Soft dollars are a form of alternative compensation money managers offer to their service providers. Instead of paying cash up-front, payment is accomplished through commissions charged on top of a regular transaction with a brokerage firm. The Securities and Exchange Commission (SEC) allows this arrangement if the services availed help money managers make investment decisions. An example that meets the SEC’s requirement is an expense related to research services. Because of the nature of soft dollars, money managers can pass on payments to investors without disclosing the transaction details. This contrasts with the procedure for paying through hard dollars, which involves reporting the expenses to clients. Soft dollar arrangements can benefit clients if they help money managers make wiser investment decisions. However, they can also lead to a conflict of interest. Thus, it is crucial to understand and inquire about this type of spending before investing in a fund. In soft dollar arrangements, payments are made by money managers to brokerage firms for the purchase of goods and services, such as research. These payments are made through commissions rather than paying cash up-front. To explain further, consider this scenario: Company X and Company Y enter a soft dollar agreement wherein Company X provides inventory control systems and software to Company Y in exchange for directing trades to Brokerage Firm Z. Brokerage Firm Z then charges Company Y an additional amount on top of their regular transaction fee. The proceeds from the actual transaction are kept by Brokerage Firm Z, while the excess earnings (or the soft dollars) are sent to Company X as payment for their services. The extra fee added by Brokerage Firm Z to cover the soft dollar arrangement is only a small amount per unit traded. However, these amounts tend to accumulate due to the billions of shares traded daily by Company Y. The example above shows how investment companies can use soft dollars to obtain services without actually paying for them with hard cash. In some cases, paying with hard dollars can involve a lengthy process, which is why using soft dollars might be more convenient. For example, instead of issuing and recording a check on Company Y's books and passing the associated expense to the investors via the fund's annual fee, as would be required for a hard dollar payment, soft dollars lump these expenses amongst trading costs. Despite being perfectly legal, this practice is not beneficial to investors who wish to compare the cost of using one mutual fund versus another. As such, it is more challenging to determine which fund offers a more optimal price point if soft dollar expenses are not considered. Soft dollars offer institutional investors significant advantages, particularly when investing in equity markets. One such advantage is the access they allow to a much wider variety of research and other services that brokerage firms provide. Soft dollars enable money managers to gain access to new information more quickly, which helps them make better decisions for the investments they are managing. Eventually, the increased knowledge of these professionals can result in higher returns for their clients. Defenders of this type of arrangement argue that removing this practice can discourage research efforts, lessening the availability of detailed analysis and, consequently, lowering returns for investors. Using soft dollars as a means to finance operating costs can be an attractive option for mutual funds, but there are also drawbacks, such as: Soft dollar arrangements have come under increased scrutiny in recent years due to the lack of disclosure on the part of mutual funds. Without clear documentation, it is not possible to know how much of a fund's assets are being used for soft dollar payouts or how much is actually going towards research services. This lack of transparency in disclosure has been identified as a major concern in financial analysis and regulation, as investors need to be informed about where their money is going. Consequently, this undermines investor confidence and public trust due to the potential for misuse of funds by dubious entities with little accountability. Another drawback of using soft dollars as payment is the difficulty in accurately analyzing costs associated with their use. Their intangible nature makes it hard to decipher how the value received compares to the value paid when comparing it to expenses paid with hard dollars. With hard dollars, the actual cost of goods or services can be easily computed and are often recorded. This is not necessarily the case when payments are made with soft dollars. For example, when soft dollar payments are used to cover research costs, it can make it difficult for investors to evaluate how much they are spending and if they are getting a good deal when deciding which fund to invest in. Additionally, a lack of standardized practices and rules means that firms must rely on their personal markup guidelines. This increases the potential for manipulation and further obscuring cost measurements based on this form of purchase compensation. Since investment managers are the ones who decide how much is paid as soft dollars, there is a risk of a conflict of interest. They may be overpaying for trades and research or using their investors' money to pay for services that primarily benefit them rather than their clients. Soft dollar arrangements may also provide inadequate oversight and a lack of transparency, potentially allowing investment house personnel to receive undisclosed payments that could conflict with their duties and responsibilities. Soft dollar expenses can vary significantly for each investment manager and may not always be at par with the actual value of the service obtained. The disparity between these hidden charges and the service quality may negatively impact investors without their knowledge. Because of all its drawbacks, proper implementation of smooth-dollar strategies is crucial for the integrity of the financial industry and investors' trust in money managers and advisers. A typical example of a soft dollar arrangement is when a brokerage firm pays for research from a third party through soft dollars. For example, a significant investment fund may pay its broker a commission fee of 4% to sell or buy stocks. Out of that commission, 2.5% may be retained by the broker, while 1.5% will pay for different services such as training programs and research reports. This allows large institutional investors access to necessary resources in addition to trading and market services. In this case, the brokerage firm would receive valuable insight into the markets without having to incur upfront costs and undergo the process of documenting a hard dollar expense. Soft and hard dollars are methods of paying for services provided by a broker. Soft dollars refer to the use of commissions to pay for services like marketing costs and research. Meanwhile, hard dollars refer to the use of upfront cash payments as a traditional method of paying for services. Soft dollar arrangements can be difficult to total up due to their complexity. In contrast, the cost of hard dollar arrangements is easier to determine since they are often recorded and openly discussed with clients. For instance, investors generally know the exact monetary amount they are to pay their broker, which often includes fees for account maintenance, transactions, and the research services provided. The strength of soft dollar arrangements is that they grant access to research that money managers can use to increase an investor’s returns. Meanwhile, the main benefit of hard dollars is their transparency, which helps clients make informed decisions about their investments. Soft dollars are valuable for investors, brokerage firms, and money managers. They represent additional commission payments made to pay for services such as research, consulting, or technology solutions related to portfolio management. A soft dollar arrangement is considered the direct opposite of a hard dollar payment. Hard dollar arrangements are seen as more transparent since they involve direct payments for specific services, making it easier to track how much is being spent. In contrast, soft dollar arrangements can be more complicated to calculate, leaving room for potential conflicts of interest and a lack of transparency. As a result, soft dollars have been the subject of much debate and controversy in the investment world. While soft dollar arrangements may provide additional access to research and analysis, they can also pose potential conflicts of interest and greater complexity in accounting for the actual expenses involved in making an investment. Soft dollars are just one of the hidden costs investors may encounter. Those who wish to make the most out of their investments can consult a financial advisor for guidance on how they can avoid hidden costs.What Are Soft Dollars?

How Soft Dollars Work

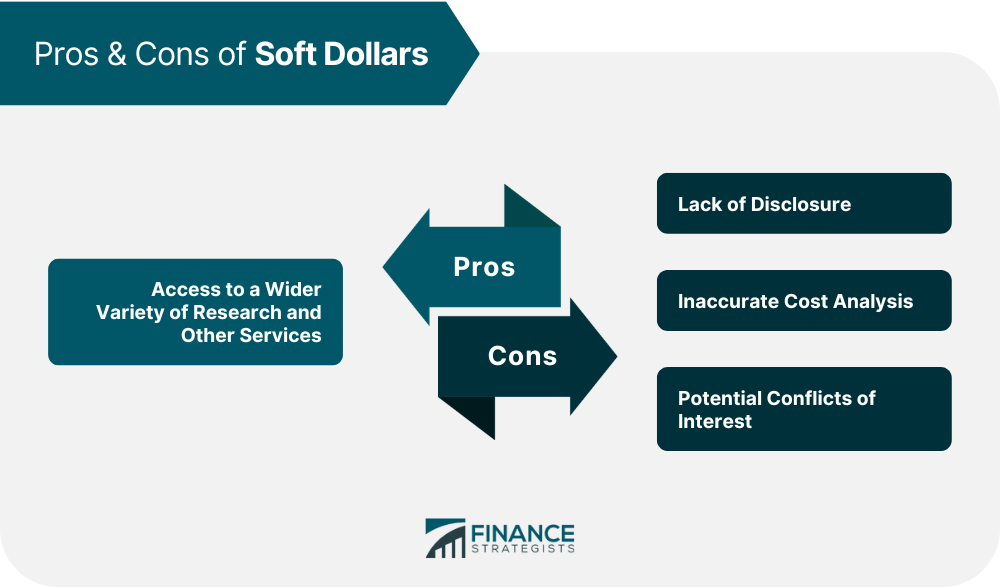

Benefits of Soft Dollars

Drawbacks of Soft Dollars

Lack of Disclosure

Inaccurate Cost Analysis

Potential Conflicts of Interest

Example of Soft Dollars

Soft Dollars vs Hard Dollars

Final Thoughts

Soft Dollars FAQs

Soft dollars are a form of compensation that money managers offer to their service providers, where payment is made through commissions charged on top of a regular transaction with a brokerage firm.

Soft dollars represent commission payments made by an investor rather than cash paid out directly. They are another way of obtaining research and other services related to portfolio management. Hard dollars, on the other hand, are cash payments made directly to the provider of the services.

Soft dollars offer a way of accessing research and other services that may benefit investors. They also provide efficient access to expertise without paying out large sums up-front or undergoing the process of recording a hard dollar expense.

Soft dollars are generated when a broker charges investment companies a commission for trading services, such as research and execution. A portion of these fees is then allocated for purchasing soft dollar items, such as research reports or technology used by the broker's staff.

The potential misuse and abuse of soft dollars are one of the main drawbacks associated with this strategy. Brokerage firms may be tempted to use soft dollar payments for non-research purposes, such as entertainment expenses or travel costs. Also, since these funds are not tracked or monitored closely, it can be difficult to determine exactly how they are being used.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.