay them a portion of the client's investment funds. A commission could be applied to any investment. Brokers may deduct 1% to 5% off the value of a bond, and mutual funds may be subject to sales loads of up to 8.5%. Financial advisors may get a regular salary for working in a bank or other financial institution. Selling specific products may also earn them a commission or incentive. The process of becoming a financial advisor is greatly influenced by the type of financial advisor a person intends to become and the area of expertise they choose. A bachelor's degree is required to work as a financial advisor. Economics or any business-related degree is advantageous but is not necessary. Typically, advisors begin their careers as freelance financial advisors or employees of financial services firms. Companies may be willing to sponsor their advisors in getting specialized licenses. However, an independent financial advisor must shoulder the cost of the licensing process. The requirements for each certification program will be different. These specifications could include having a specific level of education, completing coursework, having a specific quantity of job experience, or passing tests. Financial advisors are indispensable to their clients. They assist clients in making sound investment decisions and planning for their financial future. A variety of factors influence the income of financial advisors. Among others, the location and pay model are given significant consideration. In 2022, the median pay for financial advisors was $95,390 per year. The top 10% of earners make more than $239,000, while the bottom 10% earn less than $46,700. Alaska, New York, New Jersey, Pennsylvania, and Massachusetts are the top-paying states with annual rates above the median salary. A bachelor's degree is a minimum requirement for becoming a financial advisor. Sometimes, they may need to obtain specific licenses for certain designations, which will impact their fees. If you want to help people with their finances and earn a good salary, becoming a financial advisor is a wise career move.Financial Advisor Salaries: An Overview

Financial Advisor Salaries per Industry Concentration

Financial Advisor Salaries by State

Financial Advisor Compensation Schemes

Fee-Only

Fee-Based

Hourly Fees

Fixed Fees

AUM-Based

Commission-Based

Salary

How to Become a Financial Advisor

The Bottom Line

How Much Do Financial Advisors Make? FAQs

Financial advisors can make anywhere from $50,000 to over a million dollars per year depending on their experience level and the services they provide.

Factors that figure into what a financial advisor earns include their experience in the field, the size and type of firm they work for, the services they offer, their client base, and the geographic location in which they are employed.

Financial advisors typically receive a salary plus commissions on sales or fees charged to clients. In some cases, bonuses may be awarded based on performance.

Yes, financial advisors are regulated by the Financial Industry Regulatory Authority (FINRA) and must take a series of exams to become licensed.

To work as a financial advisor, you'll typically need to have a college degree in finance, accounting, or a related field. You may also need to obtain certain licenses and certifications depending on what services you're offering. Additionally, financial advisors should possess strong interpersonal and communication skills as well as analytical and problem-solving capabilities. Ultimately, employers will determine their individual requirements for potential employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.