What Does Fiduciary Duty Mean?

Fiduciary duty is a legal term that refers to the obligation of a trustee to act in the best interests of their beneficiary.

The trustee is someone who holds or manages property or assets for another person.

In the context of investments, fiduciary duty means that investment advisors must always put their clients' interests ahead of their own.

In other words, fiduciary duty is the highest standard of care that an investment advisor can owe to their clients.

Jobs that require this standard of care are known as "fiduciary jobs" and they usually require a high degree of skill and trustworthiness.

A fiduciary is a person or an entity (such as an investment firm) with a legal and/or ethical relationship of trust with one or more other parties (known as "principals").

The distinguishing characteristic of a fiduciary is that he or she owes loyalty and fidelity to the principal(s).

This means putting the interests of the principals ahead of his or her own, which mandates that conflicted compensation should be avoided.

When advisers must choose between conflicting recommendations, they are required "to give priority consideration" to what is in the best interest of the client.

Have a financial question? Click here.

What Is an Accredited Investment Fiduciary?

An accredited investment fiduciary is an individual or organization that has met specific requirements set by the U.S. Securities and Exchange Commission (SEC) and is authorized to provide fiduciary advice with respect to investments.

This ethical certification is issued by Fi360 or the Center for Fiduciary Studies, and its meaning is legally binding.

As a certified accredited investment fiduciary, the advisor has professional expertise in the financial field with respect to client investments and operates under strict legal ethical standards.

An accredited investment fiduciary must also demonstrate a deep understanding of how investments work, be able to separate fact from fiction, and have excellent communication skills that allow them to easily explain complicated financial concepts to investors who aren't experts themselves.

The AIF credential puts its focus on six key areas: risk management, investment analysis, and recommendations, due to suitability, monitoring and oversight, client communication, and fiduciary responsibility.

It aims to help financial advisors by giving them the benefits of having a fiduciary advantage while also offering clients a strong measure of protection.

How to Become an Accredited Investment Fiduciary

To receive the certification of being an accredited investment fiduciary, Fi1360 requires that financial advisors meet a point-based threshold based on a combination of education, relevant industry experience, and/or professional development.

The candidate has to complete a choice of these two programs: Web-based Program or Capstone Program.

The cost of this training is said to be around $1,600 to $2,000.

After finishing the program, they are to pass a final certification exam. To maintain the certification, a six-hour per year continued education is required.

The financial advisor should also attest to a code of ethics.

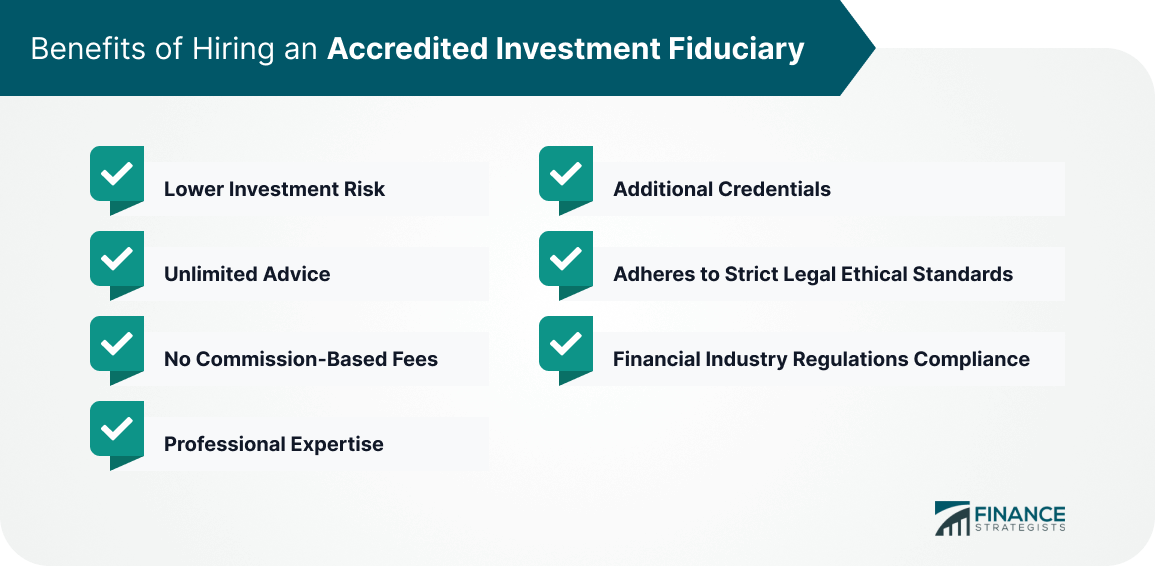

Benefits of Hiring an Accredited Investment Fiduciary

Lower Investment Risk

Hiring a financial advisor who is an accredited investment fiduciary will lower the risks for investors by offering them advice that's in their best interests and not just attempting to sell them products that make the advisor more money.

Unlimited Advice

Hiring an accredited investment fiduciary gives clients access to unlimited financial advice because there are no caps on the number of services they can provide clients.

No Commission-Based Fees

Fee-based options are much better because you want someone looking out for your best interest when it comes to investments, not someone trying to get paid by directing you into something that may not be the best for you.

Professional Expertise

Accredited investment fiduciaries are professionals who have the expertise to understand complex financial matters and explain them in an easily understandable way so clients don't feel intimidated by them.

Additional Credentials

Accredited investment fiduciaries receive additional credentials when they complete training programs in finance, retirement planning, insurance, investing, estate planning, income taxes, employee benefits, and charitable giving.

This means that AIFs can offer advice on a wide range of topics that affect their clients' lives.

Adheres to Strict Legal Ethical Standards

Accredited investment fiduciaries are held to the legal ethical standards of a fiduciary, which means they must always put their customer's interests first and cannot work for commission.

Financial Industry Regulations Compliance

Accredited investment fiduciaries are required to stay current on all financial industry regulations, including the Financial Industry Regulatory Authority (FINRA) rules.

The Bottom Line

Investors need to do more than simply find someone with investments in order for it to be in their best interest.

They need professional advice from a certified accredited investment fiduciary who has gained extensive financial education and industry experience.

When it comes to choosing a financial advisor, choosing one with the AIF designation is your best bet for safeguarding your financial security.

With them, you can rest assured that you're getting the right advice from a professional who has your best interests in mind.

Accredited Investment Fiduciary FAQs

There are many reasons why you should consider hiring an accredited investment fiduciary. Some of the main benefits include lower investment risk, unlimited advice, no commission-based fees, professional expertise, additional credentials, adheres to strict legal and ethical standards, and financial industry regulations compliance.

A fiduciary is legally bound to act in the best interests of their beneficiary, while a non-fiduciary is not held to the same standard. Financial advisors can claim to be fiduciaries, but they don't have to follow through on that commitment unless they are also accredited investment fiduciaries.

There is no definitive answer to this question, as salaries can vary depending on experience and other factors. However, accredited investment fiduciaries typically earn more than those without the designation.

While both CFPs and AIFs must adhere to a code of ethics, only AIFs are required to meet the legal definition of a fiduciary. CFPs are not held to the same legal standards as AIFs, meaning they may not always put their clients' best interests first.

Yes, you can still work with your current financial advisor even if he or she is not an accredited investment fiduciary. However, you may want to consider hiring an AIF in the future if you are looking for unbiased advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.